Tapping into the Potential of Underrated Crypto Sectors

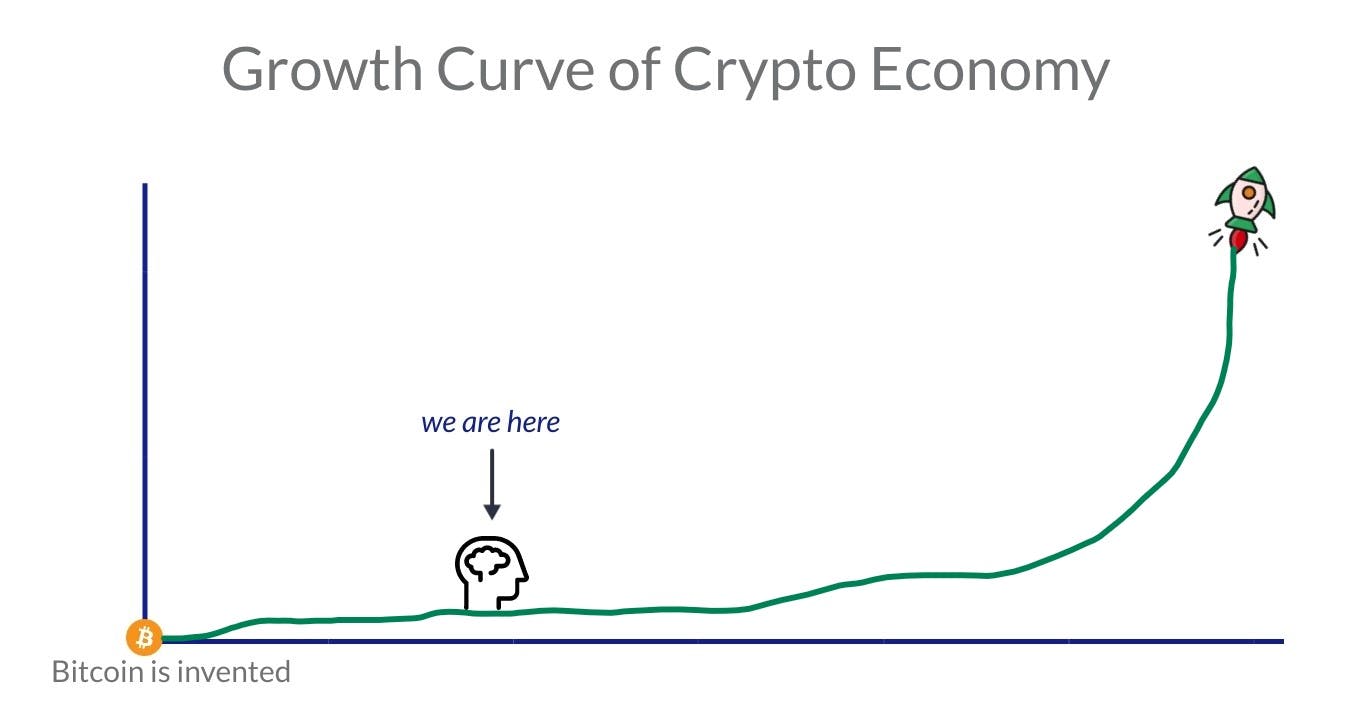

If you are in crypto, you might have heard the saying “You’re still early”.

Whether a trader, investor, or entrepreneur, that is the absolute truth.

On the surface level, it seems as though the vicious market cycles of crypto flourishing, dying, and coming back to life have created the impression of technological maturation. That is just a short-sighted illusion.

To put things into perspective, as of writing, the entire crypto-economy (and its many sub-sectors) carries a nominal value of ~1.2 Trillion USD. Whereas the world's traditional FOREX market alone is sporting an eye-watering value of over ~2,409 Trillion USD. Yes. that is 1,200x the size.

With so much at stake, this emerging economic sector has had a Cambrian explosion of innovation take place over the last decade. However, that innovation has been extremely narrow in its focus; primarily on money and computation.

Only in these last couple of years has blockchain technology (public DLT) begun expanding to other areas. DEFI, decentralized storage, art, supply chain, gaming, asset management, social media, the list is truly endless. (For those interested here is a 2023 Industry map)

Given the broad surface area of potential development, the scope of market applications within the crypto-verse reigns far and wide.

It may come as a bit of a surprise that in spite of all the new verticles for innovation, there have been a few sectors that have gone nearly untouched or unnoticed. Certainly, there have been valid reasons such as limited talent pools and design hurdles that contributed to this lack of development. However, with the acceleration of human intelligence and an expanding availability in the workforce, this should be ringing alarm bells and spiking your creative faculties!

There are potential multi-billion dollar opportunities that haven't even been chipped away at yet!

How do we measure the potentiality of a market?

Marketcap is definitely a good starting point, but it does not accurately capture the entire picture.

There are 5 touch points of questioning that I use to define the potential of a sector/project:

1) Sector Capitalization and TAM (Total Addressable Market):

What is the current size of this specific market in the crypto economy? What is the size of the market in the traditional economy?

2) Amount of projects:

How actively are new projects spawning to deal with this sector? How often are they failing or dropping their efforts? How far along do they get before they seize development? How competitive is the existing landscape? How difficult is it to get involved?

3) Adoption of projects:

How quickly can projects scale their user bases? How long does the average user stay with the platform? How difficult is it to get the next user? Is there a network effect of referrals that plays into the use case?

4) Amount of support from ancillary projects:

Integrations with other players in the ecosystem are quintessential for the longevity of any project. How many affiliated projects are there? How deep is the support they provide?

5) Degree of application to real-life users:

Will the subject matter of the application actually be useful to people in their daily lives; is there a product market fit for what is being developed?

Enough chit-chat, let's get into it.

Here are just some areas of the crypto economy that are incredibly opportune and waiting to be tackled by entrepreneurs:

Insurance

Recession-proof, high margin, and always in need. Seems obvious that one of the world's oldest and largest markets should make its way on-chain. To be fair, it's not that simple. There are still a lot of uncertainties in the technology itself and regulation is still unclear.

First and foremost, hacks are demolishing the space. Every year, since the advent of cryptocurrency, people have been hijacking hardware, scamming, and sneaking phishing links into browsers worldwide. In 2022 alone, more than roughly $3.8 Billion USD were stolen by hackers. Surprisingly (or not) much of this was due to vulnerabilities found in DEFI smart contracts, mainly bridges.

As it stands, there are some players already on the prowl, taking market share, stacking up TVL, and buidling silently. But they are few and far relative to the monstrous size of this market; here are the ones I found that are worth keeping an eye on (and honestly maybe even consider using, nfa)

- Nexus Mutual

- Bumper Finance

- Unslashed

- Insurace

- Insure Finance

- Neptune Mutual

- Open Cover

- Solace

- Sherlock

The design space for decentralized insurance is mindboggling, if you take a moment to review some of the projects I listed you will see that there are so many creative approaches to providing insurance for nearly every vector/touchpoint of crypto, from price volatility to smart contract failure to stablecoin de-pegging and so much more!

Binary Options

Exotic financial instruments never hurt anybody right? (no they haven't, people who don't know how to use these instruments hurt themselves with it, it's part of the learning curve.)

Everybody knows that there are hundreds of DEFI protocols ranging from perpetual swaps to bridges to DEXs and everything in between. In fact, DEFI is the sector with the most innovation taking place. Protocols are popping up left, right, and center! However, after doing some research I came to find out that there are no major players developing decentralized Binary Options; actually, I only found three projects worth mentioning:

- Tytanid (on ETH)

- ProphetX (on BNB)

- Buffer Finance (on Arbitrum)

A very popular tool in legacy financial markets (primarily retail) Binary Options allow people to bet on the direction of the price over a set time frame. Instead of buying Bitcoin at $30,000 expecting it to go to $33,000 and selling for a 10% profit (paper-handed mfer) somebody can make a bet that within the week, the price of BTC will be higher or lower than where it is right now. It is an all-or-nothing bet though, so if their contract closes even 1 micro pip in their foretold direction, they get the entire contract's reward and if not, they lose their whole position deposit.

Considering the degen nature of the average DEFI power user, it's strange that this instrument has yet to make it to market properly.

I have considered that the actual size of the market of people that want to use a product like this might be undefined, however, as an options product it is possible to make the entry threshold very low and in turn invite more people to participate in the marketplace.

* I have found a few more centralized tradfi platforms that offer binary options for cryptocurrencies, but as you might already understand, we're talking about on-chain innovation in this article.

Prediction Markets

This is one of my favorite sectors that for some odd reason cannot seem to take off. As the name might suggest, prediction markets are where people come to bet on the outcome of well, any prediction.

The perfect marriage between finances and pop culture, prediction markets introduce a new way for people to “put their money where their mouth is” and prove the power of their voodoo insight convictions.

Political elections, sporting events, climate change, video game tournaments, Kim Kardashian’s next botox injection, if you can think it, you can bet on it!

Just as in the case with Binaries, there are very few projects worth mentioning that are actually pursuing this segment;

- Augur

- PolyMarket

- PlotX

- Azuro

- Prosper

- Zeitgeist

- NumerAI

I'm sure as hell that as the world continues its ascension into tokenization, and nearly every aspect of human life becomes financialized, this segment will continue to grow. (I would be willing to make a bet on it 😁)

M&A (Mergers and Acquisitions)

The dark art of combining projects to obtain their users and developers. All mergers and acquisitions are negotiated and settled behind closed doors.

In the crypto-verse, mergers and acquisitions are actually commonplace. During bear markets, as projects run out of funding and become desperate to save themselves, industry leaders that stockpile cash swoop in and “save the day”.

There are two categories of M&A in crypto; traditional companies buying other companies and networks acquiring other networks:

A few known TRADFI acquisitions:

- Concord Group buys Circle Financial

- Huobi buys Bitex (exchange on exchange stuff) in 2022

- CoinMarketCap buys Hashtag Capital in 2019

- Poloniex acquires TRXmarket (now called SunSwap) in 2019

A few known Decentralized mergers and acquisitions:

- Polygon acquires Hermez network.

- Keep Network & NuCypher merge into Threshold

- Nike acquires RTKFT nft collectibles studio

Crypto is a game of networks, it works best through cooperation. I anticipate that decentralized M&A will become more popular as the rate of innovation continues to grow.

If you are building or are interested in building a project in one of these sectors and would like to connect;

then my dear friend I propose to you,

Let's find each other and do something great together 🥂

Otherwise,

Thank you for reading,

May this serve you well on your journey through the digital economy 🙏

Live long & Prosper 💎