Uniswap Drama and KYC Hooks?

Enhancing the LP experience, Anti-LVR Hook - 15 bps fees

Total Volume + Fees

On the docket today

Uniswap adds a fee!

V4 Hook minimizing LVR

KYC Controversy around v4

In the world of DeFi and Liquidity Provisioning, change is the only constant. This week, we find ourselves in the midst of a recent Uniswap frontend fee announcement and the whirlwind of responses it has stirred in Hodlers of $UNI.

We also investigate a KYC stirrup within the Uniswap V4 ecosystem. There is also a new innovative V4 hook by Arrakis Finance fighting LVR that we take a dive into. As well as breath of fresh air when it comes to Uniswap forks.

Fee Flooding: App.Uniswap Fees

Uniswap Labs' recent decision to introduce new fees has created waves in the crypto community. Starting Oct 17th the main Uniswap app will charge 0.15% on the trade value.

Some are comparing these fees to some other traditional financial services, suggesting, relatively, these are just a drop in the ocean. Others, however, see this as a storm brewing, accusing Uniswap Labs of straying from the principles of decentralized finance.

At the time of this writing Uniswap Labs has accrued ~$115000 in these new fees.

Protocol lead of @aerafinance, Peter Erins welcomed the news as:

"Fees, however, enable self-reliance."

The consensus among many web3 founders was that they deemed this fee implementation as a fair way to sustain Uniswap Labs.

The new fee, effective from October 17, 2023, is separate from the Uniswap Protocol fee switch, which is entirely subject to votes by UNI token governance.

However this has led to another contention of DAO participants and $UNI holders feeling they are being subjected to the control of large DAO players. This is primarily because of multiple futile attempts to turn on the protocol fees switch. Following the announcement, $UNI fell steeply.

One reddit user expressed:

"A good reminder that token holders are not shareholders. The company that is Uniswap Labs is incentivized to maximize shareholder value through the web app they manage, as they are doing here."

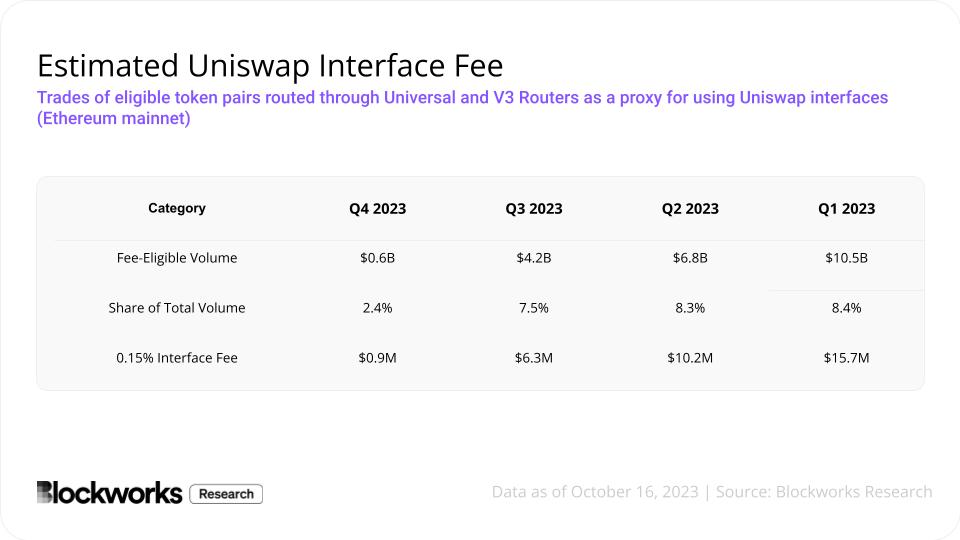

One thing to note here is that Uniswap has raised hundreds of millions in funding and might be feeling pressure to generate revenue. According to a blockworks report, total fees only for this year till now could have been $33 million

Effect on LPs

While the LPs don't seem directly affected by the fees, DEX aggregators seem like the winner here, but that also means that liquidity and trade volume will flow to other DEXes.

Consequentially more liquidity will flow to other protocols like Curve. On the other hand, as Uniswap Labs paves it's path to generate revenue, they allocate more resources towards the expansion of the protocol.

Diamond: A Uniswap V4 Hook minimizing LVR

We previously highlighted an innovative V4 hook by Arrakis Finance: The Dynamic fee contract. Today, we want to delve deeper into another disruptive singleton hook by Arrakis. A new way to navigate the choppy waters of LVR and protect our hard-earned liquidity.

LVR, more aptly known as 'the price for knowledge', costs LPs to tune of $100 million a year.

To address this issue, Diamond charges the builder for LVR-specific trades, forcing them to occur at the start of the block. Builders must commit to the final pool price at the end of the block at the start and deposit collateral to the smart contract before any trades take place

Diamond Contract: An Overview

Here is the crux of it:

The key functionality of the Diamond Hook contract is the updating of the pool price in a block before any swaps can take place. This price update is performed via a function in the Hook contract. This function takes as input the price to which the builder will commit to in the block, which is expected to correspond to the LVR maximizing price

Ensuring the pool hasn't been created before

Ensuring users can only access pool liquidity through the hook

Checking that the builder has updated the pool price in the current block

Ensuring there is enough collateral in the PoolManager contract to revert the price back to the committed price after each swap

It's expected that the diminishing returns for LVR exploits will cause a surge in liquidity provisioning and a subsequent rise in transaction volume.

For a more in-depth explanation you can visit here

KYC Controversy

Reactions splashed onto the shores of twitter this week, as an innocuous KYC v4 hook started controversy.

In a see of mis-information, the speculations that Uniswap would implement KYC as default for all pools became rampant, while the creator of the hook made it clear that it was a personal project.

This incited a more extensive discussion on whether the adoption of permissioned tools and methods is an unavoidable progression in light of stricter regulations dawning upon Defi.

A notable concern trickled down from the community— a slippery slope towards regulatory overreach. Another sentiment was that a regulatory framework is necessary to bring in more money.

On the flip side, there was a fear that transactions without KYC might soon be labeled illicit if the trend caught on.

There was a suggestion of a harmonious blend of regulatory compliance and decentralized ethos. The idea would be to anchor oneself away from centralized services and sail towards the horizon of decentralized identities for KYC.

The idea of mandatory or optional KYC in LP/DEXes, are uncharted waters, and it will be interesting to see how it evolves.

High-Risk

OX/ETH in the exotic pairs category for the ones feeling adventurous.

Low-Risk

BLUR/ETH for the balanced swimmers.

Safe

ETH/USDT in the 5bps category for the cautious paddlers.

We will see you next week with another round of LP focused news. So stay tuned and keep those liquidity pools bubbling!

2,521

2,521