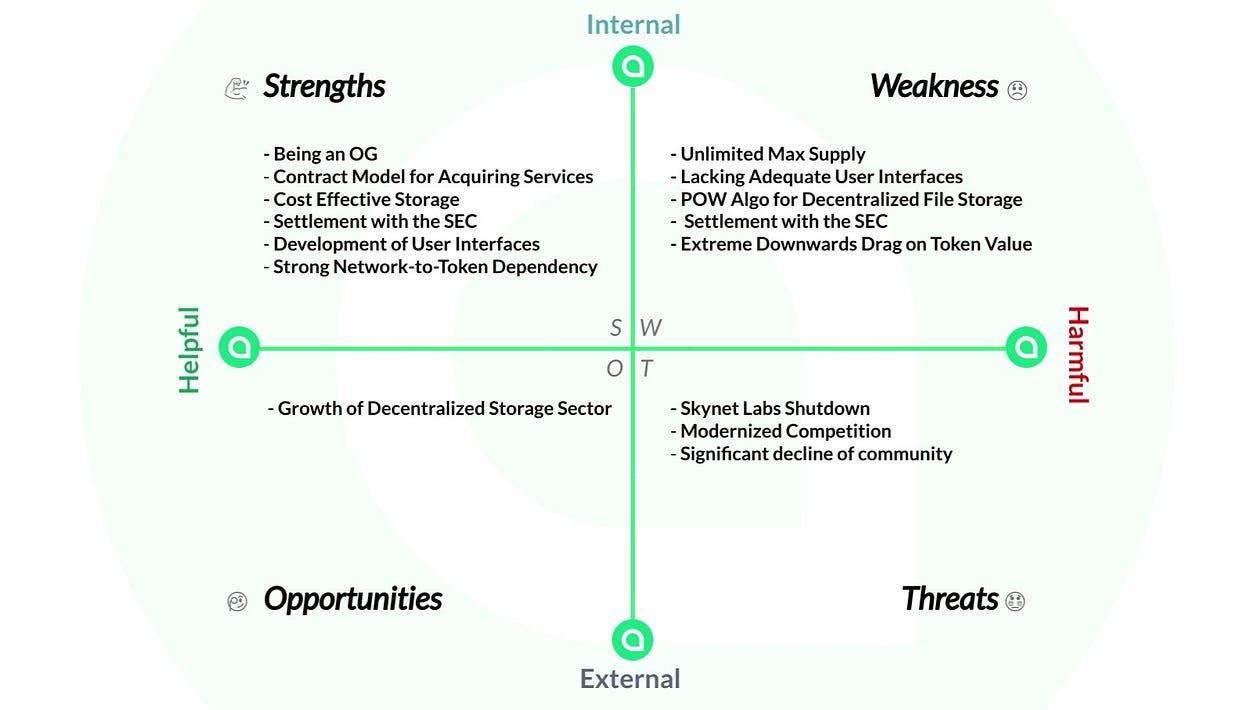

SWOT Analysis: Siacoin (SC)

*Note: a SWOT analysis is an evaluation of the fundamental, operational, technical, social, economic, and even to some degree administrative elements of a project. This is not a model to be used for trading purposes. (NFA, DYOR)

Composed of four elements, Strengths, Weaknesses, Opportunities, and Threats, a SWOT analysis framework provides excellent insight for establishing a high-level understanding of the state of a project’s well-being through the lens of a birds-eye view.

It can help formulate decisions around which areas require more attention, set performance goals, and organize a foundational understanding of where a project is headed.

Rarely (if ever) used in crypto, it is time to apply this timeless method of evaluation to the digital asset space.

Today, Sia (SC), the OG marketplace and decentralized cloud storage provider that is based on a proof-of-work system, will get a SWOT.

1. Being an OG

Sia is one of the oldest remaining generation one projects that actually had its first token sale (at the time called Sianotes) before Ethereum ever had its own. Arriving on the scene in that generation also imbued a fundamental system architecture that is rooted in proof-of-work, arguably the most decentralized consensus model. Moreover, being rooted so early in the budding industry that was extremely tightly knit (due to very few participants) gave the project immense potential exposure to build relationships with many of today’s most prominent market participants.2. Contract Model for Acquiring Network Services

Whenever users are entering agreements for network resources, the SC coin must be locked up in an escrow account. Because Sia is a Proof-of-work system, there is no native “staking” modules, however, there is strong resemblance of SFA (stake-for-access) business logic. This potentially can create positive medium-term upward pressure on the SC token price.3. Cost Effective Storage

Considering that Sia was established as far back as 2013 in an MIT Hackathon and its blockchain was operational in 2015, it is astounding that even after a multitude of new generation solutions came to market, Sia still remains one of the most affordable in terms of storage cost. Coming in at approximately $2.00 per Terabyte per month, Sia’s storage costs rank 2nd across the entire decentralized market (behind only Filecoin) and leaps ahead of any centralized solution.4. Settlement with the SEC

Both a strength and a weakness. Resolving issues with the SEC through a settlement positions Sia well to avoid regulatory kurfuffle in the future. In the event of any global crypto crackdown, a foundation of compliance gives them an opportunity to circumvent being targeted. Should other decentralized solutions that have not been able to and will not be given a chance to resolve their regulatory relationships, Sia will, by pure serendipity, inherit all of their market shares. The settlement was around their dual token model SC and SF. SC (Siacoins) have been deemed not a security, however the SF (SiaFund) tokens, were deemed a security as they pay out portions of revenue generated by utilization of the underlying network. SF is now registered with the SEC as a digital security.5. Development of User Interfaces

There are three applications that are already deployed as beta’s/alpha’s available on GitHub or are currently in the process of being developed that will serve as the endpoints that enhance user experiences. Renterd, hostd, and walletd. Renterd is a consumer-facing application for creating contracts and buying network storage. Hostd is an administrative panel for network storage providers to organize their operations. Walletd will serve as the focal point for interacting with SC and SF (Siafund) tokens.6. Strong Network-to-Token Dependency

The role of SC and its economic significance in the Sia ecosystem is very direct and simple. Given that the SC must be locked into contract escrows and that network utilities can only be paid for in SC, in the event that the demand for on-chain storage explodes, the unit value of SC should follow/lead very closely in tandem. If the token value explodes upwards, it can be assumed that over the next weeks/months, the amount of new contracts will likely increase.

1. Unlimited max Supply

Perpetual inflation of a digital asset exerts a constant downward drag on price. While the inflation rate (as a percentage of total circulating supply) will eventually taper off around the 2.9% mark, the simple fact that it never stops turns the SC into a poor choice for value retention.2. Lacking Adequate User Interfaces

Even though this problem is currently being addressed, the fact that after so many years on the market, they have not been able to provide something so fundamental/basic is a bit strange. While other projects are able to attract new users, Siacoin is unable to because of something as seemingly trivial as an interface.3. POW algorithm for Decentralized File Storage

While Proof-of-work is the “puritans” Sybil protection mechanism, the application of it is very limited due to the prohibitive costs associated with its computation. Moreover, POW is subject to limitations based on the processing capabilities (as measured against the level of security provided). Having to work with POW in decentralized file storage systems creates design constraints that potentially hold back the system from realizing necessary levels of scalability.4. Settlement with the SEC

Both a strength and a weakness. In the SEC settlement, the Sia Foundation arrived at their SF (SaiFund) token being recognized as a security. With this acknowledgment, the ownership of SF is more convoluted than ever before and a huge turnoff for any potential investors because now they know that is they own SF they are immediately liable to the full extent of securities law.5. Extreme downwards drag on token value

The economic model does not position itself as overly effective, in fact, the majority of the tokeomic design is net-negative on the value of the digital asset itself. No incentive for providers to hold/keep the SC after getting paid, very weak incentive for users to speculate, perpetual inflation, strange (ineffective) attempts at implementing a burn mechanism, and a splitting token model (SC/SF) that accrues to the SF holders, only expediting selloff pressures.

1. Growth of Decentralized Storage Sector

The category that Sia is operating in is considered to be among the largest and primed for continued growth at a CAGR of ~23.4%. The demand for computation shall continue to rise alongside the development of mankind and all of his creations (especially with AI). As computation grows so does the need for memory in which to store all of its associated data.

1. Skynet Labs Shutdown

The entire Sia ecosystem was initially conceived by Nebulas Inc. which later split into two entities that were wholly responsible for developing, promoting, and managing the network. One of these entities was Sky Labs, which contributed tremendously to the business development side of things, bringing tremendous value to the network in the form of new contracts. After the unwind and shutdown of it Sia experienced an ~88% drop in the total active contracts and had an equally strong decline in the instantiation of new ones. *Note on this, whenever the shutdown transpired, other environmental problems (namely Filebases technical hiccups) caused compounded issues.2. Modernized Competition

The decentralized Storage sector is easily one of the most promising in terms of the evergrowing market size. Coupled with the highly intelligent caliber of players at the table here that are improving functionality and presenting *potentially better storage solutions, Sia can be rendered suboptimal over the course of time and disregarded.3. Significant decline of community

In crypto, community is everything. Siacoin’s long history and insane funding (raising over $300 million USD) would incline us to think that they would have a strong community due to incentives, marketing, and affiliations with influencers. That is not so. The foundation overlooking Sia has disappointed and angered its community so many times with so many downright strange decisions (such as its massive $20,000,000 treasury burn where they literally said they don’t know what to do with it because they are scared of potential taxes) that they have been loosing all their original believers and have not been able to recoup any of them.

This one’s a heartbreaker.

The Siacoin mission is great, but the technology is now so far behind, and the community so far detached that the project seems to be living on a prayer. A lot of delays, controversial system architecture decisions, bag fumbling by the foundation, and involvement with the SEC.

There is a disbalance of positives to negatives, with the negatives outnumbering the positives and outweighing their importance.

I give them tremendous respect and credit for being able to resolve things with the SEC and still prove the project to have staying power after the fact.

Unfortunately, it seems that rather than being beneficiaries of the first generation, they fumbled the bag due to leadership errors and poor decisions; that gap seems to have tilted outside of the realm of a potential recovery and will be taken by newer generation projects.

I really want to like Siacoin. I am a huge proponent of proof-of-work systems. I love the Generation One philosophies.

However, the current objective state of Sia is disappointing. It seems that even if they deliver on all of their promises, it simply will not be enough to make the project as valuable as it was once perceived to be.

Something that was not addressed in depth here is the controversial dual token model that Sia has within its ecosystem: SC and SF. Simply put, SC is the native token for conducting transactions and paying the network fees and SF is a token that earns a portion of all network fees. I am not a fan of dual token models because of how much it skews the vectors at which potential value is captured. Not to mention that SF doesn’t even provide governance rights, and over 85% of the supply is owned by the Sia Foundation.

Would I invest in SC (Siacoins)?

Hell no.

All respect to the project, I want to see them succeed, but under the current circumstances, I would never invest in the digital asset.

Would I invest in SF (Siafunds)?

No.

Even though it is SEC-compliant and provides revenue, I simply do not believe that out of all the opportunities in the crypto industry, this one is worth spending time or taking a risk on.

If you know something that I don’t or feel as though I might have missed anything worth noting, please do share, I would tremendously appreciate some feedback.

Thank you so much for reading,

I hope this serves you well on your journey.

Live long and prosper 🥂