Signum Newsletter 2

Weekly alpha for your weekend reads

This edition of the newsletter dives into zk-coprocessors, exploring what they are and their market potential. We'll also share some interesting articles, portfolio updates and market highlights.

Special thanks to YY, Melvin, Adna, Nikos and Ash for their help.

Please do enjoy reading,

Ash

1. Research Articles

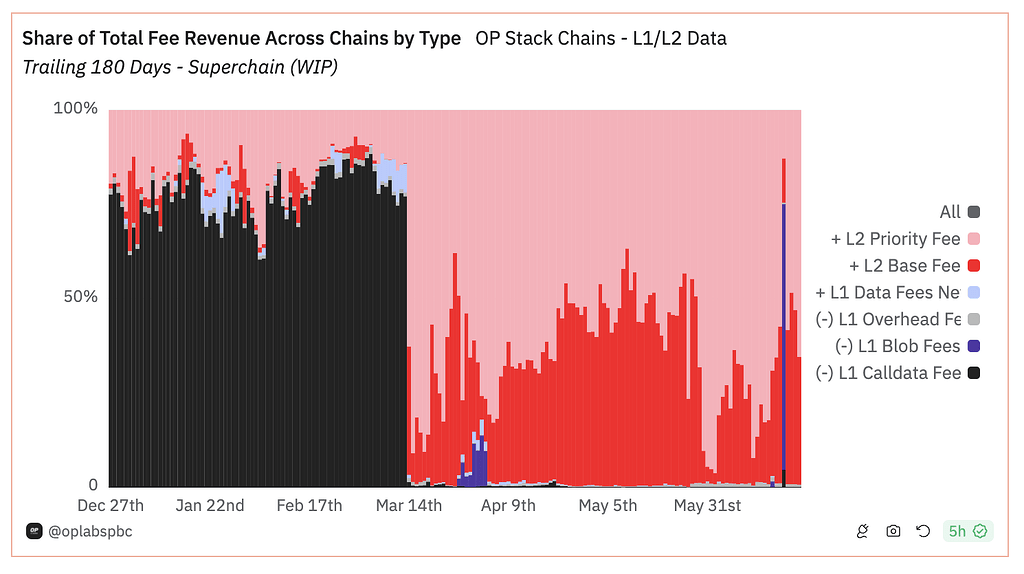

a) It's time to talk about L2 MEV

• The Dencun Upgrade has led to a significant reduction in L1 fees paid by L2s with the transition leading to an overall decrease in average total gas fees across L2s by approximately tenfold.

• MEV activities on L2s are largely unquantified, but open source datasets and research exist. Atomic Arbitrage MEV volume across six major L2s is $3.6 billion, while Sandwich volume is significantly lower due to single sequencer setup.

b) Do airdrops hurt more than they help?

• Airdrops have the benefit of decentralizing a protocol, reward early users, align incentives, and solidify a strong initial community.

However, with the amount of on-chain users increasing and industrial farmers (sybillers), airdrops these days leave most users unhappy which alienates its user base and leak massive amounts of value to sybils.

• Current trend of airdrops follow a points program or airdropping to strong token/ NFT communities.

c) Hyperliquid: the high performance era

• Hyperliquid is a self-funded (no VC or insider funding) and custom-built, performance-optimized L1 developed to operate a seamless perpetuals DEX, and uses a custom consensus algorithm called HyperBFT.

• Risks to Hyperliquid's traction include smart contract risk, execution risk and competition (other perp DEXes or CEXes).

• Hyperliquid is a promising scaling solution for Ethereum, with fiat on-ramps, lending market, perpetuals liquidity, swap front-end, and more in development.

d) MEV landscape in the parallel execution era

• This article explores the challenges and considerations involved in designing a Miner Extractable Value Auction (MEVA) infrastructure for Monad, a high-performance blockchain with deferred execution.

• MEVA is crucial for optimizing block production by mitigating negative externalities and aligning incentives.

• Monad's MEVA design needs community collaboration - researchers, developers, and validators need to work together to create a robust and efficient system.

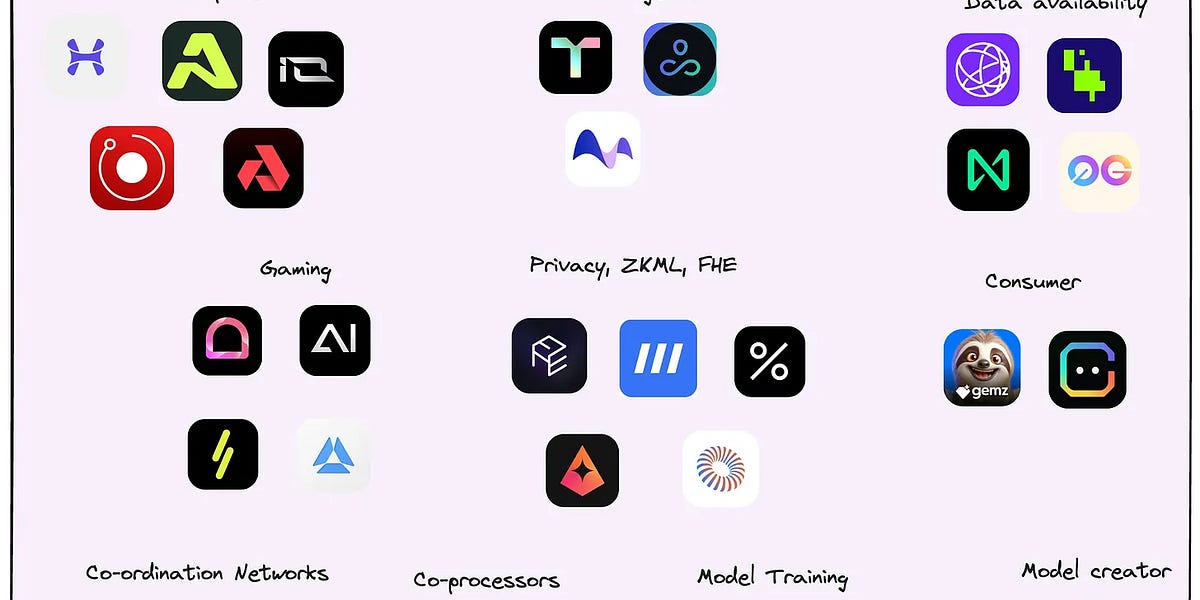

e) A deep dive into the crypto x AI ecosystem

• Crypto x AI is a rapidly growing field that aims to leverage blockchain technology to improve various aspects of AI, such as data availability, privacy, and efficiency.

• Subcategories include compute, AI agents, data availability, privacy, gaming, consumer AI, coordination, coprocessors, model training and model creation.

• Shoutout to our portfolio Myshell which was included in the article. Myshell is developing an AI consumer layer that connects users, creators, and open-source AI researchers.

f) What's the deal with BGT?

• BGT (Berachain Governance Token) lies at the heart of Berachain's tri-token model used for governance and staking. BGT can only be obtained by providing liquidity (PoL - proof of liquidity) to a list whitelisted dApps on Berachain.

• The collaboration between BGT <> dApps on Berachain modernizes token value, and revamps governance entirely.

• The flywheel for BGT occurs due to 3 stakeholders making up the demand for the token: users (on-chain actions rewarded with more governance power), dApps (supplement native token emissions with BGT to attract more users) and validators (maximise voting power and revenue).

• One of the initial crucial applications for facilitating this flywheel is Signum's portfolio - Infrared Finance. Infrared’s PoL based liquid staking makes it simple for users to deposit BGT into Infrared vaults and earn rewards, made possible through their iBGT (liquid + tradable version of BGT).

2. Portfolio Highlights

a) IX Swap

• IX Swap bridges the gap between TradFi and blockchain by leveraging on DeFi infrastructure to facilitate issuance and trading of real-world assets (RWA).

• Signum Capital x UOB Venture Management recently backed IX Swap in their attempt to transform the blockchain space. With our expertise and industry connections, we are well-positioned to facilitate IX Swap’s growth to aid it in achieving their ambitions.

b) Kakarot

• Kakarot public testnet is now live for builders to experiment with deploying smart contracts and users to test out dApps.

• Important point to note: users of the testnet will earn cross-dApp tokens through community-driven interactions (alpha IYKYK).

• Users can head over to https://sepolia-faucet.kakarot.org/faucet and connect their on-chain wallet to the faucet for gas tokens and try out dApps like Izumi Finance and Hisoka Finance.

c) Artela Network

• Artela Network is the first extensible L1 blockchain with parallel execution and modular VMs.

• They have an emphasis on 'Full-Stack Parallelization,' aiming to fully unlock blockchain scalability and enable dApps to have predictable performance.

• In their new blog post, Artela proposes the Elastic Block Space (EBS) solution, which provides independent scalable block space for high-demand DApps.

d) Sipher (Ather Collective)

• Sipher recently rebranded to Ather Collective - where they envision a suite of innovative products beyond a single IP, spanning gaming, entertainment and AI.

• The Ather Collective is a decentralized ecosystem of builders and products that fosters innovation through guided principles of collaboration, creativity, and community empowerment.

• Their play2airdrop campaign is now live where users complete a series of quests to get multipliers and enjoy future $AETHER token rewards.

e) Arrakis

• Hybrid Order Type (HOT) AMM is a new a new MEV aware AMM designed by Arrakis Finance and Valantis Labs.

• Retail LPs are suffering from rising toxic flow (phenomenon of exploiting price discrepancies in trading) from arbitrageurs on traditional AMMs, while Private Market Makers (PMM), empowered by Intents Protocols, capture all the favourable flow within a restricted network of market professionals.

• The HOT Liquidity Module gives on-chain LPs access to non-toxic, intent-based order flow while protecting from latency arbitrage

• Thanks to Valantis' modular infrastructure, HOT combines a standard AMM with a novel "flash swap" feature through the Arrakis Quoting Service. This RFQ system offers permissioned solvers guaranteed quotes, driving more flow and fees to LPs. Valantis’ unique reserve model achieves efficient CEX-like pricing and processing high volume akin to PMM. HOT AMM also protects passive LPs from MEV and centralized sources of liquidity, preserving the important backbone of DeFi permissionless liquidity.

f) Derivio

• Derivio's Modular Layer 2 (L2) solution aims to significantly enhance Ethereum's scalability, allowing for an impressive increase in orders per second.

• Their modular architecture optimizes performance, security, and scalability with specialized layers such as Turbo VM, Ethereum security, and EigenDA. This combination of technologies enables dApps to run efficiently, securely, and with high reliability.

• In short, Derivio offers advanced shielding, runtime-native modularity, and atomic invariants to create secure, flexible, and high-performance decentralised applications.

g) Chromia

• Chromia releases their MVP mainnet on 16th July indicating an early launch with essential features for public testing

• The Chromia token ($CHR) will natively exist on the network and serve as gas and platform currency for all dApps and activities hosted on the network.

• The $CHR tokens that reside on Ethereum mainnet and Binance Smart Chain will be bridgeable to Chromia Network on Day 1, via the Chromia Vault (other assets can be bridged upon deployment of a custom bridge).

3. Introduction to zk-Coprocessors

zkCoprocessors, although still not very well known yet, is a term that has been slowly gaining popularity. The entire thesis of this innovation lies in the fact that power is given to developers to perform intricate + intensive computation without adding additional trust assumptions and at a low cost.

Note: we agree that the nomenclature used may not be entirely accurate. This is to focus on simplicity for non-technical readers.

Proving something that is true in the form of zkVMs and co-processors:

• zkVMs: usually built as rollups (think of Starknet, Scroll, zkSync) which provides and environment for smart contracts to prove certain things.

• Co-processors: takes the proving process off-chain but submit the verifiable data on-chain.

With zkCoprocessors, we look to answer the question of what can currently be done on centralised platforms that cannot yet be done on decentralised alternatives.

Before we continue, let us briefly recap where the idea of zkCoprocessors come from and break down all of the moving parts by visualising Ethereum as a computer architecture:

• Ethereum: the super-computer where smart contracts reside on to execute different tasks. Ethereum can thus be viewed as a computer’s main processor, which is the central processing unit (CPU) that does important + intensive tasks. At times, the CPU becomes overloaded if computations get too complex.

• Coprocessors: this is where a co-processor comes in —> an assistant that helps out the CPU with less intensive, but specific jobs. This frees up the CPU to focus on important tasks, thus making the entire computer run faster —> extra power to help the computer run smoothly. An example of a coprocessor is a GPU (graphics processing unit) which helps the CPU do large scale computations. This division of labour helps to improve the computer’s performance.

• Zero Knowledge Proof (ZKP): allows a party (prover) to prove to another party (verifier) that they know the answer without revealing the steps taken to derive that answer/ any other additional information. This essentially provides the receipts back to the blockchain that the computation was accurately performed.

• Zero Knowledge virtual machine (zkVM): usually built as rollups (think of Starknet, Scroll, zkSync) which provides an environment for smart contracts (like a special computer program running within another program) to prove certain things with ZKPs - benefits are increased privacy + efficiency.

Now that we know what are zkVMs + coprocessors, putting it together will mean that zkcoprocessors aid the main processor (e.g. Ethereum mainnet) in specific tasks while using zkVMs to keep the data private.

Simple flow: combining the 2 methods —> getting data from the blockchain —> use zk technology for the off-chain processing (indexing + calculations) —> generates a proof —> feeds the data to on-chain smart contracts —> use zk to verify + prove the results are genuine. Note that the zkProof is also stored in a smart contract/merkle tree for everyone to verify.

Areas where zkcoprocessors may be helpful include:

• dApps: zkcoprocessors can help verify transactions on a a specific L1/L2 without revealing all the transaction details.

• Compute: Sensitive calculations can be performed without exposing the data itself.

With zkcoprocessors, it users zk tech to produce a verifiable cryptographic proof of computation (done off-chain) + They are able to handle large sets of data without imposing additional overhead on-chain and as well providing user privacy.

There are a myriad of benefits to the use of zk-coprocessors including:

• Making the blockchain a more efficient and scalable platform for dApps - blockchain to handle to primary computations while all others should be done by the zkCoprocessors.

• Outsource complicated and intricate zk technology to 3rd party will be an advantage to developers.

• This will hopefully open up more interesting use cases such as data-rich applications in DeFi to on-chain gaming; and allowing access to historical data to provide data-driven actionable insights.

There are a number of projects operating in this vertical including Brevis, Axiom, Lagrange and Herodotus. In the next article, we will dive deeper into Brevis of which we found to have the most potential.

4. Market Highlights

Since June, we have had a number of negative news such as the Mt. Gox distributions (so far, 47,228 BTC have moved - track here: https://goxxed.org/), German government selling BTC on the open market and SEC suing Consensys over Metamask staking service and alleges Lido and Rocketpool staking programs to be securities.

On the flipside, there are a number of reasons to remain bullish as well including:

• ETH ETH flows after S1 approval (mid to end July)

• Crypto adoption as one of the main topics of the upcoming US election

• Solana ETF by filed by VanEck

• Future rate cuts by the US government

We remain optimistic about the next year and look forward to backing teams building exciting solutions/applications in crypto especially in AI x crypto, gaming and consumer apps.

Before we end today's newsletter, we wanted to leave you with an analysis done by Ceteris where he provides a snapshot of how different sectors/altcoins fare against BTC and ETH.

From the table below we can see how the Modular and Cosmos related ecosystem fare the worst when comparing against the BTC and ETH benchmarks.

122

122