Weekly Report #45 Market Analysis + Index Signals

What's the reason behind the rebound in volume? Could it be that the market is recovering, or is there any other reasons?

CONTENTS

1.Weekly Market Analysis

Market Volume/Traders/Blue Chip Index/Whale Capital

2.Index Signals

NFTs Bottom-fished by Whales Last Week

Trading Signals for Blue Chip NFTs

SMA Trends for Blue Chip Collections

1. Market Analysis

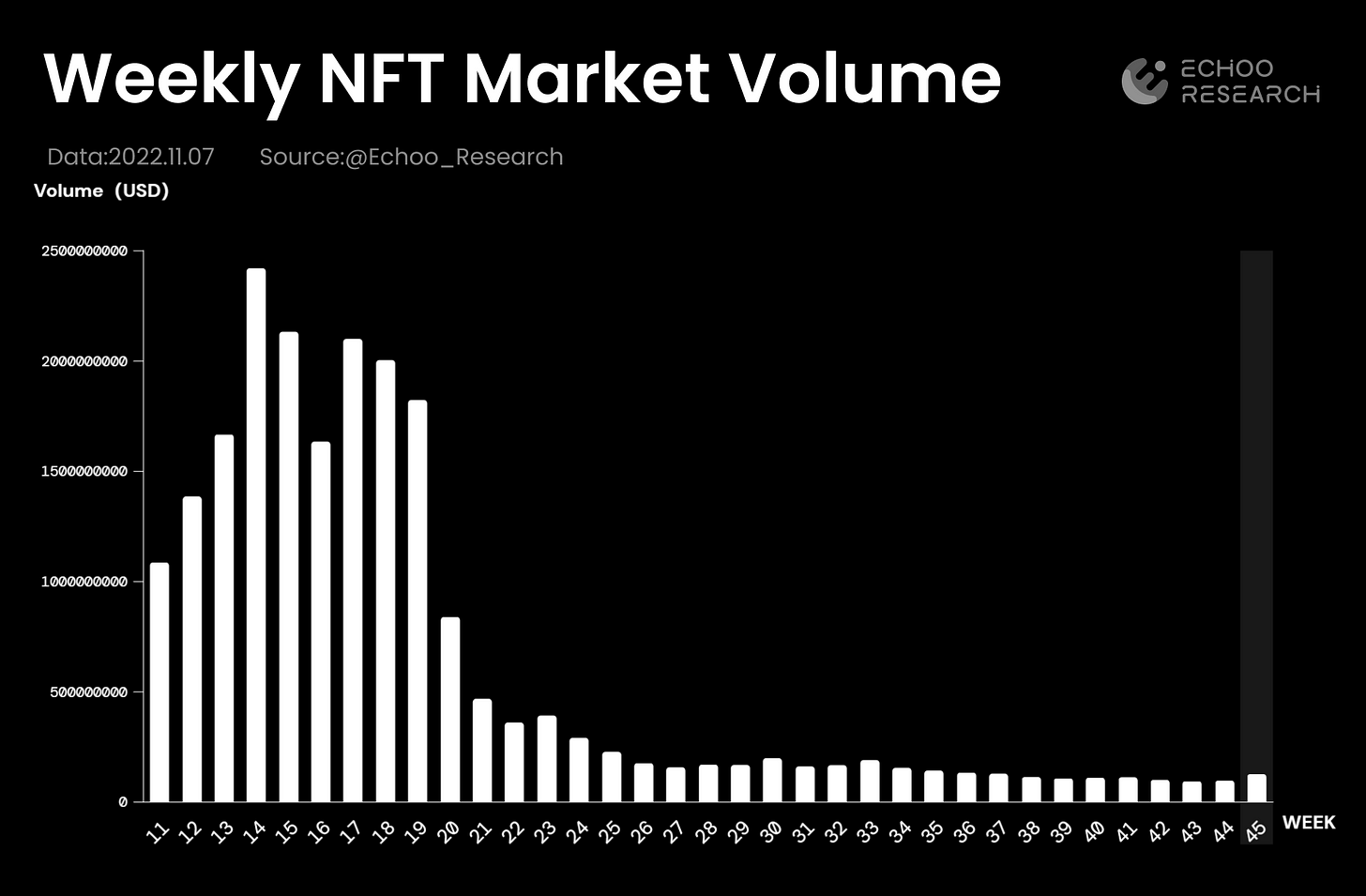

Weekly NFT Market Volume (Source: echoo.substack.com)

This week's volume saw a significant 30% increase WoW. Even though the number has temporarily returned to the market level of September, it does not represent the overall trend of the market, as this statistical uptick is mostly attributable to the trading hype of individual projects (for example, Art Gobblers' weekly trading volume hit 4468 ETH). On the other hand, most classic NFT projects remain low on trading volume. We will keep a close watch on market data to find out about the possibility of a rebound.

It is worth noting that, having gone through two previous cycles, the NFT market is now in the "mild contraction" phase. This phase is characterized by extremely weak trends and a prolonged period of minimal trading volume. This indicates that most people have a very high degree of recognition of the market's future trends.

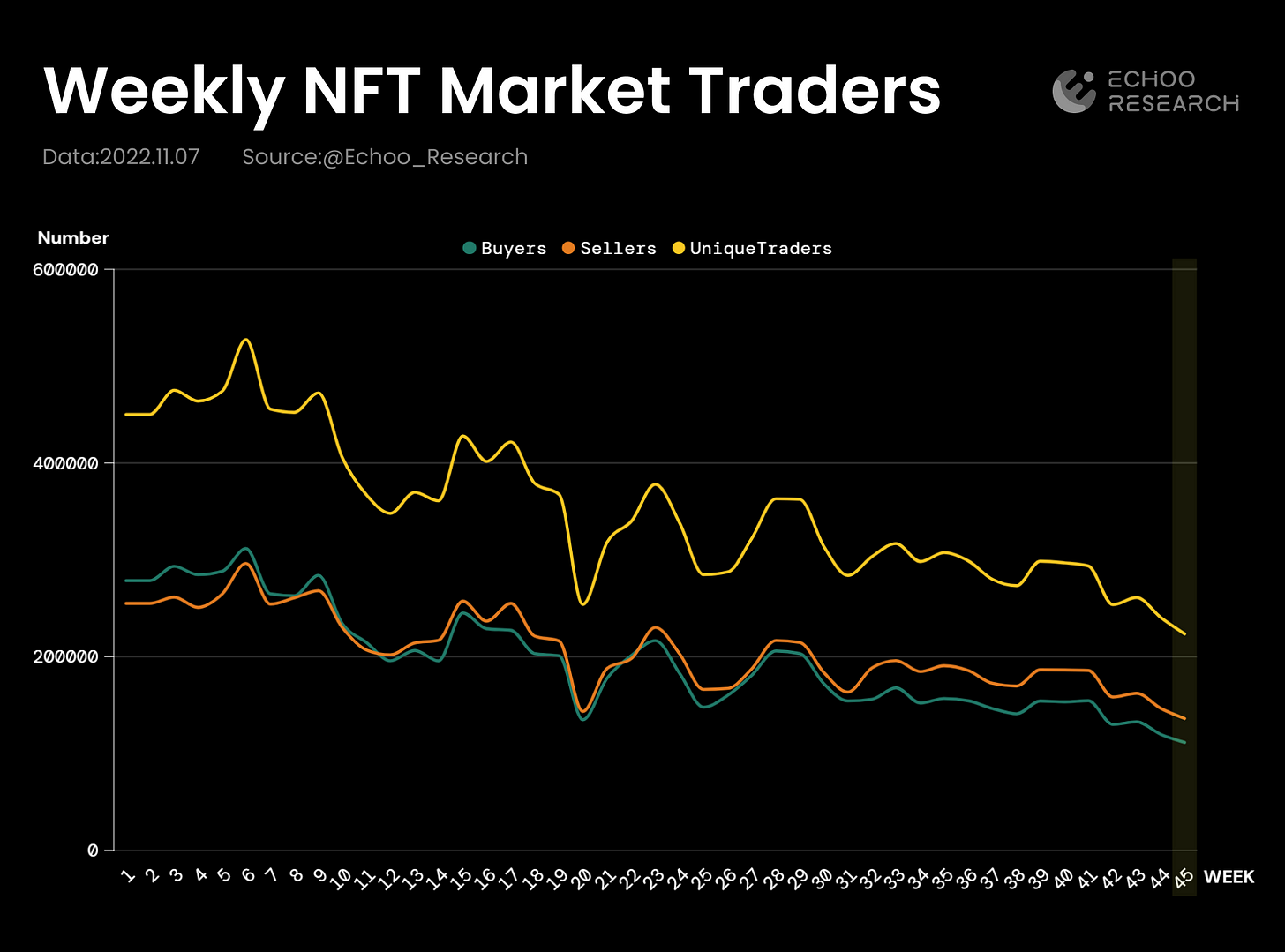

Weekly Trend of NFT Traders (Source: echoo.substack.com)

The number of traders fell 7% this week compared to last week, breaking the lowest figure seen in May and setting another record low of the year. Participation in the NFT market remains low. As seen from trading activities, sellers continue to outnumber buyers. People are more inclined to sell their NFTs now.

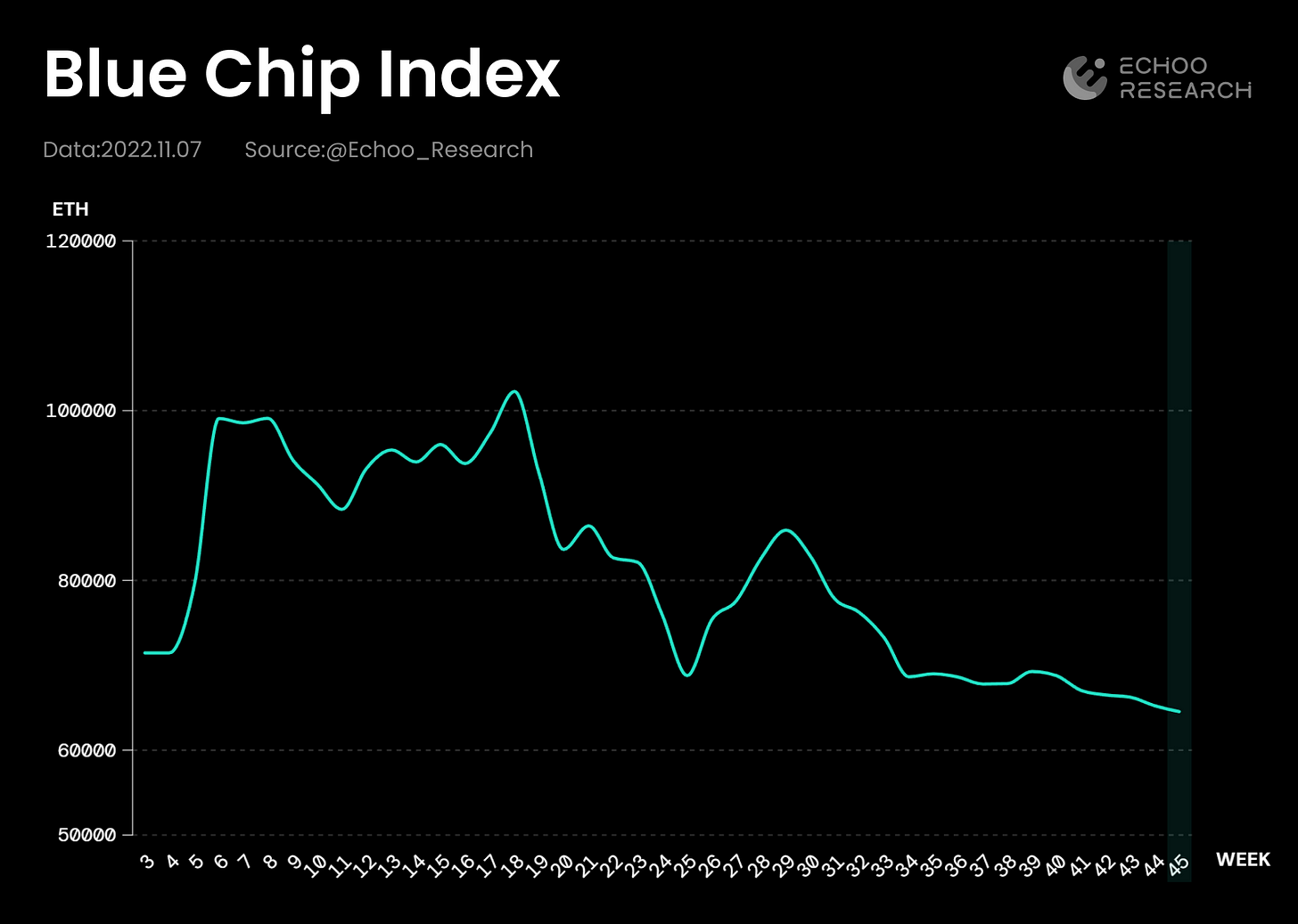

Market Cap Trend of Blue Chip NFTs (Source: echoo.substack.com)

As for whales, the size of capital outflow has reduced this week despite whales' participation remains on the low. While major whales prefer to staying out of the market, some smaller whales still trade in the market. These whales participate in the NFT market with a small capital size, and they trade fast with the "fast in, fast out" strategy.

2. Index Signals

Note: Trading risks are high due to the recent sluggish market performance. The data and analyses provided by Echoo Research are for reference only.

2.1 NFTs Bottom-fished by Whales Last Week

This week, Art Gobblers, Art Blocks, and CryptoPunks top the list of most-bought NFT collections by whales.

Some whales with a smaller capital size also bought into projects like Mint Pass Mexico City MPMX, SPLOOT by De la Dondi, and LOSTPOETS: POETS.

The figure below shows the top 15 NFTs bought by whales and the amount and average costs.(Some values may be affected by extreme values and are for informational purposes only.)

NFTs Bought by Whales

2.2 Trading Signals for Blue Chip NFTs

With the recent contraction in trading volume and reduced price volatility, short-selling signals are triggered less. This also reminds us that we should minimize our operations and wait patiently for the right timing. See below for details:

(Note: This signal is used for short-swing trading and is only suitable for actions within the volatility range. When unilateral trend arises, inaccuracy might occur.)

Buy-sell Signals

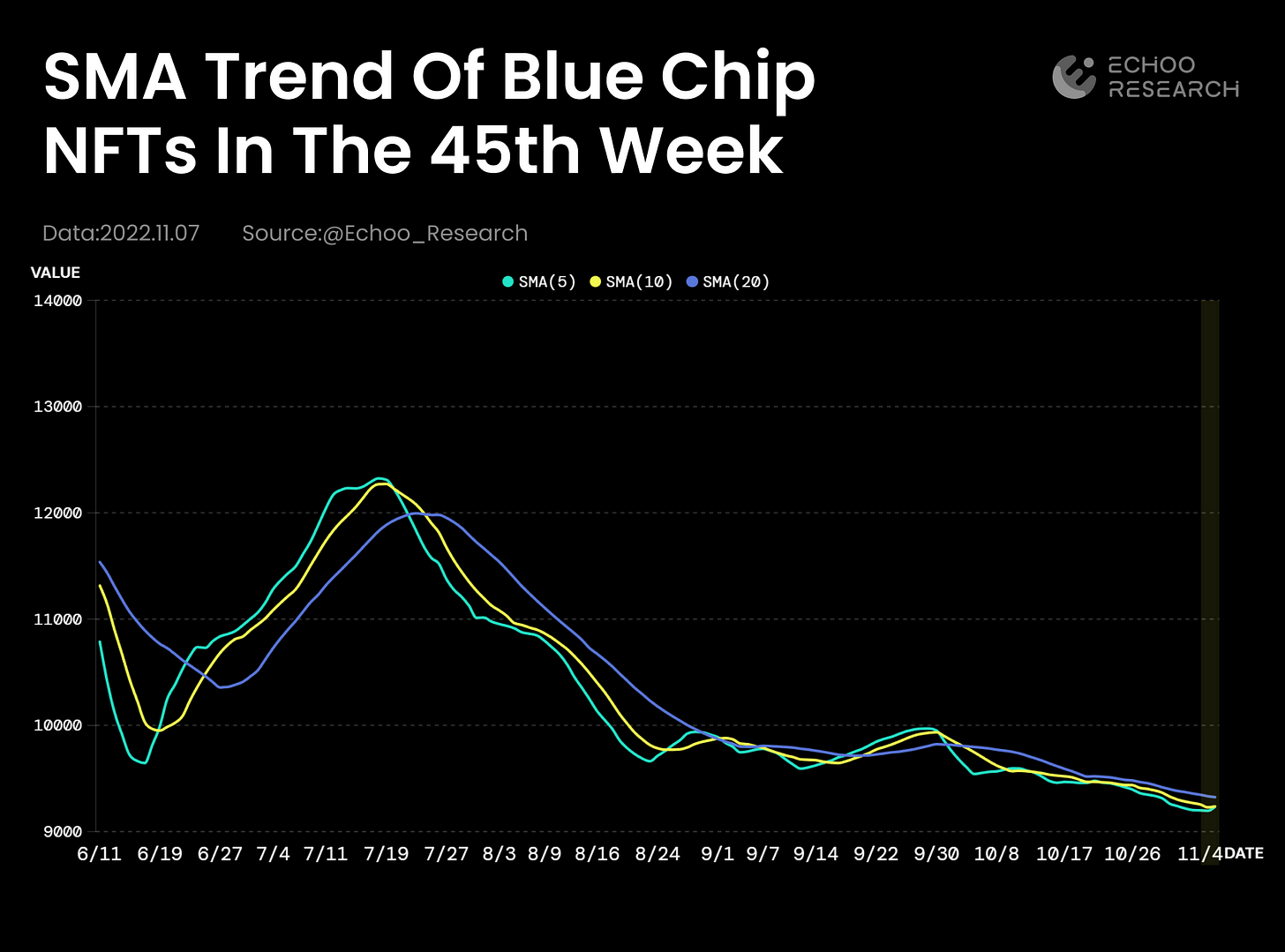

2.3 SMA Trends for Blue Chip Collections

Ever since the beginning of of October, short-term trends have been suppressed by long-term trends, resulting in a lack of rebound momentum in the NFT market.

Recent trend: This week, the SMA (5) trend line remains below SMA (10), which means the near-term market will stay weak.

Long-term trend: The entanglement of short-, medium-, and long-term trend lines are getting tighter and are suggesting the emergence of a new direction soon. We will keep a close watch on these trends.

(Note: This indicator is obtained through market simulation of blue chip market caps and is used to predict market trends.)

Market Trend of Blue Chip NFTs (SMA)

DYOR. Please consult with a financial advisor before making any investment decisions. Echoo Research does not provide any financial advice and the above contents are only for informational purposes.

Echoo Research is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.