M^0, Rebuilding Monetary Stack from the bottom

Leveraging blockchain to build new monetary stack that fits new state of finance.

Stablecoins are one of the few certified PMFs in the crypto industry. They were also the only blockchain/crypto-related item listed in the recently announced Y Combinator's Requests for Startups.

We want to have the advantages of both physical and digital money.

The advantages of physical cash are as follows:

Self-custodial: The bills in my pocket are mine.

Minimal counterparty risk: As long as the country doesn't default, my bills will have value.

Fungible: The $1 in my pocket is the same as the $1 in your pocket.

However, as the digital share of life increases and the actual living space expands globally, the disadvantages of physical money have also started to be highlighted.

?. But aren't these problems solved by existing fintech?

In fact, no one carries physical cash anymore. Everyone pays with cards or mobile pay, and transfers and investments are easily done via mobile. However, the development of digital banking has certainly compensated for the disadvantages of physical cash, but it still does not have the advantages of physical cash.

Self-custodial: When you deposit money in a bank, the bank actually stores and manages that asset, making you dependent on the bank's operations and stability.

Counterparty Risk: When you deposit money in a bank, the bank becomes your counterparty, and if they face financial difficulties, it can be risky for you to withdraw your deposits.

Fungible: My money deposited in Bank A and my money in Bank B may not be fungible depending on the financial stability of the two banks.

Therefore, we want a new form of 'money' that has the advantages of both physical cash and digital money, and we expect stablecoins to fulfill this role. But can stablecoins actually do this?

There are already various stablecoin projects in the world. From projects like Ethana Labs, which creatively use crypto-native assets as collateral, to classic ones like Circle, which issues $USDC backed by dollars, the types and spectrum are vast.

?. What if we rebuild the currency issuance system itself?

As society changes rapidly and existing infrastructure struggles to keep up, opportunities arise when new technologies emerge.

Our economic life is borderless and digital-native compared to the past.

Blockchain is a new coordination layer.

→ What if we use blockchain, a new technology, to rebuild the system for creating money that fits our changed financial life?

Today's project is M^0 Labs' M^0 Protocol.

Rebuilding Monetary Stack

Money Middleware

New money issuance infrastructure

Through 1) blockchain, a new coordination technology, 2) for the changing face of finance, creating a new coordination layer which 3) entities related to currency creation interact.

Blockchain is a new coordination layer. Using immutable smart contracts and value representation tools on a shared computer that the whole world can use, we can collaborate easily with anyone in the world with relatively little trust.

M^0 Labs wants to use this tool to build a new currency system that is borderless, requires less trust, is transparent, and is digital-friendly.

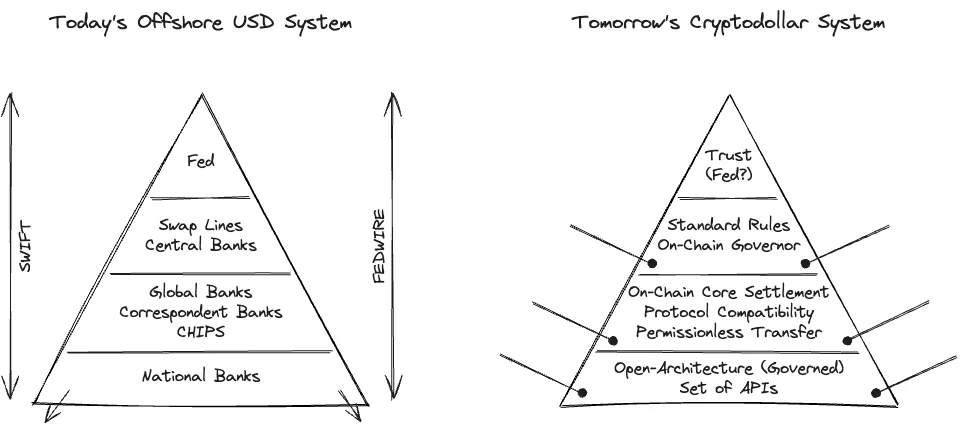

The above diagram is from an article by Luca Prosperi, Co-founder of M^0 Labs, and it shows the ambition to redefine the vertical monetary issuance and management system that goes from the Federal Reserve, central banks, to corporate banks.

The reason their team name is M^0 Labs might be because they, inspired by how money's liquidity is divided into M1, M2, M3, want to innovate a more fundamental currency layer than these.

$USDC and $USDT are excellent as stablecoins, but they are merely a tokenization of bank deposits, a proxy on top of the existing financial system. M^0 Labs wants to design not just a proxy layer, but the underlying currency issuance and management system itself through blockchain.

One thing we can learn here is their approach to money. Like I mentioned earlier that stablecoins are crypto's verified PMF, most stablecoin projects treat money as a product. In contrast, M^0 Labs wants to approach money as infrastructure.

The word 'stablecoin' does not appear even once in the M^0 whitepaper.

Ambitious: I like the ambition itself, not just to create a stablecoin, but to create a new monetary system (stack) that fits people's current economic lives.

A typical example of solving the lag of infrastructure with the emergence of new technology: The formula of solving the rapidly changing face of society with new tools has historically been the typical storyline of successful infrastructures.

Appropriate use of blockchain: As we'll see, the M^0 Protocol can be seen as a system where various entities related to currency issuance and management interact. M^0 Labs uses the advantages of blockchain appropriately, but does not make the mistake of overestimating blockchain and implementing all elements on-chain.

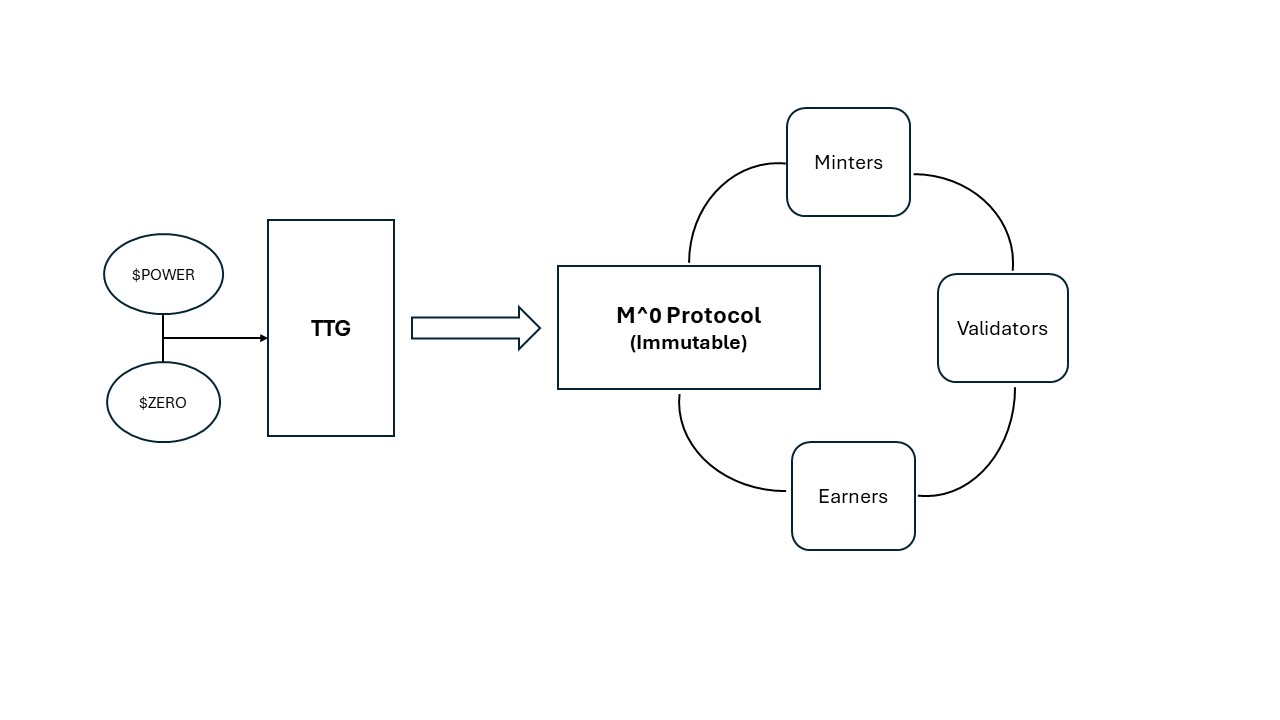

M^0 can be said to consist of three main components.

M^0 Protocol: Immutable smart contracts on the EVM, responsible for interactions among entities involved in the creation and management of $M.

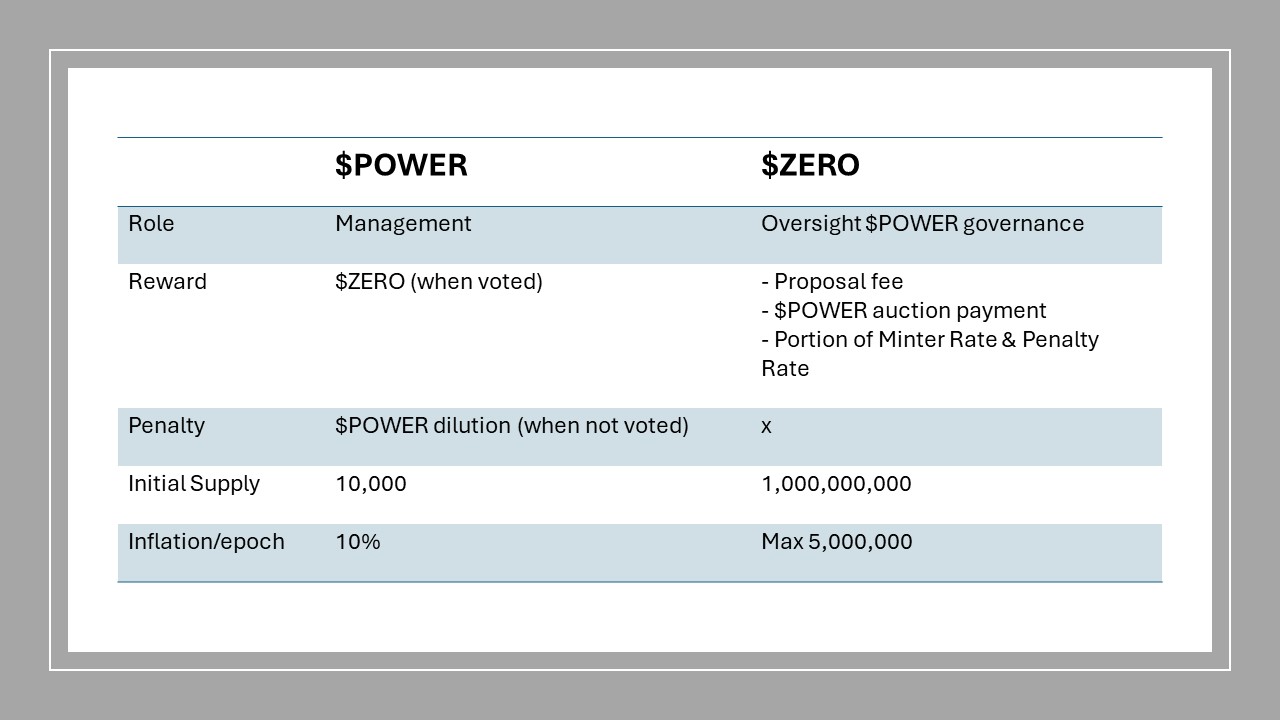

M^0 Two Token Governor (TTG): A newly designed governance system in M^0, carried out by holders of two tokens, $ZERO and $POWER.

M^0 Ecosystem: Entities interacting with the M^0 Protocol, including Minters, Validators, Earners. These entities can participate only if they pass through the TTG.

The M^0 Protocol itself is immutable unless there is a hard fork, meaning the system of currency issuance and management itself never changes. However, various input values for the system, such as which Minters to include, are determined through the on-chain governance of TTG.

$M is an ERC20 token form of the most basic raw material for value representation, which can be used as a stablecoin after being wrapped as needed, and its uses are endless. Notably, the issuance and management of $M are permissioned by TTG governance, but the use of $M is permissionless.

Minters, as the name suggests, are entities that issue $M through the M^0 Protocol. The key here is that they can create $M less than the value of 'specified collateral' through a 'specified method.'

Currently, the set collateral is short-term U.S. Treasury bills (T-bills), and the specified method is storage in an independent Special Purpose Vehicle (Orphaned SPV). This seems to be for the stability and trust of $M.

As mentioned earlier, since the M^0 Protocol is a collection of smart contracts, Minters proceed with the process by calling each method. The most critical method is as follows.

Update Collateral Method

To issue $M, Minters first need to call the Update Collateral method to claim the amount of their off-chain collateral (T-bills stored in Orphaned SPV) on-chain.

?. Couldn't Minters claim more value than their actual collateral?

→ This is where Validators come in. Validators check whether the actual off-chain collateral of Minters matches the amount they claim through the Update Collateral method. If there are no issues, Validators issue their signature along with a timestamp.

Minters must receive a minimum number of Validator signatures set by the M^0 Protocol to successfully complete the Update Collateral process. Minters must periodically call the Update Collateral method to update the value of their collateral at a set interval (Update Collateral Interval).

Propose Mint Method

After having their collateral recognized, Minters can attempt to issue $M. At this point, the contract checks whether (the existing $M issued by the Minter + the new $M to be issued) ≤ (the value of the collateral claimed in Update Collateral * Mint Ratio).

The Mint Ratio ensures that $M remains over-collateralized. For example, if the Mint Ratio = 0.9, a Minter with $100M in collateral can only issue $M worth $90M. If this check passes, $M can finally be issued through the Mint M method.

There are also methods like Burn, to burn issued $M, and Retrieve, to recover excess off-chain collateral.

There are mainly two types of protocol fees that Minters must pay: the Minter Rate and the Penalty Rate. The fees generated here go to Earners and $ZERO holders. Let's first look at each fee.

Minter Rate

The Minter Rate is a continuous fee imposed on the $M issued by a Minter from the moment of issuance (Mint M).

Penalty Rate

The Penalty Rate is imposed when, for some reason (such as bond maturity), the value of the $M issued by a Minter exceeds the value of the collateral they have. It is also imposed if the Minter fails to call Update Collateral at the set interval.

Understanding with an Example

The assumptions are as follows:

Mint Ratio: 90%

Update Collateral Interval: 24 hours

Minter Rate: 5% APY (0.00058% per hour)

Penalty Rate: 0.02%

Day 1, 3 PM - Minter calls Update Collateral (collateral: 100) / existing issued $M: 0

Day 1, 11 PM - Minter issues 90 new $M through Propose Mint & Mint M

Day 2 - Minter forgets to call Update Collateral.

Day 3, 1 PM - Minter calls Burn (to burn $M: 50.042).

→ The total penalties imposed are as follows:

Since 38 hours have passed since Mint M, the total $M due to the Minter Rate is 100 * (1 + 0.0000058 * 38) = 100.02204

Since Update Collateral was missed once on Day 2, the total $M with the Penalty Rate is 100.02204 (1+ 0.0002 * 1) = 100.042

Finally, by burning 50.042, the final amount of $M is 50.

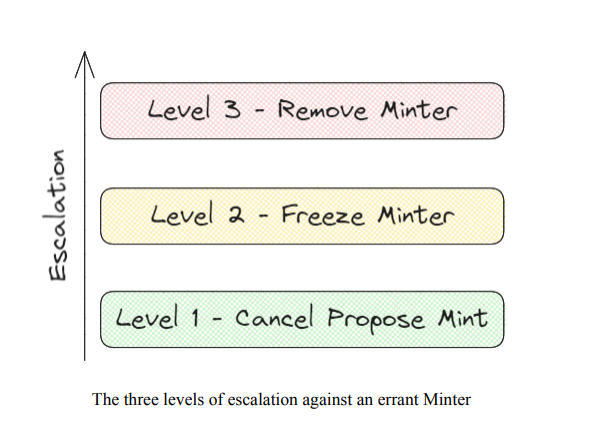

There are three main ways to prevent malicious Minters.

Cancel Method by Validator: Validators can cancel a specific Mint M method call by a Minter if it is deemed incorrect or malicious.

Freeze Method by Validator: Validators can temporarily suspend the activities of a specific Minter if they are deemed malicious.

Removal by TTG: As the strongest measure, $POWER holders can vote through M^0's governance system, TTG, to expel a specific Minter from M^0.

TTG plays a significant role in the overall picture of M^0. While the M^0 Protocol handles the immutable part, TTG determines the variable input values for the system through governance.

As the name Two Token Governor suggests, on-chain governance is carried out by holders of two tokens, $POWER and $ZERO, with $POWER holders handling overall governance and $ZERO holders monitoring $POWER holders.

TTG operates in 30-day Epochs, each divided into a 15-day Transfer epoch followed by a 15-day Voting epoch. During the Transfer epoch, $POWER holders can delegate, transfer, or purchase their tokens, and the voting power confirmed during this period is used for actual voting during the Voting epoch.

First of all, not all variable values are determined by TTG, and some values are immutable from the beginning. For example, the length of the Epoch, initial quantities of $POWER & $ZERO, and inflation rates cannot be modified.

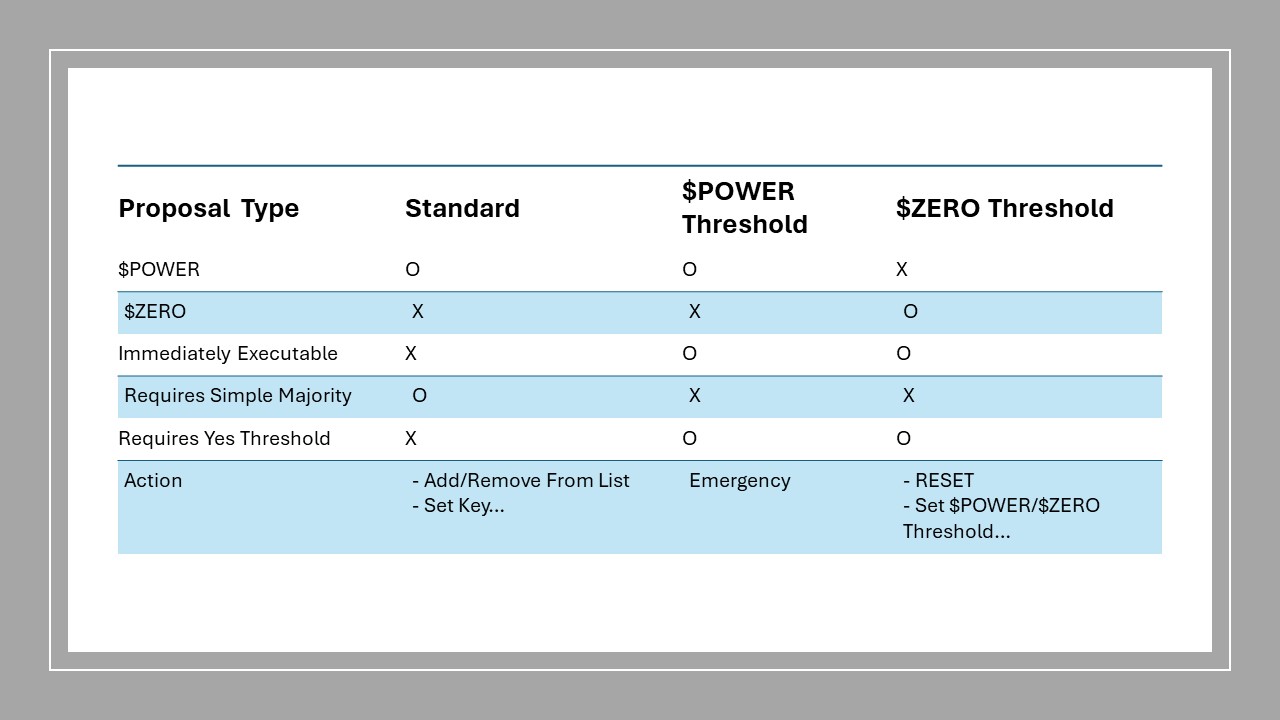

Excluding these, proposals processed by TTG can be divided into three types.

Standard Proposal

The most basic type of proposal, proceeding according to the aforementioned epochs. $POWER holders vote, and it is processed if more than half agree without a minimum quorum.

Note that all TTG items have no minimum quorum, and there are no options for Abstain or NoWithVeto.

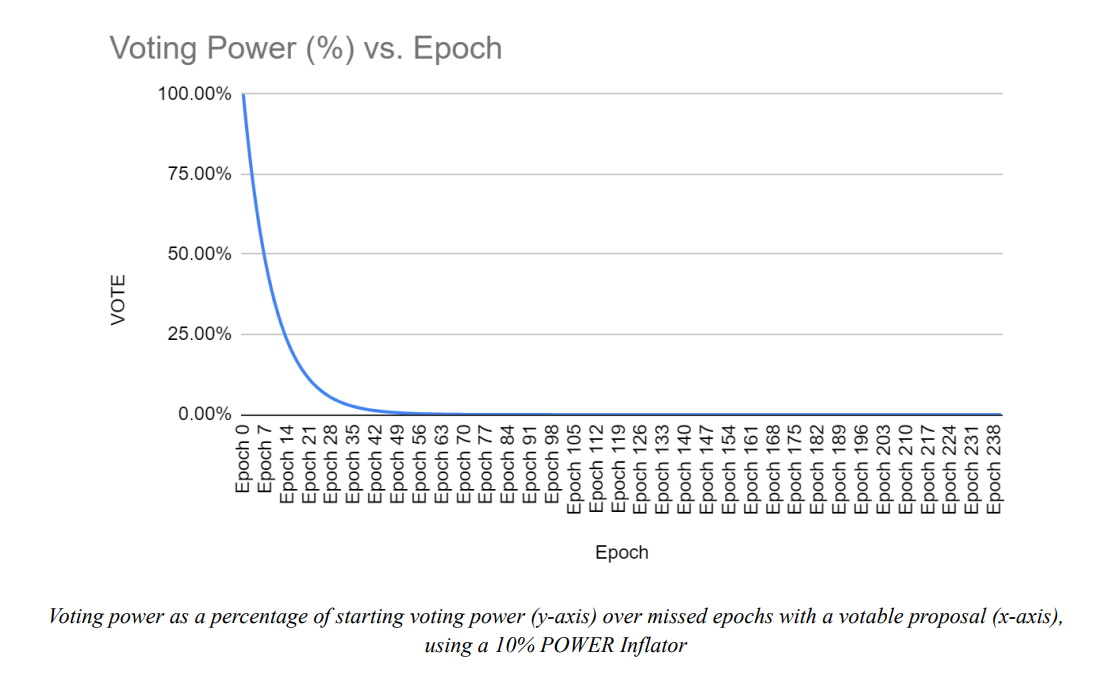

For $POWER holders, the Standard Proposal is a mandatory task, and there is a penalty for non-participation. Inflation of $POWER and $ZERO is provided only to $POWER holders who participate in the vote during that epoch, so not participating naturally leads to dilution and loss of value.

There is no obligation to participate in proposals other than the Standard Proposal.

$POWER Threshold Proposal

The biggest difference between the Standard Proposal and the $POWER Threshold Proposal is 1) it needs to exceed the $POWER threshold set by TTG, not just a simple majority, and 2) it is executed immediately once the threshold is exceeded. This is used in emergency situations where $POWER holders need to quickly adjust some variable values.

$ZERO Threshold Proposal

The only type of proposal in which $POWER holders do not participate, but $ZERO holders do, including Reset, setting $POWER & $ZERO thresholds. The notable proposal here is 'Reset,' which allows $ZERO holders to monitor whether $POWER holders are governing well and take away their power.

If $ZERO holders determine that the current $POWER holders are not governing properly, they can mint a new version of $POWER through the Reset proposal, allowing $ZERO holders to take their share and become the new owners of TTG. In other words, $ZERO holders become the new $POWER holders of the new era, replacing the existing $POWER holders. This mechanism can be seen as 'I'm stepping in because you're not doing well enough.'

$POWER

As mentioned earlier, $POWER can be considered the main governance token. What differentiates it from other projects is the penalty for non-participation in governance through dilution. The initial quantity of $POWER is 10,000, and new $POWER is issued every epoch (about 30 days) at an inflation rate of 10%. Therefore, if you do not participate in governance for 6 epochs (6 months), you lose about 45% of your voting power, and if you do not participate for 12 epochs, you lose about 70%.

The reward for $POWER holders' governance participation is provided in $ZERO, with a maximum of 5,000,000 new $ZEROs issued by inflation each epoch distributed pro-rata to participating $POWER holders. If no new standard proposal is proposed in that epoch, no separate inflation occurs.

Of the new $POWER issued each epoch at a 10% inflation rate, the unclaimed $POWER due to non-participation of existing $POWER holders is sold through a duction auction. $POWER can also be delegated to others, with the $POWER inflation going to the delegator and the $ZERO reward to the delegatee.

$ZERO

$ZERO requires less active governance participation than $POWER but has the authority to ultimately replace $POWER holders and earn a portion of the revenue generated in M^0. The replacement authority is possible through the 'Reset' proposal among the $ZERO Threshold Proposals mentioned earlier.

The economic rewards for $ZERO holders are, as mentioned in the table above, the fees required to propose Standard Proposals, unclaimed $POWER auction revenue, and a portion of Minters' fees. $ZERO can also be delegated, but there are no separate economic incentives for the delegatee.

The participants in the M^0 ecosystem can be distinguished as Minters, Validators, and Earners. A specific entity must pass through a TTG proposal to participate here.

Minters play the role of depositing collateral and newly issuing $M through the M^0 Protocol. Their economic incentive to do so is the interest spread between the collateral and the Minter Rate. Let's take a look through an example.

Understanding with an Example

The assumptions are as follows:

T-bill interest rate: 5%

Mint Ratio: 90%

Minter Rate: 4%

Administrative Buffer: $10,000 (The Administrative Buffer is a reserve for handling tasks related to the remaining collateral when a Minter is deactivated or expelled.)

I deposit $1,000,000 in T-bills as collateral and can issue up to $900,000 (Mint Ratio: 90%) in $M accordingly. Assuming I sell $M at a value of $1,

→ Total investment amount: $1,000,000 - $900,000 + $10,000 = $110,000

→ Revenue: $1,000,000 0.05 - $900,000 0.04 = $14,000

→ ROE: $14,000 / $110,000 = 12.7% >> 5%

As seen in this revenue, from the Minter's perspective, the higher the Mint Ratio and the lower the Minter Rate, the higher the profit, making participation in M^0 more attractive. However,

If the Mint Ratio is set too high, the value of the collateral can be overestimated, breaking the over-collateralization.

If the Minter Rate is too low, the rewards for Earners and $ZERO holders can decrease, which can also impact the entire ecosystem.

Validators monitor and evaluate Minters' off-chain collateral, prevent malicious $M minting, and are responsible for the security of M^0. The economic relationship between Validators and Minters is complex and difficult, so they handle contracts off-chain. For example, a specific Minter can contract with three Validator companies to audit their SPV and provide signatures and timestamps. As mentioned in the whitepaper, specialized Validators for on-chain signatures, malicious $M minting, off-chain collateral audits, etc., may emerge in the future.

Earners are large institutional entities like exchanges that hold large amounts of $M. In exchange for a portion of the protocol fees, such as the Mint Rate and Penalty Rate, Earners 1) act as a constant source of demand for newly issued $M by Minters, 2) maintain the value of $M through economic arbitrage, and 3) provide deep liquidity for $M.

As with all crypto projects, risks always exist.

Validator

First, the performance of Validators. How well can Validators participating in the M^0 Protocol monitor Minters? What if a specific Minter and Validator collude?

In fact, this is inherently unpreventable. This risk is like verifying 'What if Circle and its auditing accounting firm collude?' However, even in this comparison, M^0 has several security advantages.

First, by increasing the minimum number of signatures required by TTG's decision, the number of Validators a malicious Minter needs to recruit increases, reducing the economic incentive for malicious behavior.

Also, all Validators' approvals are left with signatures and timestamps, so it is immutably recorded when any Validator audited incorrectly, which also reduces the motivation for malicious collusion.

Finally, if a specific Validator discovers that another Minter and Validator have colluded, they can later use the Freeze method or inform $POWER holders to expel those malicious parties.

For these reasons, I think the mechanism for monitoring the currency issuance entities in the M^0 Protocol is superior and safer than the existing system.

Unknown Side Effects of the New Governance Mechanism

TTG is undoubtedly a new governance mechanism, so there may be unknown side effects. Especially in the case of the Reset proposal, it's very new, so we need to carefully consider what risk vectors might exist.

For example, is there a possibility that $ZERO holders will abuse the Reset proposal?

Thinking about it, this seems unlikely because $ZERO holders work less and receive sufficient economic rewards compared to $POWER holders. Therefore, in my opinion, $ZERO holders will not want to pass the Reset proposal unless absolutely necessary.

Other questions I have include:

How will the initial $ZERO be distributed? For $ZEROs issued later by inflation, they primarily go to $POWER holders or $POWER's delegatees. Then, isn't the initial $ZERO distribution demographic important?

Can we disincentivize insincere governance participation? What if $POWER holders simply push YES in every vote without thinking, just to avoid penalties?

Assuming $ZERO holders pass the Reset, do they have the capacity to lead M^0 Protocol's governance? What if they are mostly short-handed traders who came in looking at the token price?

Will there be a problem if participants in the M^0 ecosystem (Minters, Validators, Earners) become large $POWER holders? If I were one of those participants, I would want to hold a lot of $POWER to influence various values of the M^0 Protocol. While this incentive certainly helps raise the price of $POWER, could it also impact the neutrality of the entire protocol?

M^0 is a very ambitious team trying to rebuild the currency issuance system from scratch for the new era. Looking at the design of their protocol, it's very minimalistic, and efforts to learn from existing stablecoin protocols are evident. What remains to be seen is 1) what Minters, Validators, and Earners M^0 Labs can bootstrap initially, and 2) what services will be built on top of M^0.

TTG's governance mechanism cannot be overlooked. There have been consistent attempts at dual token governance models, but TTG is particularly creative among them. Of course, it should be noted that in the case of M^0 Protocol's TTG, the values determined by governance are very specific variables and numbers, so it cannot be said that this mechanism is suitable for all on-chain projects. The combination of M^0 Protocol and TTG is personally very exciting to see how it will flow in terms of the appropriate balance between code-based immutability and governance-based mutability.