Signum Newsletter 5

Weekly alpha for your weekend reads

This edition of the newsletter dives into the landscape of Solana MEV and also our plans for Token 2049. We'll also share some interesting articles, portfolio updates and market highlights on the Ethereum ETF flows.

Special thanks to YY, Melvin, Adna, Nikos, Keith and Ash for their help.

Please do enjoy reading,

Ash

1. Research Articles

a) Zero-Knowledge Proofs: An Introduction to the Fundamentals

• This article explores the underlying theory, mathematics, and cryptography that powers zero-knowledge proofs.

• After which it shows how to apply said learnings to Solana to contribute to the overall discussion and development of zero-knowledge proofs.

b) Does MegaETH Work?

• A review / personal thoughts on the MegaETH whitepaper and the problem areas it highlights --> TLDR: am EVM-compatible, real-time blockchain built to bring web2-like performance to crypto.

• Other than architectural improvements and scalability, there’s still a massive need for inter-rollup shared liquidity and cross-chain tooling to make the experience on rollup A equivalent to that of rollup B.

c) How Babylon Works

• Restaking is getting really popular lately. It lets people make new services and systems that are safe and decentralized, just like Bitcoin and Ethereum.

• Babylon lets people who own Bitcoin use their Bitcoin to help protect other kinds of blockchains. It's like using Bitcoin to keep other systems safe.

d) Chain Abstraction and MPC Protocols

• Chain abstraction refers to the concept of hiding the complexities of blockchain technology from the user experience.

• The goal is for users to interact with applications without realizing they are using a blockchain or knowing which specific blockchain is being used.

e) Stablecoins

• Stablecoins accelerate past 100M holding addresses to a staggering 107M, from a base of 95M, a gain of 13%.

• MiCA regulatory framework went into effect on the last day of June, placing significant restrictions on the issuers of stablecoins, which they called "E-money tokens".

f) The Next Wave of On-chain Consumer Adoption

• The next wave of on-chain consumer adoption seems to be happening on Base where projects are experimenting with cool ideas.

• The Base ecosystem is creating real on-chain utility and growth.

g) Polymarket, or how I learnt to love drama

• Regulated markets cannot offer political-event contracts, and this leaves a huge vacuum to be filled, and a massive opportunity for an upstart to dominant. Ultimately, prediction markets serve as an important source of data, and arguably is the closest source of truth.

• Prediction markets have become popular entertainment, blurring the lines between politics and digital fun. Technology has merged these worlds, changing how we engage with global events.

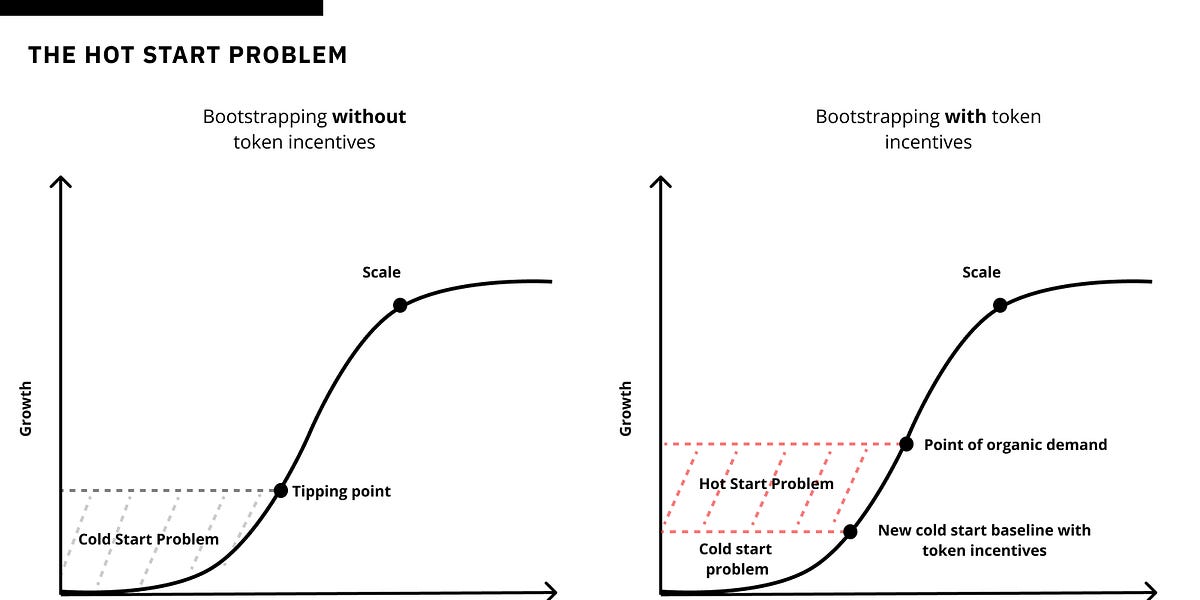

h) The Hot Start Problem

• When combined with new and innovative products, tokens – or the promise of tokens – have proven effective at alleviating the cold start problem.

• But while speculation brings the blessings of network activity, it’s also accompanied by the spoils of short-term liquidity and inorganic users.

2. Portfolio Highlights

a) Huma Finance

• Huma Finance introduces PayFi, which powers financing of global payments, with instant access to liquidity anywhere, anytime.

• “PayFi is the creation of new financial markets around the time value of money. On-chain finance can enable new financial primitives, and product experiences that are impossible in traditional or even Web2 finance.”

b) Kakarot

• Starknet uses its own Cairo VM and Cairo language, optimized for ZK proofs and scaling, unlike the EVM. Cairo VM allows efficient use of ZK proofs without requiring deep ZK knowledge from developers.

• Most developers still use Solidity for EVM, meaning many Ethereum dApps cannot utilize Starknet's scalability. To bridge this gap, Kakarot was created—a Cairo-based EVM implementation on Starknet launched in October 2022.

c) Ajuna Network

• BBB is the second collective-based game on Ajuna with AAA-like gameplay and unique twists.

• It tests a free-to-play model, affiliate system, and incentivized tournaments.

3. Solana MEV

In traditional Proof-of-Stake (PoS) networks, the block producer holds the authority to determine its contents. Miner Extractable Value (MEV) represents the potential profit gained by manipulating the order or inclusion of transactions within this block.

Solana's unique architecture is evolving the nature of MEV. While sophisticated traders and searchers are developing strategies to maximize profit and optimize transaction efficiency, Solana's short block times, rapid block propagation, and constant state updates limit the opportunities for value extraction compared to other networks.

Solana's stake-weighted multi-layer block propagation mechanism, known as Turbine, combined with its frequent state updates, reduces the window for searchers to profit from arbitrage and liquidations. To capitalize on these fleeting opportunities, searchers often establish close proximity to key network nodes, enabling them to quickly access the latest network state and execute trades ahead of competitors.

Status quo

Solana's Turbine mechanism propagates the network state by having the block leader distribute partial blocks (shreds) to a stake-weighted group of validators. To optimize their chances of successful trade execution, searchers often seek to control a significant stake directly or partner with a validator holding substantial stake. Once a profitable trading opportunity is identified, the searcher must swiftly execute the trade.

Currently, Solana experiences a high transaction failure rate, with approximately 50% of transactions labeled as spam. Due to the fixed network fee of 0.000005 SOL per signature, searchers frequently submit numerous orders to validators, overwhelming the system to ensure their transactions are included in blocks. This practice often leads to transaction sandwiching and failure. While users can include an optional priority fee to increase their transaction's importance, spamming remains the most effective and cost-efficient strategy for securing transaction execution within the current protocol.

MEV opportunities

a) Arbitrage: The simplest form of atomic arbitrage occurs when two decentralized exchanges (DEXs) offer divergent prices for the same trading pair. On Solana, this typically involves profiting from price discrepancies between an AMM with outdated quotes and an on-chain limit order book where market makers have adjusted their prices to reflect more current off-chain market movements.

b) Sandwich Attacks: A sandwich attack involves a MEV searcher manipulating the price of an asset by placing orders before and after a large pending transaction that is expected to impact the asset's price. The searcher profits by buying at a lower price and selling at a higher price, taking advantage of the price movement caused by the original transaction. This tactic is prevalent on decentralized exchanges where pending transactions are publicly visible before execution.

c) Liquidations: DeFi protocols incentivize third parties to liquidate undercollateralized positions to maintain protocol stability and liquidity. When a margin position approaches liquidation, as indicated by an updated oracle price, liquidators, including searchers, can seize the opportunity to close the position and acquire the collateral at a discount.

Case study: Jito

Jito is a company dedicated to addressing the spamming issue on Solana and enhancing transaction efficiency. The platform introduces off-chain auctions for partial block space and block construction, guaranteeing the execution of bundled transactions either in their entirety or not at all. By winning an auction, searchers can submit bundles for guaranteed inclusion in exchange for an additional tip to validators. This tip, separate from in-protocol priority fees, significantly increases validator earnings.

Jito's off-chain auction mechanism aims to reduce spam and optimize Solana's resource utilization by ensuring only winning bundles are submitted to the blockchain. Searchers can leverage these bundles for rapid and guaranteed transaction inclusion, as well as to execute arbitrage and front-running strategies.

Jito Mempool

The Jito-Solana client addresses the pervasive spam issue on Solana by introducing a Flashbots-like bundle mechanism. This effectively creates a virtual "pseudo-mempool" despite the network's native mempool absence. Over 65% of Solana validators rely on the Jito-SOL client, which temporarily holds transactions for about 200 milliseconds. During this brief window, searchers can compete for lucrative MEV opportunities by submitting bundles, with the highest-paying proposals forwarded to validators.

Solana's relayer landscape differs significantly from Ethereum's. Unlike Ethereum's centralized relayers connecting builders and proposers, Solana relayers manage incoming transactions, including verification and deduplication, before forwarding them to the block engine and validator. While sandwiching is a prominent form of MEV, as indicated by validator tips, Jito searchers can also capitalize on arbitrage and liquidation opportunities through bundle submissions. However, due to the escalating prevalence of sandwich attacks tied to meme-driven trading, Jito has temporarily suspended its mempool functionality.

Despite the current mempool hiatus, Jito's relayer and mempool solutions remain indispensable for validators. These tools not only generate additional revenue but also substantially reduce network spam, optimize transaction execution, and enhance the overall user experience.

Parts of the engine

a) Block engine: The block engine simulates various transaction combinations and conducts off-chain auctions for block space. The bundle offering the highest potential maximum extractable value (MEV) is then forwarded to the leading validator utilizing the Jito-Sol client.

b) Searchers: exploit price discrepancies by inserting transactions into blocks, using sources like Jito’s ShredStream or their own data.

c) Validators: build and produce blocks, reserving 3 million Compute Units for Jito transactions in the first 80% of a block.

Vertical integration is common, with validators often exerting full control over their blocks, enabling them to manipulate transaction inclusion, order, or censorship. Searchers exploit Solana's low transaction fees and unpredictable transaction scheduling by submitting transactions via RPC methods. This environment fosters persistent MEV opportunities spanning multiple blocks.

Potential solutions to mitigate toxic MEV

a) RFQ systems: In RFQ systems, orders are fulfilled by Private Market Makers (PMMs) instead of through an on-chain Automated Market Maker (AMM). Signature-based pricing facilitates off-chain execution, leading to more efficient price discovery and reduced spam, ultimately enhancing the user experience.

b) MEV protection: As observed in comparable solutions within the EVM ecosystem, RPC endpoints could potentially capture a portion of this value and subsequently return it to the user. Searchers could engage in a bidding process to secure the right to arbitrage a transaction, offering a corresponding rebate that would be refunded to the original user.

Conclusion

MEV is not inherently harmful. In fact, "good" MEV, such as arbitrage and liquidations, contributes positively to overall network health by improving market efficiency. Conversely, "bad" MEV exploits or disadvantages ordinary users, who may suffer financial losses or missed opportunities.

As Solana's ecosystem expands, the significance of MEV will undoubtedly grow. To address the challenges posed by "bad" MEV, innovative solutions like those pioneered by Jito, including off-chain RFQ systems, intents, and COW swaps, are expected to optimize network efficiency and enhance user experience.

4. Token 2049 Singapore

On 17 September 2024, together with UOB Venture Management, Signum Capital will organise 3 panels at OGBC Innovation Hub.

The topics for the panel include:

• What are the missing pieces for crypto mass adoption (Link: https://lu.ma/nijb29g1)

• Where is crypto heading to in the next 5 years (Link: https://lu.ma/v7jt3x1l)

• RWA, fact or fiction? (Link: https://lu.ma/yxe8h6n8)

If you are building something interesting in the space, or if you want to talk to our team to discuss ideas, do sign up and come and meet them!

5. Ethereum ETF

The ETF for Ethereum finally launched this week on 23 July 2024. Track the flows here: https://farside.co.uk/?p=1518.

305

305