Total Volume + Fees

We usually try to get the Poolfish newsletter out every Friday. But hey, sometimes we have too much turkey and have to loosen our belt. So here's the newsletter for last week 2 days late!

It's never a boring week in the LP space. This week we saw an attempt at a hostile takeover of KyberSwap, many $GROK/$GFY tokens launched (some even becoming among the most profitable pools on Uniswap). The bull market is on the horizon. Fear and Greed index is now inching towards Greed and people are ready to be overconfident and extend their risk profile. The promise to make generational wealth hinges upon the next antic from Elon Musk. Very reminiscent of the last bull market.

On the Docket  this week:

this week:

Meme token liquidity is rising

Uniswap Research: Private mempools working as they should

LPing on Solana is better?

Liquidity tool by Austin Adams

News Cycle/Meme Tokens are back

In the past few weeks we saw GROK taking over as one of the most profitable pools for LPs. Currently the WETH/GROK pools sits as the third most profitable pool on Uniswap V3 and has accrued $344,752.50 in fees just in the last 7 days. This token is the one based on the new X AI chatbot.

Another token $GFY launched right after Musk's recent interview. This pool is about two days old and has a TVL of $313,000 and is also raking in fees.

While meme-coins may seem like a good opportunity, the risk with these is one of the highest. So proceed with caution.

Just like prediction markets, there are now speculations that for every major news cycle, there could be an accompanying token and thus a LP pool.

But timing is of the essence when LPing in meme coin pools.

As an example take the address : 0x721cf5873d65556f8632feba7fb12a73a5feb22e

They have two open positions:

- A 6 hour old position in GFY/WETH has a PnL of $153.62.

- And a nearly day long position for GROK/WETH, but a today the twitter for GROK @grocerc20 got banned and the price fell swiftly. And our LP now has a negative PnL on it.

While many liquidity providers (LPs) are undoubtedly making much more LPing in memecoins, the potential rewards can be substantial - but you can lose big too!

Uniswap Private Mempool analysis

The Uniswap team conducted a research based on data from 500,000 trades on the USDC-WETH and PEPE-WETH pools. Why would they go through old data? Well to make sure that the none of the trusted private RPC providers were siphoning off MEV from the private mempools. Using on-chain data, they tried to determine whether or not the top five RPC providers re-ordering blocks using a novel metric called "reordering slippage".

"Reordering slippage measures the difference between the actual slippage of a swap and the average slippage of the same swap with the entire block randomly ordered. "

The crux of this study proves that this is a viable method of keeping RPC providers in check as they are essential to mitigate MEV in AMMs but also have access to data that can be used to sequence blocks in their own favor. This means that traders would never suffer significant losses due to the manipulation of RPC providers sandwiching trades.

LPing on Solana

The "Uniswap" of the Solana Chain are Phoenix and Orca. Orca(Whirlpool) is spiking as SOL reaches new heights and breaks $60 with Orca generating ~$900,000 in fees for period of 20th Nov - 27th Nov. Given the rise in prices in the past 7 days we can expect it climb even higher for the coming weeks to months.

This is a reminder of how Solana is one of the notable players in the L1 crypto space being one of the only popular L1s that are cheap for real world applications.

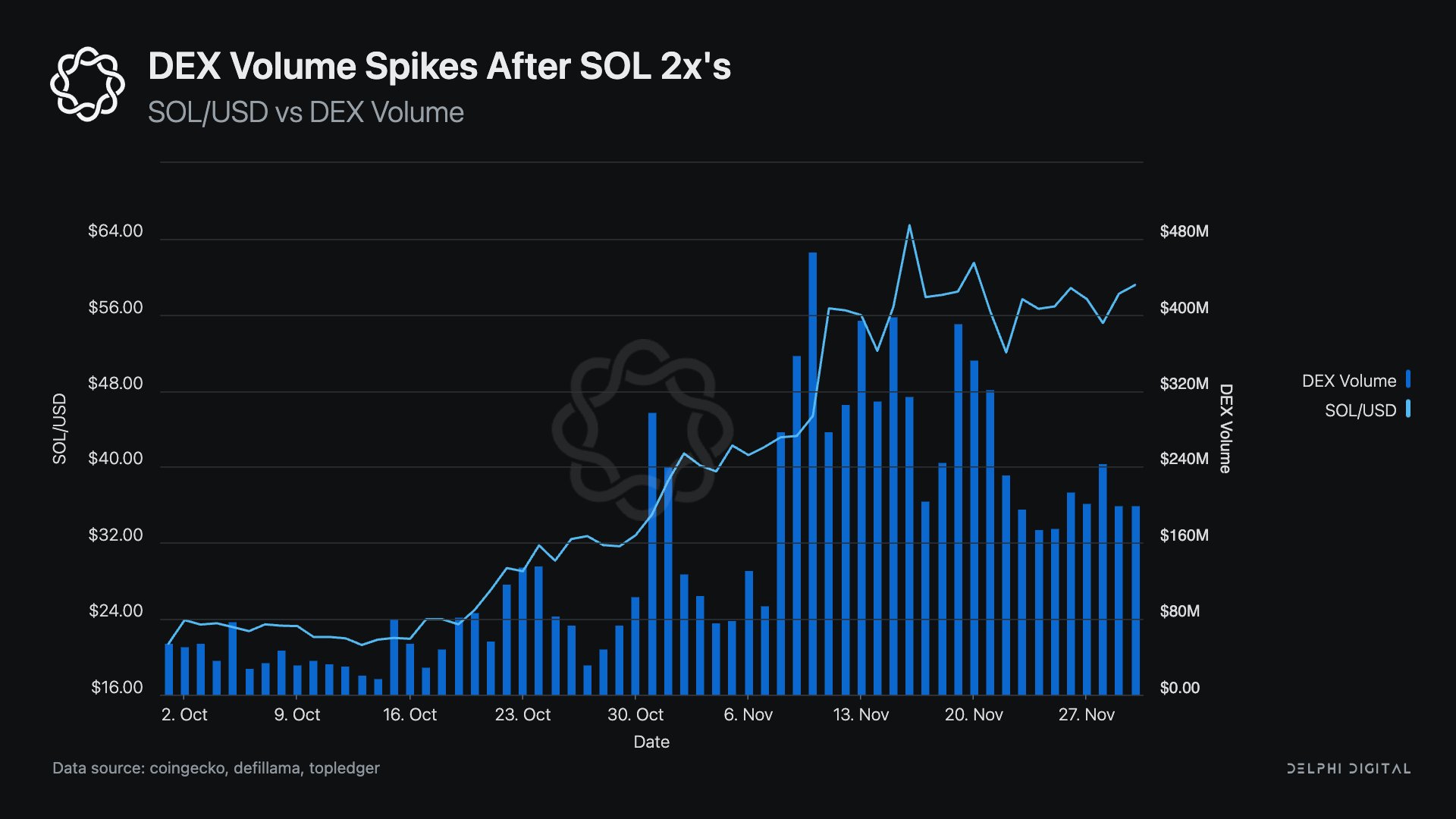

@ceterispar1bus highlights how Solana price and Dexs on the Solana chain corelate

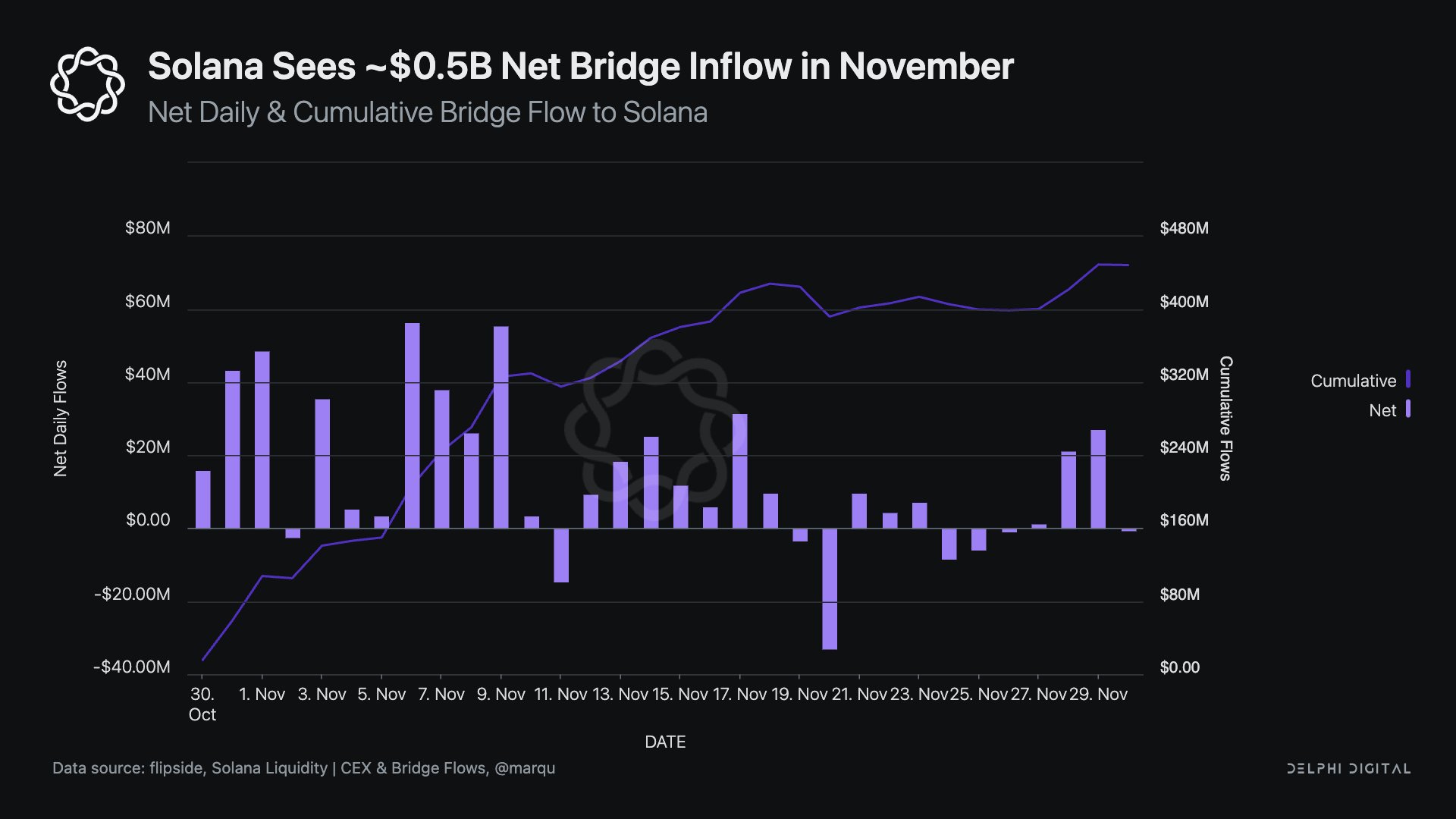

Here is a graph that illustrates the increasing trend of people bridging to SOL. It shows an rising trend as SOL may promise LPs a brighter future.

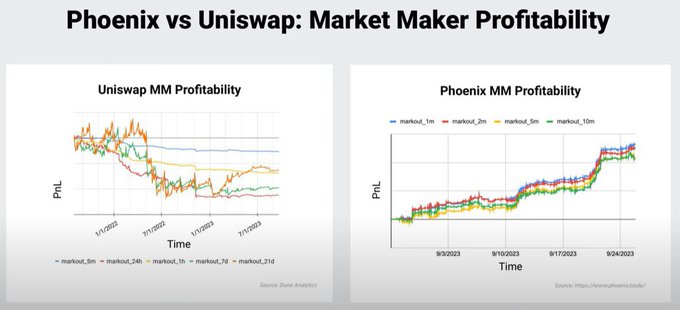

@mrink0 even makes case that LPs on Solana(Phoenix) are more profitable than LPs on uniswap

Remember last week when KyberSwap was hacked? Well now we know that multiple DEXs, especially on Solana, have the potential to LP healthy amounts of fees. So there is no reason to put all your eggs in one basket.

Smol tool Big picture

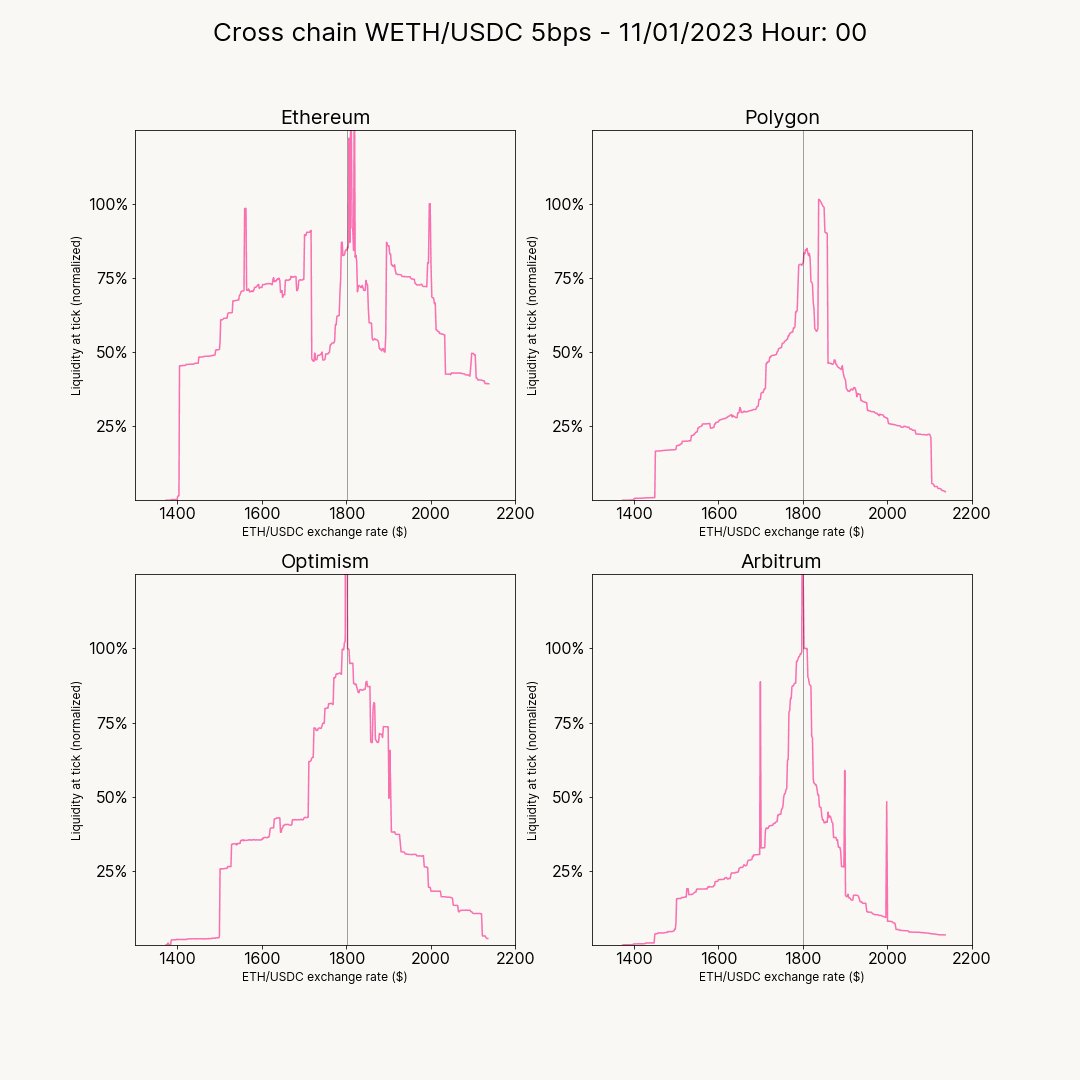

Austin Adams opensourced their package to create a mesmerizing graphs that illustrate the movement of concentrated liquidity in pools over time. Which pool would you like to see the data off? Let us know in a reply to this email.

Top Pools of the Week

High-Risk

in the exotic pairs category for the ones feeling adventurous.

Low-Risk

gOHM/USDC for the balanced swimmers.

Safe

USDC/ETH in the 5bps category for the cautious paddlers.

This is all for this week folks. Tune in next week for the next wave of twitter inspired meme-coin LP opportunities and more LP related news!

30

30