Book of Concepts #1: RugPool

Below is just a brain gymnastics of an aspiring conceptual artist and curator who works out to become of a dev one day. Neither a design nor an advice. Tho’ a simulation for security ends.

There exists a need for a product that the market desires. Product/ market fit of such an existential banality that would utilize blockspace for pseudo-degen ends is immeasurable especially at the peak of a bull market.

void main() industries try to gamble their way into that fit (or a gap as they like you to call it in PhD project proposals for Hums.) They hire a maverick dev—cheaper per block (better we measure time in blocks) since the dev is well alive and only a chad at the degenscore ladder of existence.

They image what they have in mind in words, and think that it will be a super-safe safe, cryptographically speaking. Herein, the safe refers to a single, or a set of smart contracts that comprise a pool of non-fungible tokens, a pool with only a limited quota of seats (depositors) with some preliminary conditions for a sort of a whitelist (pardon me, Randi).

🏊 The first rule of RugPool Club is to have an NFT by Ryder…rewind, cosmos kiddin’.

🏊 Depositors need to be in possession of a non-fungible token that is a) needs to be of a collection of at least 2/2, b) have a market-cap of at least $690K at any given time regardless of the network, and its native token (few of you might recall we aped into tokens with a supply of less than a single token during DeFi Summer 2020).

🏊 Let’s say the void main() have deployed the contract, or fam thereof, to the mainnet; and, those pseudo-degenismus are frothing to try out the product. Because:

🤽 The pool has 10 seats during a fortnight maturity period.

🤽 Depositors do depart from their precious and so-calledly blue-chip NFTs by depositing it to the pool for a loss—I really do not care how the liq is provided, I am not a dev/ solution arch yet.

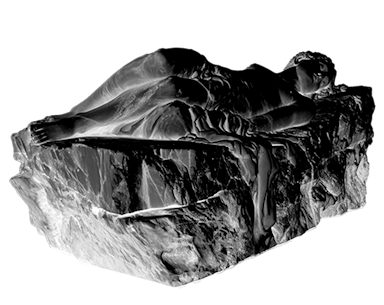

🤽 Now, pool owns the NFTs. It is a vault. Maybe, a sentient one.

🤽 Goodbots of the pool bot the listings via aggregators across the marketplaces. That is, they list the NFTs for 15 days for addies (to bid) that are whitelisted through a non-centralized KYC process via zk.

🤽 Sold as they are, the NFTs are now gone, and the revenue is in an escrow. Guess what happens? All the revenue minus some sort of fees are auto-sent to the owner of the wallet whose NFT sale was the highest in monetary value.