What is Hodlify ?

Hodlify is a decentralized platform that allows users to earn yield on their crypto assets in a manner that's both simple and straightforward. It aims to combine the ease of use typically found in traditional centralized finance (CeFi) platforms with the security and autonomy of decentralized systems. One of its key features is that it operates without third-party custodians or intermediaries, ensuring users have full control over their assets. In essence, Hodlify provides a user-friendly and secure way for crypto investors to earn yield on their holdings.

Diamonds.

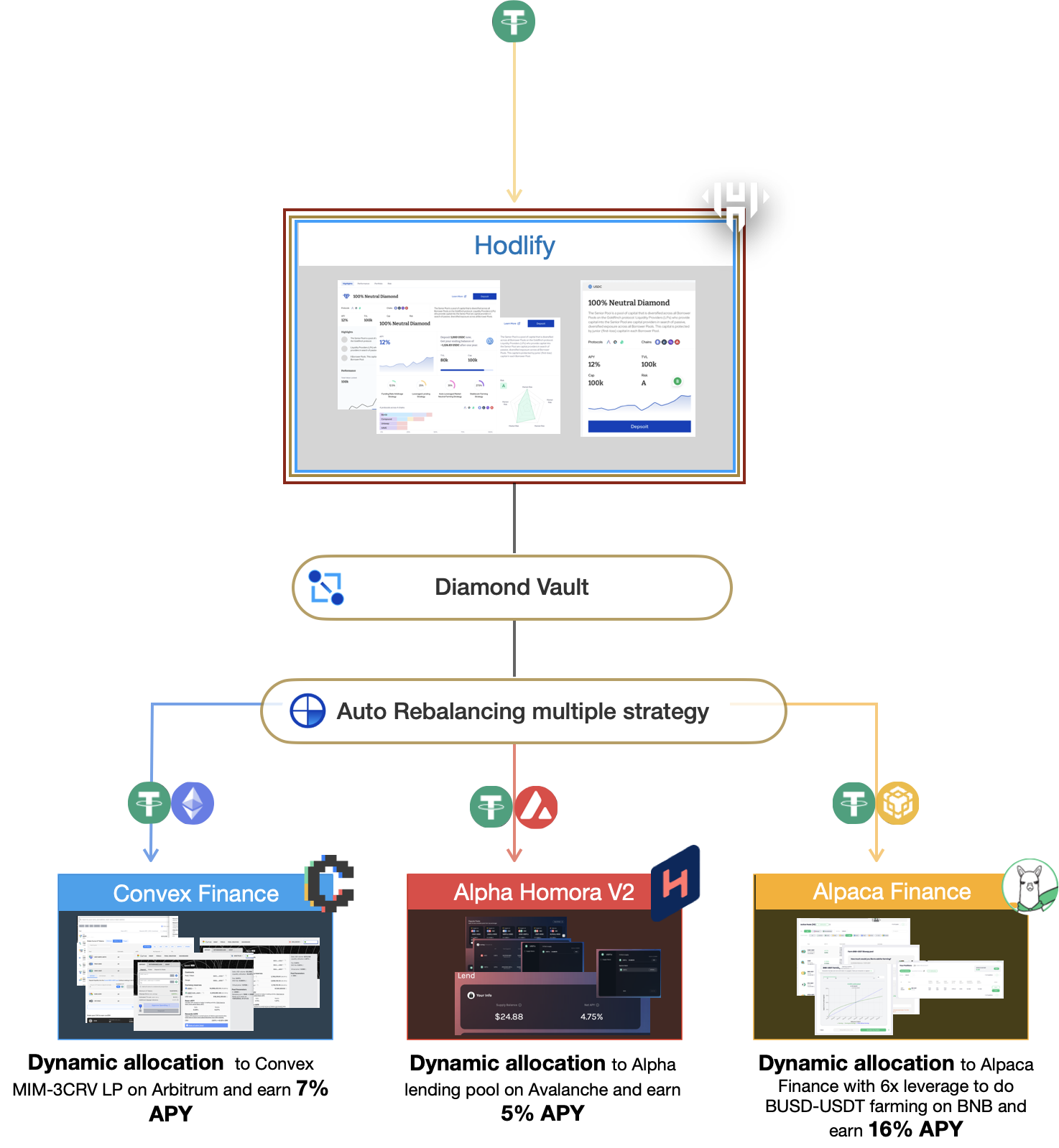

Hodlify Diamond is a specialized vault within Hodlify that offers the following features:

Multiple Strategies in One: Users can deploy various strategies simultaneously within a single Diamond variant. This provides a unique diversification and flexibility to investors.

Diversification: The Diamond vault allows users to capitalize on different yield-generating opportunities in the crypto space.

Range of Strategies: Diamond incorporates multiple yield-generating strategies such as:

Leveraged lending

Liquidity farming

Arbitrage

Maximized Yield Generation: By integrating these strategies, Diamond optimizes yield generation across different protocols and chains.

Simplified Investment Process: The integration of multiple strategies within one Diamond variant streamlines the investment process, making it more convenient and efficient for users.

Optimized Returns and Risk Management: Whether users aim to maximize returns, reduce risks, or explore various market opportunities, the Diamond vault offers a comprehensive solution.

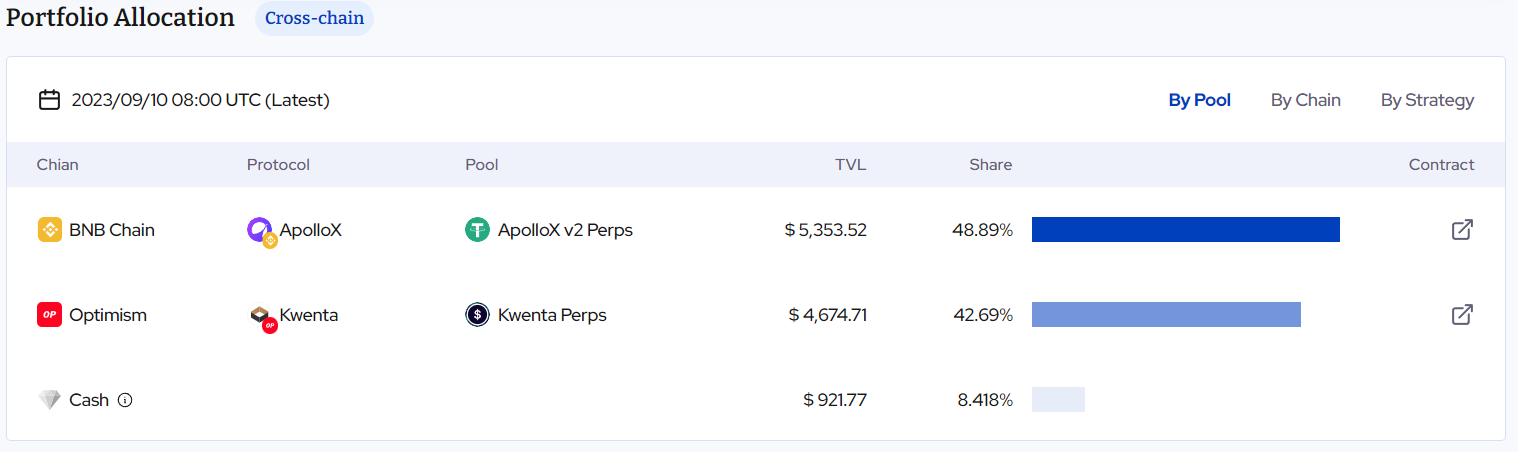

Hodlify Diamond's Full Transparency Dashboard

Hodlify offers one of the sexiest UI you've ever seen:

Asset Allocation Disclosure: Hodlify Diamond provides detailed information about the distribution of assets within its portfolio.

Detailed Breakdown: The dashboard reveals the proportion and value of assets allocated to specific protocols, chains, and strategies. This ensures users have a clear understanding of where their investments are being utilized.

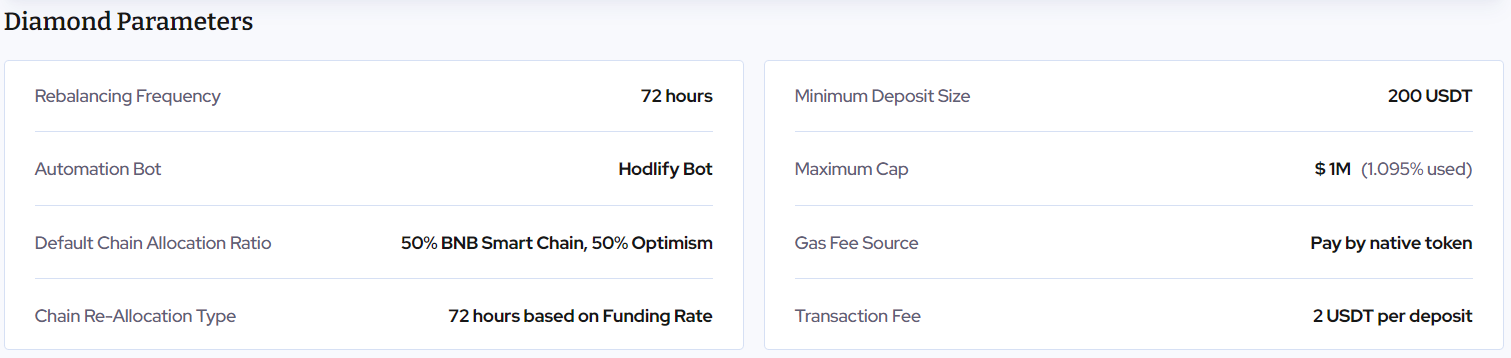

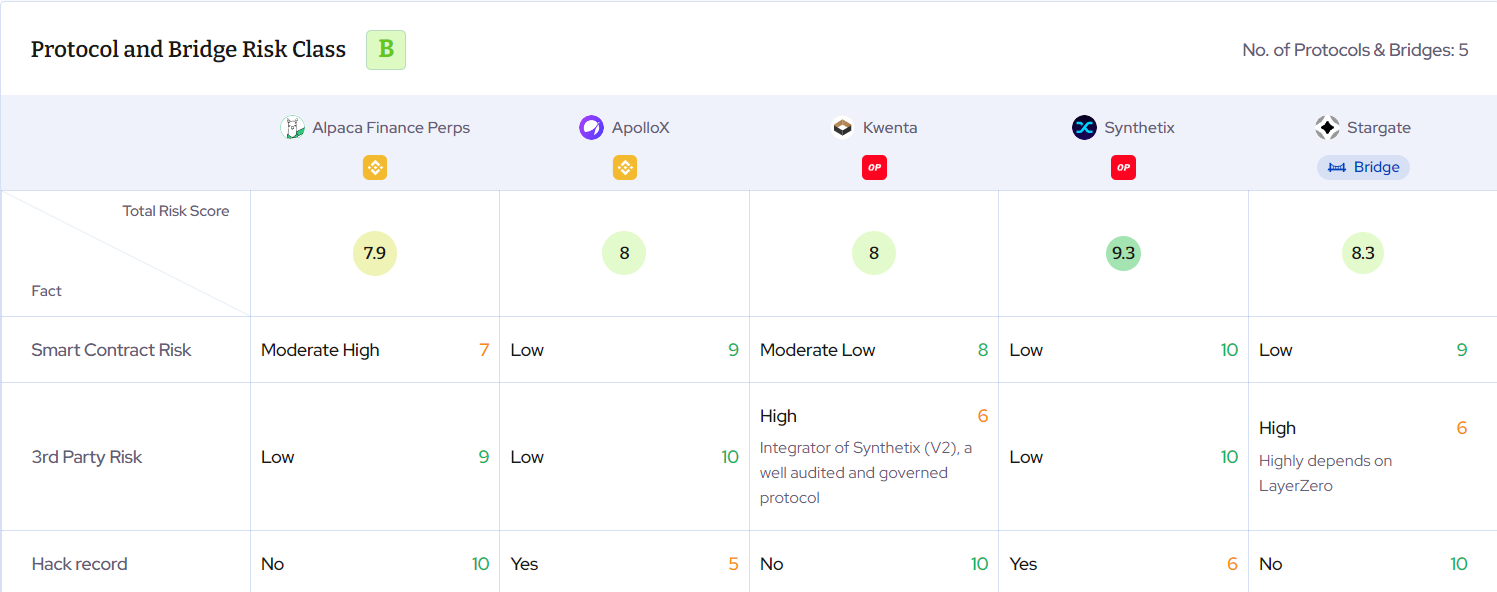

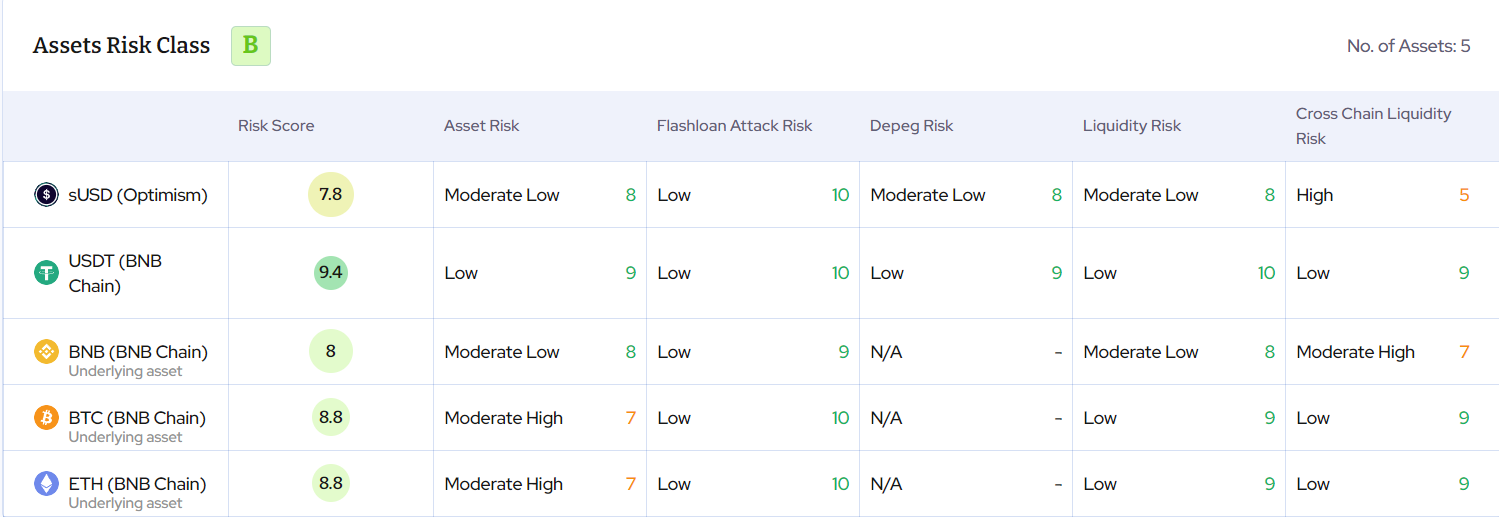

Diamond Parameters view:

Risks view:

Hodlify Strategies

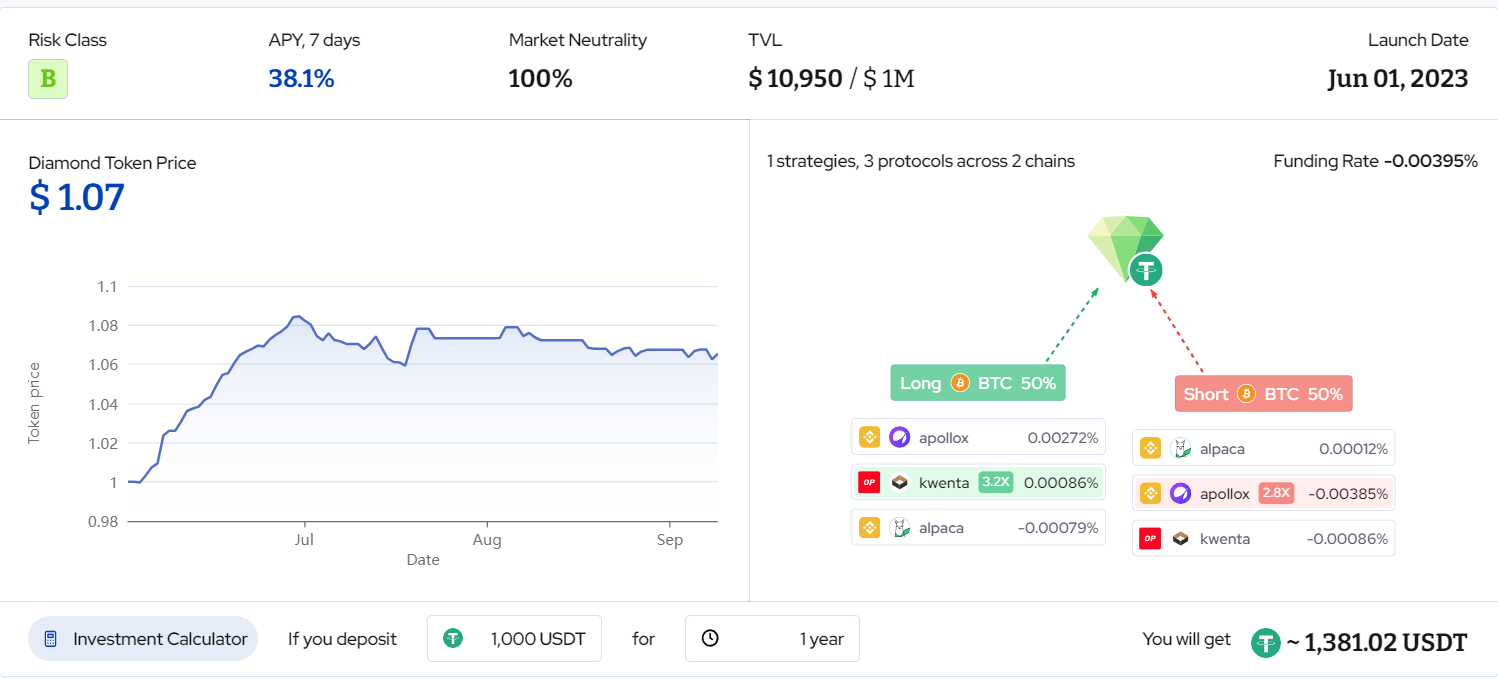

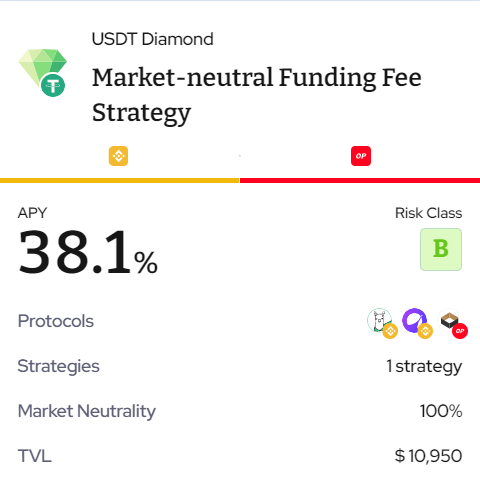

Market-neutral Funding Fee Strategy

The Market Neutral Perpetual strategy exploits cross-chain differences in funding rates of perpetual contracts. This approach involves holding a long position on one blockchain and a short position on another for the same non-stable token. The strategy earns funding fees from both positions, ensuring a 100% market-neutral stance, regardless of token price fluctuations.

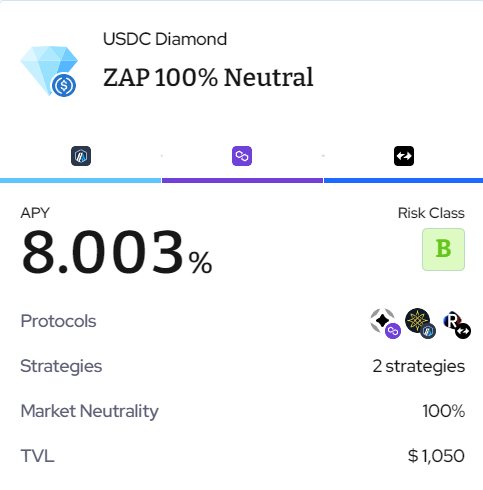

ZAP 100% Neutral

Cross-chain Single-sided LP (20%): Some cross-chain swaps offer a unique liquidity provider (LP) opportunity that doesn't come with impermanent loss. While this strategy is straightforward, it carries a risk of fluctuating returns due to the reward token's price volatility. To mitigate this risk, the auto-compounding frequency is adjusted.

Lending (80%): This strategy involves investing in lending vaults. It's ideal for users who prefer to HODL their tokens and simultaneously benefit from high interest rates safely.

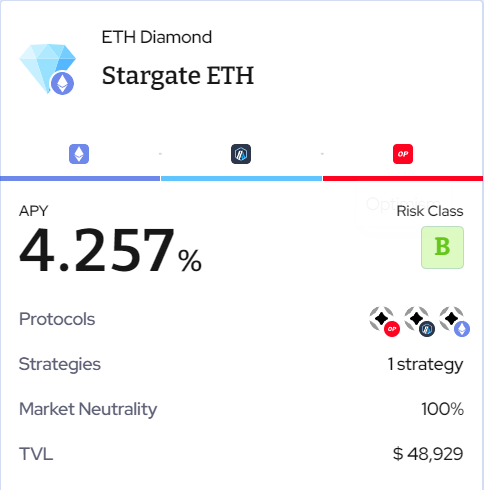

Stargate ETH

The strategy invests in different ETH pools on Stargate.

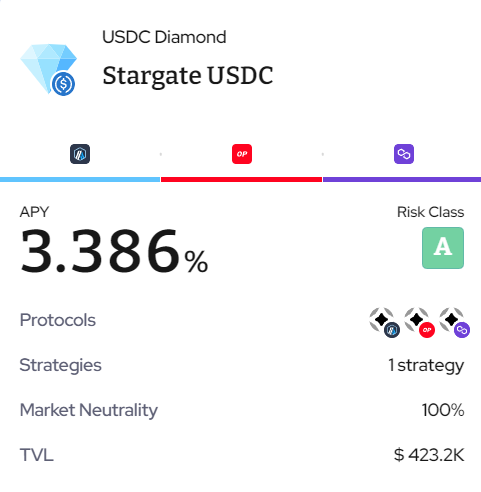

Stargate USDC

The strategy invests in different USDC pools on Stargate.

SWOT Analysis.

Strengths:

Diversification: Hodlify Diamond offers a diversified approach by running multiple strategies across various protocols and chains. This can potentially spread risk and enhance returns.

Transparency: The Full Transparency Dashboard provides users with a clear view of their investments, ensuring trust and clarity in the platform's operations.

Innovative Strategies: The platform incorporates unique strategies like Cross-chain Single-sided LP, which offers liquidity provision without the risk of impermanent loss.

High Interest Rates: The lending strategy allows users to HODL their tokens while enjoying potentially high interest rates.

Weaknesses:

Complexity for Newbies: The diverse range of strategies and cross-chain operations might be overwhelming for newcomers to the crypto space.

Dependence on Multiple Chains and Protocols: The platform's performance is tied to the health and security of multiple blockchains and protocols.

Threats:

Price Volatility: Like all crypto investments, there's a risk of price volatility, especially in the Cross-chain Single-sided LP strategy due to potential price fluctuations of the reward token.

Smart Contract Vulnerabilities: As with any DeFi platform, there's always a risk of smart contract vulnerabilities or bugs that could be exploited.

Reliance on Bridges: The cross-chain functionality relies on bridges, which could become points of failure or vulnerability.

Opportunities:

Potential High Returns: By diversifying across multiple strategies and chains, users have the opportunity to tap into various yield-generating avenues, potentially maximizing returns.

Auto-Compounding Benefits: Adjusting the auto-compounding frequency, especially in strategies like Cross-chain Single-sided LP, can lead to compound interest benefits, enhancing overall returns.

Passive Income: The lending strategy offers a way for users to earn passive income on their held tokens.

Hodlify, still in its early alpha stage, already offers a working solution for those interested in diverse crypto earnings. It promises unique strategies and good returns, but like all DeFi platforms, it comes with risks, especially given its newness. It's essential to do your homework before investing.

Links:

Website: https://hodlify.io/