People love credit. And card issuance is only growing. Especially with millennials and gen Z. So it's likely that, for the foreseeable future, traditional credit-based payment methods persist. Problem is, this model crushes merchants with high fees. It is absolutely ripe for disruption. And that's absolutely easier said than done. So the question becomes, if consumers love paying with credit, how do we disrupt the underlying fee-based model of issuing banks, networks and acquiring banks, and inject crypto in the mix to reshape payments?

I think a defi-powered credit card should exist to do this.

Flow of Funds would look something like this:

Defi credit line -> APIs in POS (consumer taps card as usual) -> stablecoin settlement to end merchant.

Traditional credit cards rely on issuing banks to provide credit lines. And for taking on that risk the issuing banks get most of the 3% merchant fee. And most of that that, if not all, goes back to the cardmember in the form of rewards to incentivize use of the Card. Issuing banks make money off revolving balances, late fees, annual card fees. We would do the same, and use some to incentivize adoption by Cardmembers.

Replace the issuing bank with defi lending. People could lend their stablecoins (any crypto prob) to a liquidity pool. LP converts/holds in yield bearing stables and earns the risk-free rate, which is handed back to the LP providers for lending. And that LP provides the credit lines to consumers.

So, you might be thinking, well lenders can earn the risk-free rate just buy holding stables in their wallet. And that's correct. The added benefit of lending to our platform is that they also could earn a percentage of the interest generated from revolving balances. What specifically that would amount to, I'm not sure, but could push lenders returns to 8%. Assuming that is enough to incentivizes de-fi lending to fund a consumer's credit line, what's the next step?

New Kind of Card. Then you need a new kind of physical card that operates on NFC and APIs integrated into POS systems (likely enabled via "SoftPOS"). Consumers still “tap to pay” but it doesn’t touch traditional networks (v/mc/amex). With a combination of NFC and APIs, maybe you can build a new type of card that connects with POS systems via a TAP, but checks the onchain credit limit for the AUTH and then, if approved, settles in stablecoins to the merchant. Private, compliant and secure. This requires partnerships with POS providers.

For online you need a new UX to enter the new card numbers. But that seems like a bit of a road block to adoption. Instead, you could still use the card networks for their established POS/online integrations (i.e. consumer still taps the card at the register, or entire their CC# online). That only costs about 15-20 bps for transactions, so might be a faster GTM. But it requires Bin Ranges. Getting Bin Ranges for this new type of credit card at a price that doesn’t crush the model could be a problem.

Bin ranges are the initial 6-8 #s in your CC#. They identify the issuing bank. To get our own Bin Ranges, we could use a Bin-sponsor for this. Of course, that costs $/adds fees to the transaction.

So getting rid of Bin Ranges is perferred, but might not be easy.

Stablecoin Settlement. Then, we’d settle to the merchant in stablecoins (yield bearing obvs) from the LP.

At the end of each month the consumers get a "Credit Card" bill as in the normal course, and can pay back that bill with crypto, stables or a bank transfer.

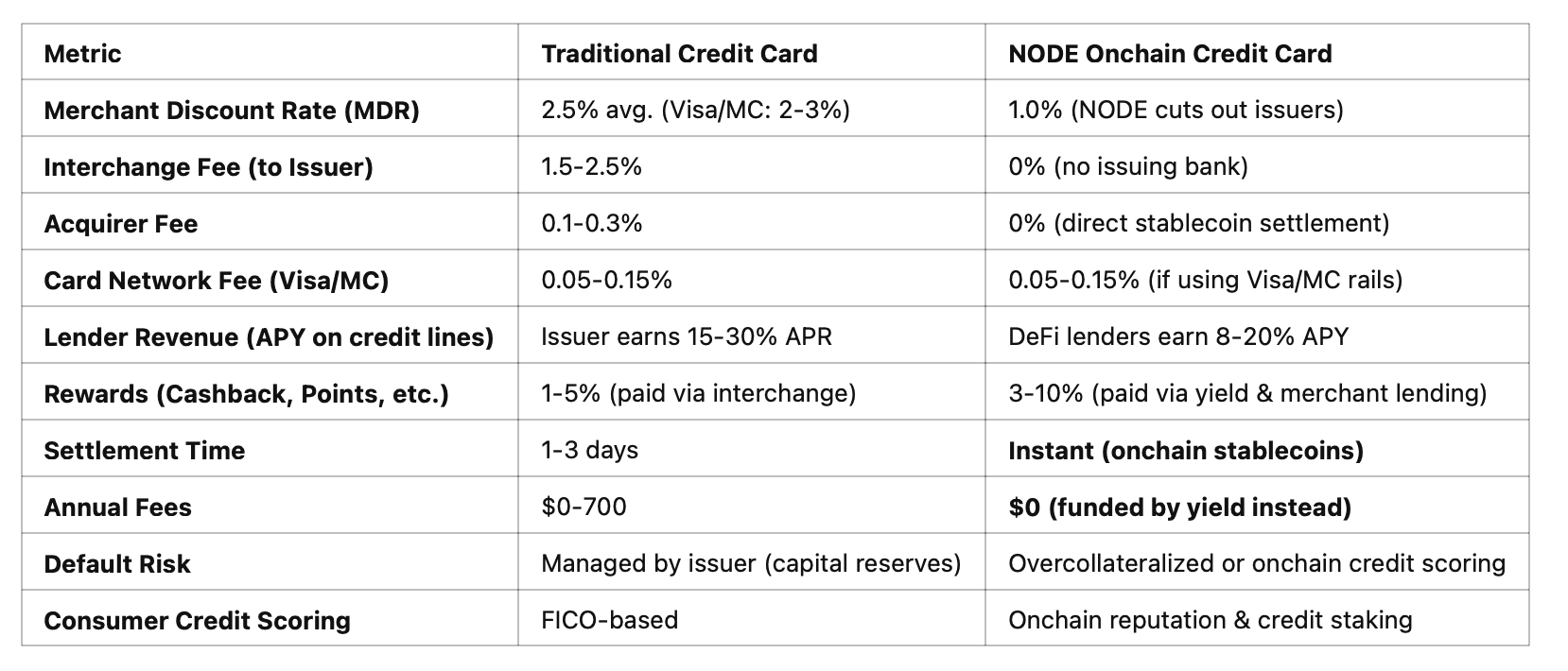

This achieves faster, cheaper settlement. With lower credit rates if you carry a balance (5-10% v. +20% for CCs). And you use yield from stables to incentivize adoption. This would cut out the issuing banks and the acquiring banks, and save a boatload on fees. Here's a rough estimate of the economics vs. traditional CCs:

You would also have to provide customer service, dispute management and fraud management. All adding to the costs of running this Card program.

So, getting all that set up in year 1 would probably be costly.

But, in year 2 and beyond, there’s huge potential to make substantial profit from this new type of defi-powered credit card model, and disrupt the existing economics of payments.

An “onchain Amex” will propel stablecoins into mass adoption and reshape payments. That’s worth exploring.