Signum Newsletter 1

Weekly alpha for your weekend reads

Welcome to the first edition of the Signum Newsletter, a weekly curation of research articles, industry news highlights, portfolio updates and articles occasionally written by the investment team.

With information overload a perennial problem in crypto, the team felt it was necessary to collate various content for people to stay up to date about the latest trends bite sized content.

Special thanks to YY, Melvin, Adna, Nikos and Ash for their help.

Please do enjoy reading,

Ash

a) Subsquid (SQD): A Blue-Chip Hiding in Plain Sight

• M31 Capital did a research piece on Subsquid (which is also a Signum portfolio company) where they believe it is undervalued and has a 20x potential in the near term.

• Subsquid is essentially a modular indexing and querying solution for blockchain data that allows developers to access and analyse on-chain information.

b) Research: AO, a F**King Big Computer

• AO is Arweave's (decentralised permanent data storage project) new project which aims to be a scalable and trustless customisable compute platform - essentially a hyper-parallel computer that can bring intelligence directly on-chain.

• The intersection of AI and crypto will be one of the biggest paradigm shifts in the decade and AO will likely be a key player in this change.

c) Inside the Restaking Ecosystem

• Gauntlet visualizes the restaking ecosystem with restaking protocols, liquid restaking protocols, active validated services (AVSs) and operators.

• Key restaking players include EigenLayer, Symbiotic, Nektar, Karak, Exocore and Babylon.

d) The Social App Thesis

• Apps must become social to win, and this inverse correlation between financial capital and social capital is ubiquitous.

e) Execution Auctions as an Alternative to Execution Tickets

• Principal-agent problem in Ethereum --> when a protocol creates MEV it leaks to its prosperers and the only way to solve this is for the protocol to sell the rights to earn the MEV with a proper mechanism in place.

• Two approaches: Execution Auctions (simple architecture) and Execution Tickets (more decentralised).

f) We're all Building the Same thing

• The overarching mega-trend in crypto is clear that we're all converging on increasingly similar architectures.

g) Project Spotlight: Jito - Efficient MEV for Solana

• A major infra player on Solana focusing on MEV and staking.

a) Infrared Finance

• Binance Labs has strategically invested in Infrared, a protocol aiming to enhance the DeFi landscape by providing easy access to Berachain's innovative Proof of Liquidity (PoL) mechanism in just one click.

• Infrared operates validators and introduces the iBGT token which is a yield bearing LST backed 1:1 by $BGT.

• Signum Capital participated in the previous seed round fundraising together with the likes of Synergis, dao5 and Oak Grove Ventures.

b) FirstBatch (Dria)

• Dria advances AI integration in crypto platforms by improving AI models with synthetic data.

• They are focused on enhancing the data pipelines with the right data when developing AI-dependent solutions like crypto agents and compute networks.

c) Solv Protocol

• Solv Protocol introduced an enhanced points system to increase earnings with active BTCFi participation and new dApp partnerships.

d) MyShell

• MyShell is reshaping the AI industry by establishing a first-ever AI consumer platform that connects AI open-source model researchers, application developers, and consumers.

• The platform consist of a model layer (contains both open and closed-source models, developer platform, application layer (app store) and an incentive network.

e) Kakarot

• Kakarot addresses critical scalability challenges in blockchain technology, specifically within Ethereum, by implementing advanced sequencers in zero-knowledge (ZK) rollups.

• Learn more about unlocking blockchain scalability: the essential role of sequencers in rollups.

f) Fantom

• Fantom recently won a court case, reversing an initial judgement which granted the plaintiff payment of over 198 million in $FTM tokens.

• They are also ready to launch a substantial airdrop, providing up to 190 million $S (native token of their new chain, Sonic) tokens to users of its Opera and Sonic platforms.

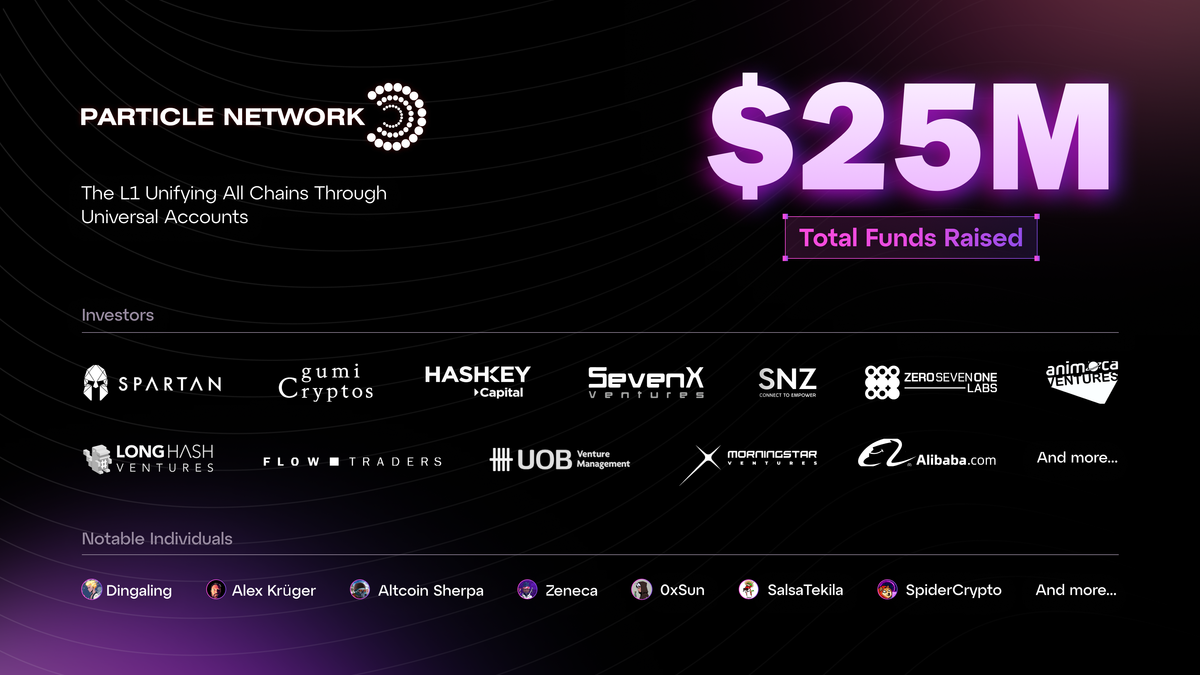

g) Particle Network

• Particle Network secures a $15 Million fundraise ahead of their mainnet launch to enhance blockchain interoperability.

Blast layer 2 (L2) has finally airdropped its token and allowed its community govern the protocol. It reached a high of $2.8b FDV before the price dumped and current it is trading at a $2b valuation as of current time of writing. Its TVL has managed to remain at $1.4b putting it in the top 10 chains on DeFiLlama.

Two points to note:

• There was a period of time where L2 projects could command a high premium in FDV simply because they were building their own infrastructure (chain) + valuations could be made while comping it against other L1s ecosystems. We believe that meta is probably coming to an end as not every L2 is going to trade at the same breath as Arbitrum/ Optimism and with the advent of RaaS and development stack by established L2s (Optimism <> OP Stack, Arbitrum <> Orbit) it makes it so easy for anyone to spin up an L2.

• The arbitrage gap between private valuations (VCs) and public valuations (retail) is narrowing --> look at recent launches of hyped protocols: Starknet is trading at a $6.5b FDV (which is lower than their latest valuation at $8b), zkSync at $3.5b, LayerZero at $2.6b FDV and Blast at $2b. This is in stark contrast to both Arbitrum and Optimism at ~$7b.

Signum Capital has 3 portfolio companies that are building on Blast and we are constantly supporting them on GTM and growth.

a) DistrictOne

• One of the top social dApps on Blast together with Fantasy Top, DistrictOne turns group chats into SocialFi hubs with engaging money games.

• The recently launched Meme Labs which is a take on pump.fun which allow users to launch their own meme coins.

b) Kettle Finance

• Kettle is building a marketplace for luxury watches and since inception, it has achieved over $25m of transaction volume and seen 327 watches being tokenized in 8 weeks.

• Although luxury watches is a niche market, a study shown by Robb Report shows how 41% of GenZ acquired a luxury watch in the last 12 months with an average spend of $10k per watch.

c) Wand Protocol

• Wand Protocol offers structured products on Blast to leverage long/short stable assets without the risk of liquidations.

• They enable this via a pooled CDP model where everyone shares a common CDP to make over-collateralised values uniform and tradable.

• Wand has secured strategic partnerships with the likes of Redstone, BlastID, Natrium and MonoSwap.

.png)

32

32

Great curated newsletter, and thanks for the shoutout for our AO research article at chainofthought.xyz! I appreciate it. - Teng