Signum Newsletter 4

Weekly alpha for your weekend reads

This edition of the newsletter dives into the revival of DeFi 1.0 with a case study on Convex Finance. We'll also share some interesting articles, portfolio updates and market highlights.

Special thanks to YY, Melvin, Adna, Nikos, Keith and Ash for their help.

Please do enjoy reading,

Ash

a) From speculation to credible neutrality

• Mixed feelings on crypto finding PMF even with the market's maturity and emergency of various interesting protocols since most of them rely on speculation. Speculation helps the market and industry achieve scale, but for it to be justified, the industry must ultimately find a suitable PMF.

• Blockchains however brings credible neutrality into the digital realm - especially when the flaws of centralised systems become evident.

b) How a 7-Year-Old Can Understand FHE / Fully Homomorphic Encryption

• Encryption = keeping info confidential ; homomorphic = allowing delegation calculations to an untrusted party without revealing sensitive numbers ; FHE = allowing any number of encryptions to prevent untrusted party form snooping on private data, achieving “having it both ways.”

c) The fat bera thesis

• Applications built with PoL at the forefront will capture the majority of value in the Berachain ecosystem.

• Berachain will change the way applications are valued proportionately for the amount of work they put in - blockchains derive value from successful apps and infinite economic games can be played by all parties.

d) Attributions in crypto

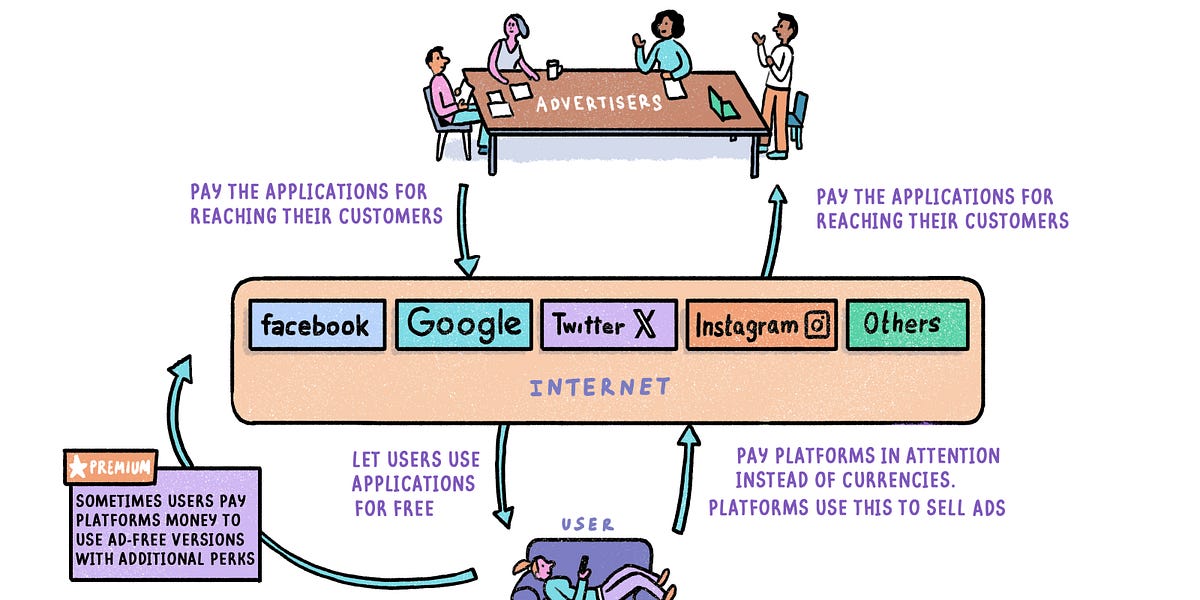

• Free content runs the web. But in order to make something “free,” you need to be able to attribute value to the eyeballs that pay attention to it

• Marketers track a user’s journey from click to purchase, and the rise of Web3 with a potentially game-changing approach to ad tracking through open-ad networks.

e) The Economics of L3s

• The article shows that L3s struggle to break even unless they either do 50M+/month transaction volumes or keep fees within 3x of L2s.

• Dramatically lower fees for L3s creates a challenge = they cannot rely on sequencer fees as their primary revenue source.

• As a result, L3s must differentiate from L2s on things like scalability, customizability, and community ownership.

f) The Trustless Economy - Understanding Ethereum

• Humans are fundamentally reliant on trust for society to function. From personal relationships to global economic systems, trust is the glue that binds us together.

• To enable the next wave of vast and advanced societies of cooperation there must be a new supporting structure that allows for it - this is in the form of smart contracts.

g) Lending and stablecoins

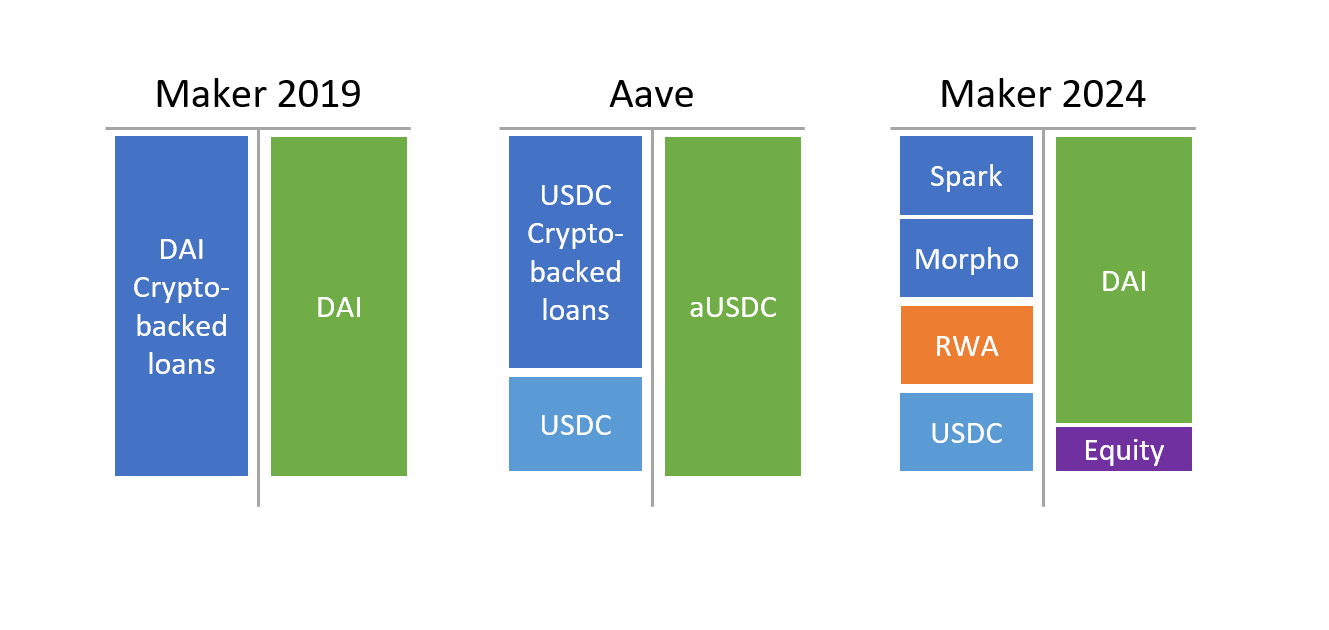

• The article explores the intrinsic connections between lending protocols and stablecoin issuers - stablecoins not only originated from lending protocols, but lending protocols themselves can be seen as a type of stablecoin issuer.

• As lending protocols have become more specialized and established, it has started to make sense for stablecoin issuers to delegate this component - this is for distribution and liquidity improvement.

h) Web3 Marketing

• Crypto marketing is difficult due to limited channels (Twitter, Telegram, WeChat, YouTube) and high barrier of entry for new participants.

• The solution is foundation (focus on users needs) + culture (collaboration among users) + communication & solidarity (understanding different contributors).

a) Startale

• Startale introduces several advancements such as integration with key partner, Astar Network, and establishing their Startale Cloud Services.

• Solutions by Startale enables companies to seamlessly transition from traditional infra to crypto.

b) Solv Protocol

• Solv Protocol announces the 3rd epoch of SolvBTC.BBN (SolvBTC Babylon) opportunity for Bitcoin holders.

• This will open on 19 July with a 500 SolvBTC cap. Networks supported includes Ethereum, BNB Chain, Merlin Chain, Arbitrum and Mantle.

c) Infrared Finance

• Infrared Finance introduces $iBERA which will be a liquid staking solution for $BERA

• $BERA’s role has expanded beyond a native gas token and is now used by validators to secure the network, produce blocks, and earn rewards - but involves locking capital up.

• $iBERA provides a LST (liquid staking token) solution which is a liquid token backed 1:1 by $BERA to allow users to use it in other DeFi applications.

d) UXLink

• UXLink is a web3 social platform and infrastructure for users and developers to discover and distribute crypto projects and assets in socialized and group-based manners.

• Their token went live on 18 July and is now traded on centralised exchanges such as OKX, ByBit, Gate and KuCoin.

e) SeaSeed Network

• Tether announces a strategic collaboration with D3 Labs, the company behind SeaSeed Network aiming to build a new blockchain trusted by leading regional financial institutions to tokenise their financial assets.

• The MoU with D3 Labs could potentially expand Tether's footprint in Southeast Asia as part of their commitment to fostering a thriving blockchain ecosystem.

Lately, with the low float/high FDV controversies running around, there’s been some newfound interest for coins that are of higher float and almost fully vested and circulated. Particularly, the spotlight has fallen on DeFi 1.0 once again. We’re here to figure out if these OG DeFi dApps have what it takes to rise like a phoenix from the ashes.

Intro to DeFi 1.0

DeFi 1.0 consists of dApps built by those considered to be the forefathers of the DeFi space such as Uniswap & Curve (DEX), Aave & Compound (money markets) and Synthetix (derivatives). These dApps served as the building blocks of every ecosystem, providing services such as swaps and lending & borrowing.

Today, many of these dApps and communities are very much still alive and heavily utilised. Some examples are as follows:

These tokens have extremely high MCAP/FDV ratio; are almost fully vested. Most of these protocols also feature good DeFi activity and business models in place, cementing themselves as fee generating machines. Another reason to note is that these protocols often have communities that are engaged in governance activities such as proposing proposals for improvements and voting on them as well. These pointers give these protocols a stronger fundamental value proposition.

Case study: Convex Finance

Today we take a closer look into Conex Finance, which once upon a time, was all the rage, mentioned and loved all over CT especially during the Curve Wars era in 2021. Convex Finance originally started out with the goal of optimising yield for Curve.fi users by aggregating Curve.fi’s governance token, $CRV.

Currently, Convex Finance has expanded and integrated similar protocols to Curve.fi such as Frax Finance, Prisma Finance and FX protocol, opening up more yield and opportunities for $CVX holders.

How does Curve Finance work?

To keep this simple, I will be referencing Curve in this thread. But note that this generally applies to the other protocols that Convex has integrated with.

Curve Fiannce is a DEX and AMM which incentivises LPs with CRV rewards. Curve users have the option to lock $CRV to receive $veCRV based on the lock duration and the amount locked. Locking is not reversible and $veCRV tokens are non-transferable. By holding $veCRV, LPs can boost their $CRV rewards up to 2.5x by collecting a portion of the fees from swaps and loans that occur on Curve. LPs can also deposit their LP tokens into Convex Finance to earn trading fees and claim boosted $CRV without locking $CRV.

Who should use Convex Finance?

$CRV holders can irreversibly convert $CRV to $cvxCRV which is then staked on Convex. $cvxCRV earns users token rewards in the form of governance tokens ($CRV, $CVX) or stablecoins ($3crv, $crvUSD).

LP here, stake there, convert this, but what’s the big deal? To understand this, let’s dive into $CVX. Users can stake CVX to earn a portion of the platform’s revenue, distributed as $cvxCRV tokens. Users can also opt to lock $CVX for a minimum of 16 weeks, earning a share of platform fees. More importantly, $vlCVX gives voting weight for Curve, Prisma & f(x) emissions weight votes. $vlCVX holders can redirect these external incentives to certain liquidity pools via the Votium bribes platform.

The Curve-Convex integration once brought Convex Finance to fame, dubbing it as DeFi’s Kingmaker. Up till today, more than $800 million USD worth of $CRV has been farmed by Convex.

Additionally, the number of Weekly Active Users (WAUs) who deposit Curve LPs into Convex is largely consistent.

Accounting for the slight deviations caused by the weekly vlCVX unlocks at the end of every epoch, it can be seen that around 50-60% of $CVX is being locked up constantly.

With recent buzz around VC coins that are low float and high FDV, $CVX sits on the opposite camp. As of writing, $CVX sits at a market cap of $198.7m, while having a FDV of $227.1m; $CVX has a MCAP/FDV ratio of 0.87. As it currently stands, Convex still commands a good amount of DeFi activity, has healthy tokenomics which reduces sell pressure, and is an extremely high float coin.

After this analysis, we wanted to ask what do you readers think, is $CVX making a comeback or would retails/whales chase the new shiny thing in DeFi?

Relevant links for the article:

• Token Terminal: https://tokenterminal.com/terminal/projects/convex-finance

• DeFiLlama: https://defillama.com/governance

• Dune Dashboard: https://dune.com/0xsamoyed/convex-finance

240

240