In this article, we are going to dive deep into the world of Liquid Staking. We’ll look at some of the existing liquid staking protocols. In addition, we’ll evaluate the benefits of liquid staking and the drawbacks.

Table of contents

1.2 Liquid Staking TVL Rankings

1、Background

1.1 Liquid Staking

We all know that in the proof-of-stake (PoS) consensus, validators secure the network by staking digital assets. Once staked, the assets cannot be used for other purposes such as borrowing or lending anymore. Yields for staking assets are relatively lower compared to those of DeFi protocols. Furthermore, those that stake their assets on the network do not get immediate access to these assets when they remove their locked up capital.

The problems above are solved due to Liquid Staking. It allows investors to stake their assets while also allowing them to use those assets in other projects during lock-up.

1.2 Liquid Staking TVL Rankings

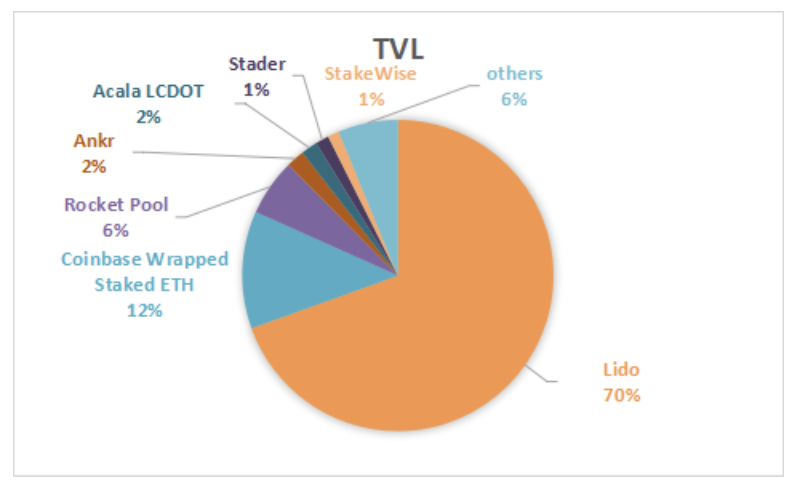

According to DefiLlama, there are about $8.7b in liquid staking protocols across many blockchains. With $6.05b of TVL, Lido Finance makes up more than 70% of the liquid staking market, almost all of which comes from their Ethereum pool.

1.3 Ethereum liquid staking

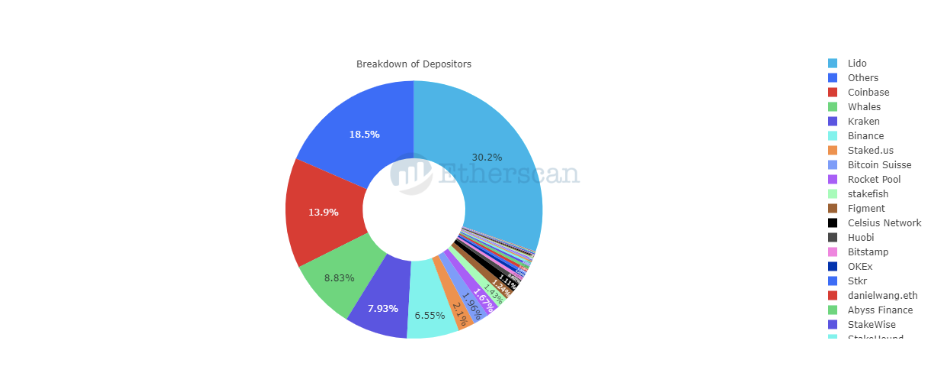

Ethereum is the blockchain with the most value in both staking and liquid staking. Lido Finance makes up the dominant share of Ethereum’s liquid staking. The chart below shows the distribution of various liquid staking providers.

2、Lido

We once introduced Lido in our article: Catch the tail of ETH 2.0 You can jump into it for details. We will update some data in this report.

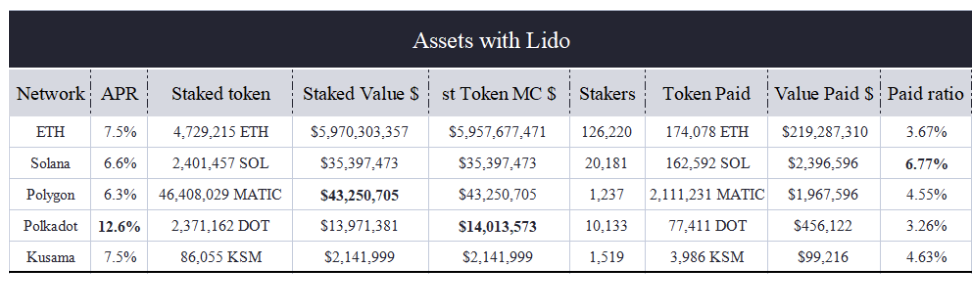

First we see the assets staked on Lido. Now DOT has the highest APR which is 12.6%, and ETH has the most staked amount followed by MATIC, but the stakers of MATIC is the least. Most of the stTokens have less value than staked tokens, except DOT.[2022.11.15]

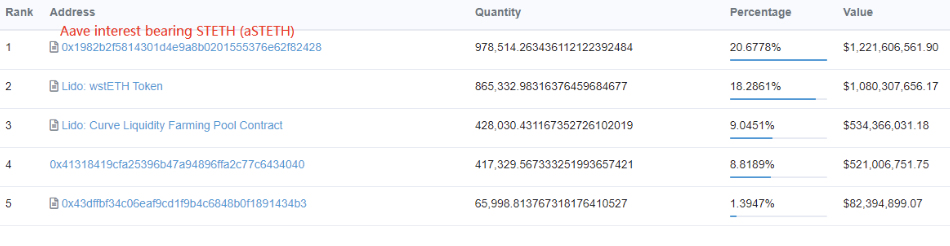

The total stETH is 4,729,215, over 50% of it is held by less than 5 holders. Among them Lido is the second one following Aave.

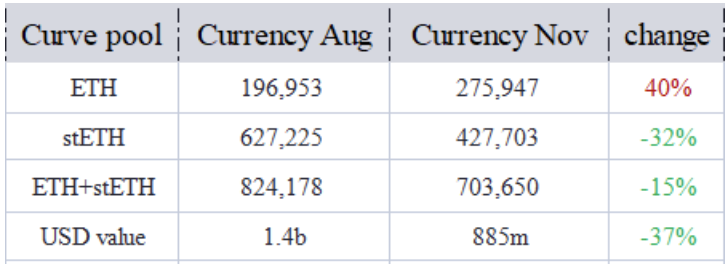

Lido has also built a liquidity pool for stETH on the Curve platform, with over $885 million worth of stETH locked in Curve’s stETH-ETH pool.

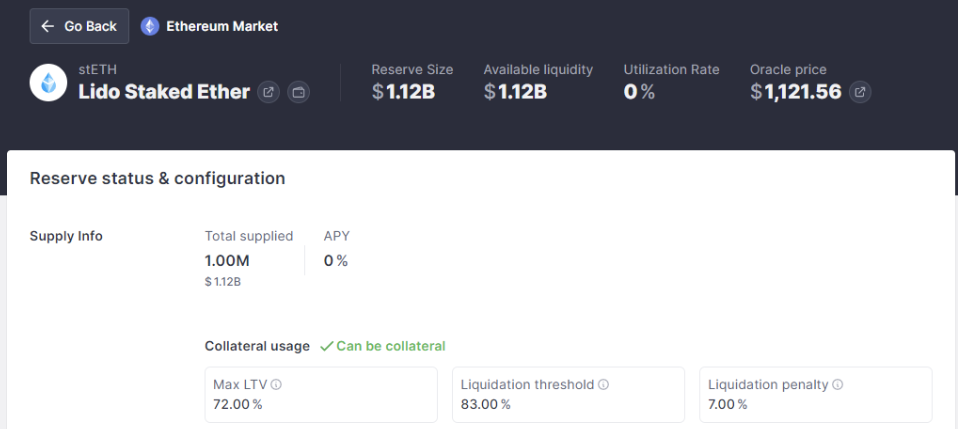

Perspectives: when will holders of stETH would like to sell the stETH, and how? The first situation is that holders need to cash out when they need money. They can go Curve to swap stETH to get ETH in return. Another situation is that they want to improve capital utilization, then they go to Aave to borrow money and trade with leverage. The max LTV on Aave is 72%, so this is a nice choice.

Will stETH de-peg? Once stETH whales sell off at a low price or holders sell in panic, then the price of stETH falls to a certain level. It will trigger AAVE's leveraged liquidation line, causing further sel-offl. The amount of ETH is much less than stETH, so the liquidity can be used up soon. Finally, the price of stETH falls into a death spiral.

However, the above assumptions have a very low chance to happen. Other events like FTX, leading to depegging, provide arbitrage opportunities instead.

Depegging history of stETH=Arbitrage opportunities

The price of liquid staking tokens is not “pegged” to the price of ETH - they trade freely in the market. As a result, in bear market the price of Ethereum liquid staking tokens begin trading at a discount to Ethereum.

In June of 2022, as overleveraged market participants hurried to sell their stETH, the price of stETH moved down to a 7% discount below the price of ETH, as shown in the chart.

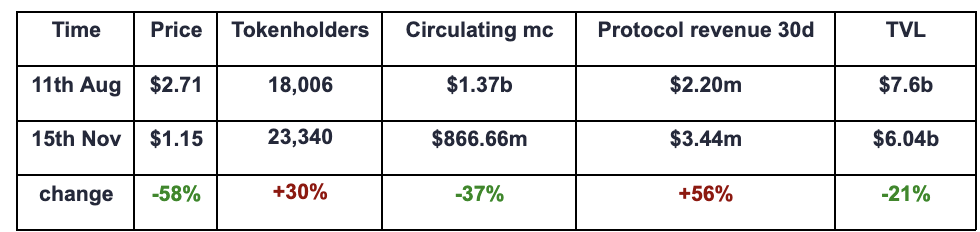

At last, we compare the the token information:

3、ANKR Staking

Ankr Liquid Staking supports two types of tokens: reward earning tokens and reward bearing tokens.

Reward earning tokens represent the staked asset. Rewards occur through the rebasing process where more tokens are issued to the stakers' wallet, increasing the number of tokens without changing their price. For example, if you stake 1 ETH, you are issued 1 aETHb. Every 24 hours your aETHb balance increases — a portion of aETHb is added to your wallet, according to your stake amount and the current yield value.

Reward bearing tokens represent the staked asset plus all future staking rewards. They don't grow in number but grow in value. For example, the fair value of 1 aETHc token vs. ETH increases over time as staking rewards accumulate.

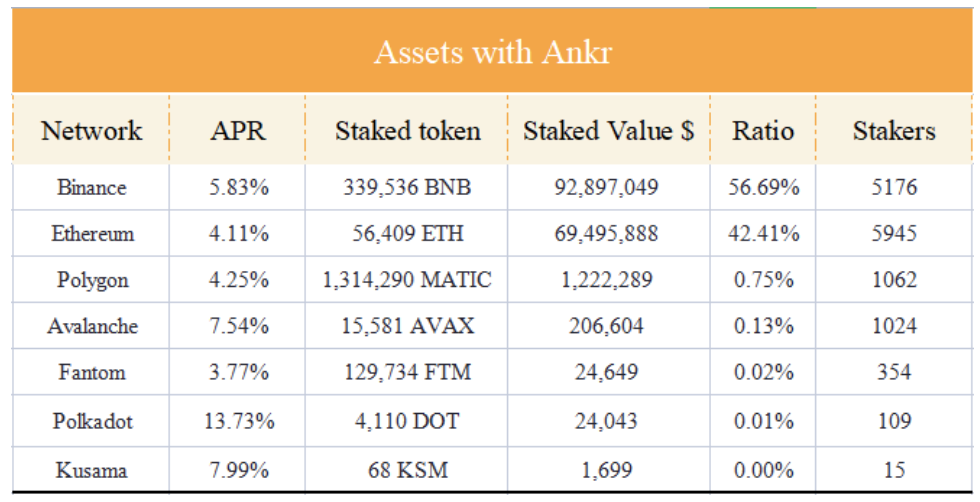

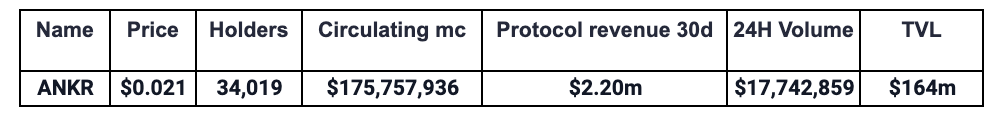

Currently Ankr Liquid Staking is available on 8 platforms, namely Avalanche/ Binance/ Polkadot/ Ethereum Mainnet/ Fantom/ Kusama/ Polygon and SSV (Ethereum Goerli). The total TVL is $164m, and 57% is from BNB stake.

Now DOT has the highest APR which is 13.73%, and BNB has the most staked value followed by ETH, but the stakers of ETH are the most. [2022.11.16]

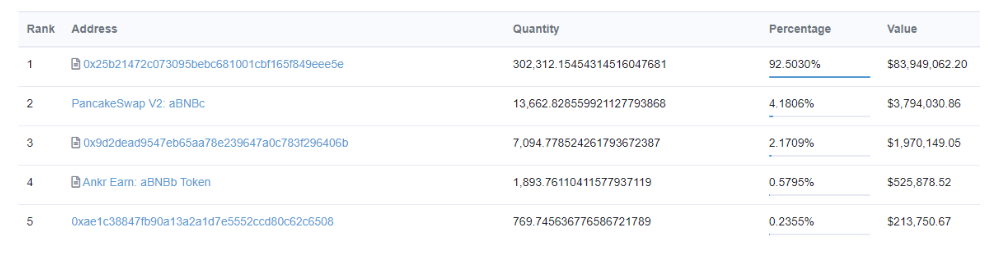

We find that the holders of aBNBb and aBNBc are totally not similar. They are 2,842 and 2,315 respectively, but the distribution is much different. Holders of aBNBb are very scattered, while over 92% of aBNBc are held in one protocol which is Helio. Helio Protocol is an open-source liquidity protocol for borrowing and earning yield on HAY —a new BNB backed over-collateralized destablecoin. The TVL is $83.95m.

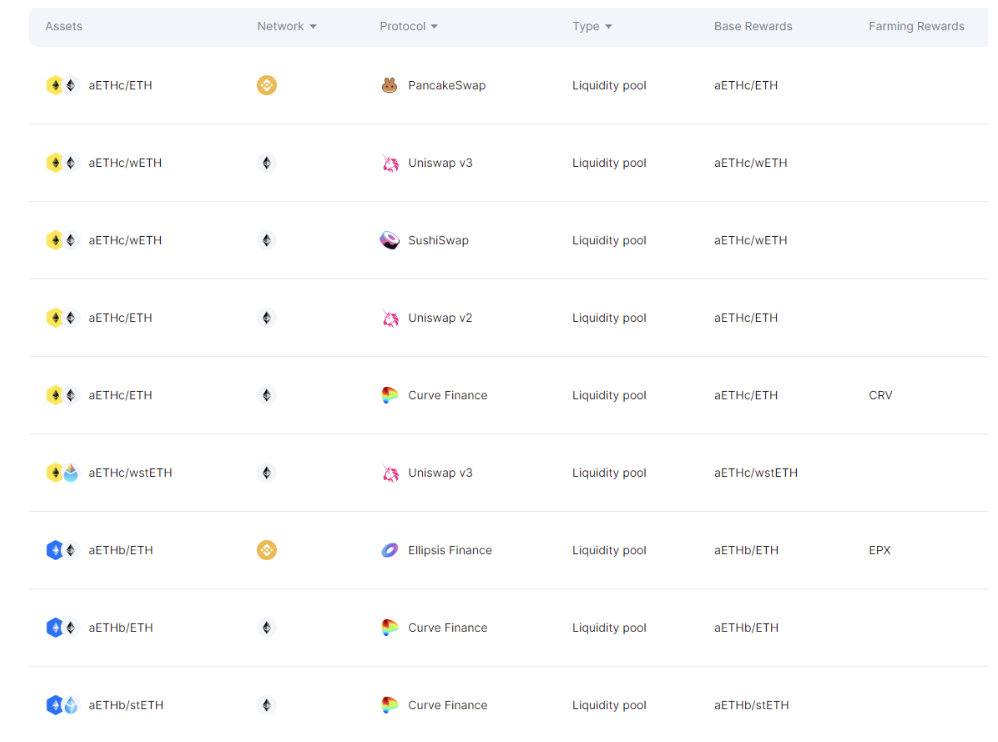

Like Lido, Ankr has also built liquidity pools for staked representative tokens on the DeFi platforms, including Pancakeswap, Uniswap, Curve.

At last, we see the token information:

4、StakeWise

StakeWise tokenizes both deposits and rewards earned by those staking in the Pool. sETH2 (staking ETH) is a token that represents users' deposits in StakeWise Pool in a 1:1 ratio. rETH2 (reward ETH) is a token that represents users' ETH rewards in StakeWise Pool in a 1:1 ratio. As long as you hold sETH2 that represents your deposit, rETH2 will accrue on your address as a reward from staking.

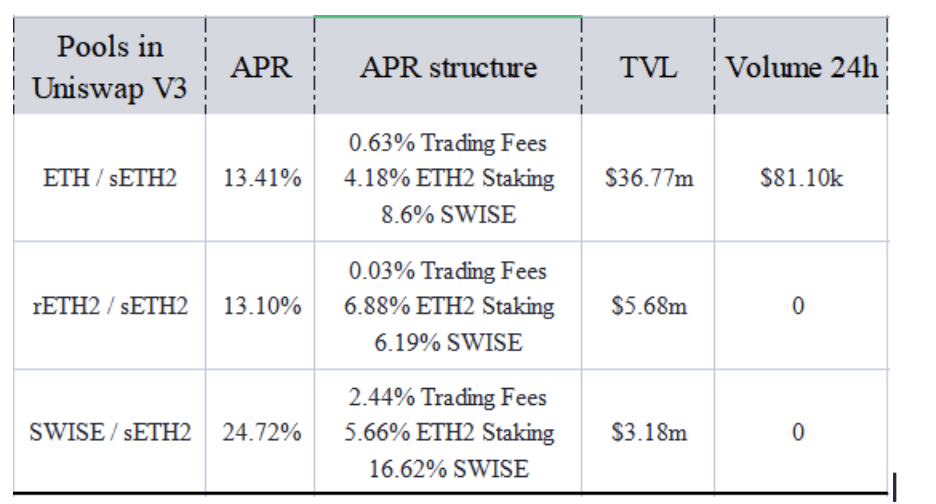

Holders can use protocols like Uniswap, Sushi or Curve to exchange sETH2 and rETH2 into other assets.

Vital Data: There are 67,315.21 ETH staked in the pool, so 67,315.21 sETH2 were minted and the holders of sETH2 are 4234. However, only 3,826.07 rETH2 were minted now, and holders are just 409.(According to Etherscan)

Why? There can be 2 reasons for this: One is stakers don’t want to wait for the staking rewards, so they sell them. Another reason is that holders didn’t claim for it after they put sETH2 into some contract.

Let’s see the liquidity situation: Liquidity and rewards for rETH2 is much less than those of sETH2.

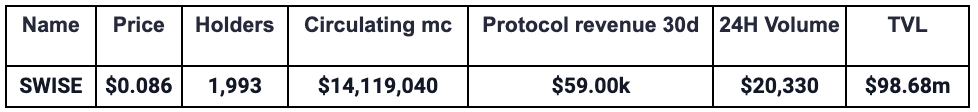

At last, we put the token information as below:

5、Persistence-pSTAKE

5.1 Persistence

Persistence is a Tendermint consensus-based Layer-1 network that focuses on decentralized finance (DeFi) applications that help drive adoption and utility for PoS liquid-staking assets.

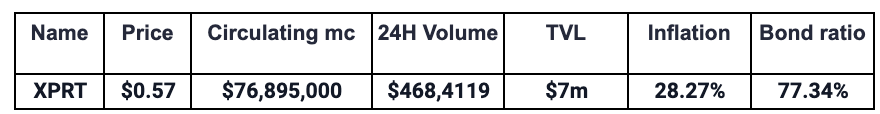

First, note that the native asset of the Persistence network is called $XPRT, it carries a variety of use cases within the ecosystem, including governance, staking, and its role as a work token. XPRT is a deflationary token with a genesis supply of 100,000,000 XPRT and a maximum supply of 403,308,352 XPRT. Initial inflation will range from 25-45% with the target of 35% achieved at 66.7% bonding ratio. Inflation halving happens every two years and the maximum supply cap is expected to be reached by the year 2035.

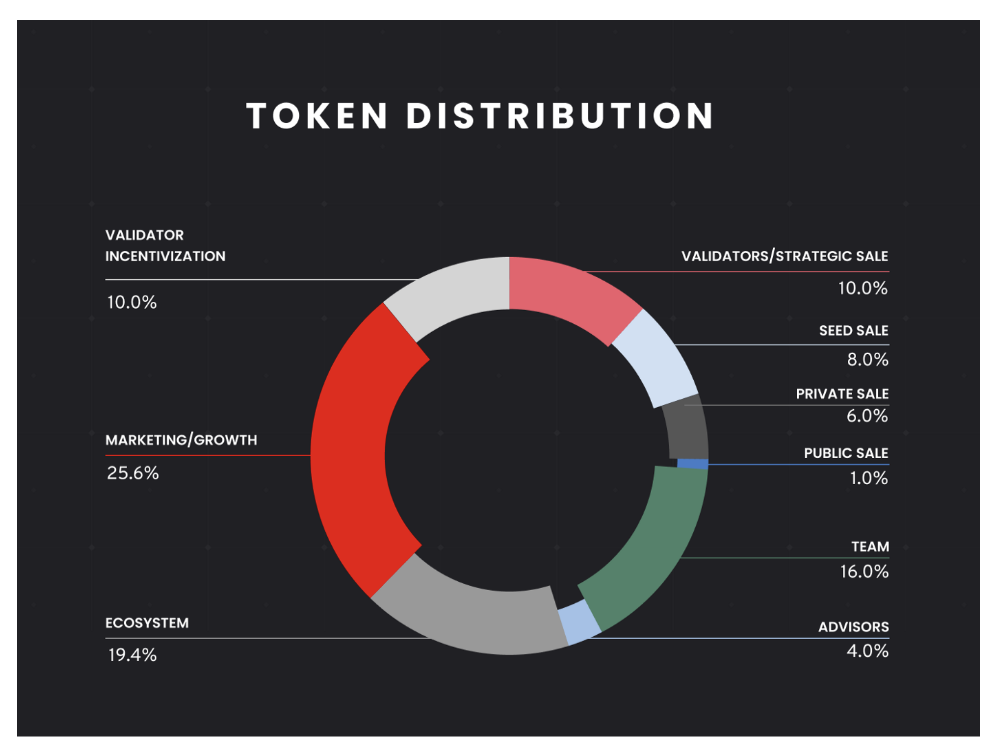

100 million XPRT will be minted at genesis and will be gradually released over the course of 42 months. The distribution is as follows:

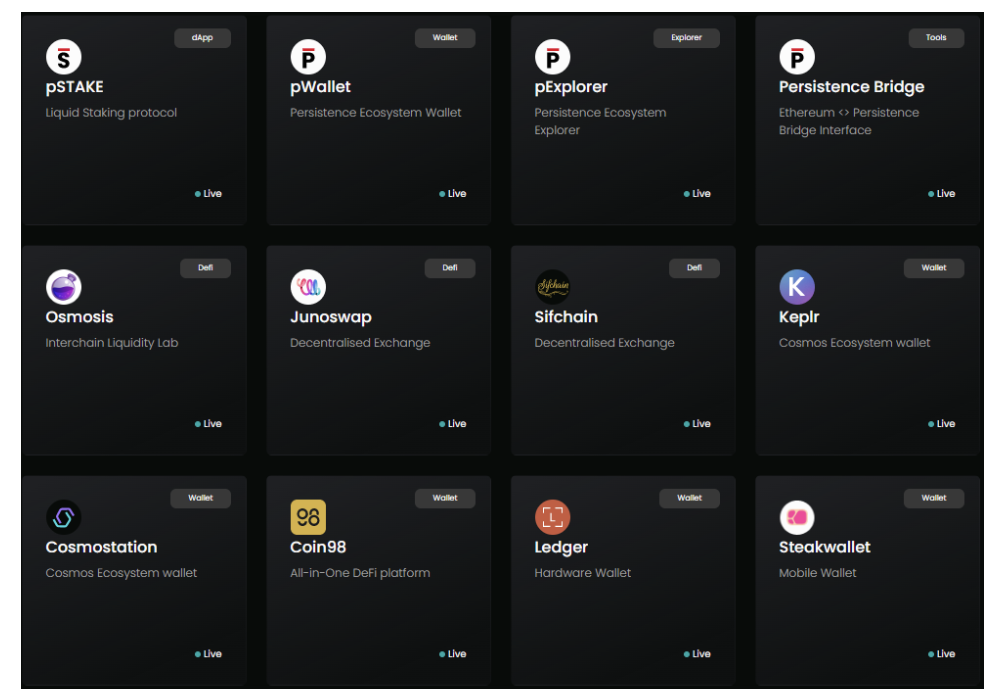

There are 26 dAPPs on the Persistence network, and they are most wallet and DEX that are Cosmos native products.

5.2 pSTAKE

pSTAKE is a product of Persistence, which is a liquid staking protocol. On staking with pSTAKE, users earn staking rewards and also receive staked representative tokens (stkASSETs) which can be used in DeFi. pSTAKE currently supports liquid staking for Cosmos, Persistence, Ethereum and BNB chains.

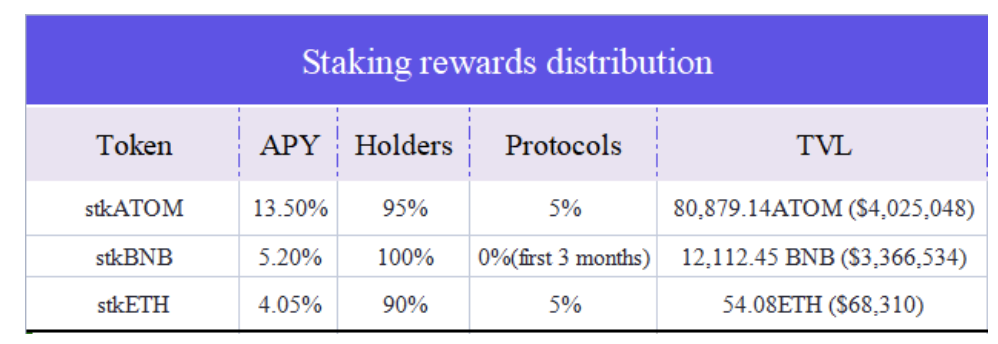

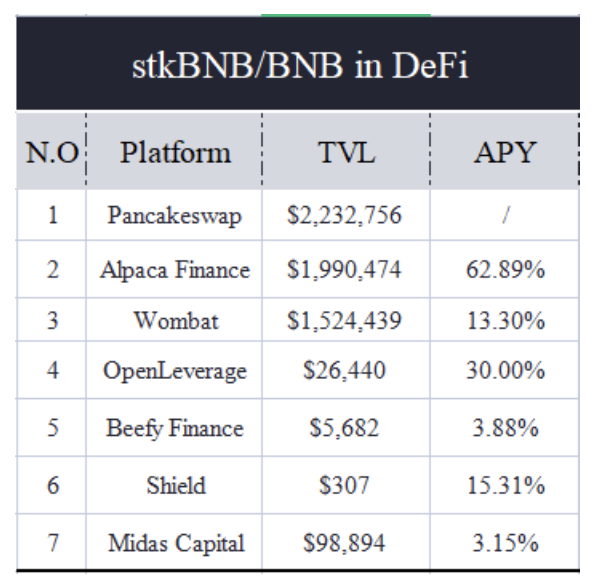

In August, pSTAKE went live with its liquid staking system for BNB Chain. Users holding stkBNB can participate in DeFi protocols to generate additional yield on top of their staking rewards. Currently, there are 7 protocols supporting stkBNB. Holders of stkBNB are 830.

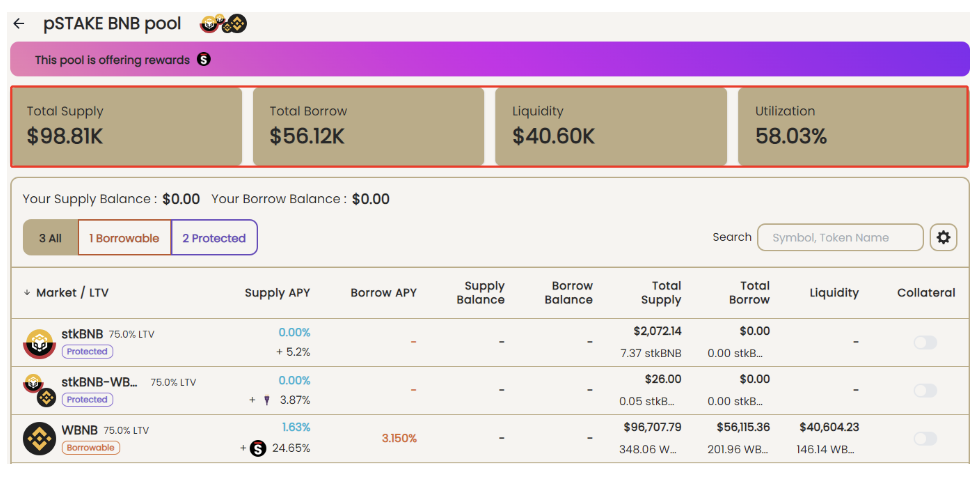

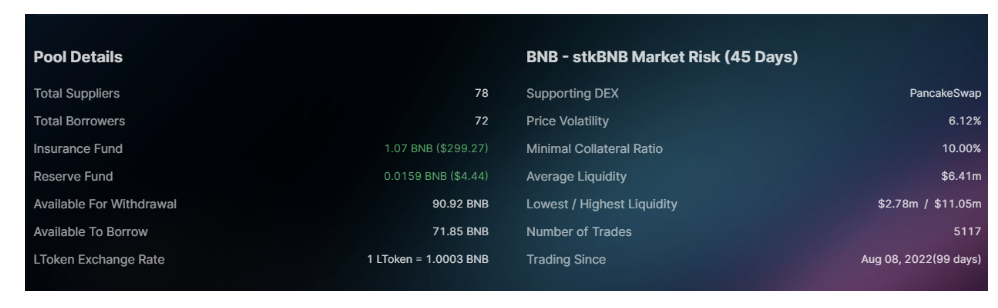

We put the information of Midas and OpenLeverage here, and we can see that the utilization of stkBNB is not very high.

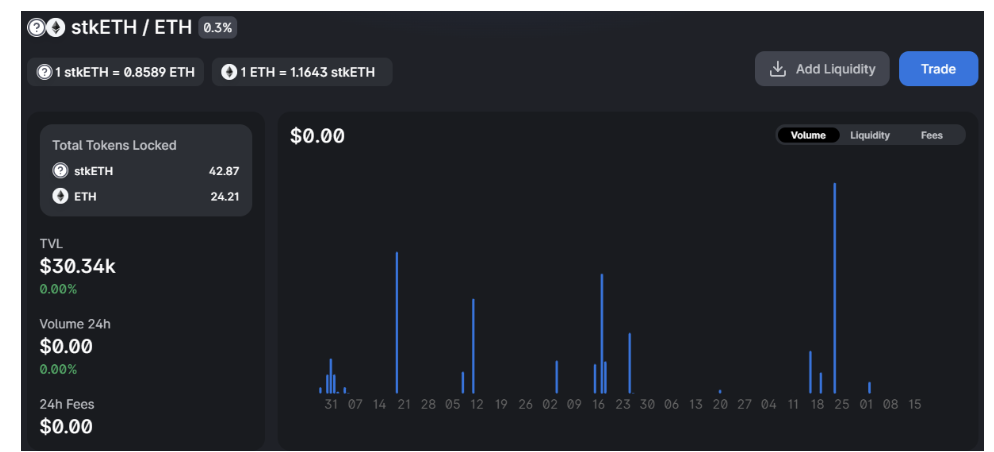

stkETH on Uniswap V3 has a pool whose liquidity is $30.34k with no trading volume and the price difference is 16%.

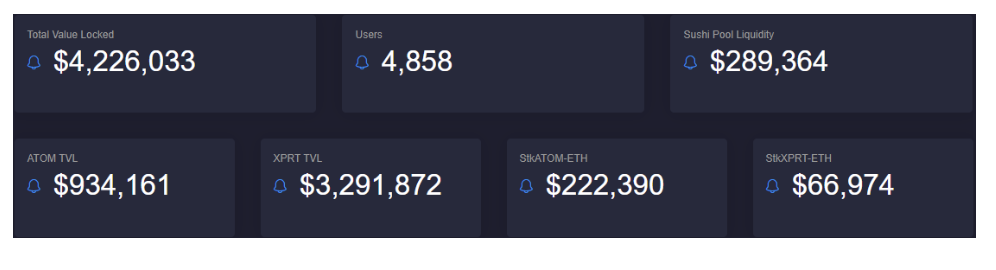

The total users of pStake are 4858, and the TVL is $4m now. pStake also has stkATOM/ETH and stkXPRT/ETH pools on Sushi. Below is the analytics from pStake.

6、Summary

It is true that Liquid Staking has many advantages both to POS and stakers.

Current results from stETH show that Lido makes the system more and more centralized, bringing some arbitrage opportunities to users, as well as some risks.

Networks such as BNB chain, the strategic investment in pSTAKE Finance has brought more DeFi innovations to the BNB chain ecosystem.

However, besides ETH, people who stake other assets are not very much, resulting in the staked representative tokens not receiving much liquidity and volume. So there is still a long way to go for liquid staking protocols.