Tracking a LP Whale 🐳

Greetings! and welcome back to another edition of your favorite DeFi LP newsletter and primary source of fish metaphors. We're thrilled to deliver more liquidity insights and exciting opportunities this week, while we also distill some key insights from a LP titan.

On the docket this week:

In Depth with a Liquidity leviathan 🐋

Uniswap Quest, University, V3 internals

UniswapX wrecks LPs?

New upgrades over at Poolfish 💦

Top pools of the week

Total Volume + Fees

• Trading volume for Uniswap V3 took a dive by -24.10% this week.

• LP fees for Uniswap V3 dipped by -21.94% this week.

TVL 🔻 Decrease of 0.87% over the past week (across V1,V2&V3) | Sep 14 - Sep 22

The TVL experiences minor decline despite the ongoing bear trends, overall TVL remains resilient. This suggests stable demand for liquidity provision especially with all the action from newly launched L2s.

Let’s go LP Whale Watching!

We get on a boat, grab our binoculars, and go see what we can learn from observing a whale-sized liquidity provider up close. 🐳

And we found one! He’s got a nice $832k sitting in his wallet.

So he isn’t the biggest whale you’ve ever seen but when it comes to LPing, he’s pretty up there!

Because he has done just close to 900 LP positions!

So let’s take a look at what LP positions he’s holding right now.

PEPE/ETH - We should have known 😅. - $507k pooled

VMPX/ETH - Talk about small cap! - $172k pooled

XEN/ETH - $28k pooled

HDRN/USDC - $6,168k pooled

On these 4 positions, he’s up a cool $60k. Not bad!

Most notably his VMPX/Eth pool has done well. He’s held it for 3 months and done 146% APR. Netting him $53k so far!

Now I can’t say I know much about VMPX and it most likely is risky because it’s only has 3.8k holders and is a $4.8 million market cap.

The pool only has a TVL of $296k! Which means our whale is the majority of the TVL!

This goes to show that whales have some special advantages. They can probably do things that not all of us can. He is eating up a good share of that pools fees.

Also possible that this whale is someone connected to the project and has inside information.

That being said the pool volume has also seen brighter days. Our whale likely got in early and provided liquidity as the pool blew up.

The downside is he probably can’t sell this position. If he did the token would tank and there wouldn’t be enough liquidity! So he’s probably stuck in the position for the time being.

But our whale has done a lot more pooling than just this token. Probably the one I saw come up the most was Pepe. A good meme can bring great volume for LP-ers.

He’s been holding his PEPE position for only 2 days and made a nice $5k off of it. That’s 160% APR!

He’s running a pretty tight range on this position which of course brings more fees. At the same time it’s harder to manage and he more so has to look out for impermanent loss.

When looking at his pool history I can tell you that he likes to play hot potato! Other than the positions he is currently holding, he only holds a position for hours or a couple days at most.

One thing that can be learned for sure from this whale is that experience and repetition brings gains!

Uniswap University Splashes into Session 🏄♂️

We're all about empowering liquidity providers at Poolfish, so we're thrilled to see Uniswap University launch their 411 course for LPs.

The Uniswap Foundation just made their new educational resource live, for LPs of various levels of experience. It’s a beautifully curated list of:

Full length guides ranging from basic of DEXES to advanced backtesting tools.

Tidbits are flash cards that give bit sized intros to concepts

Courses in-depth syllabus and hands-on simulations let you practice complex maneuvers like rebalancing positions.

Simulations allow you to get familiar with UX of the Uniswap app as well as periphery services that allow LPs to manage their concentrated liquidity positions better.

One special simulation in their repertoire is…yours truly…albeit with our former identity.

UNI-Poly Quest

Uniswap announced LP positions reached 1 Million in number on the polygon chain, and announced their new quest on Layer3. Gain first-hand experience (and XP on layer3) transferring tokens via a bridge and subsequently performing a trade on Polygon and level up on Layer3.

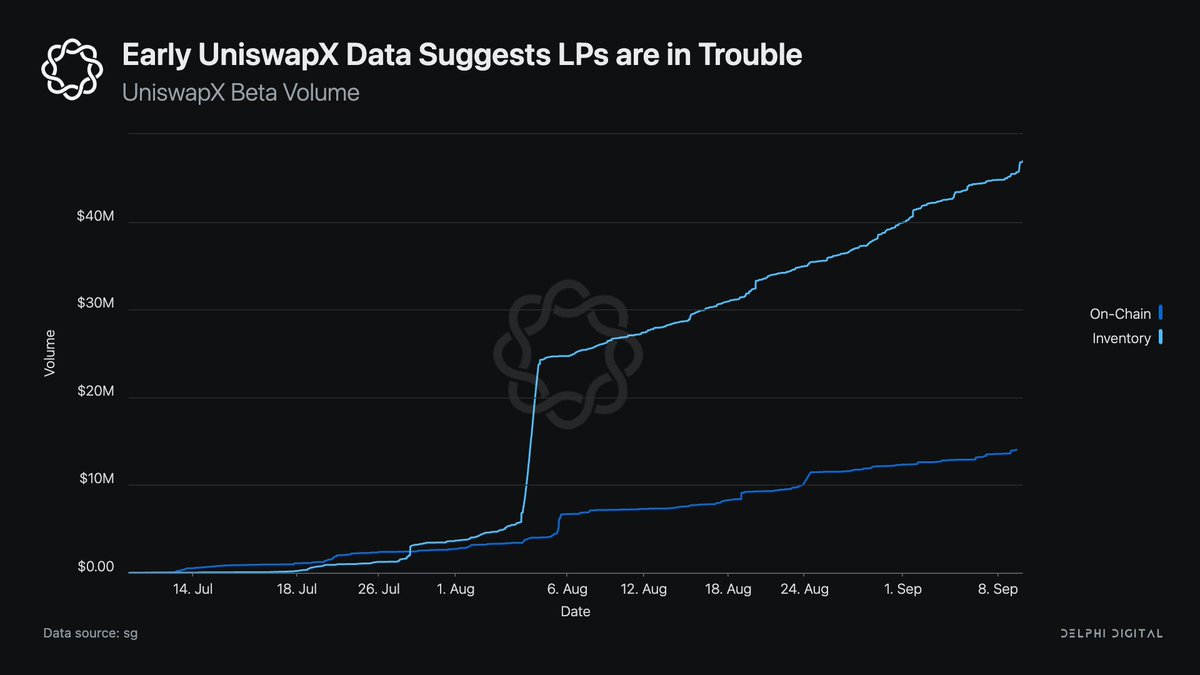

UniswapX wrecks LPs?

A recent report from a twitter user claimed that 77% of Uniswap volume is being filled with off-chain inventory, suggesting most volume is coming from a single market maker.

This was met by an explanation by a Uniswap protocol researcher who was quick to dismiss the insights as cherry-picked and skewed from the true picture.

Confusingly, the report only looked at trades happening on Uniswap's new X platform. On Uniswap X, off-chain market makers compete with on-chain liquidity providers. The problem is, trades only reach X if the off-chain rates beat the on-chain rates. So there's a built-in bias. This chart misses all the trades that on-chain liquidity providers capture directly - about 80% of volume.

So the real amount of volume from on-chain liquidity is much higher than the report concluded. They only saw a small slice of data - trades that off-chain already won, not the full picture. We’re going to have to hold our horses 🐴 giving a verdict on UniswapX as of now.

Underlying Tokenomics - Pool Party Popularity of ETH

For LPs out there, It is interesting to note that a significant portion of the highest-volume liquidity pools across blockchain networks utilize ETH or a wrapped derivative as one of the pair assets. Turns out there's a good reason behind ETH's poolside prevalence and the answer is the tokenomics emerging after ‘the Merge’ i.e. ETH's sqrt(N) issuance rate and O(N) burn rate = Price remains bounded and stable source

Reeling in the Math behind V3!

🌊 Ever been curious about the math behind Uniswap v3 and dive into topics like ticks to price conversion, calculating exchange rate, and how fees work in depth. In that case, this blog post by Uniswap goes into the nitty-gritties along with code-examples

Poolfish Timeframes

When providing concentrated liquidity, properly analyzing time frames and price history is crucial and gives insight to expected yields. Poolfish now supports viewing the price based on 1 week and 3 months in addition to the 1 month default timeframe. Along with the chart, Poolfish also updates the expected fees based upon the selected timeframe.

Top Pools 💦of the week

We have compiled the highest-performing liquidity pool each, from three distinct risk profiles - high-risk, low-risk, and safe. You can see a complete list here.

High-Risk

WOOL/ETH in the exotic pairs category for the ones feeling adventurous

Low-Risk

TONCOIN/ETH for the balanced swimmers

Safe

ETH/USDT in the 5bps category for the cautious paddlers

That’s a wrap folks! If you've got suggestions on what we can do to up 👆🏻 our game, we're all ears! You can reach out to us on twitter @poolfish_xyz or reply below.

189

189