No, I'm not talking about dubious purchases of meme coins that, in 99% of cases, will leave you penniless. If you're looking for quick speculations, you might want to look elsewhere.

I'm here to guide you on how to identify a project that will provide you with a steady cash flow in the future.

Those who transitioned to crypto from traditional finance might be familiar with some of the most common investment advice:

1. Don't follow the crowd.

2. Invest in a fund of the top 500 stocks and sit back.

3. Don't fall in love with the stocks you buy.

In the crypto world, these pieces of advice should be flipped on their heads.

/butt

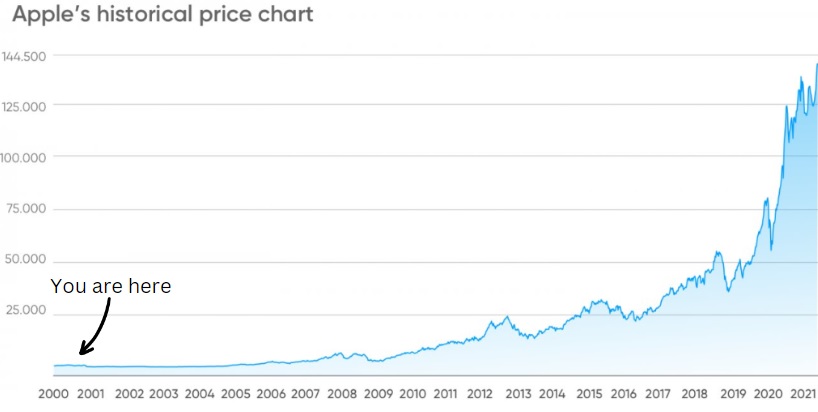

Traditional finance advice is geared towards investing in value companies that are large and consistently profitable. If you strictly adhered to this advice, you'd never have bought into Microsoft or Apple in their early days.

But in the crypto space, you're essentially surrounded by the early stages of Microsofts and Apples, requiring a different approach

1. Follow the crowd.

The crypto industry is teeming with venture startups. Their primary way of gaining attention is by purchasing advertisements in the form of "research" or crypto threads from major influencers.

Another method is promising airdrops or other rewards for activities. If you don't keep an eye on influencers and platforms like Galxe(you should be in tune with the sentiments, rather than trying to obtain every useless OAT out there), you'll miss out on potentially great projects.

So, initially, you do need to follow the crowd, but don't rush ahead.

Stay back, take your time, and ensure you're not blindly following a herd of lemmings blinded by greed, ready to plunge off a cliff in search of quick riches.

2. You'll have to do stock picking in the crypto industry.

Every day, dozens of new crypto projects emerge.

If you blindly invest in every appealing project or through funds (like AMKT or Velvet), you'll quickly run out of money and likely underperform compared to Bitcoin or Ethereum.

You need to establish criteria for the initial screening of projects.

Don't be mesmerized by the positives; everyone writes about them because they sell. Look for the negatives, critique, and ask questions:

What will I get if I buy this token?

Who benefits if I buy this token?

What's the crowd sentiment about this token?

Does everything seem too good to be true?

How does the project plan to make money in the long run?

Are there better alternatives with fewer risks than this investment?

3. Fall in Love with Your Chosen Projects

Once you've filtered out projects that don't meet your criteria, you should become passionate about the remaining ones. Choose 5-10 projects, follow their Discord, X, Telegram, and Medium.

Engage with ambassadors and accounts that, like you, are passionate about the project.

The best way to understand a project is to write a detailed article or thread about it.

It doesn't matter how many followers you have or the reactions to your post; you're writing for yourself to better understand the project. You should genuinely fall in love with a few projects to stay updated on their developments.

To truly be in the loop about what's happening in your chosen projects, you must be deeply passionate about them.

The real insights, the genuine inside information, can only be gleaned by spending a significant amount of time in a project's Discord or Telegram chat.

You need to become an integral part of the project.

And I mean this literally.

If you find yourself drawn to a project, try to contribute in some way. Young projects notice ambitious community members and invariably reward them.

Such participants stand out from the majority of the audience, many of whom are there primarily for freebies.

For instance, Parallax Finance once asked in their Discord for suggestions on interesting influencer channels they could hire for their promotion. They liked the channels I recommended and granted me a whitelist spot for their private sale. I didn't ask for it.

@symbiosis Finance & Bolide Finance sent me their tokens multiple times simply because I identified glitches in their dApp and reported them. I never even thought to ask for a reward for this.

In another instance, while writing an article about a project and going through their documentation, I somehow landed on their closed alpha page (I didn't even realize I was somewhere I shouldn't be). I liked the project and invested a small amount for testing in their vault, after which I noticed something amiss. When I complained on their X, asking for my money back, they responded saying they hadn't even officially launched yet and all money movements were manual. They asked how I even accessed that page. In the end, they recognized me as a tester :), inquired about my experience interacting with the platform, and the project even followed me. While it's still a small project, it's precisely these kinds of connections that you need in the crypto world.

However, there's always a "but". Even the best relationships end, and sometimes you'll need to end them. Watch out for red flags:

Unclear Roadmap: If a project can't clearly articulate its plans, it's a concern.

Lack of Transparency: Projects that aren't open about their progress can be alarming.

High-pressure Sales Tactics: Beware if you're being pressured to invest quickly.

Overpromising: Be cautious of projects making grand promises without clear ways to achieve them.

Abrupt Strategy Changes: If a project suddenly changes its strategy, you'll need to reevaluate your investment.

Disrespect to the Community: Blatant rudeness to their community on social media is a red flag.

In conclusion, the crypto world is vast and ever-evolving.

With the right approach and due diligence, you can find projects that not only align with your values but also offer substantial returns.

Always stay informed, engaged, and passionate about your investments.

In future articles, I'll discuss which projects I've chosen for myself and the criteria I used to select them.