Decentralized Finance (DeFi) has revolutionized the financial landscape, and one of its standout features is the transparent and equitable distribution of earnings. Bolide Finance, exemplifies this ethos. The platform not only shares its earnings but also uses a portion of its profits to buy back and burn its native tokens.

Bolide Finance is a cutting-edge decentralized yield aggregator. Its primary function is to optimize asset deployment across a myriad of DeFi platforms. The goal is straightforward: maximize returns while keeping risks at bay.

Operational Mechanism

The process begins when users deposit their assets into Bolide Vaults. These assets are then entrusted to Bolide's smart contracts, which strategically invest them in selected DeFi ventures. These strategies primarily revolve around lending, farming, and collaborations with third-party DeFi projects. The rewards earned from these ventures are converted into $BLID tokens and subsequently distributed to the users.

$BLID Token: A Deep Dive

Nature: ERC20 revenue-share & governance token.

Supply Cap: 10 billion BLID.

Supported Blockchains: Ethereum & Binance Smart Chain.

Availability: Platforms like Uniswap, PancakeSwap, Ape Swap, and LBank Exchange.

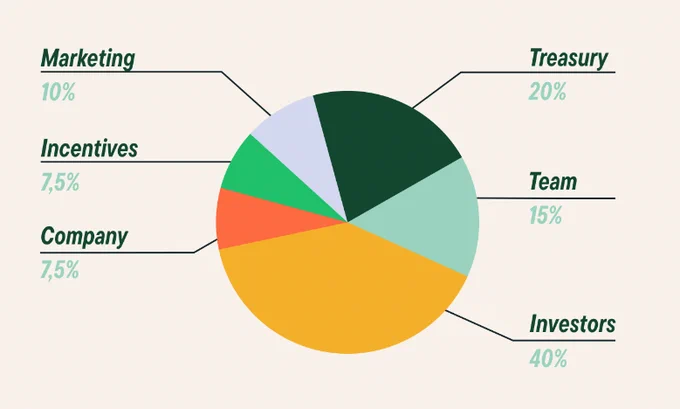

Distribution Breakdown:

Team: 15% (vested over 4 years)

Investors: 40% (spanning various investment rounds)

Company: 7.5% (a fraction reserved for initial liquidity)

Marketing: 10%

Treasury: 20%

Incentives: 7.5% (focused on enhancing strategies and client profits)

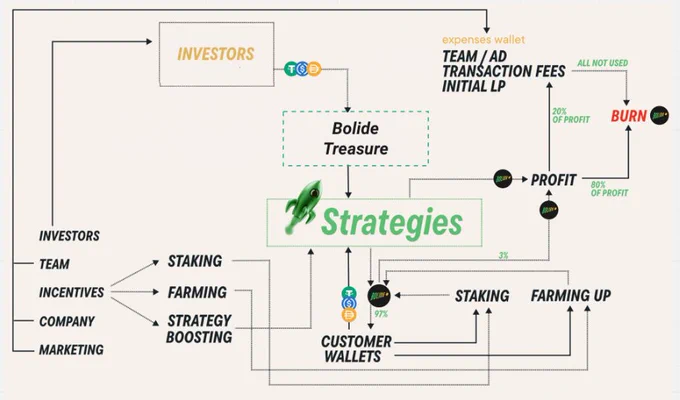

Bolide Treasury

The treasury holds a significant 40% of the token supply sourced from Investment Rounds. These funds are earmarked exclusively for strategies that aim to generate consistent profits, ensuring the platform's long-term sustainability.

Tokenomics: Earning and Burning

Bolide's tokenomics is designed to be non-inflationary. Profits are derived from the platform's strategies and a nominal 3% performance fee. Out of the total profit, 20% is allocated for Bolide's operational expenses, while a whopping 80% is channeled to buy back and burn $BLID tokens, a move aimed at bolstering its market value.

Investment Strategies

Bolide Finance offers dynamic strategies such as Lend-Borrow-Farm and Leverage Lending. Users deposit assets, which are then algorithmically invested to maximize yield. Periodically, rewards are harvested and distributed in the form of $BLID tokens.

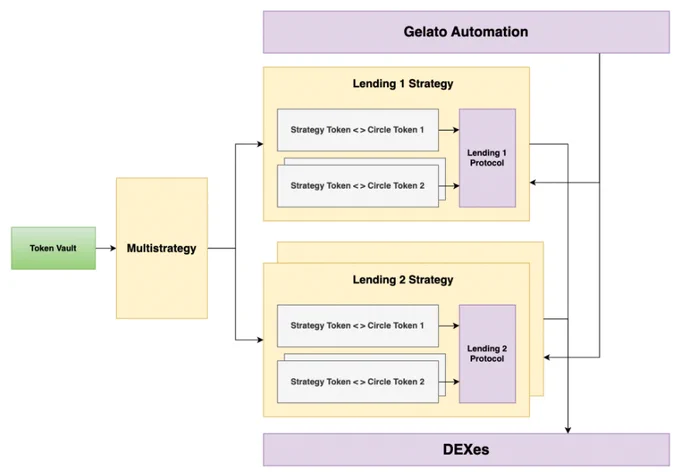

Bolide V2: The Next Step

Bolide V2 represents an evolution in DeFi applications. It boasts a multistrategy approach, real-time data integration, multi-chain support, and enhanced vaults on blockchains like Polygon and BSC.

Boosting APY with $BLID

Users can amplify their vault's APY by depositing $BLID tokens. The amount of $BLID deposited directly influences the APY boost. In essence, the more $BLID you deposit, the higher the APY for your vault.

Bolide's Season Pass NFT

Bolide is introducing unique NFTs with monthly drops. Collecting all NFTs in a season qualifies users for a "Season Pass", making them eligible for a raffle. Transparent on-chain methods determine the winners, with prize pools announced every season.

Roadmap Highlights

Development of strategies targeting PancakeSwap V3.

Implementation of strategies on chains like Optimism, Arbitrum, Ethereum, zkEVM, and zkSync.

Introduction of strategies in collaboration with ThenaFi, GNDProtocol, among others.

Launch of a mobile application.

Pros and Cons of Bolide Finance

Pros:

Innovative strategies like Lend-Borrow-Farm.

Robust tokenomics with a buy-back and burn mechanism.

Multi-chain support, including Ethereum, BSC, and Polygon.

Cons:

Complexity can be daunting for DeFi novices.

Dependence on third-party platforms.

A competitive market landscape necessitates continuous innovation.

Risks and Advantages

Risks:

Potential vulnerabilities due to smart contract bugs.

Challenges posed by evolving DeFi regulations.

Market volatility's potential impact on $BLID's value.

Advantages:

Strong tokenomics with a planned buy-back and burn mechanism.

Active development, as evidenced by a clear roadmap and regular updates.

Conclusion

Bolide Finance is tailored for conservative investors, making it an ideal platform for stablecoin storage. Investing in $BLID is recommended for those with a long-term perspective. Despite the current downward pressure on the BLID token price, as the project evolves and expands its strategies across various blockchains, the buyback and token burn volume is expected to rise, positively impacting the token's price. Presently, it offers an excellent opportunity to accumulate the token at lower prices.

Useful Links