Climate Tech Guide Part 2

Overall, regulations are so SO critically important for climate tech because big technological breakthroughs absolutely need tax dollars to commercialize. Regulations also help create the markets and help the tech deploy at scale.

There have been many one off policies such as the US Clean Air Act which created smoke control zones. Since 1990 the level of nitrogen dioxide in American emissions has dropped by 56%, carbon monoxide by 77%, and sulfur dioxide by 88%. Imagine if we had aligned policies instead of one-off ones!

The Paris Climate Accord was one of the biggest landmark agreements to reduce emissions. Trump withdrew America from the agreement in November 2019, and the Biden administration rejoined, thankfully. With this new presidential regime, Biden has implemented many Job and Infrastructure plans and bills that will cost $1 trillion over the next 8 years, funded through corporate tax to redo infrastructure, invest in transportation, water, and energy, and create jobs. He wants $100 billion in funding to update the country's electric grid to become more resilient to climate disasters, and wants to boost spending by $174 billion to help the electric vehicle market and install half a million charging stations across the country by 2030 (currently electric vehicles make up ~2% of new auto sales). He also wants to invest $35 billion in R&D for climate tech such as DAC and storage, offshore wind, and also help those working with fossil fuels transition their jobs. Other initiatives include a reauthorization of the weatherization assistance program and building upgrades.

He's requiring representatives from each of the major federal agencies overseeing the economy to become members of a working group to help climate change along with the representatives of the National Climate Advisor and the director of the National Economic Council, with final metrics to be published by January 2022. He's also proposing the creation of an Energy Efficiency and Clean Electricity Standard mandate to require US electricity to partially come from zero carbon sources.

The state of NJ has already rolled out regulations mandating building codes to comply with the new climate normal. Top companies in the US are banding together to help Biden's policies come through. Blackrock, notoriously known to have a very poor record on pro-climate shareholder support, is teaming up with Temasek to establish a net zero investment partnership called Decarbonization Partners. Each will contribute a combined $600 million with third-party investors to reach their $1 billion target and launch growth to late stage funds focused on advancing decarbonization solutions to reach a net zero economy by 2050.

Bill Gates's National Institutes of Energy Innovation

Will more money fix everything? Definitely not. Bill Gates calls for the government to be better set up to handle all these increased resources. He proposes a model similar to the NIH (National Institute of Health). The NIH is the largest single funder of biomedical research in the world and results from scientists supported by this Institute are mapping the human genome, cutting deaths from heart disease by 2/3 in the past 50 years, and more. They're successful because they have a clear and specific mission. They allow independent researchers actually do their research instead of having their incentives be very misaligned by changing political regimes. These researchers are empowered by science and impact only. And it has strong bipartisan support from policymakers and the public.

Gates calls for a National Institutes of Energy Innovation comprising of separate institutions focusing on specific areas. One could be an Institute of Transportation Decarbonization while others could focus on energy storage, renewables or carbon capture and management. Commercialization of the technology and making sure it is affordable is just as important as actually creating the technology, so that should be part of each institutes' mandate as well.

United Kingdom

By 2022, the UK government expects all listed companies and large asset owners to disclose their climate-risk-exposure and targets in line with the Task Force on Climate-related Financial Disclosures (TCFD). They will become the first country to make this task force instead of asking companies to comply then explain. They are also spending £10 million to create ‘green finance’ hubs in Leeds and London.

China

Since 2014 the government has been issuing programs to combat pollution and since 2015, the central government issued the Integrated Reform Plan for Promoting Ecological Progress to establish a framework for promoting progress. In 2016, Guidelines for Establishing the Green Financial System set out additional rules for the development of green bonds (Green bonds are the second-largest and fastest-growing source of climate finance in China!), lending, and other financial services. The 2017 Green Finance Reform Pilot Area which now covers 9 cities in 6 provinces created more opportunities for innovation and in the September 2020 UN general assembly, President Xi committed to peak GHG emissions before 2030 and achieve carbon neutrality by 2060. While this all could be interpreted as lip service, Beijing in 2014 did launch programs to combat fog in urban areas and reported a 35% decline in certain pollution in Beijing and 38% in Baoding. Without intention there will never be execution.

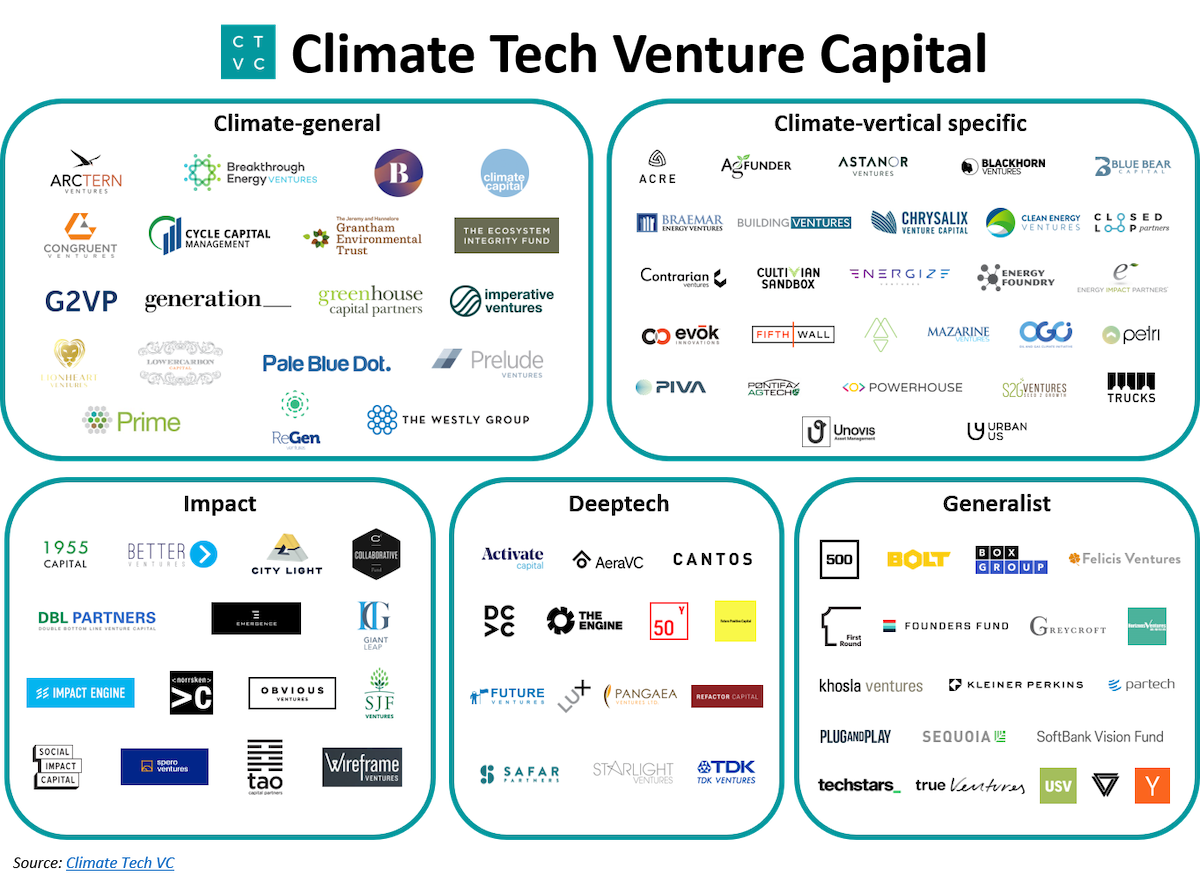

Funds look for impact, capital efficiency especially given the huge upfront costs, commercialization, and technical feasibility.

Beyond just VCs as stated earlier, alternative forms of financing are important such as strategic partnerships, CVCs, government subsidies, other green financing instruments, etc.

Makes software-controlled electric motors to create cost savings for smart building technology

“In a conventional motor you are continuously driving current into the motor whatever speed you want to run it at. We’re pulsing in precise amounts of current just at the times when you need the torque… It’s software-defined hardware. The average energy reduction [in buildings] has been a 64% reduction. If we can replace all the motors in buildings in the U.S. that’s the carbon equivalent of adding over 300 million tons of carbon sequestration per year."

Took 11 years of R&D as the computing power previously did not exist

Technology was acquired in 2013, took 4 years of R&D for a pilot to launch, then last 3 years were spent on GTM and commercialization

Rise of EVs is a huge tailwind

Application of software is neat because Moore's Law then applies to their motor; not limited by special materials

$270 million+ funding

Solving the problem that companies don't know the carbon impact of their decisions, and most are not influential enough to care that their decisions all move the needle collectively

Helps companies measure their footprint in days (not months) and traces emissions to their origins to see how they stack up to other industry players. Recommends steps for companies to cut carbon and help them actually execute on that plan. Helps companies engage suppliers. Companies can also offset and remove carbon through their marketplace by buying clean power and funding carbon removal projects.

Series A by Sequoia and Kleiner Perkins

Has an API that can calculate a company’s emissions footprint based on an integration with their ERP system, and then invests money into offset projects that are designed to remove an equivalent amount of carbon dioxide

Offers an array of potential investment opportunities for offsets. And the company tries to nudge its customers to some of the more expensive, high-technology options in an effort to bring down costs for emerging technologies

Similar to Pachama, Cloverly, Carbon Interface, Cooler.dev

$4.5 million funding, a16z

Helps buildings become more energy efficient and better at withstanding extreme weather

The company has developed software to analyze a building’s construction by creating a virtual twin based on blueprints and public records. Using that digital twin the company can identify what upgrades a building needs. Then the company taps lines of credit to work with building owners to manage the retrofits and capture the value of the energy savings and carbon offsets associated with the building upgrades.

BlocPower is proving that it is possible to have commercial solutions that improve public health in underserved communities, create quality jobs and lower carbon emissions

$63 million equity and debt funding ($8 million VC, $55 million Goldman Sachs debt facility)

Others

Silo

KoBold Metals

Carbon Engineering

Electric Last Mile

Climeworks

Swell Energy

Sunlight Financial

Ofo

Oxford Photovoltaics

Kraftblock

Impossible Foods

Solaxess

NODE

Planet Labs

Biokable

Hazel Technologies

Moortal

Fenix Intl

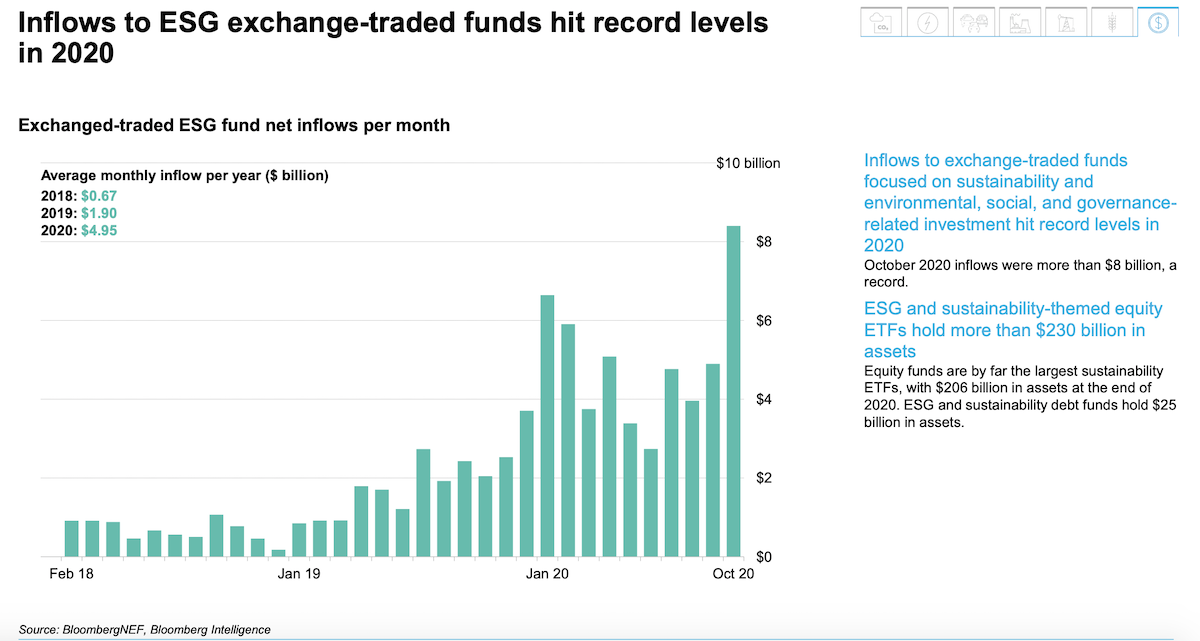

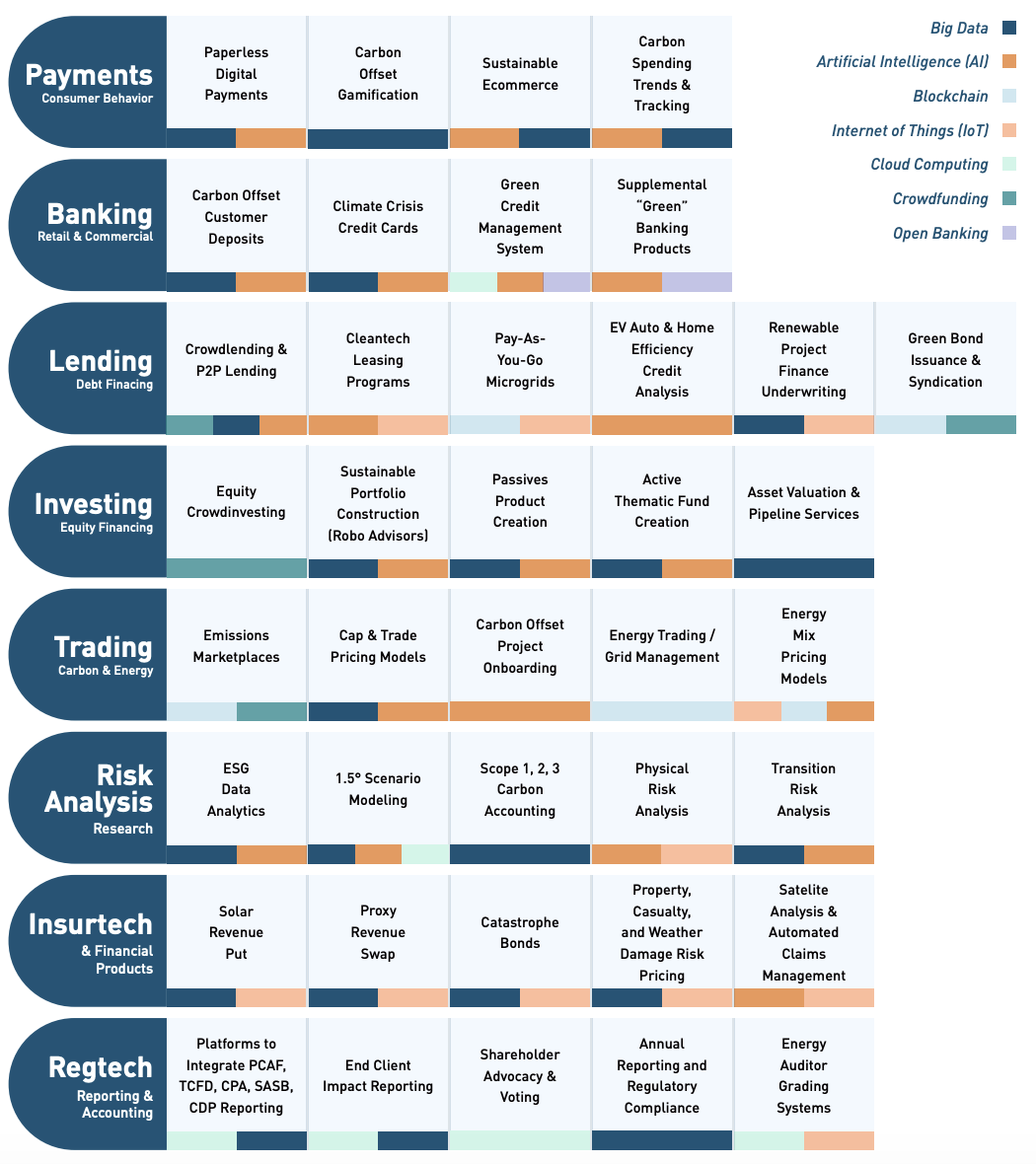

This writing would not be complete if I hadn't looked into the fintechs involved in this space... Surprisingly I found quite a bit! My conclusion after some investigation is that while climate fintech won't solve the hard science problems, awareness amongst all of us (consumers and businesses) will drive demand and thus more R&D and attention from investors and government folks alike. Again, there won't be execution without intention. Furthermore, there is increasing interest in ESG recently, which is very helpful!

10 climate tech SPACs are outperforming SPACs in general

Posting 131% return vs 50% return of total SPAC market assuming $10 offer price

Some well known public climate tech stocks

Plug Power, Tesla, Blink Charging, FuelCell

NEX Index - WilderHill New Energy Global Innovation Index is a dollarweighted index of publicly traded companies active in renewable and low carbon energy

Since 2019: up 196% as of April 13, 2021

2020 was the warmest year for Europe.

The majority of index members are quoted outside the U.S.

2020 Low was 179.50 and it ended 2020 at 535.65

Solar, battery, and fuel cell companies are the largest index components by weight

Renesola Ltd (2.1%), Plug Power Inc (1.9%), FuelCell Energy Inc (1.7%) and Lithium Americas Corp (1.5%) are the largest index components.

Corporate Reporting

Quentic, Normative, Novisto

Audit:

Position Green, Measurabl, Nossa Data

ESG data, screening, signals:

Akadia, Urgentem, Util, Clarity AI, Accern, Act Analytics, Arabesque, Sentifi

CarbonChain, Joro, Jupiter Intel, Meniga, TripIt

Client Communication:

Matter, Tumelo

Digital Green Banking:

Tickr, Clim8, Cooler Future, Earthbanc, Aspiration (highest rates of customer growth!), Tomorrow, Helios, Ando Money, Atmos Financial, Carbon Collective, Carbon Zero, Cooler Future, Doconomy, Tomorrow, Treecard, Trine,

Investment management:

Carbon Collective, Carbon Delta (acquired by MSCI), ClimateSeed, OpenInvest, Swell Investing

eCommerce:

Cloverly (API), EcoCart

Green Financing:

Mosaic, Powerhive

Marketplaces:

Raise Green, OpenInvest

💡

Please note that there are definitely overlaps and other startups! These are just some that I found 😇

Of course a spotlight on blockchain climate tech too...

There is a natural fit between the decentralized nature of blockchain and DERs (distributed energy resources). During the 2017 crypto boom many startups launched using blockchain to manage electric power systems. Several hundred million was raised mostly via ICOs but most failed due to how heavily regulated the energy sector is.

However, I still think that blockchain will be useful as more DERs come online... it's just a matter of time (probably quite a bit of time). For example, LO3 Energy is a B2B2C enterprise offering for utilities and electricity retailers. It basically enables prosumers who own DERs or community assets to provide services to other retail customers.

Another issue carbon markets have where blockchain could help with is its double counting problem. If a buyer in Country A buys a carbon credit from a Country B developer, both countries count the emissions reduction (double counting). Blockchain can help securitize and make accurate the carbon accounting and replace paper based settlements. Blockchain is great for data verification and validation.

Blockchain would also be rather useful for green bond issuance. Essentially, a smart contract with built-in encryption features making a transfer of value basically fraud-proof. Blockchain can bring huge cost-savings and can enable automated impact reporting, coupon payments, and KYC. In February 2019, BBVA issued the world's first green bond using blockchain of EUR 35 million using proprietary distributed ledger technology. Great for validating that this implementation is possible!

In addition, blockchain would be helpful for energy trading if assets are listed on a distributed ledger. Dipole Tech is an energy trading platform based in China that uses IoT, AI, and blockchain to trade distributed energy and renewable assets. It also provides low-cost electricity metering, billing, and more. It's actually scalable as it is adaptable to grids of any size.

Lastly, blockchain can be very helpful with energy grids. Decentralized microgrid systems aka smart grids (network using technological upgrades like smart appliances, renewable energy, smart meters) are ripe for innovation in increasing efficiency and reducing carbon emissions as improving its efficiency by 5% alone would eliminate fuel use and emissions of 53 million cars. AI power tools can help predict energy demand, top-connected sensors on wind turbine blades using machine learning can optimize for power generation... as decentralized systems produce power and sell it onto the grid, blockchain would be great in tracking and trading these kilowatts equitably.

Other companies and initiatives include ClearTrace (connect to smart metering and load data to a blockchain ledger), the Climate Ledger Initiative (Mission of accelerating climate action in line with the Paris Climate Agreement and the Sustainable Development Goals (SDGs) through blockchain-based innovation applicable to climate change mitigation, adaptation, and finance. Supported by governments, major international organization, and more.), the Climate Chain Coalition, the Yale Open Climate Project, and more.