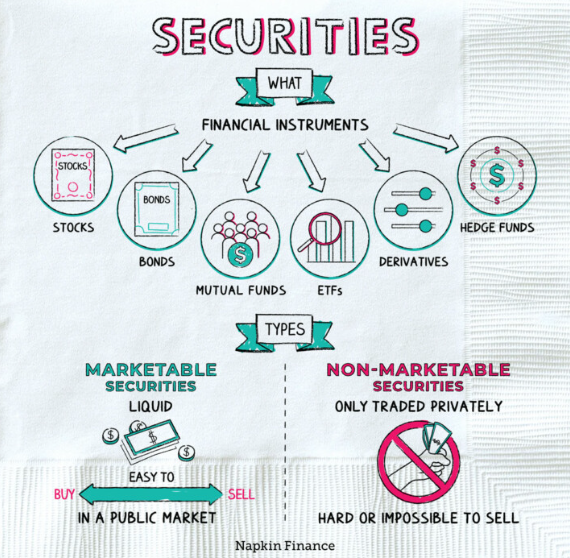

What is a security?

My take on regulations in Crypto

I have finally come to a complete defensible opinion on cryptocurrency regulation. So bear with me as I build out this story.

Before Regulations

The 1920’s were a very fun time to be in the stock market. The United States was the most fun place to be. The United States had begun becoming the center of the global financial system, especially after the Panic of 1907. The First World War left the US the preeminent global power.

“Federal aid in such cases encourages the expectation of paternal care on the part of the Government and weakens the sturdiness of our national character.”

- President Grover Cleveland, 1885 - 1889, 1893 - 1897

The United States was becoming a global power and remained a passionate isolationist and libertarian nation. The US Markets were as Laissez-Faire as they would ever be. The presidents of the 1920’s embodied these attitudes. The Recession that cured itself was held under their administrations of not acting in markets.

The credit boom was orchestrated by the Federal Reserve’s coordination with foreign central banks. Money (Gold) was pouring into the US because the interest rates were much higher and the dynamic US Economy offered guarantees of currency. Europe begged the US to cut rates, and markets skyrocketed as rates were suppressed and investors chased returns.

This is the period in history when I studied asymmetric information. Brokers were taking money from Americans and shoveling in the market in amounts never before seen. Everyone wanted a piece of the action. Banks hired brokers to make the market more accessible and banks began to commingle jobs - as Investment Banks & Commercial Banks.

This brought ruin to the economy later and brought forth regulation & regulators. Regulation went to the banks, who were commanded to separate the function of investing & maintaining deposits for commercial banking

. The Securities & Exchange Commission was created to ensure all securities and exchanges share more information with investors.

Why Regulations

Intermediaries are a necessary part of the old economic system and that is very easy to defend.

If a farmer in Omaha, Nebraska (circa 1926) goes to the Bank of Omaha and asks to buy 10 shares in General Electric, the Broker would take the money and likely give him a proof of purchase. A telegram would be sent to a place like maybe Chicago or even New York to approve the purchase. Record of Ownership would be held at the bank.

There are many intermediaries here standing in the way of the Omaha Farmer and General Electric but simply put, there is the broker, the bank and the exchange. This is why there is a need for intermediaries because they can make the market what they want with asymmetrical information.

Is Cryptocurrency in need of regulation?

Joe wakes up and buys 100 USDC and sends them from Coinbase to his sovereign wallet. He then approves his USDC on Uniswap and swaps them in exchange for Ether. He then deposits the Ether in AAVE to earn interest.

Coinbase is an intermediary and requires regulation to inform all holders of interests, risks, and rewards. Once the asset hits the sovereign wallet it is no longer in the presence of an intermediary. It is held by Joe.

When Joe voluntarily approves his USDC on Uniswap there is another entity with access to the asset, but this is open source public code, not a human being. How Joe voluntarily chooses to expose his funds to this risk with all the appropriate awareness because code is not asymmetric nor does it have the desires a human might.

When Joe deposits his assets in AAVE, he is fully able to audit the lending agent and manage his own monies.

In this scenario, the only things that requires regulation are Coinbase and USDC. Both are producing representations of assets rather than the raw asset. USDC is a representation of a US Dollar. USDC on Coinbase is a representation of a USDC which is naturally on Ethereum.

The Ether is an unregulated asset because it is held in sovereign storage. Because it was attained without a human intermediary.

The truth is if there is no human intermediary, there is no need for regulation. There is only need for monitoring and spreading of information. The SEC should play a vital part in announcing malicious smart contracts and informing blockchain users.

Whats a Security? Whats a commodity?

This is the most difficult question because the most useless cryptocurrencies, colloquially known as shit coins, are but simple lines of code. This is the same for Ether & Bitcoin. I think the most recent law written up in the Senate begs the question, how decentralized does the supply have to be to considered a commodity?

This law, which definitely takes an odd stance against decentralized finance, says that any entity that controls more than 20% of a given token supply is required to register with the federal government.

I would not like to increase the power of the government in any capacity but, I do think that the control of 20% or more of any given token supply is alarming. I checked the Uniswap Token distribution and no single token holder fit this description. The same was found for AAVE. The same for Lido, Maker, & Frax Share.

These tokens should be considered commodities because no single entity or cadre could overtake these tokens.

In honesty I don’t think these assets can be viewed in the context of these generic and geriatric terms, but for the sake of the government, I use them.

What’s What?

I think there is something very interesting about the way that cryptocurrency titans are approaching regulation & government all around the world. Cryptocurrency, at its core, is anti state technology. It was created to take power away from the government and return it to the people.

I often ask myself, why must the government be aware of its citizen wealth? Why does it matter how we hold our currencies? The idea of cryptocurrency is in direct offence to a centralized state of centralized powers.

In this light, it is very understandable that cryptocurrency in its native state is neither a security or a commodity. It is a currency. But the nation would rather look at it as an investment rather than a competitor to the paper they print, so it must be one of the two.

The fact that there are no intermediaries, except the code written and publicly viewable is a sign of the times. Humans required governments to do a lot more many ages ago because people were focused on their own individual needs - food, family & fun. The task of trade treaties and business in the far east was far from the mind of your 15th century Prussian.

As technology has improved over the centuries, the amount of information any individual can get their hands on has jumped dramatically. Humans can now coordinate with anyone as long as they have a stable internet connection. Bitcoin, at its root as the first cryptocurrency, addresses the communication of value.

In conclusion, Crypto is an industry that is growing constantly because it offers an opportunity for citizens to reclaim powers that weren’t originally the property of the state. The ability to conduct business as a free person.