5️⃣ Comma Partners: May 2025

From austerity to acceleration

Howdy y'all, I'm back after being locked out of Paragraph for a couple months.

Sending this May update late anyway - June update coming very shortly as well.

A reminder that my main home for writing is at https://www.comma.org/, which includes more than what's here, including the podcast and other more exploratory essays.

Welcome to Comma Partners

A new-paradigm crypto fund investing at the frontier of community, technology, culture, & capital

Greetings frontierspeople.

May’s update for Comma Partners is a big one. The most important takeaway?

Our paradigm has shifted.

In April, the US administration (I’m tired of writing “Trump”) had its hands on the wheel and was steering us toward a full-scale global reordering - political, economic, cultural.

Then, bond yields spiked and put the pressure on.

The administration then made a hard pivot. Negotiations were to commence. Deals were to be struck.

Heading into May, the question was whether that softer stance would stick.

Now we know.

Not only have we been told that the administration is seeking to strike trade deals, but we’ve also seen that - as Lyn Alden says - nothing stops this train.

The One Big Beautiful Bill Act (the “OBBBA”), and the narrative shift of the administration around it - from global trade reciprocity and DOGE efficiencies to fueling growth in order to outpace increased budget deficits - cemented it.

This administration has been very transparent about the actions it has taken. It’s prudent to listen to what they’re saying.

And now, they’re saying it’s time to run it hot.

(By the way, I wrote all the above before today’s fiery crash out between Trump and Elon, which led to this:

My quick take? Elon is sounding alarms about everything we’re about to discuss below, and Mr. Trump isn’t going down without a fight.

Volatility is the name of the game in today’s world - noisier than ever. So, let’s try to zoom out, think longer-term, and pull some signal from this cacophony, shall we?

Dips are for buying.)

For the month of May:

Crypto:

BTC +11%

ETH +41%

SOL +6%

Equities:

S&P 500 +5%

NASDAQ +7%

Gold:

Gold +1%

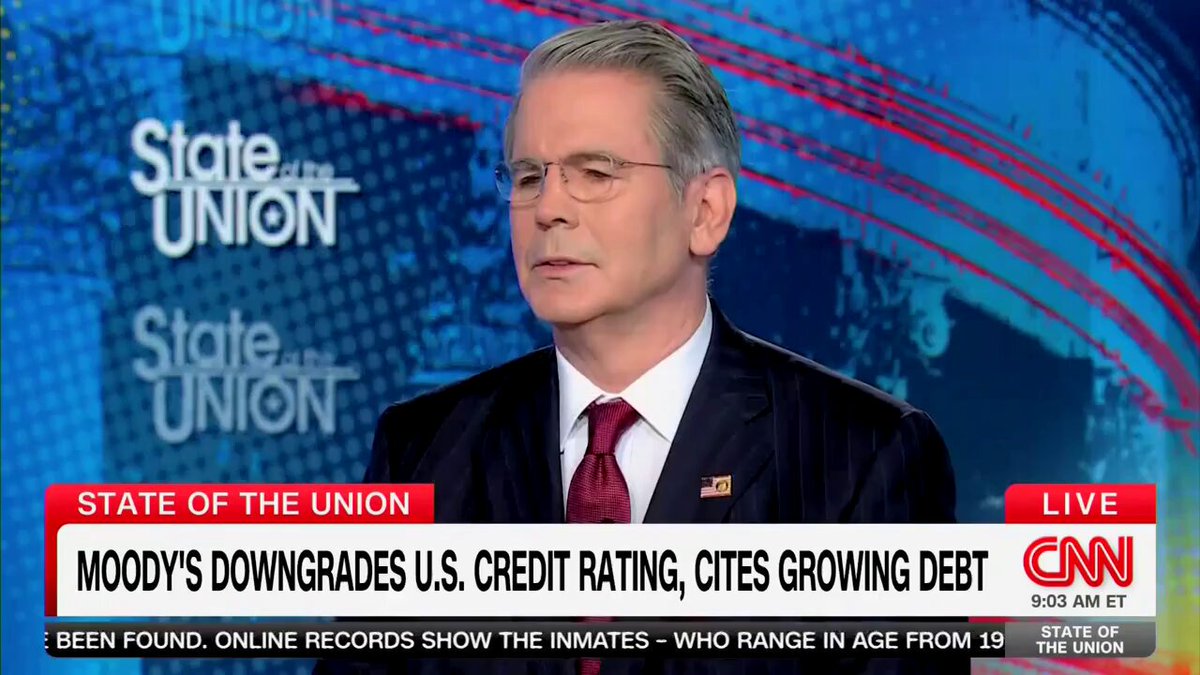

Early in the administration, Treasury Secretary Scott Bessent made it clear: the priority was getting the 10-year yield down.

Their priority was clear - lower borrowing costs for the mounting US debt, most pressingly for the ~$10T (trillion, with a “t”) to be issued throughout 2025.

Their tools?

Tariffs + increased government efficiency.

Re-balance global trade imbalances. Re-onshore manufacturing. Spark a boom for Main Street. Cut “waste, fraud, and abuse.” Lower yields along the way.

I went looking for one or two posts to prove the point and ended up falling down the Bessent rabbit hole.

It was “Main Street’s turn.”

And I’ll spare you the DOGE examples. We’ve all seen plenty of those.

Initially, yields did the administration’s bidding, with the 10-year dropping below 4.0%.

But then, they rebounded sharply, rising to ~4.5%, where the administration started pivoting.

What can we learn from this?

The initial market reaction was recession fear, not policy confidence

Investors fled US assets across the board - stocks, bonds, and the dollar all down in lockstep

4.5% on the 10-year seems to be the pain point

Bond vigilantes are doing their job - and they appear to be the market’s primary policy check

So, how did the administration pivot?

“Pauses” on Liberation Day tariffs. Negotiations to strike trade deals.

Those were just the appetizers.

The main course?

The OBBBA.

A projected $2.5T annual deficit - up from ~$1.8T last year and more than double 2019’s ~$1.0T - even before accounting for higher interest costs as we continue to issue new and more debt.

One Big, Beautiful Bill to lock in acceleration over austerity. A shift to running it hot.

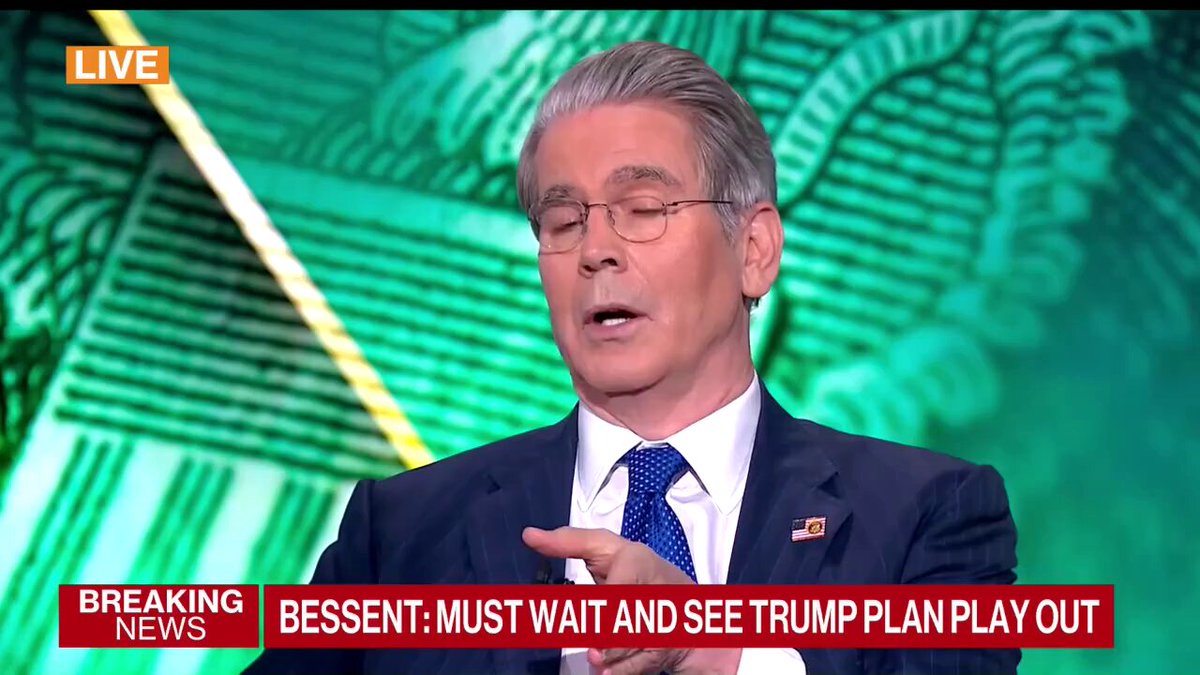

Take a look.

There is the potential growth of the debt, but what’s more important is that we grow the economy faster.

We are going to grow the GDP faster than the debt grows...

In fact, we no longer even have a choice.

Oh, and check this out.

It’s time to take the hint.

A President elected with a very clear mandate to back Main Street.

Record-low unemployment.

High Fed rates - with plenty of room to cut - and a Fed practically begging for an excuse, calling current rates “restrictive.”

An economy that’s ~80% services, softening the blow from goods-based tariffs.

Our generation’s greatest entrepreneur running a Department of Government Efficiency.

And we still couldn’t get it done.

So, truly, nothing stops this train.

And the can gets kicked down the road.

Three concepts are colliding.

Fiscal dominance (à la Lyn Alden), The Everything Code (à la Raoul Pal), and Paradigm C (à la Darius Dale).

What’s the story here?

Aging demographics → shrinking workforce

Rising fiscal deficits & debt loads to plug the productivity gap

Rising interest rates & interest payments as fiscal health deteriorates and the market demands compensation for increased risk

Bond holders & political populism restrict austerity attempts

Austerity would crush asset prices → shrink capital gains → reduce tax receipts → spiral us deeper

The endgame? Manufacture liquidity to keep it all running

This = fiscal policy dominance.

Fiscal needs overpower the Fed. Deficits set the agenda now - not rates.

This = The Everything Code.

Demographics drive macro. Aging populations slow growth, and governments step in to fill the gap with new liquidity.

This = Paradigm C.

Paradigm A: a bloated, K-shaped economy propped up by easy money and government spending - disproportionately benefiting the top part of the K

Paradigm B: a shift to a more balanced, E-shaped economy - with private sector output taking the lead

Paradigm C: all the largesse of Paradigm A, plus more tax cuts and spending that largely benefit the top part of the K

If there are three ways out of this bind - cut, grow, or print our way out of it, then:

Paradigm A was status quo when this administration entered office (a mix of attempted growth and undeniable printing)

Paradigm B was the initial goal (cut spending, restore discipline, rebalance the economy) - but the bond market wouldn’t allow it

Paradigm C is where we’re headed now after this pivot from austerity to acceleration (more growth, more deficits, more printing) - Paradigm A on steroids

Own the assets that can’t be printed - and are building the future.

Non-sovereign, fixed-supply assets driving innovation.

Stocks (selectively). Gold. Crypto.

We said it last month. We still believe it.

I still hold the belief that each time we’re faced with sudden, dramatic change that’s imposed by someone that’s in charge, the world moves one step closer to realizing the value of a neutral, independent, and non-sovereign system that exists outside of our traditional ones.

Let’s take a look at things since April 1st.

Stocks and gold up.

Crypto up more.

Just think about how crazy that is. This includes the dramatic drawdowns in the aftermath of Liberation Day.

Peak (April 2nd) to trough (April 7th):

(-12%) for the S&P 500

(-16%) for the NASDAQ

(-15%) for BTC

(-25%) for ETH & SOL

That means trough (April 7th) to June 4th (the day before the Elon and Trump crash out):

+19% for the S&P 500

+28% for the NASDAQ

+37% for BTC

+76% for ETH

+54% for SOL

The dollar’s down.

Yields are up.

Oil is down.

Despite volatility, markets have performed exceptionally well.

Even adjusted for volatility, BTC has outpaced the S&P 500 year-to-date - by a lot.

And, financial conditions have eased - setting us up for the months to come.

The strength in markets is happening against a backdrop of terrible sentiment.

Vibes are off.

We have a clear disconnect between “soft” and “hard” data.

First thing to look at is market performance - which we’ve covered.

Next, macro data.

Job openings are strong. Q2 GDP estimates are being revised up. Inflation continues to cool.

Soft data (vibes) lags hard data

⬇️

Hard data drives soft data (vibes)

⬇️

Soft data (vibes) shapes narratives

⬇️

Trump drives narratives, so soft data (vibes) is driving more and more behavior in the short-term, more distracting

⬇️

Disproportionate value to following hard data

So, what should we do?

Follow hard data.

And all this is happening with rates still elevated. At these levels, rates are less of a factor than expected. Markets have been strong, and bond volatility/distress as measured by the MOVE index is stable after coming down from touching 140 after Liberation Day.

(This is even more true after the drama we’re seeing play out today between Elon and Trump - pouring even more noisy fuel on the cacophonous fire of fearful narratives and bad vibes.)

The ZIRP (zero interest rate policy) experiment has been a wholly 21st century phenomenon.

From 1975 to 2000, the average Fed Funds rate was ~7.5%

Looking at this chart, you’d think rates are crazy high.

But looking at this chart, you’d see that rates are historically low.

We should expect rates to stay higher for longer.

The market is telling us that rates around current levels aren’t an issue.

At higher levels? Perhaps.

And we saw at the end of last year that the Fed cutting front end rates had the opposite effect on the long end.

The economy remains strong, and the Fed knows cutting could stoke inflation concerns (driving long yields higher) - so we should expect the Fed to sit nice and comfy until they’re undeniably forced to step in.

Rates at these levels don’t seem to be a problem for the market.

But who are they a problem for?

The US government, with their massive debt load (~$37T) and interest payments (over $1B annually) larger than our defense budget. And keep in mind that this is all sitting at below-market rates (~3.5% on average), which will reset higher as we roll forward, further exacerbating the problem.

This is the ticking time bomb. Every dollar of new debt and every tick up in rates shortens the fuse.

We’ve kicked the can down the road. And it will get worse.

In the long run, this is a massive problem.

In the short run? They’ll simply print more money, and hope that growth and innovation buy more time.

Idiosyncratic tariff risks remain. So do the risks tied to the personalities in charge. (Oh, and keep an eye out for capital controls next...a topic for another day.)

Still, we know where pressure gets too intense - above 4.5% on the 10-year or 140 on the MOVE index.

And, the economy is holding strong.

Plus, they’ve told us what they’re going to do.

They’ve told us they’re shifting from austerity to acceleration.

Nothing stops this train.

It’s time to take the hint.

It’s time to own the assets that can’t be printed - and are building the future.

It’s time to own crypto.

It’s time for Comma.

Overall, I’d still give us a green light.

None of the 6 technical/valuation metrics below are in the warning zone.

Currently: ~63%

Warning zone: ~45%-50% (bottomed ~40% last cycle)

Currently: ~2.2

Warning zone: ~3-3.5 (topped ~3.9 last cycle)

Currently: ~2.5

Warning zone: ~6-7 (topped ~7.5 last cycle)

Currently: ~0.55

Warning zone: ~0.6-0.7 (topped ~0.75 last cycle)

Currently: ~1.1

Warning zone: ~2 (topped ~3.25 last cycle)

Currently: not near a cross

Warning zone: when blue line approaches purple line

Also all on Farcaster

As capital markets get freer, faster, and cheaper, long-term thinking becomes even rarer

Just as we separated church & state, we will separate money & state

Graham Weaver (Alpine Investors) on Invest Like the Best

Blake Scholl (Boom Supersonic) on My First Million

Cyan Banister (Long Journey Ventures) on Invest Like the Best

If you haven't subscribed yet, join us here:

12.9K

12.9K