Analysis of the hot Canto

Table of contents

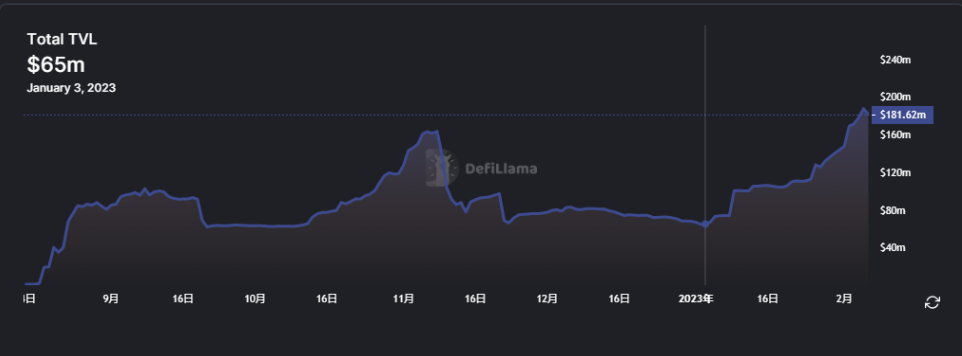

Features of Canto

The state of Canto

2.1 Comparison of Top EVM chains

2.2 State of the Canto

2.3 Token Economics

2.4 Protocols on CantoCanto Dexs

3.1 The Canto LP interface

3.2 Canto DEX-Slingshot

3.3 CantoswapCanto Lending and $NOTE

4.1 Lending Market

4.2 $NOTENFT Marketplace-Alto

Risk Analysis and Summary

1. Features of Canto

2. The state of Canto

2.1 Comparison of Top EVM chains

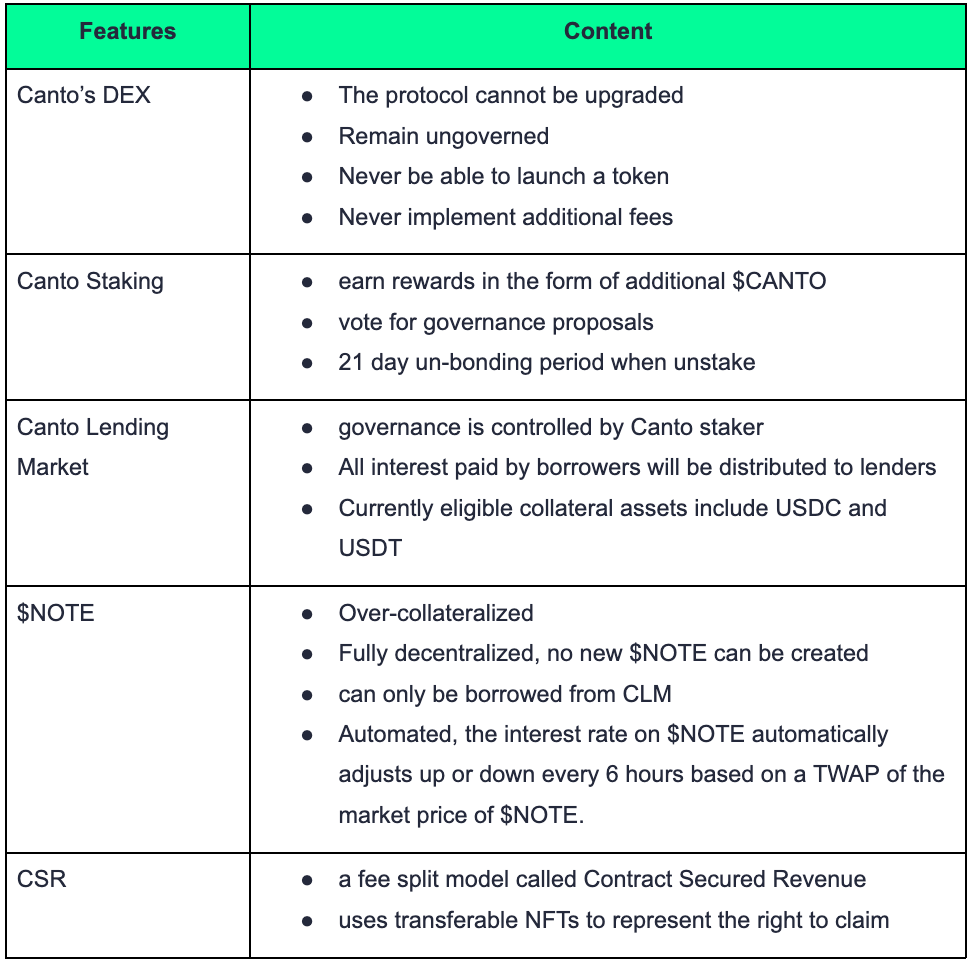

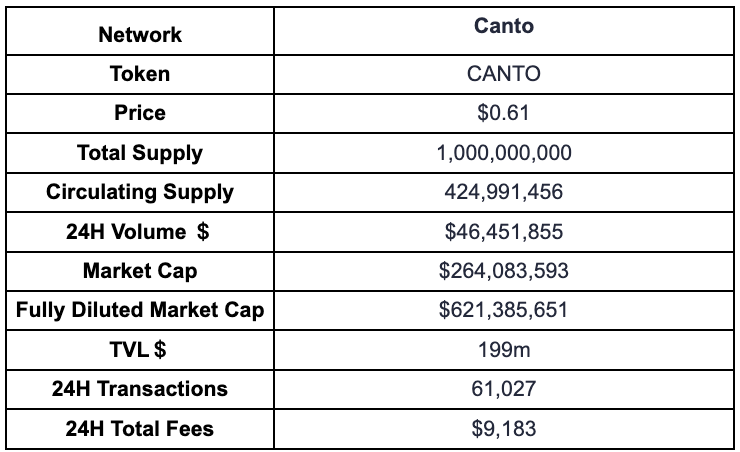

We compare the important on-chain data of 6 Top EVM public chains that have tokens, namely BSC, Polygon, Avalanche, Optimism, Fantom and Canto.

Note: 24H volume is the sum of volume of all DEXs on the chain

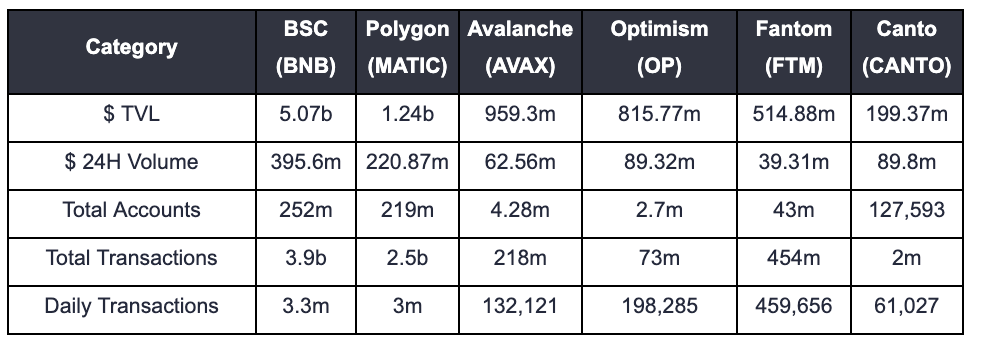

Since the new year, the total TVL of the Canto chain has been showing a rapid growth trend.

It is currently the fifth largest EVM-Layer1 in 24h trading volume.

Compared with OP, Canto has about the same 24h trading volume, but there is a big difference in the daily transactions. The daily transaction of Canto is only 30% of that of OP.

2.2 State of the Canto

TVL is nearly tripled from Jan 2023. And there was three announcements that triggered the market:

In November 2022, proposal of Synapse bridge.

In January, a prominent crypto venture fund disclosed it had taken a position in the project.

On 22th January, Contract Secured Revenue(CSR) was announced.

2.3 Token Economics

The initial circulating supply of $CANTO tokens is allocated as follows:

130,000,000 $CANTO (13%) for initial contributors

20,000,000 $CANTO (2%) for Settlers of Canto who took part in the launch of the testnet

The remaining total supply of $CANTO is allocated as follows, pursuant to governance votes by the Canto DAO:

450,000,000 $CANTO (45%) for long-term liquidity mining to be distributed over the next 5-10 years

350,000,000 $CANTO (35%) for medium-term liquidity mining to be distributed over the upcoming months and years

2.4 Protocols on Canto

According to DeFillama and Debank, only 8 protocols are deploying on Canto, namely Canto DEX, Lending market, Synapse, Canto Swap, Y2R, Forte, and two new reserve currency protocols: cantOHM and Manifesto. Among them Canto Lending has the most deposit value of $212m and users, but the borrowable assets are only $62m.

And synapse achieved a huge increase after supporting Canto, in the first 3 days over $15m assets bridged to Canto.

3. Canto Dexs

3.1 The Canto LP interface

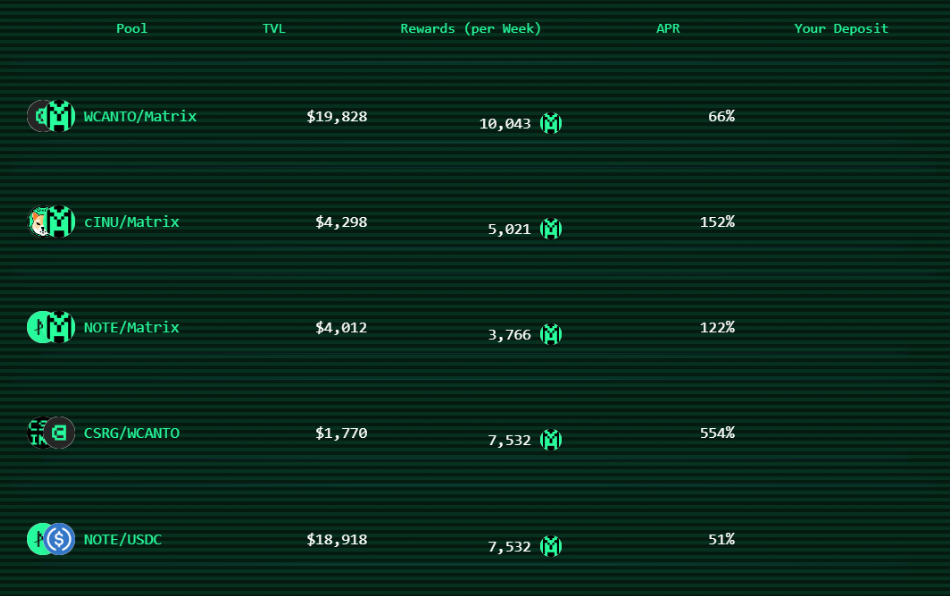

Canto LP interface allows users to provide liquidity and receive LP tokens. LP tokens can be supplied in the Canto Lending Market. At launch, Canto has five incentivized liquidity pools. However, the Canto LP interface does not allow users to swap tokens through the Canto DEX. LPs can earn inflationary $CANTO rewards.

According to the official website, Canto LP interface has a TVL of $122m.

[source: https://canto.io/lp

](https://images.mirror-media.xyz/publication-images/ui5Gj1bRrq1uzilTk4NdA.png?height=482&width=958)

3.2 Canto DEX-Slingshot

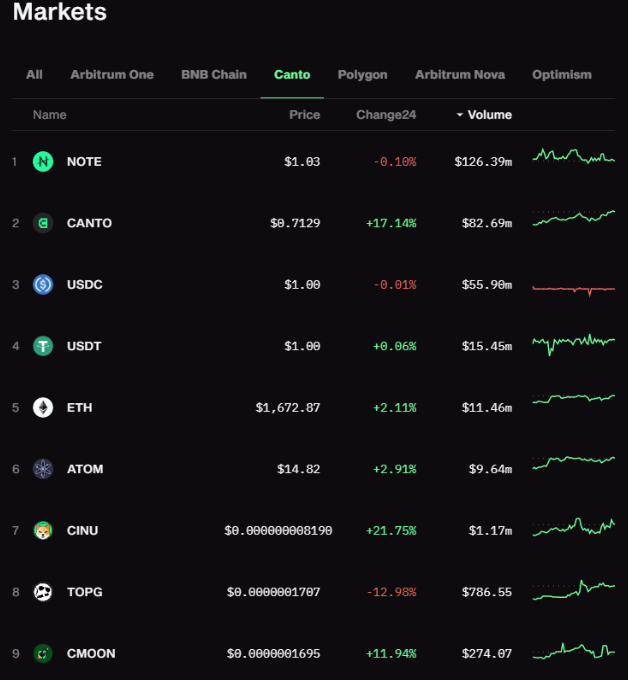

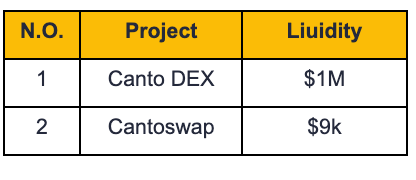

Users swap tokens through Slingshot, a DEX aggregator platform. Now $NOTE has the most volume in Slingshot, about $126m. But we can only swap NOTE to USDC or UDST up to $1m, so it seems that the TVL is not reliable.

source: https://app.slingshot.finance/markets

3.3 Cantoswap

Cantoswap.fi is an AMM protocol forked from Uniswap.

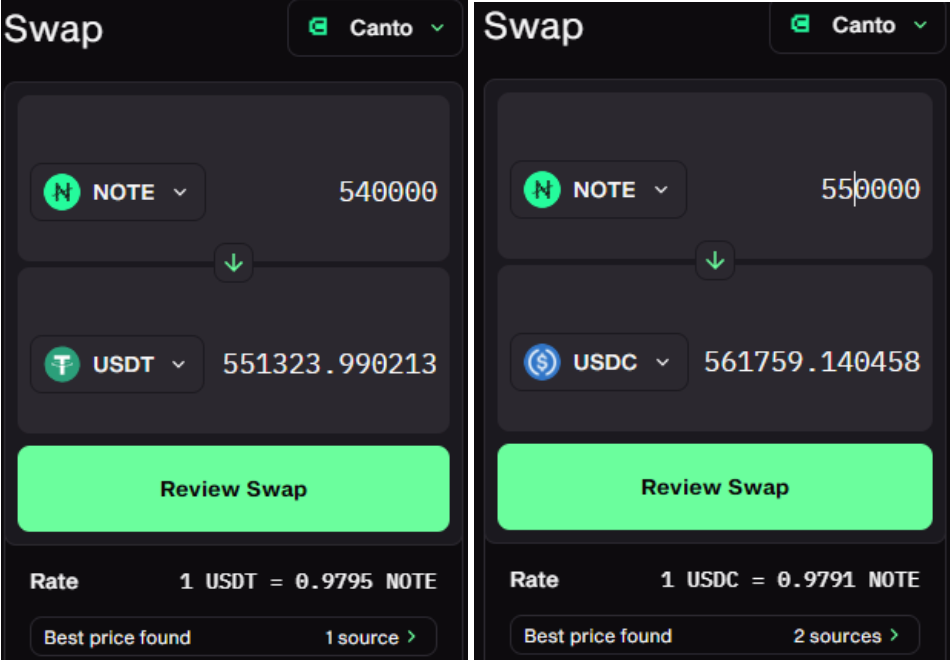

The TVL for NOTE/USDC is only $18k, meaning that we can only swap 9k USDC on it.

source: https://www.cantoswap.fi/#/farm

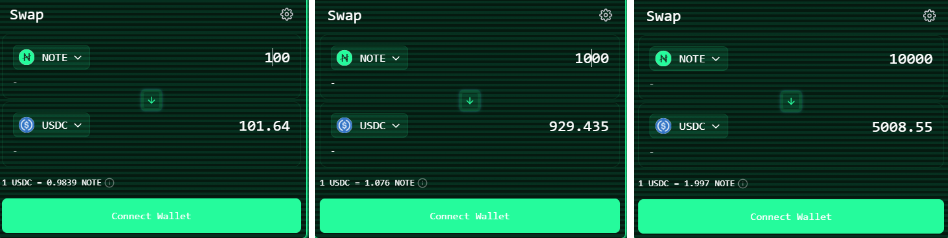

Then we found something interesting here: When you swap NOTE to USDC, you swap more, you lose more on Cantoswap due to the low liquidity.

We can not find more information in the whitepaper.

4. Canto Lending and $NOTE

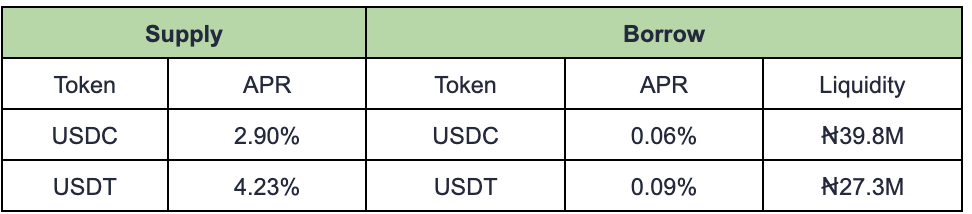

4.1 Lending Market

In order to borrow an asset from the Canto Lending Market, you must collateralize your supply positions. The amount you can borrow is directly related to the collateral factor of each specific token and how much you have supplied in the market.

Currently, the collateral factor for USDC and USDT are both 80%.

And we compared the data of the two platforms” DeFillama and Debank, it can be seen that the capital utilization rate is 71%.(Deposited and borrowed assets are $212m and is $152m respectively)

A weird thing is here: At present, Canto LPs cannot be used as collateral to borrow assets, nor can they be borrowed, but they have a high APR,why?

4.2 $NOTE

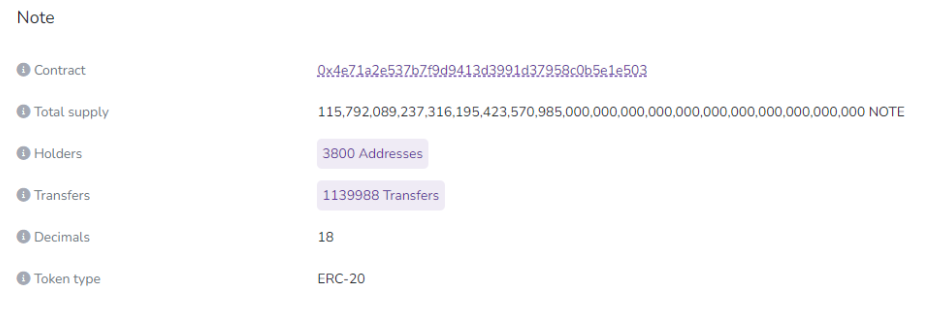

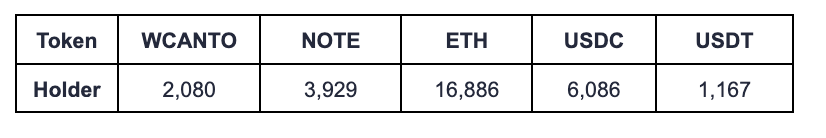

We have introduced the features of $NOTE at the beginning of the article. $NOTE is an over-collateralized currency with a value perpetually rebalanced toward $1 through an algorithmic interest rate policy. It is backed by collateral lent to the CLM. The holders are 3929 now.

source: https://evm.explorer.canto.io/token/0x4e71A2E537B7f9D9413D3991D37958c0b5e1e503/token-transfers

Arbitrage Opportunity:

If $NOTE is trading under $1, the interest rate is raised to strengthen the incentive for buying $NOTE on secondary markets and lending it to the CLM. If $NOTE is trading over a dollar, the interest rate is lowered to make borrowing $NOTE from the CLM and selling it on secondary markets more attractive.

In other words, when the value of $NOTE is less than $1, we know that the interest rate will increase so we can buy more $NOTE.

But, we can not find how to achieve this change. Is it reflected in the trading price in the secondary market, or in the lending interest rate? Since in the lending market there is no apr for $NOTE, but a high apr for CANTO/NOTE LP.

One assumption is that if you buy more $NOTE for arbitrage, you can get high apr only when you provide liquidity on Canto LP interface.

So, this is another weird thing.

Another assumption is when a DeFi participant lends $USDC to CLM and then borrows $NOTE. If the borrow rate for $NOTE is less than the supply rate for $USDC, that DeFi participant will be getting paid to hold $NOTE on Canto. The reward is assumed to be $CANTO here.

If this is the case, whether you arbitrage, provide liquidity, lend and borrow, or stake, the ultimate reward is the inflationary $CANTO.

Liquidity Risks:

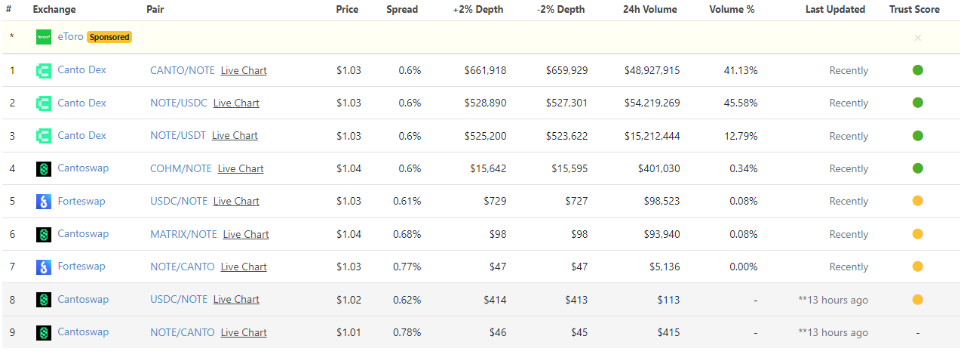

Here is the markets for $NOTE:

The amount that we can swap $NOTE for USDC in different pools are as follows, only 1 million dollars.

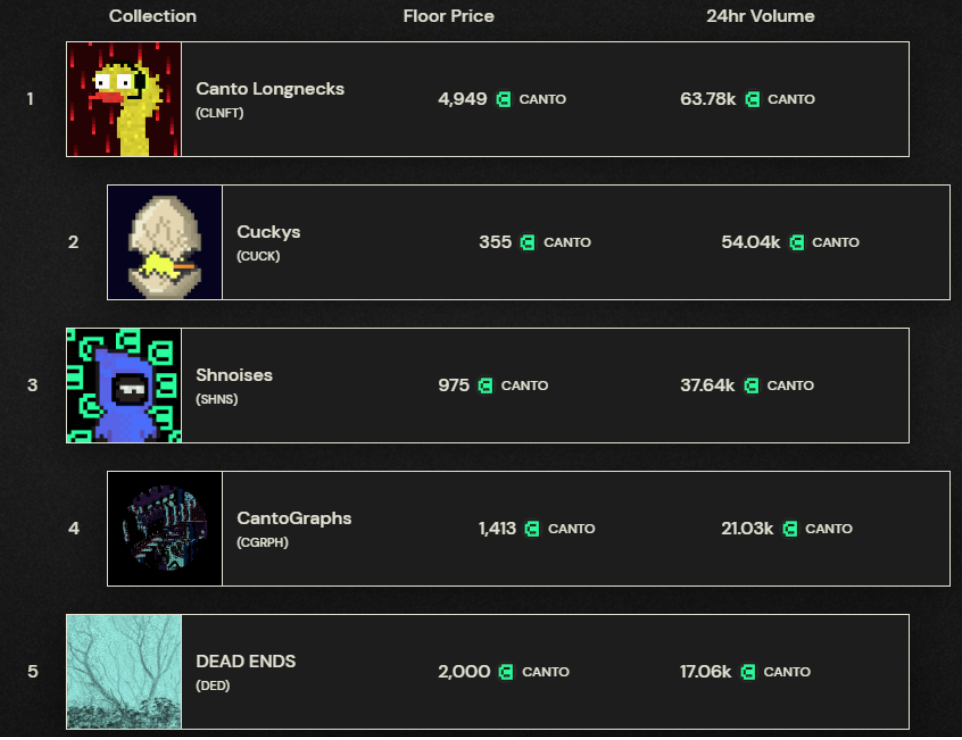

5. NFT Marketplace-Alto

Alto is a free public NFT marketplace on Canto.There are 153 collections listed on Alto. No more information can be found.

6. Risk Analysis and Summary

This round of TVL and token price surging belongs to the fomo of market, not from the value capture ability of the economic model. In the ecosystem, the DeFi projects have obtained a lot of liquidity.

Remember that the $NOTE has liquidity risks!

And don’t forget the weird super high APR of those Canto LPs, they cannot be used as collateral to borrow assets.

Once more, if what we supposed above are right, then whether you arbitrage, provide liquidity, lend or stake, the ultimate reward is the inflationary $CANTO.

One important thing is: what about the rewards of holding $CANTO?

Early Canto contributors propose CANTO emissions be structured in 30 day periods, with rewards distributed daily:

For the first 30 day period, $CANTO will inflate at a 19.84% APR.

For subsequent periods, the Canto DAO will vote to adjust emissions as appropriate.

New proposals are coming out, please follow up with: https://canto.mirror.xyz/

If you still believe that fomo will continue and long for $CANTO, then let’s see the number of users who are in the Canto ecosystem. The total accounts are 127,593 on the chain. And we check for the holders of the main tokens:

Please be careful and keep an eye on it.