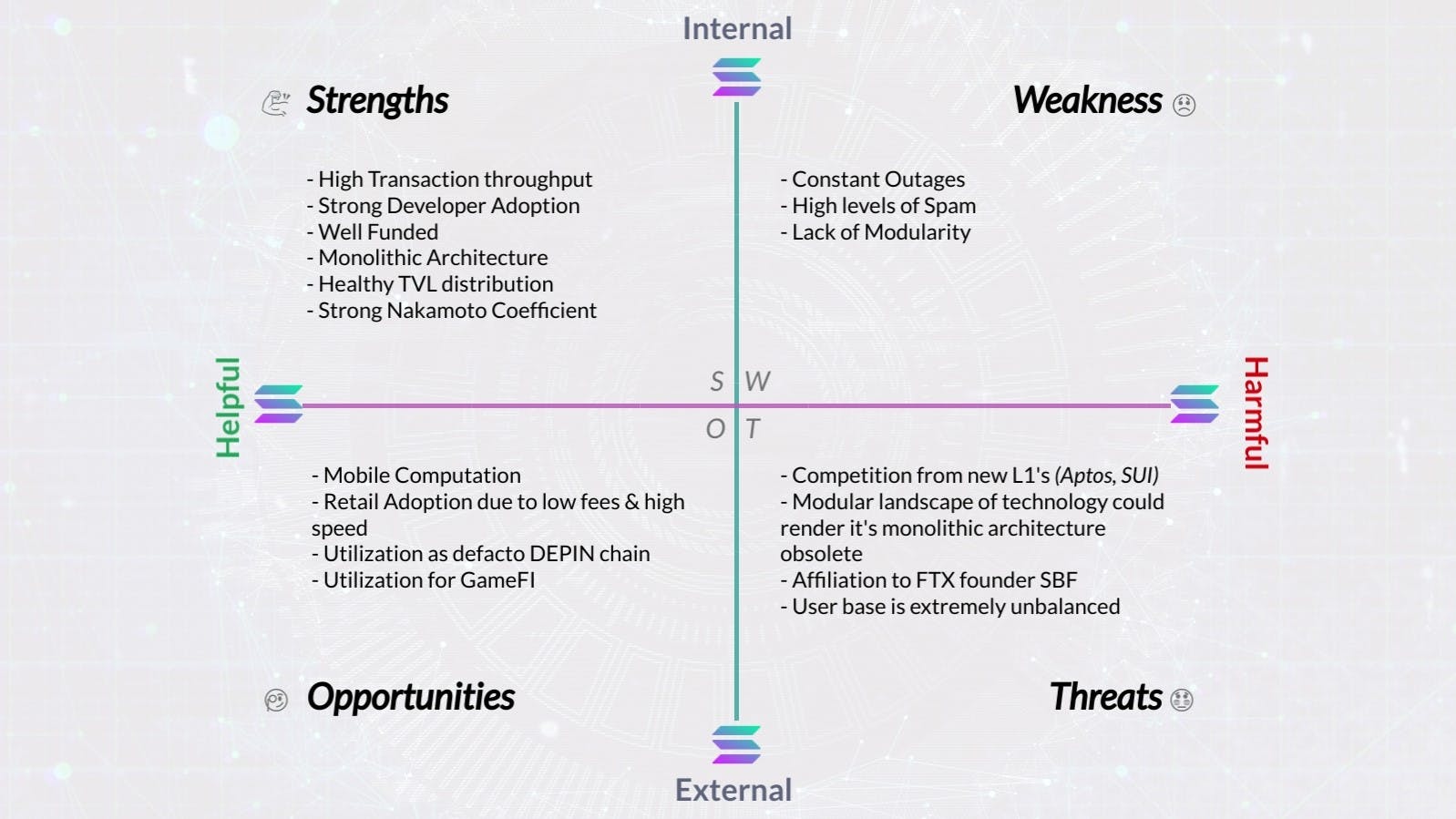

SWOT Analysis: Solana (SOL)

Composed of four elements, Strengths, Weaknesses, Opportunities, and Threats, a SWOT analysis provides an excellent framework for evaluating the state of a project’s well-being through the lens of a birds-eye view.

It can help formulate decisions on what areas might require more attention, set performance goals, and organize a foundational understanding that a project is headed.

*Note, SWOT is an analysis of operational/fundamental elements. This is not a model to be used for technical or trading purposes. (NFA, DYOR)

Rarely (if ever) used in crypto, it is time to apply this timeless method of evaluation to the digital asset space.

Today, Solana, one of the most performant L1 blockchains in the industry will get a SWOT.

1. High Transaction throughput

Handling ~4,500 TPS on average, the Solana network can theoretically, potentially be capable of achieving over 700,000 TPS. Coupled with its low latency the network has tremendous potential to draw in a wide range of applications/use cases that it would be able to sustain.2. Strong Developer Adoption

Having over 2,000 developers puts Solana in second place (behind only Ethereum) of being the most actively developed network. The hackathons that are constantly being held have brought so much positive responses from developers desiring and willing to join Solana that it seems this trend will continue to grow.3. Well Funded

Backed by prominent venture capital firms and drawing attention from many new financial institutions, the foundation that oversees Solana’s development has deep pockets to weather long periods of uncertainty and pursue growth and development.4. Monolithic Architecture

Having all core functionality baked into a single software structure creates very strong dependencies between the network and the token.5. Healthy TVL distribution

The balance of Solana’s native token SOL is not overly concentrated in any single protocol; it actually has one of the best distributions of TVL across all L1 and many L2s.6. Strong Nakamoto Coefficient

The Nakamoto coefficient is a measure of decentralization. Floating around 34, Solana boasts one of the highest measures across all L1 chains.

1. Constant Outages

Notorious for its random halts and network outages, Solana catches so much heat from degen decentralization maxis on Twitter about how it’s always going out. If more valuable operations are to arrive on Solana, outages must not be present as they would ultimately deter end users.2. Subject to mass Spam

Thought to be one of the major causes of the network halting, Spam is rampant on Solana due to its low fees and fast transaction times. By virtue of its nature, spam is low-value/malicious activity that denies potentially important/valuable transactions from taking place. Which results in failed transactions and confused users.3. Lack of Modularity

While its monolithic architecture provides benefits, it does come at the tradeoff of being rigid. Potentially denying it of novel developments that are being utilized in the broader industry.

1. Mobile Platform

Launching the SAGA mobile phone and creating its own accompanying app store has the potential to tap into a vector of adoption that has not been contended and does not have competition.2. Retail Adoption due to low fees & high speed

The vast majority of users will not use a platform that requires long wait times and incurs high operational costs. Consumers are fickle, they want what they want, when they want it! That is absolutely logical and Solana delivers!3. Utilization as defacto DEPIN chain

Decentralized physical infrastructure has been a hot topic with the potential to generate massive transactional velocity. Solana’s strong geographic distribution and underlying equipment lends itself perfectly to processing this kind of information. Two major infrastructure projects, Helium and Render, recently migrated to Solana highlighting this use case.4. Utilization for GameFI

Gaming is a highly contended sector and considered to be one of the most promising in terms of mass onboarding use cases. Blockchains capabilities to financialize gaming has sparked a new category of competition that has had hundreds of millions of dollars thrown at it. Even in the current difficult market cycle Solana Ventures has over $150 million USD allocated just for this purpose.

1. Competition from new L1’s

There has been a new generation of blockchains popping up (Aptos, SUI), all vying to displace older projects with their superior performance. Undoubtedly, as there are more advancements in technology these new L1s do have the potential to offer an exponentially better user and security experience than their predecessors.2. New technological landscape of Modularity in the industry

With constant conversations about rollups, sidechain and nested blockchains buzzing around the absence of modularity in Solana’s network might leave it out of this evolution.3. Affiliation to FTX and SBF

There is a strong connotation between SOL and the sh*tshow of the FTX platform’s debacle. While this is no longer considered likely to be catastrophic to the network, it is still something that is constantly brought up in conversations around Solana.4. Unbalanced User Base

Solana is an extremely technically complex project that demands a high level of education in order to properly understand all of its nuances. As it stands, the spectrum of users is extremely divergent; on the one hand, there are brilliant developers and technologists that support the network, on the other hand, there are absolute buffoon degens that cannot understand what makes the network different from anything else.

Odds are that my bias might have intruded on the objectivity of this analysis, nevertheless, regardless of what this analysis shows, I am personally ultra-bullish on Solana over the next few years.

I see all of the weaknesses as just opportunities for improvement and the threats as just FUD inherent to all projects.

You might have noticed that there is no talk about regulation, that is because regulation would apply to absolutely every project and this SWOT is focused on Solana.

I might have missed something and would tremendously appreciate some feedback.

Thank you so much for reading,

I hope this serves you well on your journey.

Live long and prosper 🥂