1.7.22

New year, non-fungies; Gary and the SEC are coming; and macro uncertainty

Happy New Year! It is officially 2022 and people are still buying jpegs. As such, this week’s issue skews non-fungible. At a macro level, the crypto markets have had a slow start out of the gates, with Bitcoin and Ethereum both down ~10% YTD and the broader capital markets selling off as The Fed signals readiness to shrink the balance sheet. More on that below for those interested.

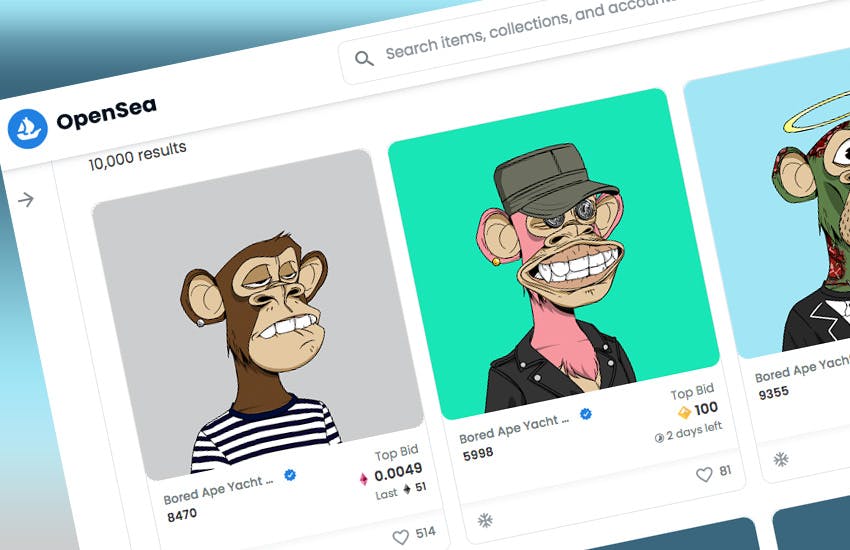

Everybody’s favorite centralized NFT marketplace, OpenSea, raised a $300M Series C at a $13.3B valuation in a deal led by Paradigm and Coatue. The company is also exploring an all-stock acquisition of Dharma Labs, one of the original digital wallets for crypto-assets. The $13.3B valuation represents an 8.9x step-up from the Series B financing announced last July. As shown in the dashboard below (h/t Dune Analytics), OpenSea has seen roughly $2-3B in monthly volume since August, generating more than $1B in fees over the last five months. The number of OpenSea users has grown from 175K at the end of July to just below 1M today. If you wanted to be early to OpenSea, that ship has sailed. (I’ll show myself out.)

Other quick NFT-related hits: Samsung is introducing an NFT platform within its new smart TVs, GameStop is reportedly planning to build a gaming-related NFT marketplace, and MoonPay announced the launch of a concierge service to help high net worth individuals purchase NFTs, with Jimmy Fallon and Post Malone already taking advantage. And guess who’s back, back again? Eminem, who became the latest celebrity to purchase a Bored Ape, joining Stephen Curry and our two aforementioned MoonPay clients.

Electric Capital released their annual Crypto Developer Report this week. I have attached a digestible summary of the 130-page report. The growth of developers in crypto was record-breaking in 2021, but still represents a small, and rapidly expanding, percent of software engineers globally, suggesting that we are still very much in the early innings even with this tangible and continued inflow of technical talent.

Polygon, one of the largest and most prominent scaling solutions for Ethereum, announced the detection and subsequent correction of a critical vulnerability in its code’s genesis contract. This would have allowed attackers to steal over 90% of all Polygon tokens (MATIC), a bounty worth $24B at the time of the discovery (closer to $15B today). The vulnerability was reported to the team, after which Polygon undertook a hard fork to fix the bug and save the project. This event acts as a timely reminder of the technical risk teams, communities, and users take as crypto continues to mature.

BTCS, a self-proclaimed blockchain technology-focused company, announced the first ever dividend payable in bitcoin by a Nasdaq-listed company. BTCS is calling this one-time payment a 'Bividend,' which will pay 5 cents per share in bitcoin to all shareholders on the ex-dividend (ex-bividend?) date of March 16, 2022. It is possible this is purely a marketing stunt from a <$50M market cap company but considering the public market response – the bividends will total roughly $500K and the company added almost $15M to its market cap following the announcement – don’t be surprised if we see variations of this approach from other companies in the future. This could be for bividends what MicroStrategy was to validation of bitcoin as a treasury asset.

SEC Chairman Gary Gensler is pushing to become a staple in this weekly newsletter, announcing that he has hired a senior advisor, Corey Frayer, to focus exclusively on establishing a regulatory framework for crypto. Frayer spearheaded crypto policy under Senator Sherrod Brown, an outspoken crypto critic due to concerns about the risks crypto-assets pose to investors. Senator Brown referred to blockchain technology as a 'shady diffuse network of online funny money' back in July.

Lastly, the final link below is a write-up from Arthur Hayes regarding his thoughts on the macro environment (with a heightened focus on crypto). Hayes founded BitMex, once the largest crypto derivatives exchange in the world, though he is currently awaiting trial for failing to put sufficient AML safeguards in place on the platform. Legal case notwithstanding, Hayes retains a prominent macro voice in crypto and makes the case that continued growth in network and user growth fundamentals will not necessarily 'allow crypto-assets to continue their upward trajectory unabated.' As this newsletter often leans positive and highlights the ‘micro’ drivers of crypto (eg user adoption, developer activity), I thought it would be worthwhile to share a contrasting and reminding view of the potential tension generated from ‘macro’-driven short-/intermediate-term risks (eg the Fed signaling intent to tighten their balance sheet).

Source Code

NFT Marketplace OpenSea Valued at $13.3B in $300M Funding Round:

Scoop: NFT marketplace OpenSea in talks to buy Dharma Labs:

https: /www.axios.com/opensea-nft-dharma-acquire-f6df00d5-1cc0-463a-95fd-2f5039947ed8.html

Dune Analytics OpenSea:

https: /dune.xyz/rchen8/opensea

Samsung to introduce NFT platform within its new smart TVs:

https: /www.theblockcrypto.com/linked/128942/samsung-nft-platform-smart-tv-2022

GameStop Entering NFT and Cryptocurrency Markets as Part of Turnaround Plan:

MoonPay's New NFT Concierge Service Helps Celebs Buy Bored Apes:

https: /decrypt.co/86834/moonpays-new-nft-concierge-service-helps-celebs-buy-bored-apes

Eminem Purchases Bored Ape Yacht Club NFT for $462K:

Electric Capital Developer Report (2021):

https: /medium.com/electric-capital/electric-capital-developer-report-2021-f37874efea6d

'Critical' Polygon bug put $24 billion in tokens at risk until recent hard fork:

Blockchain Firm BTCS to Offer Dividend in Bitcoin; Shares Surge:

SEC Chairman Gary Gensler Hires Senate Banking Aide to Advise on Crypto Policy:

Maelstrom (Arthur Hayes):

https: /cryptohayes.medium.com/maelstrom-ee6021e9d0c2

[Disclaimer: Any opinions expressed are solely my own and do not express the views or opinions of my employer. Because the information included in this newsletter is based on my personal opinion and experience, it should not be considered professional financial analysis or advice.]