Key Points:

Among 7 non-EVM public chains, Tron has the highest TVL, reaching $6 billion, followed by Solana, reaching $1.5 billion. The TVL of the other remaining 6 chains does not exceed $ 300 million.

Solana’s daily average number of transactions on the chain has reached 40 million, with a 30d revenue total $947.60k, surpassing other non-EVM chains by an order of magnitude.

The daily average of the locked volume of the top protocols present are balanced developing.

Table of contents

1.1 Comparison of Non-EVM chains

4、Staking Protocol-Marinade Finance

1、The state of Solana

1.1 Comparison of Non-EVM chains

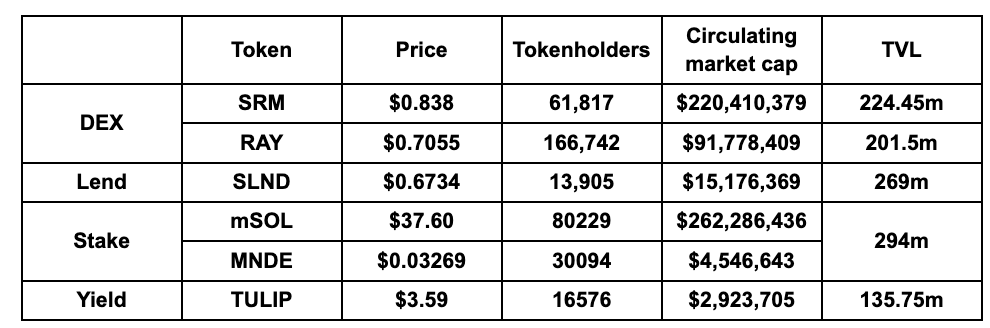

We compare the important on-chain data of 7 non-EVM public chains, namely Tron, Solana, Near, Algorand, EOS, Cardano and Tezos. And the analysis found:

At present, Tron has the highest TVL, reaching $6 billion, followed by Solana, reaching $1.5 billion. The TVL of the other remaining 6 chains does not exceed $ 300 million.

Solana’s daily average number of transactions on the chain has reached 40 million, with a 30d revenue total $947.60k, surpassing other non-EVM chains by an order of magnitude.

Tron has the largest number of daily active accounts, reaching 2.7m followed by Solana, reaching 133k.

1.2 State of the Solana

Solana has a TVL of $1.5 billion with a daily trading volume of $0.9 billion. The circulating market cap is $12.1 billion.

1.3 Protocols on Solana

According to DeFillama, Solana has 73 protocols on it in which 18 are DEXs, 11 are Lending, 10 are Yield and 4 are staking,

First, the total TVL of 18 DEXs is $853.49m and the top two is Serum and Raydium, reaching 224.45m and 201.5m.

The total TVL of 11 Lending protocols is $467.39m and Solend is the highest, reaching 267.52m.

The total TVL of 10 yield protocols is $321.84m and the top is Tulip, reaching 139.04m.

For staking protocols, Lido is not the biggest one but Marinade with a TVL of $275.37m. The total staking TVL is 455.3m.

2、DEXs on Solana

2.1 Serum

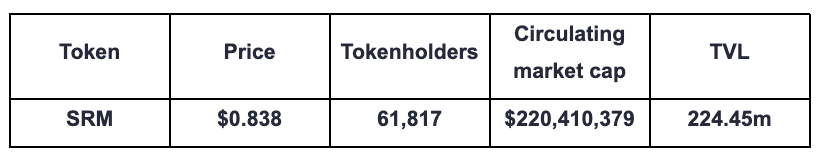

Serum is a non-custodial DEX built entirely on the Solana chain. Relying on Solana's PoH consensus mechanism, it uses an on-chain centralized limit order book (CLOB) to process transactions. It also supports cross-chain, stablecoins, and synthetic assets. And the ability to create custom financial products.

In addition, Serum is not only a decentralized exchange, but also an open source project and the infrastructure in the Solana ecosystem. With Rust, anyone can start building their own DEX quickly and cheaply. Through Serum GUI, developers can complete the on-chain operations within an hour, and connect to the centralized limit order book on Serum. At the same time as an incentive to host the GUI, you can get a portion of all transaction fees charged by the exchange.

According to the official website data on August 23, Serum has a TVL of $223.75m, and the daily volume is $25.11m. The project can get an average daily fee of $7.13k.

There are 4196 pairs of tokens are in Serum pools as follows:

$SRM is the native token of the Serum protocol anxd is used for transaction fee discounting and governance. If you hold SRM in your wallet, you receive a discount on fees. MegaSerum (MSRM) is 1,000,000 SRM stacked together. Both SRM and MSRM are available on Serum.

You can create 1 MSRM by locking up 1 million SRM, and you can redeem the MSRM back out for 1 million SRM. However, there is a limit of 1,000 MSRM in the world, so in practice, they are scarce. You generally receive benefits for holding SRM and larger benefits for holding MSRM.

There are 7.15m SRM being bought and burned up until now.

SRM has 61,817 holders, and it gains 220 million dollars market cap.

2.2 Raydium

Raydium is an automated market maker (AMM) built on the Solana blockchain which leverages the central order book of the Serum decentralized exchange (DEX) to enable lightning-fast trades, shared liquidity and new features for earning yield.

Raydium has three advantages:

Faster and cheaper

A central order book for ecosystem-wide liquidity

Trading interface: For traders who want to be able to view TradingView charts, set limit orders and have more control over their trading.

According to the official website data on August 23, Serum has a TVL of $218.47m, and the daily volume is $212.55m. The project can get an average daily transaction of 131k.

There are 1757 pairs of tokens are in Raydium pools as follows:

The total RAY mining reserve consists of 34% of all tokens, or 188.7m RAY. And 0.03% of trading fees will be used to buy RAY and distribute to stakers.

RAY has 166,742 holders, and it has a 92 million dollars market cap.

3、Lending Protocol-Solend

Solend is the leading algorithmic, decentralized protocol for lending and borrowing on Solana. Anyone with an internet connection can earn interest by lending their assets, and can use their deposits as collateral for borrowing.

According to the official website, Solend has 22 pools on it, recieving a total TVL of $269 million now, and the total supply is$431 million, total borrow is $163 million.

The top ten pools are as follows in the table below:

And here is the Main Pool details:

Users who supply collect an APY from the users who borrow. The borrow APY is split across the entire pool, so Supply APY = Borrow APY * Utilization.

When you are borrowing, you are paying a Borrow APY to the pool. On most of the tokens, such as USDC and SOL, borrowers also receive SLND rewards for borrowing.

The project token is SLND. There are 100M SLND tokens. SLND’s distribution is as follows:

Two months ago, a whale account had an outstanding loan of $108 million worth of USDC and USDT, collateralized in SOL. The loan risked being liquidated as the price of SOL tanked to as low as $27. Solend would have been left with almost no SOL. Solend passed a proposal granting it emergency powers to take over the whale account, an unprecedented move in the DeFi world.

4、Staking Protocol-Marinade Finance

Marinade is a protocol that possesses a governance token named MNDE. As part of our Liquidity Mining program, MNDE are allocated to mSOL holders staking their mSOL in this single-side staking vault. Your mSOL will safely sit in Marinade smart contract and will keep on earning staking rewards, while also giving you additional MNDE rewards.

Currently, there has been 7.4m SOL staked on it, gaining a TVL of $294m.

All the data can be found from the link below:

https://stats.marinade.finance/d/sqUQd1Onk/marinade-kpi-dashboard?orgId=1&refresh=1m

MNDE has 30,094 holders, and mSOL has 80,229 holders now.

5、Yield Protocol-Tulip

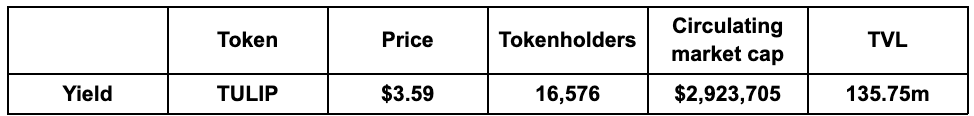

Tulip Protocol is the first yield aggregation platform built on Solana with auto-compounding vault strategies. They also integrated leveraged yield farming & lending pools into the platform, providing an investment with suitable risk rewards for any DeFi user.

Tulip has a $135.75 million TVL now, and most are from Auto Vaults, we put the top vaults in the table, more details can be found with this link: https://tulip.garden/vaults

Tulip Strategy Vault is a structured vault that is capable of hosting multiple yield strategies under the hood. The user is able to deposit a single token asset and gain exposure to all the strategies underneath.

TULIP has 16,576 holders and a market cap of $3m now.

6、NFT Marketplace-Magic Eden

Magic Eden is a community-centric company. There are over 8,000 collections on Magic Eden. Raydium’s NFT marketplace, Okay Bears’ Bear Market and Exodus’ mobile wallet NFT marketplace, are all powered by Magic Eden.

Compared with other main NFT Marketplaces, we find that Magic Eden has a high active wallets number,preceded only by Opensea which has 43,733 24H traders.

7、Summary

At present, Solana is the only one whose ecological development has become a chain. The daily average of the locked volume of the top protocols present are balanced, which means that the protocols are developing independently. But, we can also find that all the projects are having deep dooperation with each other, some of them have the same investors and founders, feeling like a little centralized.

All the data of top protocols are as follows: