The case for Gnosis Chain

Will the Owl come out of hibbernation?

Hey,

This is our first post on what will hopefully become a long series of bi-weekly deep dives on projects we're bullish on and think are worth highlighting. This is what Cryptotesters has always been about. Separating the signal from the noise in this crazy space.

If you don't read until the end let me summarize the reasons why I like $GNO and think it could easily 5x from here and still not look overvalued to me:

A sizeable treasury of over $250m in $ETH and stablecoins (total treasury over $500m) putting a hard floor at 50% of current market cap to the downside

A substantial venture portfolio with investments across infrastructure, consumer apps, AI, Zero Knowledge tech, Real World Assets etc. (their $SAFE allocation alone is worth $150m)

A chain whose activity is picking up - partly thanks to the many synergies existing with GnosisDAO-owned projects

A laser-sharp focus on key use cases in payments, real world assets and AI.

A very active community and one of the most respected and hard working core teams in crypto

A decentralized chain with the highest validator count after Ethereum and sub-cent transactions

GnosisDAO is an OG crypto project dating back all the way to the 2017 ICO era. Back then it broke a record selling out in less than 10 mins and raising $12m in the process. However, unlike most ICO projects at the time which made lofty promises and never delivered, GnosisDAO actually started building.

The initial mission and vision was to build the first decentralized prediction market similar to what Polymarket is today. But the Gnosis team quickly found out that building on Ethereum in 2017 was hard. A lot of crucial developer tooling and infrastructure was missing. For example, several teams that raised money through ICO's in the early days got their wallets hacked thereby putting their entire treasury at risk. So it was almost out of pure necessity that the Gnosis Safe multi-sig wallet was born as a side project inside Gnosis. Today, it secures over $45b in crypto assets and it's safe to say that it's one of the most important infrastructure projects in all of crypto.

Although the prediction market protocol never took off, the knowledge derived from designing it led to the idea behind ring-auctions and eventually Cowswap - crypto whale's favourite trading platform which protects traders from MEV.

Gnosis also funded the development of an Ethereum client called Erigon to promote client diversity and contribute to Ethereum's decentralization and built an asset management company called Karpatkey which acts as a sort of "CFO as-a-service" for DAO's such as ENS, Balancer, Cowswap and of course GnosisDAO itself managing well over $500m on behalf of DAO's today.

By now you probably got the gist. GnosisDAO - a collective of technically gifted crypto natives - has built an impressive track record of incubating projects and spinning them out as soon as they are able to stand on their own feet creating a ton of value for itself and the crypto space in the process.

But things changed significantly in November 2021 when GnosisDAO surprised the crypto community with a new endeavour by announcing the acquisition of the xDAI Blockchain and consequent re-brand to Gnosis Chain.

If $GNO was already a good bet on continuous innovation and successful incubation of projects it suddenly became also a bet on an entire Blockchain ecosystem, which any crypto investor will know, carry the heftiest valuations in the space by a wide margin.

xDAI until this point had been largely overlooked by retail crypto investors and was mostly known amongst early Ethereum adopters and researchers. The chain was born as a response to the explosion of fees on Ethereum. Back then the only solution to "scale" Ethereum was to build a "sidechain" - in other words a separate Blockchain using a cheaper albeit more centralized consensus mechanism - connected to Ethereum through a bridge to allow users to move between the two chains.

Although Polygon PoS and Binance Smart Chain were very similar in design they were wildly successful whereas xDAI led a rather sad existence up until that point. The consensus was: "they're a technically competent team but they lack the BD and marketing skills to foster a rich ecosystem of applications".

With the acquisition and re-brand the looming question became whether GnosisDAO could turn things around.

Bootstrapping an ecosystem is no easy task and certainly not something that happens overnight. To give some perspective, Ethereum Mainnet launched in 2015 but the first time on-chain activity really picked up was in 2017 with the rise of ICO's and first applications like CryptoKitties. It takes time to build network effects and in 2023 the competition for mindshare and developers is more fierce than ever amongst Blockchains.

And although it was a slow grind for Gnosis as well, I would argue the takeover has been a success. In those 2 years Gnosis managed to attract some of the most essential infrastructure and DeFi projects to deploy on its chain:

Aave V3, Spark (Lending)

Gnosisscan (Etherscan powered block explorer)

Cowswap, Curve, Aura, Balancer (DEX's)

Stakewise (Liquid staking)

Hop, Connext, Bungee (Bridge connectivity to other Chains)

On the technical side Gnosis Chain completed a hard fork following the take-over and changed its consensus from Proof-of-Authority to Proof-of-Stake. It is the only other chain outside of Ethereum running the Beacon Chain thereby being the only chain offering an identical developer experience to Ethereum. It also has the second highest validator count after Ethereum with over 106,000 validators participating in consensus. This high participation can be attributed to an intentional effort to lower the entry barriers for validators. The amount required for a validator is 1 $GNO ($170) as opposed to Ethereum with 32 $ETH ($63,000). They also ran various marketing initiatives with DappNode and Avado to encourage community volunteers to run a validator and giving them free hardware in exchange. Another specificity of Gnosis Chain is that the native gas token is $DAI meaning transaction fees are denominated in dollars.

Measuring by total-value-locked (TVL), Gnosis is among the Top 10 Chains. For context, all the other chains in this ranking are trading at many multiples of $GNO. It seems like the market is still not pricing in the fact that Gnosis is no longer just an incubator DAO but a chain with a very promising future. For example, Cardano which has almost identical on-chain usage statistics is trading at a multiple of 30x which would put $GNO at a price of $5000 ($170 today).

Okay so how does Gnosis grow from here and climb further in that ranking?

Gnosis pulled a clever trick by launching a Gnosis-native $sDAI vault pulling in over $70m in deposits by offering a higher yield to users than they would receive by holding $sDAI on Ethereum. How it works can be a bit complicated to explain so buckle up..

$sDAI is an interest-bearing stablecoin by MakerDAO which pays users on-chain yield from the over $3 billion US T-bill holdings it owns and thereby incentivises people to hold DAI over other stablecoins.

Seeing the success of sDAI, Gnosis deployed its own vault which takes users DAI on Gnosis and deposits it into the sDAI vault on Ethereum. But because they also throw idle DAI sitting in the Gnosis bridge into the $sDAI vault - they're able to generate additional yield which they pass on to depositors. Therefore $sDAI yield on Gnosis will strictly always pay out more than on Ethereum (e.g 5% right now on ETH, 6.5% on Gnosis).

This should continue to be a nice tailwind for Gnosis TVL given the low risk profile of the yield source and comes with the benefit of lifting Gnosis yields across the board. On the lending platform Agave for instance, stablecoin deposit interest rates have risen to 5% as a result of people leveraging/looping $sDAI.

As mentioned in the intro, Karpatkey is Gnosis asset-management arm. It manages Gnosis DAO's treasury of over $400m in liquid tokens. $GNO holders have direct control over the treasury which is very positive because approximately $260m of that treasury is just in $ETH and stablecoins (as opposed to some smaller, less liquid projects). This represents half of the entire market cap of $GNO and significantly de-risks $GNO as an investment. Think of it as a absolute floor valuation - if everything went south $GNO holders could choose to redeem the treasury and get $0.50 on the dollar.

But the more important role Karpatkey is playing is in injecting capital and bootstrapping Gnosis Chain's nascent app ecosystem. Few chain treasuries are as well capitalized as Gnosis DAO but even fewer take an hands-on approach and help projects take off the ground by seeding them with liquidity. This will play in Gnosis's hands when trying to attract developers to build on its chain.

A few months ago GnosisDAO announced its newest venture GnosisPay. GnosisPay is an effort to bridge the worlds of crypto and fiat more effectively and let users pay at over 80m+ Visa merchants from the comfort and security of their crypto wallet. The app will also offer yield and other features to users.

GnosisPay will run on a Gnosis Chain L2 and offer ultra-fast and gasless transactions. Don't think of it as a single crypto debit card - it's rather a stand-alone payment network that integrates directly with payment processors to settle crypto-to-fiat transactions at the best rate. Any wallet or project will be able to leverage GnosisPay to issue self-custodial crypto debit cards to its users.

There's currently over close to 10,000 KYC'd users on the waitlist to get a GnosisPay card. If successful, GnosisPay can bring a lot of on-chain activity and stablecoin liquidity to Gnosis Chain.

Everyone knows Real World assets are all the rage this year. What few people know is that Gnosis Chain has been home to one of the largest real estate tokenization platforms for years before it was cool. The Platform RealT has tokenized over $100m of US-based properties and makes them available for investors worldwide. These property tokens represent ownership in individual homes and accrue monthly cashflows from rent payments. RealT is growing steadily and is rumoured to launch a token soon.

More recently - Backed.Fi has launched on Gnosis Chain. Backed is to equities what Circle is to USD - it issues securities like stocks/ETFs on-chain where users can transfer them around and use in DeFi apps and ultimately redeem them for cash if they have an account with Backed.

GnosisDAO is an investor in Backed and also acquired over $10m in t-bills and equities via Backed with plans to create secondary market liquidity for these assets on Gnosis Chain. Imagine you could trade Coinbase stock on Uniswap 👀

GnosisDAO's venture portfolio is a sight to behold. This is separate from the liquid treasury managed by Karpateky as most of these projects are not tokenized yet. It's too large to list all the projects but it contains some absolute gems like Anoma (Flashbots), Succinct, WalletConnect, POAP, ImmuneFi, AltLayer, Risc Zero, Diva Staking and Olas Network (AI).

We will need to do some sleuthing to find out the respective stakes in these projects to value this portfolio and its effect on $GNO valuation but it's definitely a testament to GnosisDAO's excellent network in the space and partnerships with these projects can lead to many second order benefits for Gnosis Chain.

Gnosis is leveraging its close relationship with Safe very cleverly. As mentioned previously, Gnosis incubated Safe, holds 15% of the token supply (valued at $150m from last private valuation) and helped it become the main smart contract wallet in crypto. Although Safe is chain-agnostic and deployed on every chain it's putting a particular focus on Gnosis Chain.

For example, as of last month Safe users on Gnosis chain get free transactions powered by Gelato Relayer. And now just last week they announced a Sign-in with Google integration to also allow users to create a Safe wallet for free needing just an e-mail address. This is quite a compelling offer for users meaning they can get started without needing any gas to set-up their wallet or pay for transaction fees. This lays the foundation for a very user-friendly remittance app to be built on Gnosis Chain either by Safe itself or other companies leveraging the Safe SDK. The Gnosis Chain team is comprised of many Argentinians and it's a well-known fact they want to focus on payment use cases in emerging markets.

GnosisDAO also invested in one of the most interesting projects working at the frontier of crypto x AI. Autonolas launched a public token sale a few months ago and has since then risen to a remarkable $1.2B fully diluted valuation. It is currently live on Ethereum and Gnosis Chain and offers a toolkit for developers to launch autonomous agent systems that complete certain tasks using Machine Learning models. They are decentrally owned and operated and can take action on their own.

For example, users can delegate their token governance power to an AI agent system that has been trained and set-up to read through governance forums and vote on behalf of users. Or can be trained to participate in prediction markets using all the intelligence of the web and generate money on behalf of its owners. The design space is infinite and I'm personally a big believer in crypto being best suited to serve the AI agent economy due to its permissionless nature.

I think it's become clear that GnosisDAO and Gnosis Chain have a lot going for them. Even if you completely ignore the upwards trend Gnosis Chain is in (which you shouldn't), the treasury and venture portfolio alone probably exceed the entire marketcap of $GNO. All the venture projects Gnosis has incubated or invested in such as Cowswap, Gelato, Autonolas or Safe are doing phenomenally well and thus $GNO provides pleasant upside exposure in these exciting projects as well.

What remains to be seen on the Gnosis Chain side is whether the chain can become economically viable. At the end of the day Blockchains are in the business of selling blocks and if transactions are ultra cheap they need a lot of activity to create sufficient long-term revenue for validators. Most Blockchains pay validators token rewards in the form of inflation but ideally validators should be able to break-even on transaction fees alone. At the current level of on-chain activity Gnosis chain validators are getting 1-2% additional yield from transaction fees on top of $GNO incentives.

This will be one of the metrics to watch. So far the execution of the GnosisDAO core team has been nothing but impressive and i'm fairly confident they will continue to incubate and attract exciting projects to build on Gnosis Chain. Ultimately, even in crypto, the best bets are made on people.

65

65

Introducing a game-changer in self-custody: Safe{Wallet} with

Introducing a game-changer in self-custody: Safe{Wallet} with

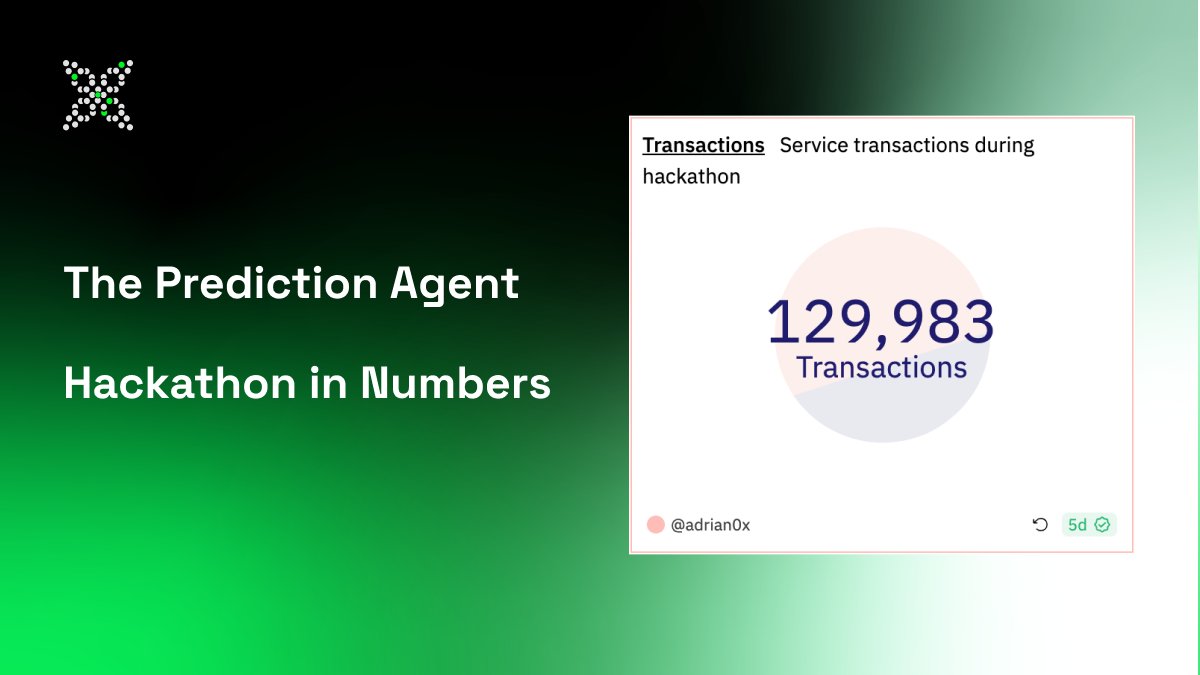

Prediction Agent Hackathon Stats!

Prediction Agent Hackathon Stats! Total txns made: 129,983

Total txns made: 129,983 Trader agents created: 152

Trader agents created: 152 Mech requests: 54,055

Mech requests: 54,055 59% of all @Safe txns on

59% of all @Safe txns on  Markets: 933

Markets: 933