Signum Newsletter 10

Weekly alpha for your weekend reads

This edition of the newsletter dives into a Decentralised Science (DeSci), a narrative that is relatively under-looked but gaining momentum and the different use case of (potential) tokens. We'll also share some interesting articles, portfolio updates and market highlights.

Special thanks to YY, Melvin, Adna, Nikos, Keith and Ash for their help.

1. Research Articles

a) Abstracting Chains

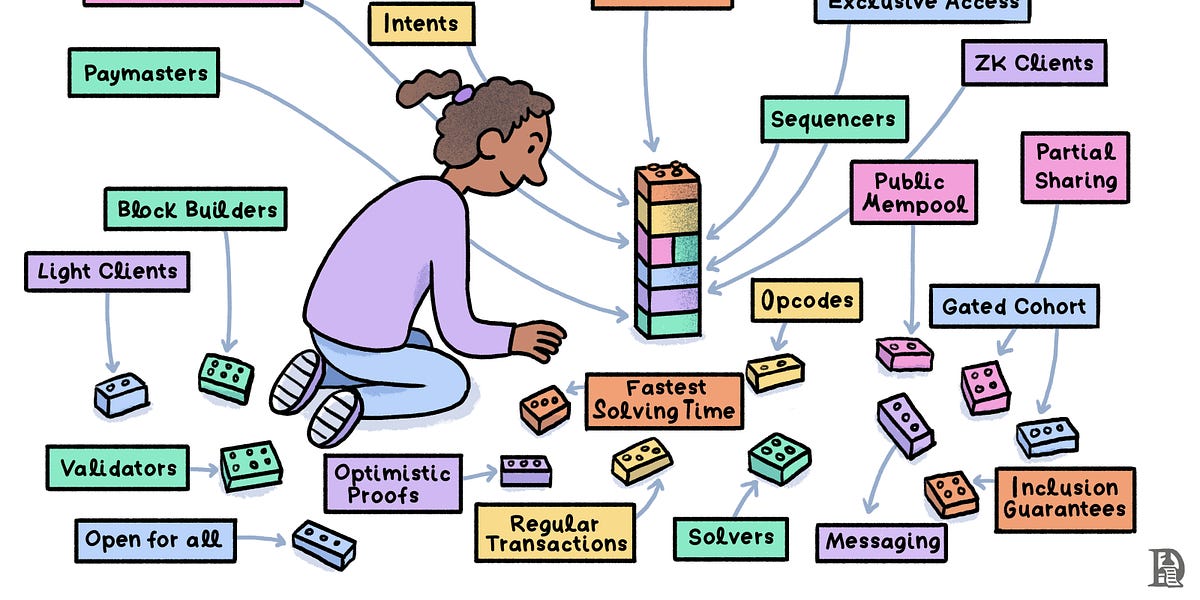

• The article discusses the current state, challenges, and potential solutions of the multi-chain world, with a focus on chain abstraction and its potential to reshape the crypto industry.

• In a chain abstracted world, there will be no chain distinctions (all chains will be treated the same, and users will belong to all of them) and easy asset movement (tokens and NFTs can be easily transferred between chains using existing cross-chain solutions and new intent-based ones).

b) Rollups Are the Final Frontier of Scaling

• The article discusses the scalability limits of L1s and L2s. While L1s are limited by consensus and network bottlenecks, L2s are constrained by hardware limitations.

• Implications of scalability for interoperability between rollups highlights the need for efficient and scalable solutions like the one developed by Polymer (a Signum Capital portfolio).

2. Portfolio Highlights

a) Pichi Finance

• Pichi Finance staking for $PCH is live.

• Holders can stake their $PCH tokens for a 3x points multiplier that will be included in the airdrop season 2 campaign.

b) Soneium

• Sony blockchain Soneium partners with Transak for global fiat on-ramp services to enable users to employ traditional payment methods to onboard into the ecosystem

c) Tap Protocol

• The Tap Protocol team explains how revolutionary Digital Matter is since Bitcoin’s raw data block being used in June 2023 used to create entirely new asset classes out of Digital Matter on Tap.

d) Mina

• Mina releases its fungible token standard, where builders can create and manage custom tokens with a specific use case for RWAs or DeFi.

• Key features include custom token creation, unique token identifiers and transfer capabilities.

3. Decentralised Science (DeSci)

Introduction

In the early days of crypto, DeFi was one of the sole use cases in the space apart from store of value and payments/cross border remittences. As the industry evolved, we witnessed a surge of innovations that transcended finance — crypto applications integrating with AI, tokenizing real-world assets (refer to our previous newsletter), and much more. However, one vertical remains largely under the radar: Decentralised Science (DeSci).

You might be wondering, how exactly do we decentralise science? To put it simply, the goal of DeSci is to create a global and transparent ecosystem for scientific research. DeSci seeks to establish public infrastructure for the fair and equitable funding, creation, review, crediting, storage, and dissemination of scientific knowledge.

By building out a decentralised infrastructure for research tooling, funding, and communication, DeSci encourages scientists to share their work openly, making scientific knowledge accessible to all. This decentralised approach enhances transparency and fosters innovation by allowing unconventional ideas to thrive, free from the constraints of traditional, centralised systems. In this article, we will be taking a closer look at DeSci protocols and products, shedding light on how the services they provide differ from that of traditional science.

Decentralised Autonomous Organisations (DAOs) and fundraising platforms

DAOs have been one of the most highly adopted crypto models in the DeSci vertical. Many DeSci DAOs are set up with the vision of fair scientific funding, as well as promoting research ownership through intellectual property (IP)-NFTs.

The traditional model for scientific funding is often inefficient, biassed, and conservative. This approach stifles innovation, as grant funding tends to concentrate among senior researchers with safer, less groundbreaking projects. Crypto offers an opportunity to revolutionise this system by leveraging decentralised and transparent funding mechanisms such as retroactive public goods funding, quadratic funding, and more. This not only democratises access to funding but also empowers researchers to pursue innovative ideas, free from the barriers of traditional gatekeeping.

IP in traditional science is often trapped within universities or biotech firms. IP-NFTs address this limitation by establishing transparent and equitable value distribution for scientific work. IP-NFTs also allow for fractional ownership, enabling all stakeholders to benefit from all transactions tied to their contributions. These NFTs can serve as keys to decentralised repositories of research data, making it easier to share, access, and monetize scientific work.

Below, we look at some areas of science that could be decentralised.

a) Data infrastructure

Currently, health or biological data is collected and handled in a way that does not give individuals autonomy over how it is utilised. However, with decentralised data infrastructure in place, users maintain ownership of their data and can track how it’s used through blockchain technology. Users can now collect and sell their data on decentralised marketplaces, ensuring they receive fair compensation while maintaining privacy. Additionally, blockchain technology ensures data provenance, enabling users to know exactly how and where their data is being used.

b) Decentralised biobank

Unlike traditional biobanks that are centralised and often limited in accessibility, decentralised biobanks leverage blockchain technology to democratise access and ensure transparency. These biobanks allow individuals to store and share biological data securely, with governance managed by DAOs to ensure ethical use. Participants can directly benefit from the data they contribute, either through financial rewards or by influencing how their data is used in research. The project Amino Chain comes to mind here.

c) Decentralised research platforms

Decentralised research platforms enable scientists to access and share research resources such as laboratory access and scientific computation models without the need for intermediaries. By tokenizing access to these advanced scientific tools and services, these platforms break down barriers for underfunded researchers, fostering global collaboration and innovation. ResearchHub is operating in this vertical, see below for a more detailed write-up.

Interesting DeSci protocols

In this next section, we will dive into some interesting DeSci protocols and their product offerings, as well as how they work.

a) ResearchHub

ResearchHub (Brian Armstrong, the founder of Coinbase, is also the co-founder of this project) is a decentralised platform for open publication and discussion of scientific research. It created a framework for scientists to efficiently raise funds, while still being able to spend the majority of their time on research. Additionally, ResearchHub also provides easy access to research peer review and eliminates barriers to participation in scientific research.

Traditionally, academic publishing is done in the form of scientific journals. ResearchHub has created Hubs in place of journals, which allows for streamlined and open publishing of scientific or academic content. The platform also allows for collaborative drafts before publishing. Users can earn ResearchCoin, $RSC by sharing, critiquing and peer-reviewing various kinds of scientific research, as well as via developing open-source features for the platform. $RSC also gives users the ability to create research bounties, tip other users, and participate in governance.

By financially incentivising and reaffirming positive actions on the platform with $RSC, ResearchHub properly recognizes and rewards users who contribute positively to the community.

Examples of actions rewarded on the platform:

• Peer reviews are awarded $150+ in RSC per quality review

• Sharing non-copyrighted research paper PDFs

• Engaging in discussions on scientific research

• Developing open-source features

ResearchHub takes a bold approach to scientific publishing, challenging the traditional limitations of academic journals. By providing a platform where research can be freely shared, critiqued, and developed, it empowers fair participation and pushes the boundaries of how research is funded, published, and evaluated today.

b) BIO Protocol

BIO Protocol is a curation and liquidity protocol that accelerates biotechnology by giving global communities of patients, scientists and biotech professionals the ability to collectively fund, build and own tokenized biotech projects and IP. They aim to establish a decentralised economy of scientific communities, BioDAOs, and create deep liquidity for the scientific IP they develop.

The platform has 5 main functions:

• Curation: $BIO token holders can stake $BIO tokens on BioDAOs they want to be accepted into the BIO network.

• Funding: Once accepted into the network, these BioDAOs can fundraise using the BIO Launchpad and direct funding towards research initiatives, IP assets, and more. BIO protocol also provides BioDAOs with custom token sale, airdrop and treasury allocation mechanisms

• Liquidity: The BIO protocol bootstraps on-chain liquidity for BioDAOs by using tokens in the BIO treasury. The $BIO token can be paired in liquidity pools with bioDAO tokens as well as with other assets.

• Incentives: The BIO protocol can issue $BIO incentives to BioDAOs for achieving key milestones related to the development of the BIO network

• Governance Layer: The BIO protocol holds various bioDAO tokens in its treasury which serves to govern a wide range of bioDAOs and scientific IP assets.

$BIO token holders are encouraged to partake in governance activities to continually improve the network and its processes. BIO Protocol is reshaping how biotechnology is funded, developed, and owned. By leveraging blockchain technology, it breaks down traditional barriers to innovation. The platform empowers patients, scientists, and professionals to take part in building and governing biotech initiatives, setting a new standard for advancing biotech transparently and inclusively.

Concluding thoughts about why DeSi has yet to take off

Despite the best efforts put forth by the decentralised science community to overhaul current research processes, this grand vision cannot be fulfilled just yet. It is true that blockchains and crypto infrastructure open up a myriad of possibilities, but there are several challenges such as legal regulations and scepticism due to its nascency. This scrutiny is further exacerbated for a vertical such as DeSci, which involves sensitive topics such as healthcare, longevity research and biotechnology.

It is also prudent to point out that at present, most protocols and products offered in the DeSci vertical revolve around DAOs. The lack of clear legal recognition and regulation in most jurisdictions is a challenge for DAOs, leaving them exposed to potential liability. Without concrete legal frameworks put in place, DAOs may run into more legal issues with respect to asset ownership and management, as well as other matters related to compliance.

While there has been a wave of innovation in the DeSci vertical, not enough has been done on the legal front for the DeSci protocols to reach their full potential. Nonetheless, this is a vertical that is brimming with potential and will likely see a breakthrough once legal frameworks are more established in the near future.

Unfortunately, we could not cover all the DeSci protocols in this article, but for a curated repository please visit our open-sourced database of projects building in this vertical (link below).

Thank you for reading this article and we hope that it has given you some insight into the current state of DeSci. Signum Capital is open to investment opportunities in the DeSci space, in particular, we are looking for projects who have sound business models and use-cases, as well as good utility for their governance tokens. If you are a founder who is interested in speaking to us, do reach out at management@signum.capital, or contact @ahboyash on Telegram or Twitter.

This article was written by 0xsamoyed

4. Kettle Finance

Own luxury watches and make them work for you

As fellow watch enthusiasts, we understand the allure of a growing collection, especially when the cryptocurrency market is booming. In comes Kettle Finance building to innovate on the the luxury watch market where users can leverage on their existing timepieces. Despite a projected growth to $134.53 billion by 2032, the industry faces disruption. Think: verification headaches for buyers and liquidity challenges for sellers.

Here's where Kettle Finance comes in – the revolutionary marketplace for luxury watch traders with a blockchain twist. Imagine it as a platform for Real-World Asset (RWA) luxury watches:

• Trade Watches Digitally or Redeem Physically: Each watch is paired with an NFT, guaranteeing authenticity. You can trade the NFT digitally or redeem it for the physical watch at any time – a one-to-one exchange.

• Last-Mile Security: Rest assured, Kettle utilizes secure international couriers with added insurance to ensure safe delivery.

• Passive Income with Watch Vaulting: Store your watch with Kettle and earn 1% in royalties every time it's traded on the secondary market (until you redeem it). Every item is also insured by Lloyd's of London for up to 100% of its value.

• Peer-to-Peer Lending Platform: Need liquidity? Leverage your watch for a secure loan with customizable terms and refinancing options, all within the platform.

To get started, visit the marketplace at: https://kettle.shop/marketplace.

This article was written by LunchKakis.

Disclaimer: Kettle Finance is a portfolio company of Signum Capital. This information is for general informational purposes only and does not constitute professional or investment advice.

PCH STAKING DASHBOARD LIVE

PCH STAKING DASHBOARD LIVE

178

178