Tradfi > Defi... now Defi > Tradfi (RWA)

Tracking how tradfi and defi have been moving into each other's domains. Emphasis on how now is the time for RWA to come on chain, given the macro environment.

Trading

Integration between TradFi and DeFi mainly happened on the trading front. On-chain trading infrastructure was created to accommodate the volumes e.g. Jump Crypto.

Asset Management

Many products moved on chain leveraging smart contracts and crypto native nonlinear yields such as DOVs (DeFi Option Vaults). Example vaults include Ribbon finance and Antimatter. Retail investors could see option premiums yielding almost 40% of returns. Institutional options market makers would buy vaults of options and sell on exchanges. However, volumes have greatly declined since due to macro reasons.

Lending / Credit

Companies such as Celsius, Blockfi, Genesis issued almost $50 billion in loans in just one quarter for institutional traders, who paid double digit APYs for liquidity. Of course, we saw these companies also implode… As they deleveraged, it created a liquidity gap in the market and DeFi solutions such as M11 Credit, BlockTower, came to light. They provide direct lending on other businesses such as Maple Finance, to market makers such as Flow Traders, to draw USDC at high single digit % and wETH at mid digit %.

Rising Rates

As FFR increases, the DeFi spread has dropped significantly. With lower yields, real world players are less interested in investing in Defi. Time for Defi to enter tradfi. This is the best time!

Better pricing models and discovery

Transparency – DLT

Efficiency – instant settlement

Automation – smart contracts

Fractionalization

Democratized access to various asset classes and risks

Programmability

Regulatory framework not there yet - PE funds even have liquidity caps. and what about KYC / AML?

Liquidity issues – potential lockups, illiquidity premium can be deterring

Communication - oracles face their own reliability issues. It needs to be perfect for RWA tokenization and payments to work. RWA tokens sit secondary to the lgal asset and thus, token holders need to be promptly notified of relevant real world issues that could affect their token. This doesn't exist right now. Asset quality needs to improve and standardize.

Custody is hard

Tradfi banks are threatened

Market adoption is not there

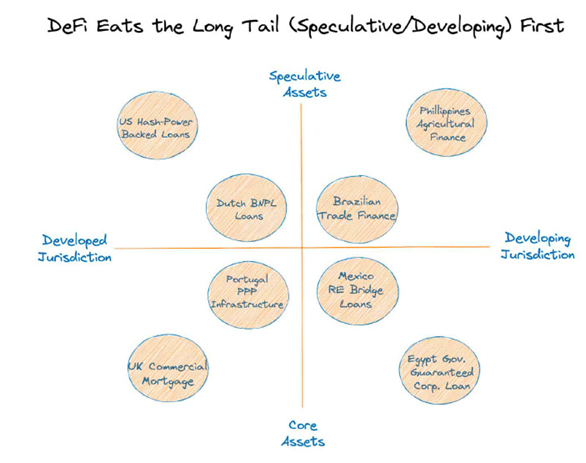

Emerging markets, just as crypto's strongest use case always was. They have the most to gain in terms of efficiency, transparency, and speed. The most suitable assets to tokenize would be stable ones such as ones representing US treasuries. Retail and SME investors could diversify their holdings in this new store of value. Trade finance, private debt, etc. are examples of ones that are very suitable because it is currently very manual and can be packaged together. Thus, smart contracts and automation would bring a lot of value to investors.

Centrifuge

Centrifuge bridges real world assets into Defi in order to lower the cost of capital for SMEs and provide stable uncorrelated yield. It brings the entire structured credit market on chain and provides liquidity providers legal recourse, and is fully collateralized and asset class agnostic. It has a Tinlake product to allow SMEs access to finance by creating pools of loans backed by collateral. The sector is appealing due to the high cost of capital and low default rate. Centrifuge is a PoS blockchain built on Polkadot. Users can bring assets on chain as NFTs.

Businesses can originate assets and finance RWAs by tokenizing them into NFTs and using them as collateral. Users can invest in TIN, the junior tranche and high risk/high return token, or DROP, the senior tranche, or yield token with lower defaults and returns.

Centrifuge launched an RWA market on Aave, so that the Centrifuge RWA token could be used as collateral to borrow USDC.

Goldfinch

Decentralized loan underwriting protocol for anyone to issue loans on chain as an underwriter, with KYC/KYB. Goldfinch relies on its backers (investors who supply USDC to borrower pools) to monitor and provide liquidity. Goldfinch gave funding to a Latam fintech called Divibank ($5

TrueFi

Offers on-chain capital markets. It is owned and governed by TRU holders. Traditional funds can move their lending portfolios on chain. It has portfolios facilitating loans to Latam fintechs, other EMs, and crypto mortgages.

Maple Finance

Launched in 2021, Maple offers undercollateralized loans to big companies like Framework Labs and Alameda (RIP). Maple offers 2 tokens to participate in governance, share in fee revenues, and provide cover.

Oracles are bridges between blockchains and the real world. Oracles are key to RWAs to facilitate proper and timely communication between on chain and off chain events.

Chainlink

Chainlink is a decentralized oracle network. It is known as one of the most reliable, and proves core infrastructure for on-chain RWAs. For example, it helps verify that assets exists off chain and their values. It potentially could also verify collaterals, and share data on weather, etc.

Masa Finance

Is a decentralized credit protocol to connect traditional and crypto accounts. It offers decentralized credit reports as NFTs. It has 10k+ data sources across 70+ countries and has many tradfi integrations.

Circle

Circle issues USDC, a multi chain stablecoin backed by US dollars. It offers a Circle Yield product, and is overcollateralized against borrowers' BTC.

MakerDAO

It charges significantly lower rates than credit risk premiums for high quality bonds and has become increasingly more attractive given rising rates. Real world players are borrowing on MakerDAO to seek yield.

MakerDAO issues DAI, which is an Ethereum backed stablecoin backed by both crypto and RWA pools. Users can mint DAI by depositing assets as collateral (overcollateralized though). When loans are issued, DAI is minted. At repayment, DAI is destroyed.

MakerDAO started off partnering with Centrifuge in 2020, and then has since onboarded many other RWA pool originators such as New Silver, Huntingdon Valley Bank, and Societe Generale.

https://makerburn.com/#/rundown

MakerDAO's RWA balance grew to 681 million DAI in January, up from 640 million in December and up from ~$335mm in November 2022. 4 lending pools are from Centrifuge, with collateral including loans to RE investors, revenue based financing assets, freight, etc. another is 6s Capital, that lends to RE developers, Huntingdon Valley Bank, and Societe Generale, a French bank.

Monetalis Clydesdale: US Treasuries

500 million Dai vault collateralized by short term US Treasury ETFs. 70% collateral is allocated to treasuries maturing <1 year.

Through this implementation, MakerDAO currently holds ~$501 million worth of US treasury short-term bonds ETFs, up from an initial ~$497 million allocation. In January, the investment contributed ~$2.1 million in yield to MakerDAO.

Huntingdon Valley Bank: Private Credit

100mm Dai loan participation facility with a public commercial bank. Expected 3% net yield annally.

As of the end of January, the mentioned loans contributed 695,174 DAI of life-to-date fees to MakerDAO.

Blocktower S1-4: Private Credit

4 revolving credit facilities totaling 150mm Dai debt ceiling, collateralized by asset backed facilities, forward flow agreements, loans, structured credit.

With Blocktower as the arranger, four RWA Maker Vaults have minted over 40 million DAI to fund senior secured, real-world credit assets. As of the end of January, the mentioned vaults contributed 79,731 DAI of life-to-date fees to Maker.

Pioneer RWA Vaults – Private Credit

Maker’s earliest attempts in the RWA space. 6s Capital (commercial real estate including Tesla), New Silver (real estate mortgages), ConsolFreight, Harbor Trade Credit, Fortunafi. 34mm Dai issued against this collateral, mostly in 6s and New Silver.

Societe Generale

In 2021, Societe Generale via SG-Forge (investment arm) raised $20mm in DAI to refinance their on-chain covered bond issuance. They used AAA rated bonds representing housing mortgages, with 0% interest as collateral. SG-Forge then borrowed Dai, swapped to fiat, and transferred to Societe Generale.

Historically capital was pretty cheap and didn't make sense to invest in defi. However due to monetary policy, crypto explosions, we've been seeing literally negative defi spreads, thus incentivizing real world assets to be put on chain to gain yield. I expect RWA innovation to accelerate and their assets to outperform in bearish conditions as they retain their cash flows due to the RWA's predetermined loan agreements. RWA will be an exciting driver of defi innovation to come.

Sources.

https://forum.makerdao.com/t/real-world-asset-report-2022-12/19413

https://aqua-hollow-alpaca-520.mypinata.cloud/ipfs/QmUgJVqdws4MRfjcfvgKCoKVDxYoqgVLZjSyZN1Jcup7Qf

https://ngc.fund/post/defi-meets-tradfi-the-integration-and-challenges-faced

https://research.thetie.io/real-world-assets/

https://docsend.com/view/u53utyp2j4ycg7r6

https://medium.com/bankless-dao/brick-and-mortar-banks-begin-to-build-on-chain-de0e78413fc2

https://medium.com/centrifuge/defi-2-0-first-real-world-loan-is-financed-on-maker-fbe24675428f

77

77