Is 0.1 ETH Too Much for NFT Art?

It depends, right?

Do you price your NFT's in ETH or USD? This was the question of the week in the Flamingo discord. With ETH skyrocketing, 0.1 ETH is more than it used to be. Or is it? We discuss in today's essay.

1. This week's AI Video: Fantasy of The Mind Volume 2

This collection of 7 videos explores the edge of creativity with today's AI video tools. In particular, take the time to watch the first video of the collection. Free Speech Apocalips by Mirage Bureau is a tour-de-force of tooling, editing, story, and music. Flamingo bid on this piece during it's Daily.xyz auction, but were outbid by antidisciplin.eth. Congrats to the collector and artist.

2. FLOCK TALK this Friday: Noon ET

While it was a tamer week for NFT drops, we still had our share of controversy with prices, punks and predictions. Join END (co-founder of Gondi) and myself as we untangle the news of the week and talk to some great artists and collectors.

3. Essay: Is 0.1 ETH Too Much for NFT Art?

In the dynamic world of NFTs, the value of Ethereum (ETH) has been on a remarkable upward trajectory, prompting a reevaluation of the cost of digital art. As ETH continues to soar, collectors are increasingly scrutinizing the mint prices of new collections and the final prices achieved during Dutch auctions. This rise in ETH's value raises a fundamental question: Should the price of NFT art be considered in ETH or USD terms?

With every fluctuation in ETH’s price, the perceived value of NFTs shifts dramatically. When ETH was valued at a few hundred dollars, a 0.1 ETH mint price seemed modest. However, as ETH approaches new heights, the same 0.1 ETH now represents a significantly larger USD amount. This disparity is causing collectors to question whether current mint prices reflect the intrinsic value of the art or are merely riding the wave of cryptocurrency’s market volatility.

The debate intensifies in the context of Dutch auctions, where prices start high and decrease until a buyer steps in. As ETH climbs, the starting and resting prices of these auctions often appear more substantial when converted to USD. Collectors are left pondering if their bids should be guided by the ETH they hold or the USD equivalent they are willing to spend. This dilemma underscores a broader issue within the NFT space: balancing the decentralized, ETH-centric ethos of the community with the practical considerations of USD-based valuations.

Furthermore, the rising value of ETH has broader implications for accessibility and market dynamics. Higher ETH prices can limit entry for new or smaller collectors, potentially stifling the growth and diversity of the NFT ecosystem. This brings to the forefront a crucial question for both artists and collectors: how to set fair and sustainable prices in a market where the underlying currency is highly volatile.

As we delve into this issue, lets look at a few notable NFT collections, their initial mint prices, and their equivalent USD values at the time of minting. By understanding these dynamics, we can better appreciate the complexities and considerations involved in valuing digital art in an ever-evolving market.

Lets begin with Chromie Squiggles. The Squiggle collection of 10k pieces began minting on Nov 27, 2020. On that day, Snowfro minted Squiggle #0 for 0.035 ETH, and ETH was priced at $518. For $18.16 plus another $5.22 in gas, history was created. Squiggles were minted at the fixed price of 0.035 ETH throughout the period that the minter was open until August 15th, 2021.

In USD terms, this yielded minting prices between $18 and $138 plus gas. I recall watching Derek, Gmoney and others mint Squiggle after Squiggle. gg.

Lets move forward to the pinnacle Artblocks collection, Fidenza. This collection of 999 pieces minted for 0.17 ETH on June 11th, 2021, the equivalent of $400. Could you imagine minting a Fidenza for $400?! I can't. I was canoeing with my son in the Minnesota Boundary Waters National Park that week, and when I got back, I wasn't sure that paying 2 ETH on secondary was justifiable.

Braindrops is an AI art minting platform that embraces the 0.1 ETH minting price point. Since it genesis drops in November 2021, each collection has been sold at .1 ETH per piece. Across 30 collections, we find a mixed bag of current floor prices relative to mint price. 16 collections have floors below 0.1 ETH, 12 are at or above mint, and 2 are still minting at .1 ETH.

Fellowship collections likewise are of mixed success looking at their current floor prices compared to mint. Some, like REWORLD by Roope Rainisto are split (minted at 2.34 ETH, current floor 0.98 ETH but the USD price is mostly flat since mint, trading at at average of $2900),

while others like the Auntieverse minted out at .168 and find a strong floor at 1.1 ETH. Still others like PPPIII and Boldtron's recent mint The Vault of Wonders, minted as low as 0.05 ETH with floors at 0.058 and 0.138 respectively.

The question of whether 0.1 ETH is too much for NFT art is multifaceted, depending on factors like the quality and reputation of the project, the artist’s following, and the collector's financial situation and risk tolerance. Notable NFT sets have varied in their initial pricing, but many have appreciated significantly over time, providing substantial returns to early adopters. Ultimately, the decision to invest at a 0.1 ETH price point should be based on thorough research and personal financial considerations. The world of NFT art is vast and dynamic, and each project offers unique opportunities and challenges.

Final Thoughts

Whether you’re an artist pricing your work or a collector considering an investment, understanding the landscape and considering both sides of the argument can help make informed decisions. As the NFT space continues to grow and evolve, staying informed and engaged will be key to navigating this exciting frontier in digital art.

4. Further Readings (and listenings)

A fascinating summary of the FIT 21 Bill. Ths bill does away with the Howey Test in favor of a new 5 prong decentralization test which is used to ascertain if an asset can be considered a digital commodity.

While the bill passed the House, it doesnt have a clear path through the Senate yet, and faces a potential Biden veto.

Alpha - for those who made it this far in a timely manner :-)

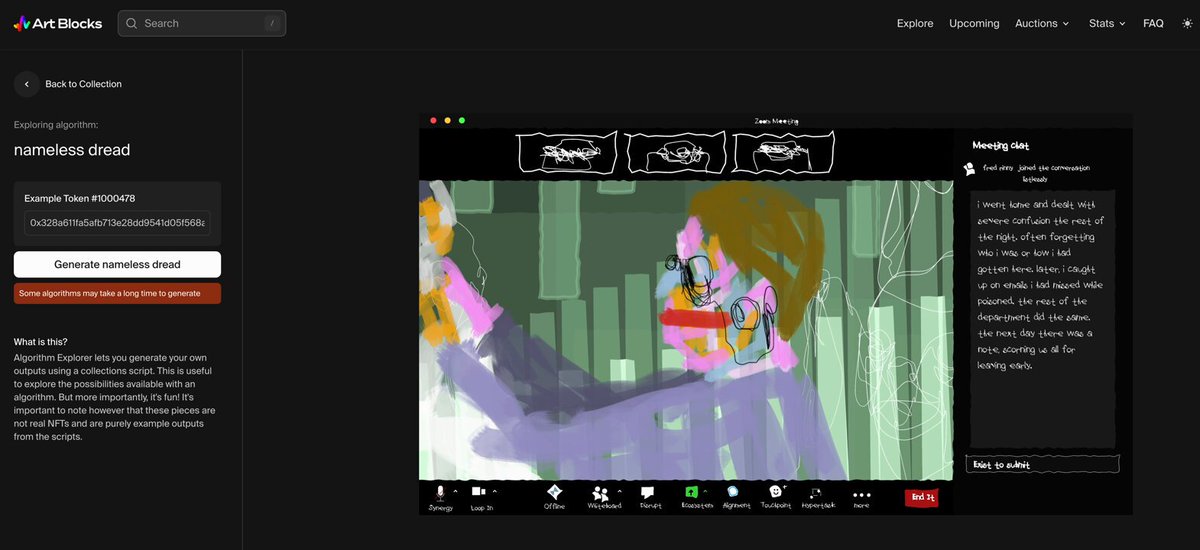

Our frens at glitch Marfa have a fascinating new artist in residence program. Their first artist is die with the most likes (aka @toadswiback) who is producing a generative collection "nameless dread". This 500 piece collection mints today (Thursday) at noon PT.

You can listen to a Twitter space with die and Snowfro: https://twitter.com/i/spaces/1lDGLPyzwWqGm

If you enjoyed FLOCK TALK, please subscribe or share it with friends who might find it of value.

0

0