Many traders have noticed some correlation between the cryptocurrency and stock market. When there is a local crisis, it affects both industries, and during the period of active growth, both types of assets grow. Is there a direct correlation here? And if so, how strong is it? IMF economists have already answered this question.

Correlation study

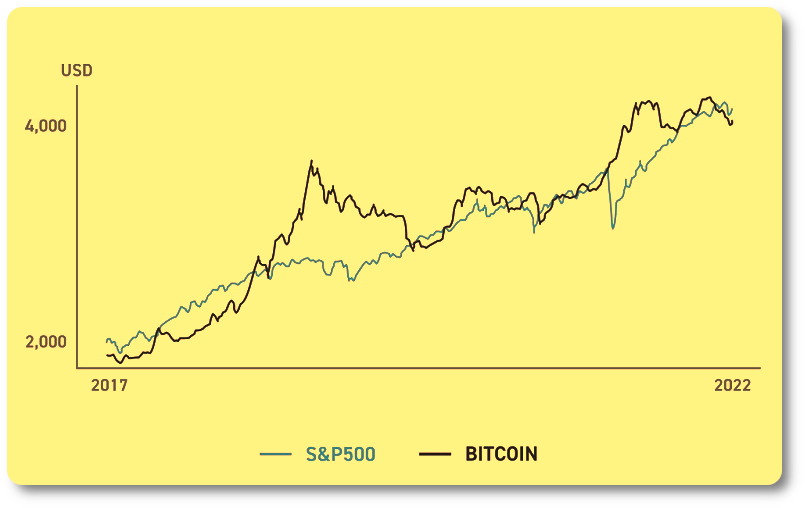

According to the IMF study, there is some correlation between the cryptocurrency market and stocks. And it is growing over time. The correlation has grown especially strong between 2020 and 2021. This study included crypto assets such as BTC and ETH, as well as the S&P 500, Nasdaq, Russell 2000 and MSCI EM1 equity indices. Between January 2017 and December 2019, the volatility correlation between Bitcoin and the S&P 500 was 0.1, and between January 2020 and November 2021, it increased to 0.46. The return correlation also increased from 0.01 to 0.36. Similar changes in correlation were seen between Ethereum and the S&P 500.

Conclusion: there is a certain correlation, although not a direct one.

However, it is worth noting that the correlation between the cryptocurrency market and the stock market is not unambiguous and constant. Some companies that are directly linked to the cryptocurrency market through investments or business processes may have a correlation with stock price movements. This is especially true for publicly traded cryptocurrency companies such as Coinbase, whose shares ($COIN) are traded on the stock markets. However, there is no clear and consistent correlation with the cryptocurrency market for general equity indices.

It is also worth considering that the correlation between cryptocurrencies and stocks is fickle. The fact that the correlation was stronger in previous years does not guarantee that this trend will continue in the future. It is best to analyze the actual data yourself and form your own conclusions.

Which market is more volatile: cryptocurrencies or stocks

Cryptocurrencies such as Bitcoin and Ethereum are known for their high volatility. Fluctuations of 3-5% per day are considered the norm here. Less popular cryptocurrencies can fluctuate even more (up to +1000% or -99% in a day). Stocks can also be volatile, but to a lesser extent. If you compare a diversified portfolio of cryptocurrencies and a stock index (like the S&P 500), the cryptocurrencies will be more volatile and the indexes will be more stable.

How to keep the balance

So, historical data shows that there is no direct correlation between the two markets. There can be large divergences between them. Which means that traders can capitalize on the divergence of the rates. It is possible to convert assets from stocks to cryptocurrencies depending on which market gives a higher return in the moment.

However, there is a problem with asset conversion here. Cryptocurrencies are usually traded on cryptocurrency exchanges, while stocks are traded on special brokerage platforms. If you constantly transfer assets between platforms, you can lose money on commissions.