Table of Contents

1. Introduction & Uses of Stablecoins

3. Key Considerations & Assessing Risks

Central Bank Digital Currencies (CBDCs) & Regulations and Sanctions

4. Stablecoins Total Value Locked

Recommended Case Study #1 - Waves/USDN

Recommended Case Study #2 - LUNA/UST

Recommended Case Study #3 - Justin Sun and USDD

1.Introduction & Uses of Stablecoins

Volatility is what many who are involved within the Crypto Space are used to.

However, there will always be a demand for some form of stable “currency” for those who wish to protect the value of their asset or think that the current prices are high enough to justify selling or in other words, “locking in gains”.

This brings us to the topic of Stablecoins, which are basically cryptocurrencies that are each pegged to values of various fiat currencies, which currently is most commonly the USD.

Uses of Stablecoins

Importance; aka why do we need or want to hold Stablecoins?

Besides facilitating trading/hedging purposes there are a few other common uses of stablecoins.

DeFi/Yield Farming

Popular protocols for stablecoins such as Curve Finance allow you to provide liquidity to stablecoin pools in exchange for APY. Another popular protocol is Aave which allows depositors to provide liquidity, also in exchange for APY

Also, an interesting thing to note; before the collapse of LUNA/UST, Anchor Protocol was a popular way to get almost 20% APY on UST!

Reduces the Likelihood of Missed Opportunities

Allows you to store/conduct time-sensitive transfers/transactions of a “stable” value of Crypto to protocols you wish to transact on.

Many DeFi Protocols do not have a Fiat Gateway, and you might want to quickly conduct a transaction (E.g. when prices are low and you do not want to hold another cryptocurrency which is exposed to volatility).

Therefore, this allows you to hold the stablecoin in that protocol without being subjected to delays in transfers.

Faster and (Usually Cheaper!) Cross-Border Transactions

Traditional banking transfers are usually regarded as “safer”. However, the process usually takes longer and generally costs more.as compared to a simple stablecoin transaction between two parties through their wallets.

2.Types of Stablecoins

There are many ways to classify a Stablecoin, but we have narrowed down the list to the most common way they are grouped.

Fiat Collateralized Stablecoins

Commodities-Backed Stablecoins

Crypto-Backed Stablecoins

Algorithmic-Stablecoins

2.1 Fiat Collateralized

Arguably the simplest variant of stablecoins.

Since the purpose of a stablecoin is needing it to represent a fiat currency, having the equivalent collateral would be quite straightforward.

The Central Institution/Entity of the stablecoin would have a reserve (usually held in a bank account), hence, the total stablecoins in circulation would supposedly have an equal amount held in that reserve.

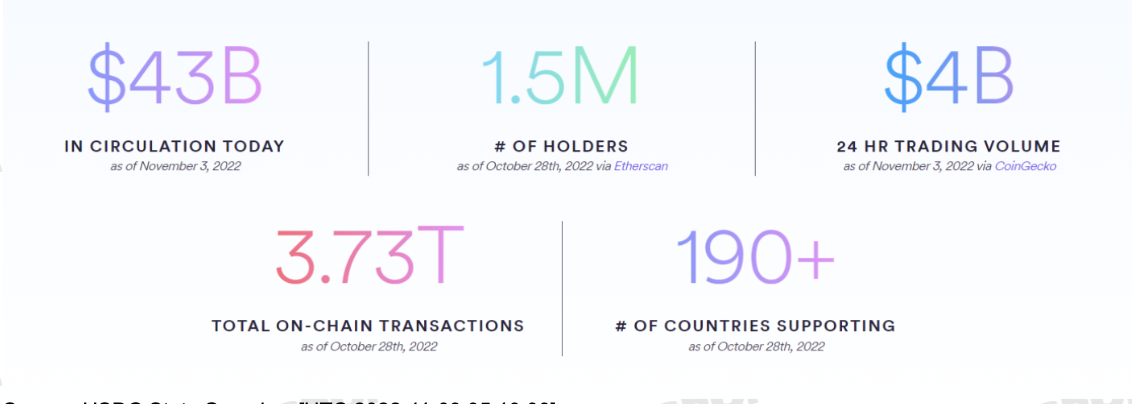

An example would be USD Coin (USDC) where it is backed by cash and short-dated U.S. treasuries. USDC is a stablecoin issued by CENTRE which is a joint venture between Circle and Coinbase.

2.2 Commodities-Backed

These are Stablecoins being backed by physical assets.

A common physical asset being used is gold, as whenever there is uncertainty or distress in regards to the macro environment, gold is frequently used as a hedge.

Using Paxos as an example, PAX Gold (PAXG) is backed by having one fine ounce of gold equal to one PAXG token. Take note not to be confused by the Fiat-Backed Stablecoin Pax Dollar (USDP) which is also offered by Paxos!

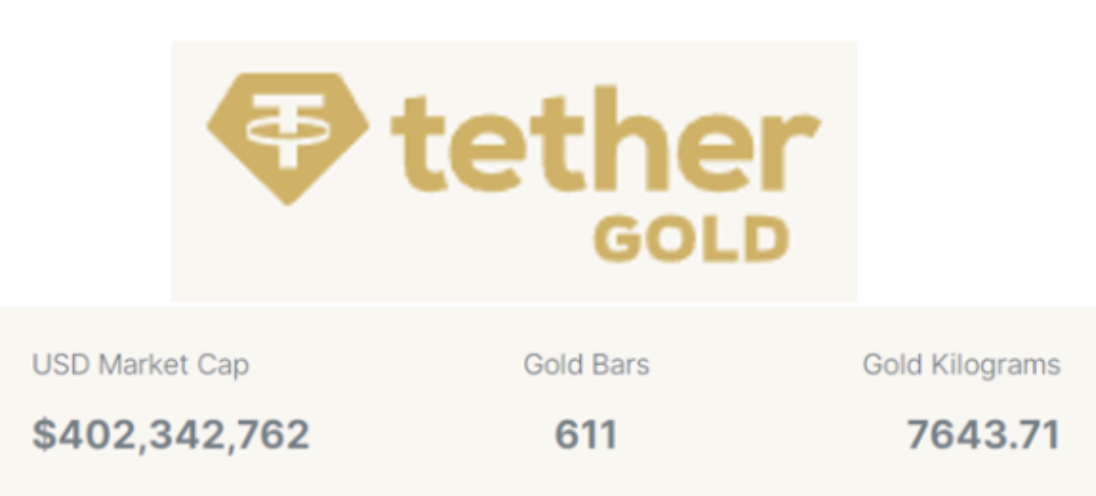

Another similar example is Tether Gold (XAUT) where it is a stablecoin that provides “ownership on a 1:1 basis of one fine troy ounce of gold on a physical bar of gold that meets the Good Delivery standard of the London Bullion Market Association (LBMA).” (Source: https://gold.tether.to/faq)

However, these stablecoins are not exactly popular as compared to the USD pegged stablecoins.

While Tether Gold is formed by Tether Gold Commodities Limited, belonging to the Tether ecosystem, it pales in comparison to the popular USDT just by assessing the volume traded.

2.3 Crypto-Backed

There is certainly some disagreement and controversy within many users involved in the Crypto Space regarding Crypto-Backed Stablecoins. It is commonly said that it does not make sense to back a cryptocurrency with another cryptocurrency, or in other words, use a volatile asset as collateral.

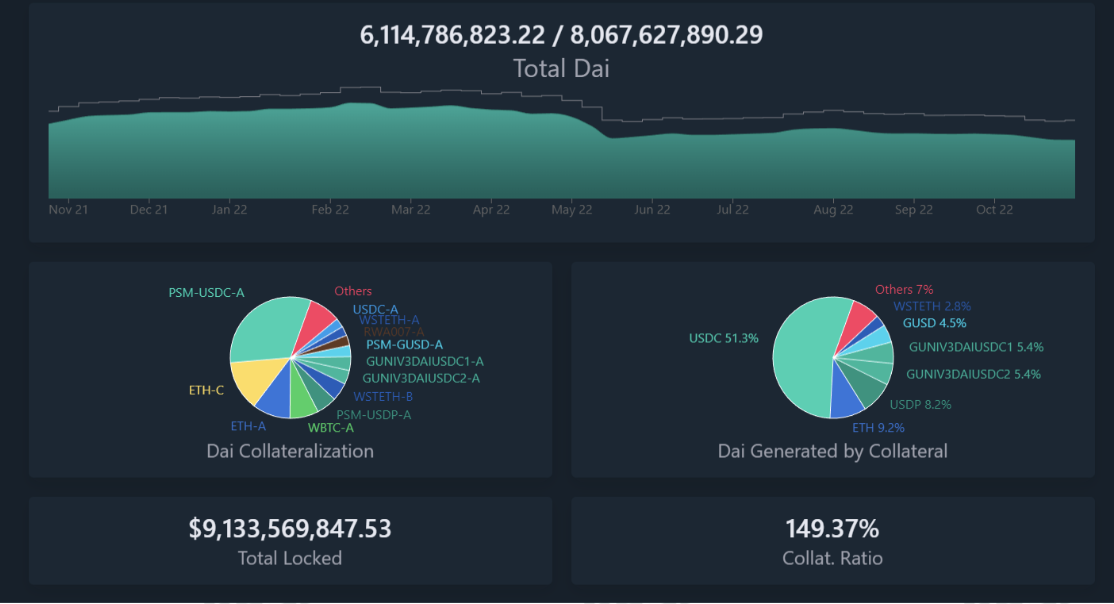

Therefore, this brings us to the topic of over-collateralization.

By having a higher value of the collateral in comparison to the stablecoin it is backing, it is said that this could be a potential way to reduce the risks of the collateral not being able to back the stablecoin due to volatility.

Using MakerDAO’s DAI Stablecoin as an example; we have Maker Vaults which allow the owner to deposit collateral and DAI will then be generated. However, a key parameter is that all vaults would have to be over-collateralized or in simpler terms, the collateral must exceed the minted DAI.

2.4 Algorithmic Stablecoins

Algorithmic Stablecoins have long been criticized by many well known within the Crypto Space as unsustainable.

Relying on algorithms defined in smart contracts to maintain its price through controlling the supply and demand of the stablecoin, usually through an exchange system with another cryptocurrency (Minting and Burning).

Therefore to keep the “peg” of the algorithmic stablecoins we need traders/holders to conduct arbitrage trades.

In the case of LUNA and UST:

Scenario 1. UST above Peg (above $1)

If UST is above peg, you can Sell LUNA for UST // Buy UST for LUNA.

1 USD worth of LUNA for UST (burn LUNA and thus raise price) and this causes additional UST to come into circulation (mint UST and thus lower price) and since UST is above peg, you can sell it and instantly make a “profit” since 1 UST is supposedly worth 1 USD at peg, and further puts pressure down on UST’s price.

Scenario 2. UST below Peg (below $1)

If UST is below peg, you can Sell UST for LUNA // Buy LUNA for UST.

1 UST which is currently worth less than 1 USD (below peg), you can still trade it for 1 USD worth of LUNA (burn UST which will thus raise price), this causes additional LUNA to come into circulation (mint LUNA and thus lower price) and since you supposedly got the LUNA for a discount since UST was below peg (assuming you bought UST below peg price), you can sell the LUNA for profit immediately.

We can clearly see that this relies on trust and confidence in that project and that a key element in such a system - there has to be demand with continued growth.

Noting that algorithmic stablecoins usually has no collateral backed, and even in the case of LUNA/UST where we have the Luna Foundation Guard (LFG) that builds reserves to safeguard the peg of UST (Exchange the UST with Bitcoin instead of LUNA), it is shown to not be effective even when holding billions in reserves, although admittedly there was never enough reserves as collateral for all the UST.

We will further discuss this topic further down the Case Study Section.

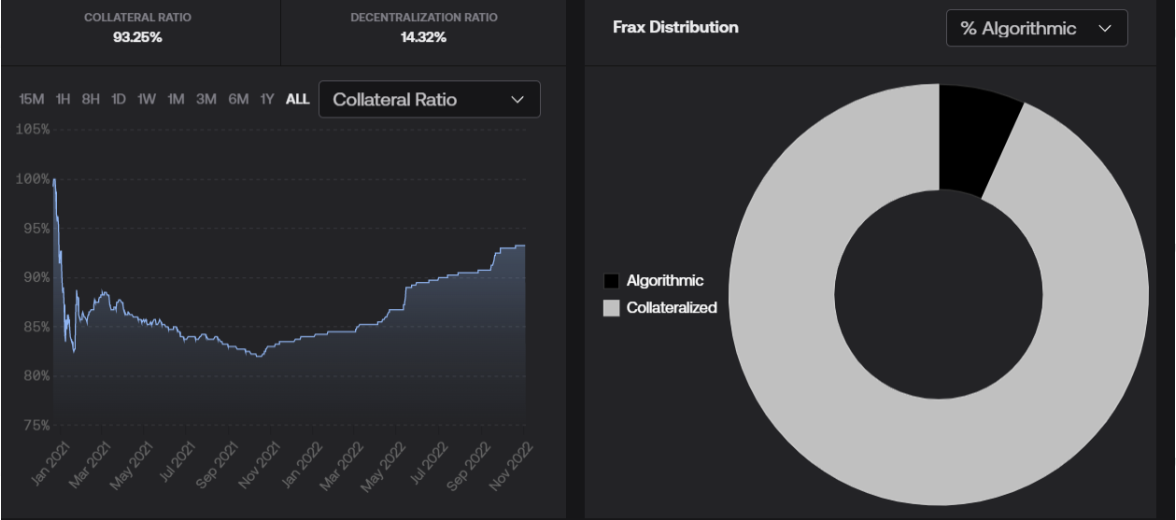

In the case of Frax:

Which is another algorithmic stablecoin which is partially collateralized, we can view the history of the collateral ratio. You can refer to their whitepaper (Source: https://docs.frax.finance/overview) to better understand how their stablecoin works.

In this case, we can see that at this point of writing, the collateral ratio is 93.25%, meaning that every FRAX can be redeemed for $0.9325 of collateral and $0.0675 of minted FXS.

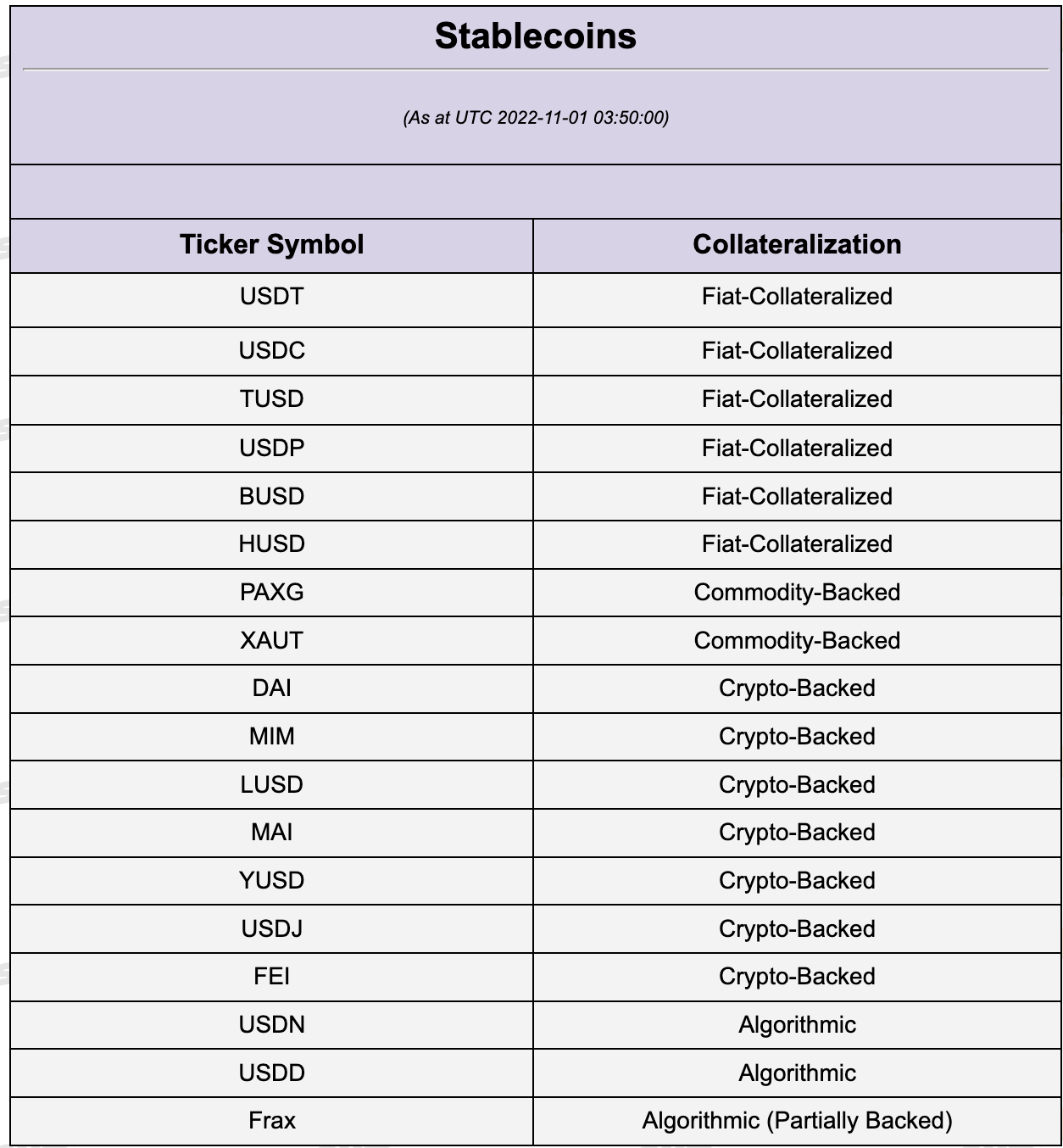

The table below is a summary of the various types of stablecoins.

3. Key Considerations & Assessing Risks

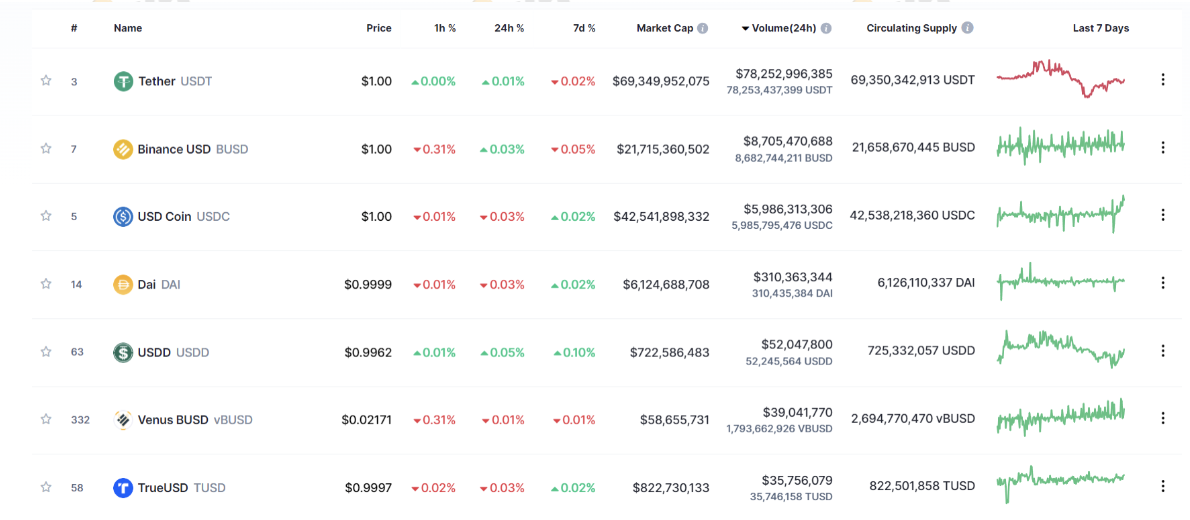

Besides the type of collateral/backing used (which we personally feel is up to your personal preference on what you feel is safer to use as collateral; some might feel gold is safer, some might feel fiat is safer) the volume traded is also important, as if there are many trading pairs available for that stablecoin and higher volume overall, in times of uncertainty, there is higher probability you can cash out your stablecoin for a “safer” cryptocurrency.

In this case, USDT easily wins by a landslide.

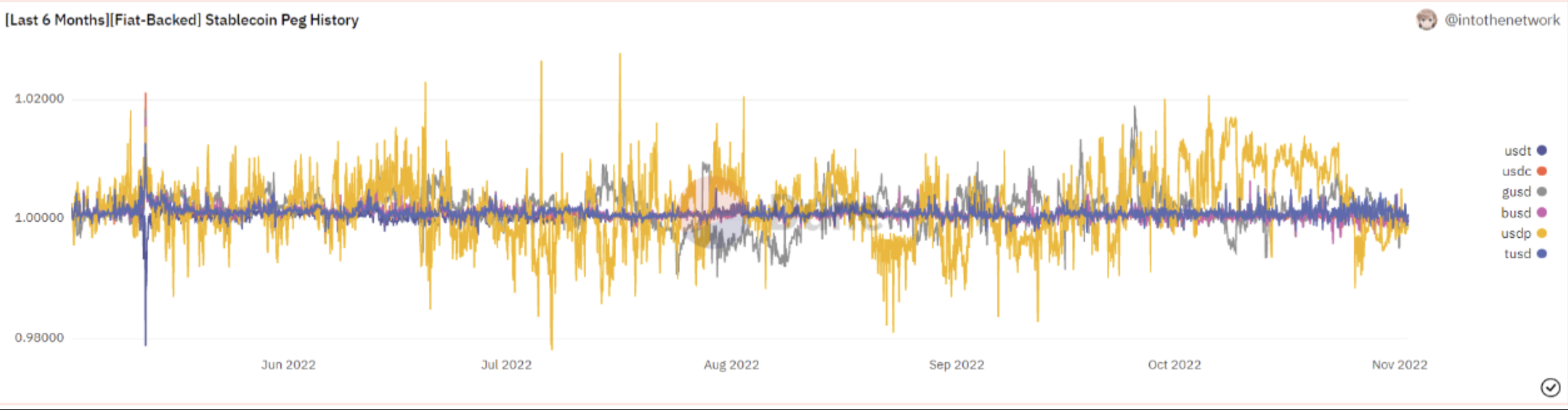

Price History

It is without a doubt that a stablecoin should remain “stable”, or in other words, be able to maintain its peg almost all the time.

In an illiquid market coupled with high volatility periods, the stablecoin would need to be able to maintain its peg. A simple way to thus assess this would be looking at its price history to identify how often it depegs, as well as the period of depeg.

Do note that prices will differ depending on the chain/pair/platform you are looking from.

We recommend looking at the price history on the particular protocol/chain that you are planning to transact/hold the stablecoins on to get a good idea of the peg history.

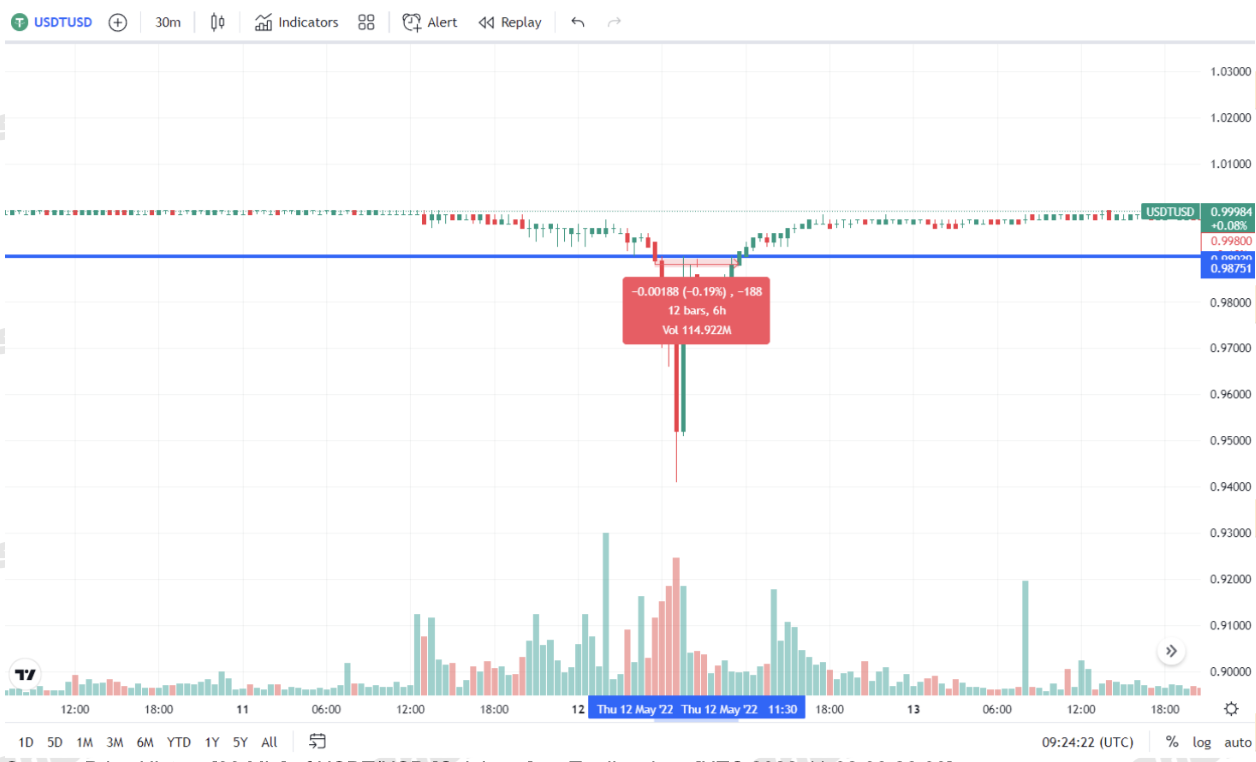

An example shown to demonstrate the period of depeg is the recent USDT depeg a few months ago, where USDT remained depegged for around 6 Hours. (To give a better estimate of the time frame, we take 0.99 as the peg amount.)

The takeaway here from observing the price history is that if it depegs too often (self explanatory) that it is riskier. Whereas the period of depeg until it repegs (if it ever re-pegs!), is just as important, as people will see it as an opportunity and it will quickly reclaim its peg. However, if few people have confidence in the stablecoin, it is likely that it will remain unpegged for longer periods of time as few would deem it as a “risk-free trade”.

This will lead to a snowball effect, as the stablecoin moves further away from the peg, and those who are holding significant amounts of the stablecoin will try to “cut their losses” and sell off the stablecoin into a “safer” asset.

We can further substantiate this point as shown from USDT depeg shortly after the LUNA/UST crash. The fear of another stablecoin crash is still fresh in people’s minds even for USDT which currently (UTC 2022-11-02 09:52:00) holds the #1 Volume (24H) and #3 Market Cap.

Central Bank Digital Currencies (CBDCs) & Regulations and Sanctions

At HashBrown Research, we are quite confident that digital currencies that are issued by Central Banks will be introduced in the near future.

An interesting report by the International Monetary Fund (IMF) mentions how many Central Banks are already looking into digital currencies and claims “They have in fact been around for three decades. In 1993, the Bank of Finland launched the Avant smart card, an electronic form of cash.” (Source: https://www.imf.org/en/Publications/fandd/issues/2022/09/Picture-this-The-ascent-of-CBDCs)

The crash of LUNA and UST has likely also caught certain regulator’s attention, and we think that they will slowly bring certain regulations into place to ensure these “stablecoins” are collateralized according to their standards.

Furthermore, the recent shutdown of Tornado Cash and banning of USDC addresses by the Office of Foreign Assets Control (OFAC) shows that regulators and to a certain extent Central Banks still have control over the Crypto Space.

It is something to think about if you value Decentralization.

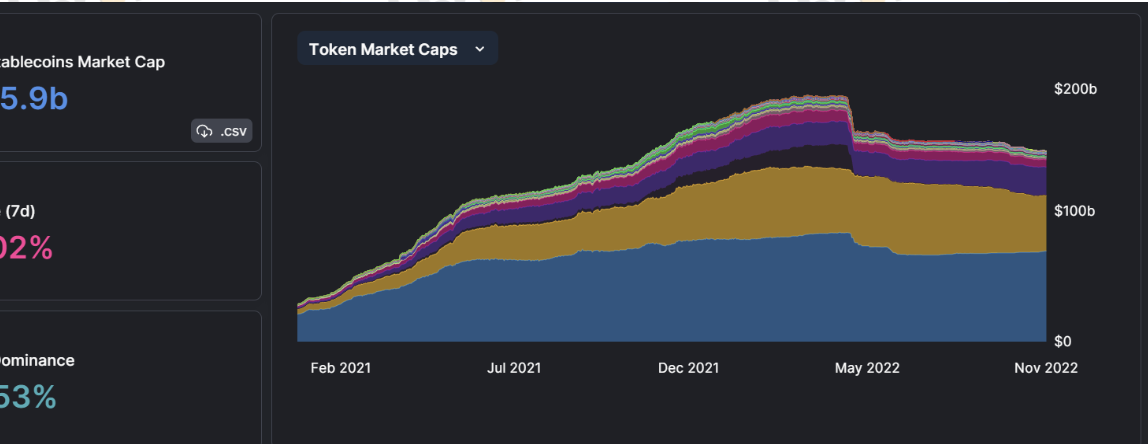

4. Stablecoins Total Value Locked

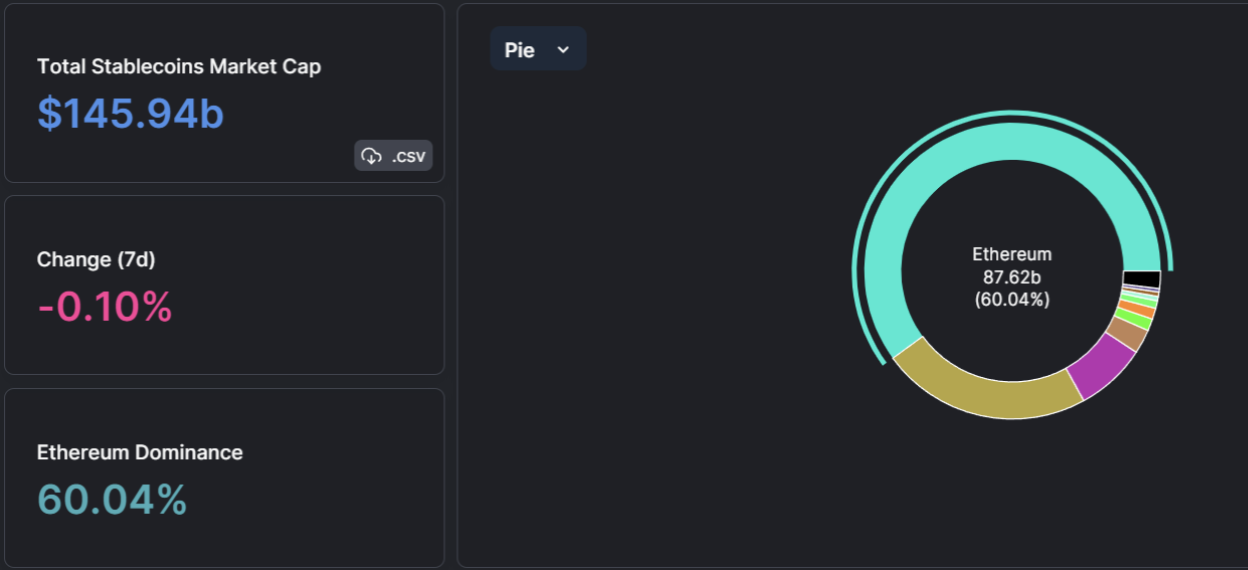

Currently at this point of writing, Ethereum is the Dominant Chain (~60.04%) in terms of the Stablecoin Market Cap.

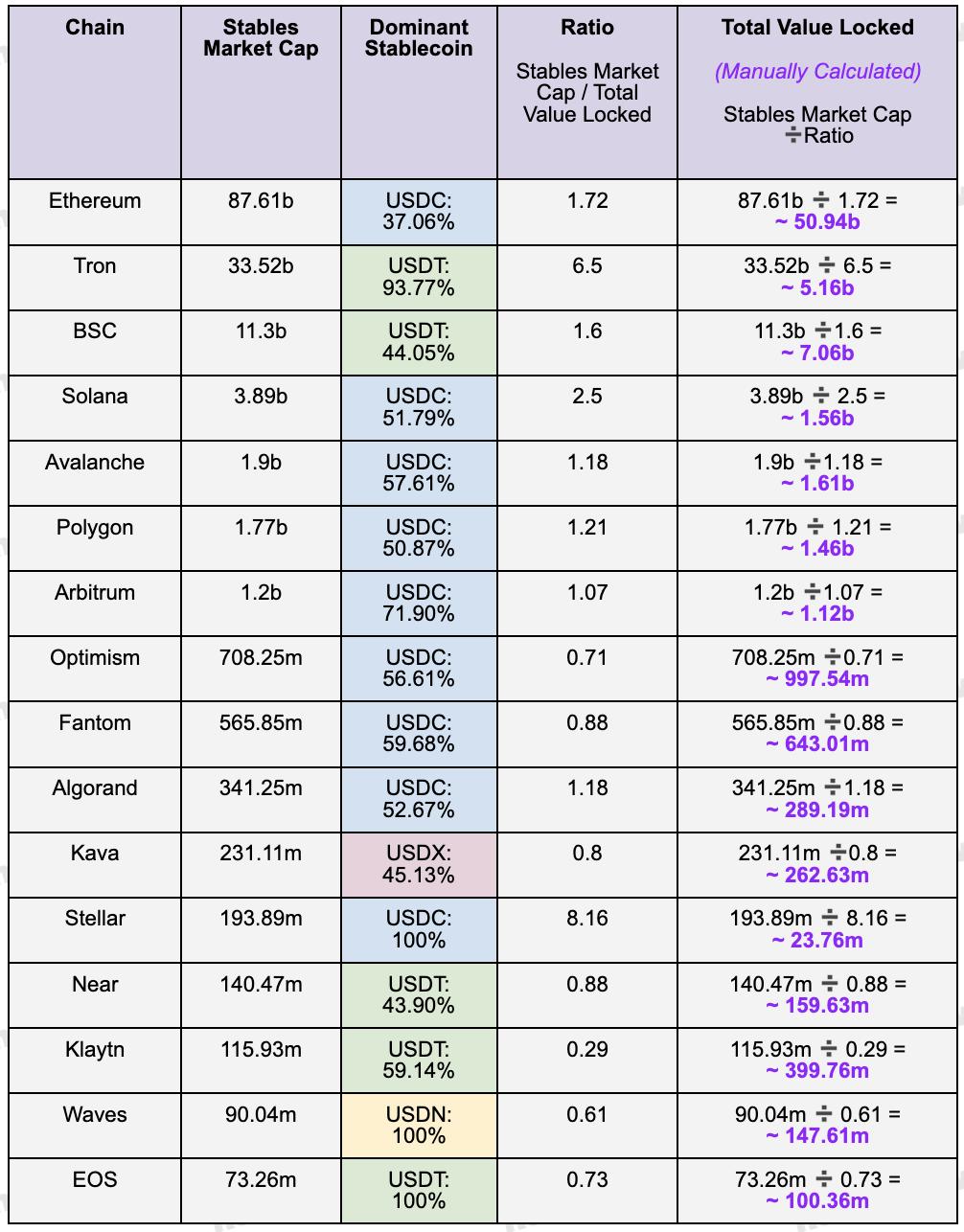

Figures below are estimated.

We have filtered out the more popular chains, and we can see that in general, USDC is the most popular stablecoin for most chains according to this list.

You can view the full breakdown of the different stablecoins of different chains on DefiLlama here:https://defillama.com/stablecoins/chains

It is important to note that in cases where TVL is higher than the Market Cap, it is because the bridged tokens are included within the TVL.

A lower ratio does not make the chain “better”, as we need to take into consideration the Market Cap and Bridged Tokens in proportion to it.

Food For Thought

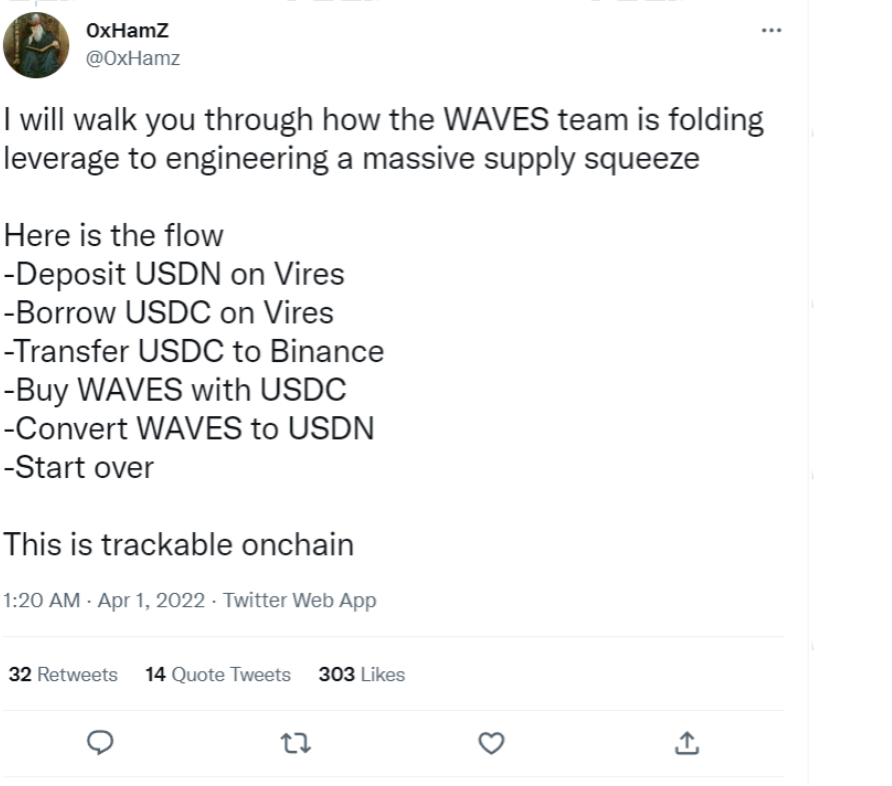

Recommended Case Study #1 - Waves/USDN

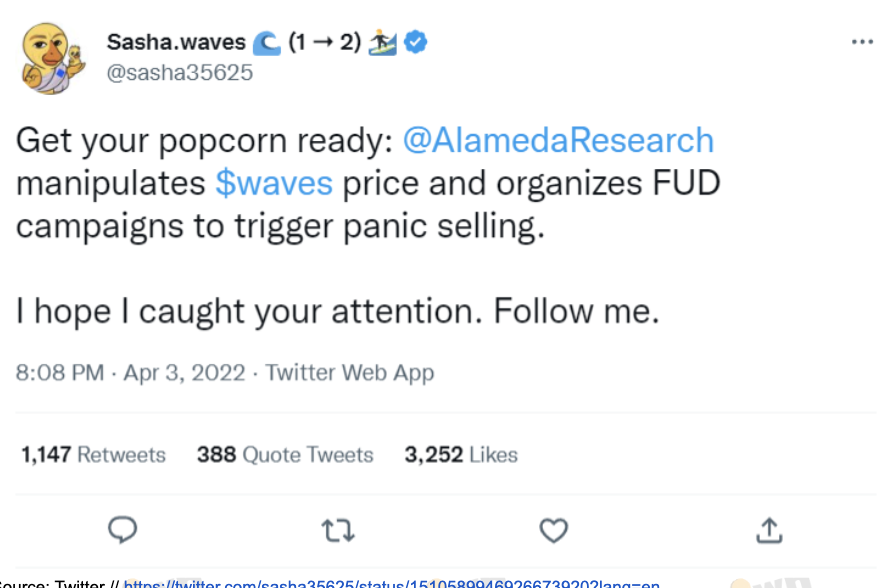

An interesting case by @sasha35625, founder of Waves and another user who goes by @0xHamz.

We recommend giving both threads a read.

We have noticed that in general, when developers/founders come out on social media to talk about their token prices, it doesn’t end well.

Recommended Case Study #2 - LUNA/UST

In general the whole LUNA/UST case is what we feel is a good read if you are interested in Stablecoins in general. From the UST withdrawal from Curve Wormhole pool for the 4pool launch and to the massive withdrawal from Anchor Protocol.

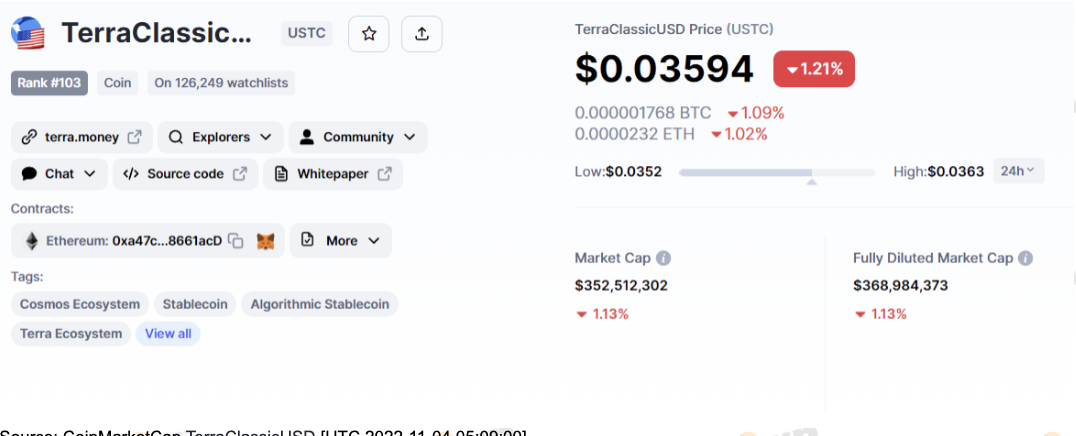

It is also interesting how UST (Now USTC) is now not a "stablecoin" but it still has a market cap of around 350 Million.

Although we do not like speaking in absolutes, we can see that algorithmic stablecoins are highly risky in environments where crypto is not “up only” and thus users should keep that in mind when using them.

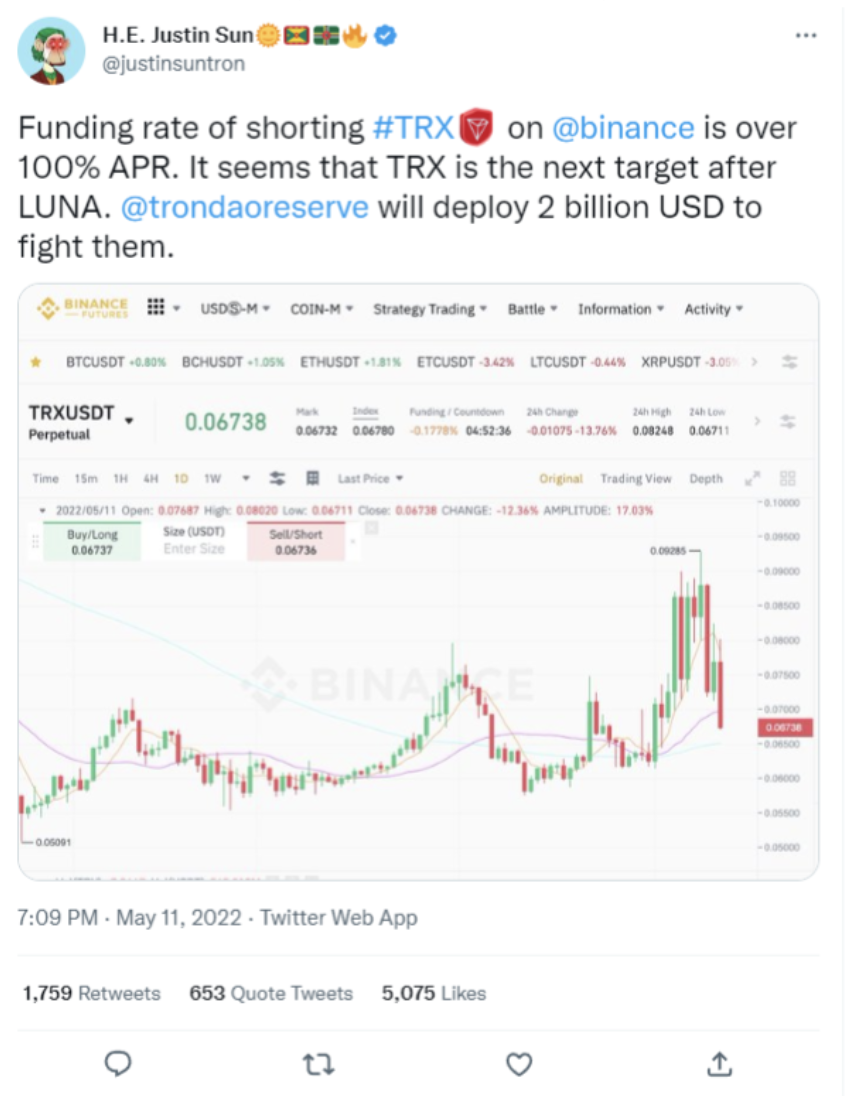

Recommended

An interesting thread on Justin Tron talking about how USDD / TRX are the next target after LUNA.

Do you use Stablecoins often and what do you consider the most important factor when selecting a Stablecoin to use, given the wide range offered?

Feel free to connect with us on our Socials as we would like to hear your thoughts!