This has been on my mind for quite a while, and not for lack of vibes, but it's not something that easy to articulate in a practical way. Sure, I can devote some theoretical conjecture to it, but there's a niggling doubt: where, should I state it as well as I can, can it practically progress? I'm talking about the funnel of societal or economic discontent to a tangible & self-evident solution. Sounds pretty broad, right? But then there's always these smells & signs that remind me of this context.

What a non sequitur, right? But this thread illuminates a pretty clear doubt: that the tokenomics of ETH consensus do not reflect an optimal accrual of economic growth as much as it is a stopgap that incentivizes the well-capitalized to secure a clearly SOTA network. Proof of Work is no different, where one can see practical examples of unintended consequences, like the concentration of issuance to the well-equipped, and the absence of realistic product-market fit. And traditional structures are even worse.

Before I get more negative, maybe it's best to highlight what I've valued in the past two decades: there are some deep network effects at play, especially around broadcasted information. Ever since Pax Romana, there's been a concept of hegemony subverting potential molestation from bad actors, as well as the concept of a malformed hegemony erring towards molesting its subjects. This is still an issue to this day. But ever since Zimmerman, we've experienced Pax Impudentia, an impossible-to-kill hegemony of memetic, cryptopunk heuristics. In the context of intensively valuable capital like AI model weights, this sticks incredibly well.

And crypto/web3 exudes so much more of this energy. Sometimes it's hard to recall the 60+ years between Gutenberg's press and Martin Luther's Ninety-five Theses, or the 80 years of anti-monarchy revolution that followed European colonial exposure to a profoundly different culture. We're still human, and we still commit errors, but are we so humble to ignore the whispers of yet another hegemonistic endgame? No, we have never been so cowed.

There's also the empirical discovery of deeply existential knowledge. We may have unlocked a mathematical window to something latent; a computable curiosity that emerges from time to time to show surprising degrees of "awareness", however delirious it may prove to be in edge cases. And though we only have deceptively convincing toys like GPT & StableDiffusion, Pax Impudentia has stuck to them. Instead of predictably just manifesting more glossy wrappers and consuming these diversions ad nauseum, we humans have been compelled to take on the hobby of responding to them and modifying them; even reacting, predictably, to a growing challenge to the superiority complex that would claim that we are the apex intelligence in the known universe.

There is also the niggling ecological concern. There may a microcosmic stereotype in which a hobbyist will weigh their GPU specs to generate a S_D waifu, but in a more grounded sense, there are hordes of users (and satirical cartoon writers) that are only weighing the subscription price, not the amount of subsidization that OpenAI may be experiencing or delegating from its capital raises. There's not so much introspection on the cost of GPUs for inference, a slowing Moore's Law, or the sociological backlash of an even more upscaled, top-heavy digital economy. While Pax Impudentia is powerful and ostensibly unstoppable, is it all but certain to persist, regardless of a potentially fat-tailed future? Have we benefitted society, or are we the lucky beneficiaries insulated therefrom?

I think that the failure of Silicon Valley Bank is a wakeup call for many reasons, but one of the least-talked about points is the underestimated risk during a bull market, the focus on the disproportionate growth of the few unicorns to justify some underwritten venture debt, has not led to a maniacal desire to use these technological innovations to drastically decentralize, automate, and bundle the accountability of much smaller firms, banks, & lenders. One would think that legitimately isolated risk would be a commodity in high, diverse supply to meet its critical demand. Is it not strange that we are observing a bank run on an overcollateralized stablecoin, for the conjecture over one centralized, questionably contaminated, source of collateral? Is it not strange that the Pax Impudentia of the recent AI trend is more or less siloed, heavily capitalized training costs, punctuated by the few instances of rogue opensourcing?

My hope is that the improvements in AMOs percolates into traditional banking. My hope is that SMEs, especially innovative startups with the potential to produce massive economic windfalls, can afford a financial entity that can store their payroll without imploding to poor timing of Treasury maturities, or even the reflexivity of bonds in response to any central bank's funds rate.

There are two bottom-up approaches that can satisfy the high-level sentiments of Coase vs Ostrom, and more importantly, bring much-needed clarity to the capitalization inherent in unsustainable tech:

In AI, training & inference costs need to be preempted by investment in the respective Mechanical Turk. This means that for every generalized layman's prompt with a glitch token, an "I'm sorry" disclaimer, or confidently delirious gibberish, there is a much-needed opportunity for stylometric analysis & stopgap distillation of the human specialists, with experiential nuance, to supply a reward model with invaluably precise feedback & prompt engineering. Civilization is effectively a sparsely-gated mixture-of-experts; my intuition is that we spend far too much in human capital costs to refine contentious laypeople debates around universal problems into practical, heuristic solutions. Brute-forcing transformers instead of focusing on a modular daisy-chain of smaller, more precise models & sources of truth is a costly choice. RLHF that resorts to insufficiently compensated labelers and an "alignment" solution is an ecological tax realized in each insufficiently inferred output.

In crypto (and traditional finance), there could be much more diversity of consensus surrounding various forms of risk-adjusted growth. In Ethereum, there is already a very active conversation around MEV, PBS, and LSDs. These three situations are mitigations of different risks. There is a very stark difference between various examples of unmitigated risk like ICOs, Terra, & FTX, and mitigated risk like DAI, AAVE, & Gitcoin. We are quickly approaching a state onchain where the most productive actors, even those outside of treasury management, contract development, & business development, are accountable enough to be marginally capitalized to prescribed outcomes. We are also quickly approaching a state onchain where the most productive actors are augmented by disciplined, automated conduct. There is a diminishing excuse for what we're seeing.

To elaborate on both of these approaches, one can picture them as a sequential funnel. Aaron Swartz once wrote on the "Theory of Change", a method of working backwards from an idealized societal change through the incremental steps of power & decision-making that are necessary to achieve that change. This passage stuck out to me:

It’s not easy. It could take a while before you get to a concrete action that you can take. But do you see how this is entirely crucial if you want to be effective? Now maybe if you’re only writing a blog post, it’s not worth it. Not everything we do has to be maximally effective. But DC is filled with organizations that spend millions of dollars each year and have hardly even begun to think about these questions. I’m not saying their money is totally wasted — it certainly has some positive impacts — but it could do so much more if the people in charge thought, concretely, about how it was supposed to accomplish their goals.

What we want from tech is, in the end, a windfall of ecological surplus from disintermediation of fallible intelligence, agency, & mechanisms. We want a valuable ecosystem that is maximally "better" relative to present circumstances. So starting from "we're going to use AI & crypto to create a valuable ecosystem that compels surplus-driven societal change" & working backwards, the immediate precedent should be "we're going to minimize the cost of the daisy-chain for contemporary AI & crypto actors". Intuitively, this leads to "we're going to maintain an open forum for commenters to self-select a plethora of coherent procedural calls (or standards of operating procedures) that independent entities can compete upon, to the extent that we can articulate a modular system that serves societal needs". Now, working forward from the present (Aaron's "Theory of Action"), we should take inventory of the open forums from which we can articulate coherent procedural calls or SOPs. Additionally, we should take inventory on how commenters on these forums map to a market of reward functions for a daisy chain, keeping in mind that Pax Impudentia is reinforcing this open forum and motivating the implementation therefrom. Now, as we've seen with social media, there's a lot of noise, and a lot of censorship and information security concerns.

But consider the example of the SIVB/USDC/DAI bank run as it's playing out on social networks. There is a reflexive self-reinforcing panic driving this irrational market movement. It's not impeded by any given social media company. Neither is the behavior in a zero interest rate economy. Consider the constructive nature of implementations of Curve, TornadoCash (and its successor Privacy Pools), and Ethereum's roadmap. Those may stick to specific social networks, but they are not captive to them. We're slowly transitioning to a variety of web3 social media where uninhibited, constructive, & divergent interaction can be indexed for retroactive rewards. Working forward, with respect to all potential competitors in the decentralized social sector, the salient question is how to passively/cheaply distill coherent procedural conclusions for automated or accountable agents to perform. And it's important to keep in mind that this is the capital cost of en masse social interactions, a volunteered, ambient resource that is colloquially called "the wisdom of the crowds". How do we make this accountable so it can be more incentivized and more industrious?

The disconnect that we're suffering from is the misdirection of social capital to the market of legitimacy we call advertising. For the past couple of decades, we've decided that social networks should be subsidized by their ability to compel the consumption habits of their constituents. Youtube, in particular, is a twilight between this consumptory cowchute of product promotion & the industrious value of practical, dopamine-optimized POV in the creator economy. Suppose the hypothetical of a complete layperson, dropped in the wilderness & supplied with the internet & all necessary equipment, confronted with the immediate need to gather resources and build a shelter. Consider a random person in an urban jungle, with access to the internet & public infrastructure, confronted with the immediate desire to perform maximally effective public service. In both scenarios it should be reasonable to assume that there is probably enough information online to at least attempt many loops of trial & error. The next question is finding the motivation & justification for any actor to execute in those scenarios, and likewise for the availability of those necessary resources. How do we progress from consumption to production?

This is where crypto can be the catalyst. Upfront, we have to confront the challenge of reaching as much of a consensus, in order to risk a certain amount of capital in the form of resources and monetary compensation (or the equivalent thereof). Luckily, consensus has a very robust market, with many newcomers.

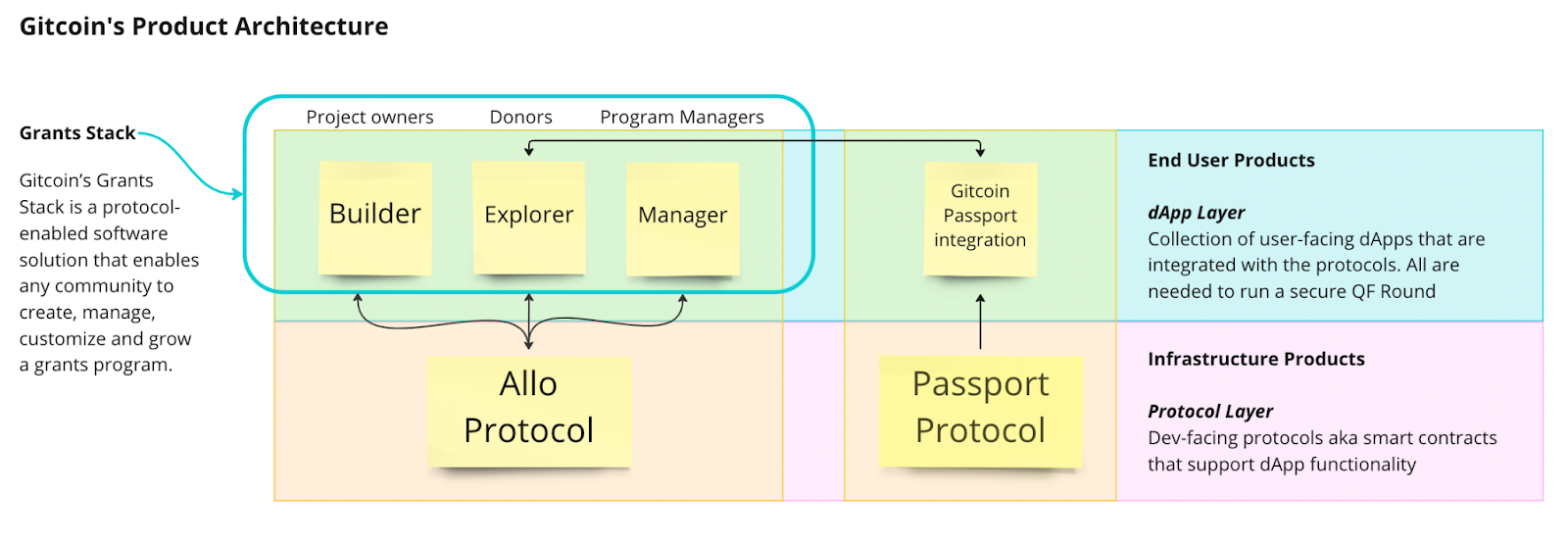

In addition to the market forces that manifest on their own, there are also registries for consensus methods. I've recently obsessed over Allo Protocol, because it so happens to be a bundled consensus method for a modifiable proof of stake, proof of work, sybil resistance, & monetary policy.

The Builders work in a given Round, but in a subsequent round in the same program, they need to justify how much they're financed to work. Explorers are matched donors, but in subsequent rounds, they may need to be effective donors (staking of financial capital), potentially even effective communicators (staking of social capital). In either case, the verifiable credential for eligibility in Proof of Work and Proof of Stake can be combined in a set of Passport Stamps. The Manager might just simply be a distributor of ETH or DAI, but it might be any token (fungible, soulbound, yield-bearing, etc), any altered rate in another protocol, or even verifiably credible creditworthiness. The Program can even compel both Builders & Explorers to deploy AMO recipients in order to be eligible for later rounds, and/or even be calibrated to favor smaller builders to outperform incumbents for a larger capital gain, and/or favor incumbents that split profits to the Program/transparently manage risk for the ecosystem.

This is extremely early to be speculating on how Allo Protocol can be used or secured. But if we go back to the initial step in this AI/crypto Theory of Action, Allo Protocol is relevant, even for labeling work for reward models or articulating standard operating procedures for successive Programs & Rounds. In the case of training costs, we may see coherent emission policy for distributed "proof of transformer" in a way that the model interface is a market of tokens for both training & inference costs. There may be an emission policy that retroactively maximizes human feedback or proactively maximizes prompt labeling to overall optimize compute costs. The important extension to all of this is that there might be a way generate economic surplus without increasing fat-tail risk, and there might be a way to minimize the societal cost of not just financial risk but the centralization of any market to less-accountable firms.

It's also important to imagine a contrary ideology of value outside of capital. The same Allo Protocol can be used to coordinate entire complexes of actors within a shared account, so long as they remain accountable to the resources they consume & the risks they produce. This is not just beneficial to a network that has to increase transactional costs the further it experiences network effects, but also to a larger society. In the present, we experience the crumbling of institutional legitimacy & the growing polarization of the discontented. The "precipitation of value" is diminished the more austere we become, the less of a dialectic we can afford, and the more insular our diametrically opposite communities become. I don't find it unreasonable to ask whether there is a beneficial diversity of thought that shares common values, especially as it concerns a society that remains intact and progressively becomes more adaptable. I also wonder whether we have sufficiently found a way to avoid overfitting ourselves to an unsustainably consummatory existence. The point of Pax Impudentia is discovery without shame. It is the essential quality of how our civilization grows on the dissemination of knowledge, how we have evolved to be more inventive, how we strive to grow our environment as much as ourselves. Is the spirit in which we have progressed worth sacrificing to our present circumstances, or is there a proactive way to connect the tools we have for a better outcome? Can we rebel against this cascade of catastrophes by precipitating value to the objective, risk-adjusted good?

m_j_r