Swell, LP Strategies, and the LVR Challenge

It's that time of the week where we bring you the latest scoop of LP nuggets from the Defi universe. This week's treasure trove features a fascinating DeFi Liquid Staking protocol(Swell), a sneak peek at the upcoming world of Uniswap V4 and UniswapX, updates regarding Poolfish and why you should care about LVR.

When you stake ETH on Swell, you receive swETH tokens at a 1:1 ratio. This swETH represents your staked ETH, but moves freely in DeFi and can be traded as easily as vanilla ETH. Simply hold swETH to earn staking rewards around 4.16% APR. If that's not enough to rock your boat, they also have an upcoming airdrop and you are eligible to get their signature pearls.

Active validators: 1,296

Total staked ETH: 48,295

Stakers: 13,620

APR: 4.16%

Use our Poolfish referral link when staking ETH to get 10 bonus pearls per ETH. Thanks for taking the bait!

The more ETH you stake, the more shiny pearls you'll reel in.

Stake more ETH and hold longer to accumulate even more precious pearls over time.

You can also get bonus pearls for referring your fishy friends to stake with Swell too!

NOTE : We encourage everyone to take part in DeFi protocols with care and research.

Just 4 days ago, a renowned LP Jake Call stocked his treasure chest with $19,973 in WBTC/USDC and cast anchor in a bubbling liquidity pool, reeling in $123 positive PnL.

Jake tried to swim against the current, netting $138 in pool fees. But that impermanent loss scoundrel struck again, this time pilfering an IL of $270 and leaving him $100 in the red as compared to HODLing.

Thinking fast, he charted a course to rebalance the pool at $27,500. He knew prices would soon ebb, making it the perfect time to recapture lost loot.

To quote Jake; 'And just like that RETRACEMENT! Don't panic rebalance with pumps like this, most likely there will be a retracement within 24 hrs.' At the time of closing his impermanent loss stood at $90 and fees at $210. Now that's quite a remarkable comeback.

Of course, too much rebalancing risks being sunk by gas fees. Data shows LPs who rebalance daily lose 70% more treasure than those who let positions drift for a month or more.

We previously did a whole blogpost regarding automation in your LP strategy (including auto-rebalancing) with our friends at Aperture Finance. You can view our blogpost here.

On October 4th, The Bell Curve podcast featured Alex Evans, Jason Milanov, and Dan Robinson. They discussed loss versus rebalancing (LVR) in decentralized finance.

LVR refers to losses liquidity providers can face compared to simply holding assets, due to lag in automated market makers adjusting prices. We are going to summarize the salient points discussed in podcast.

Reducing LVR is important for liquidity provider returns and decentralized exchange sustainability. Potential solutions include dynamic fees to reprice spreads based on external data, and auctions to recapture value from arbitrageurs.

Of course, it's not all smooth sailing. Finding the right dynamic fees without scaring away volume is tricky, and rough waters can make auctions less competitive. Some speculation stirs up useful financial products, so arbitrage isn't all bad.

Here is a visual representation of LVR from the paper of @jason_of_cs.

LVR here is the vertical distance between B* and B.

Faster block times means more arbitrage, but provides little value to us LP swimmers. Dan Robinson suggested slowing things down with batch auctions could steady price discovery without falling behind speedy competitors.

Overall, LVR is a critical issue in liquidity providing and may be currently disincentivizing potential LPs . Innovations like dynamic fees and auctions could keep returns flowing and exchanges afloat. But balancing the needs of various stakeholders remains an open voyage for DEXes.

One of the more interesting takes on LVR came from X user @guil_lambert who claimed that LVR is a problem market makers and LPs interested in sub 5bps fee tier category, and that retail LPs don't have to worry about it.

For those interested in empirical data and fond of reading complex research papers, here is the link of the paper discussed in the video.

We've got an exciting new feature to share in this week's edition - percentage labels that show the difference between your range and the current price.

We hope this takes some of the friction out of assessing pool opportunities on the fly. Just another way your friendly Poolfish is working to make your DeFi journey as smooth as possible!

Poolfish has expanded its offerings and now includes PancakeSwap!, providing the same set of features as it does for Uniswap.

Let's delve into uncovering how the utilization of LP tools can distinguish you in the competitive ocean, keeping you afloat and preventing you from being swallowed by the undertow of a larger fish LP.

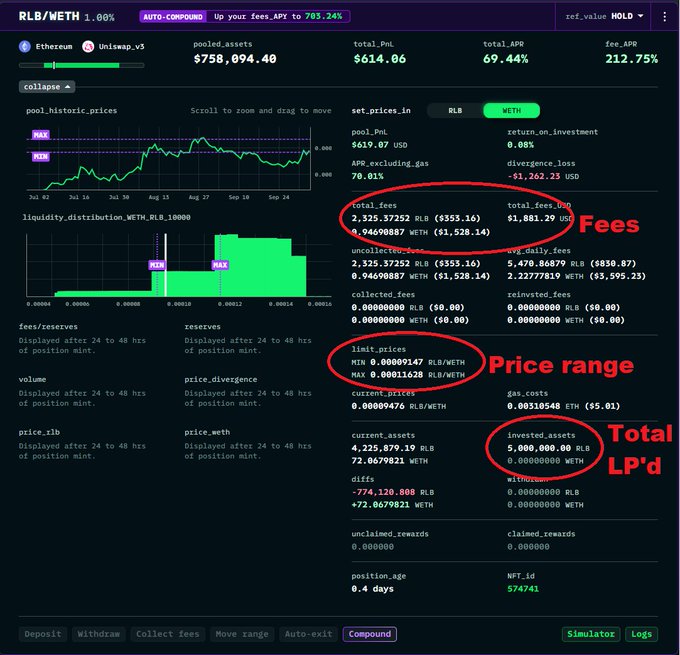

In the screenshot below, we can see a major Rollbit Coin (RLB) LP committed 5 million RLB tokens to a Uniswap v3 liquidity pool with a one-sided range of $0.147 to $0.188 per RLB token. A coin soaring will make LPs salivate with those potential fees, apeing into the coin.

However, using Revert.Finance user @cryptobink on X(twitter) discovered this position which exerts a pressure $750,000 in potential extra sell pressure on the RLB market price.

In the realm of liquidity provision, delving into LP tools to scrutinize liquidity pools is essential. Regardless of whether you're taking a passive or active approach, liquidity providers should employ tools that align with their specific strategy. Fortunately, Poolfish blogposts, in conjunction with Uniswap.University, are valuable resources.

OX/ETH in the exotic pairs category for the ones feeling adventurous

AAVE/ETH for the balanced swimmers

WBTC/ETH in the 5bps category for the cautious paddlers

Until our next rendezvous on these digital shores, stay afloat 🤽🏻♂️ and navigate wisely, dear readers.