Paradigms Driving Crypto Cycles

A lil history of technology + narratives driving previous cycles, and a new TG group!

[published @30K ft, enroute to ETH Denver]

This article builds context to understand what might occur in the next cycle. At the end I mention the technological paradigms associated with this early bull market.

If you want to ask questions or learn in real time — join our alpha group in telegram [push button]👇.

Introduction

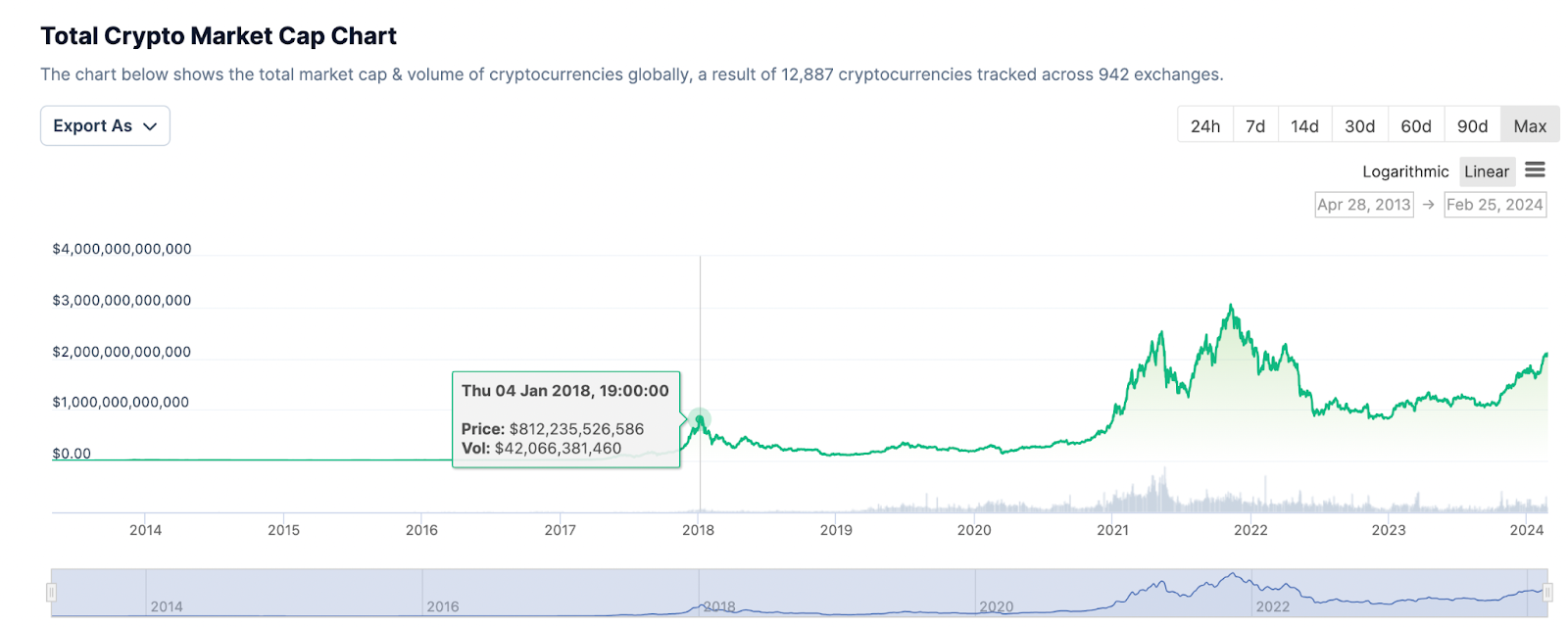

Markets cycle. They go up. They go down. The Tulip Mania of 1634-1637 provided one of the first examples of this socio-economic behavior. The Roaring 20’s led to the Great Depression of the 30’s, and unprecedented valuation of Internet companies in the 90’s led to a market crash in 2000. Cryptocurrency economies offer a market that exhibits a similar, but distinct pattern.

Each cycle is driven by technological narratives within the ecosystem and also FAIL due to these technologies being poorly executed or manipulated. Here I mention the tech narratives of past cycles, and touch on the narratives driving this early cycle we see today.

Note: I will not cover all technologies and failures, nor will I touch macro trend details. I will share the technologies I perceive to be most critical for each cycle.

Pre Cycle: 2013 – 2014

FWIW I didn’t experience this cycle, but I think it’s worth considering how changing demographics factors into market momentum.

In the first few years of Bitcoin’s launch, the community online using the network consisted of:

1. Drug dealers and customers,

2. Cryptographers, and

3. (very rarely) Investors.

In every cycle, the space expands into new demographics and institutions that drive market behavior.

Cycle 1: 2017 – 2018

I started following crypto in 2017, reading white papers about energy on the blockchain. I then fell down the rabbit hole, reading more than selling solar (my job at the time). Many of these white papers resulted in failed startups based on hand-wavey technology that didn’t exist. The market peaked early 2018 and then fell into a bear for two years.

The defining narrative and technology of this cycle: the ICO. Initial coin offerings offered a way for anyone with an internet connection to fund startup ideas. The technology launching most of these leveraged the most simple Smart Contract on Ethereum (an ERC20 contract).

Once funded, these tokens trade on Centralized Exchanges (CEXs), and many people with Alpha insight via the right networks became multimillionaires buying early.

The Bear: 2018-2020

Ultimately this cycle was driven most by marketing rather than usable technology, which was a key reason for the collapse. Very few applications existed on any blockchain network, and thus very few people used crypto outside of an investment on Coinbase. This realization along with the awful user experience offered by Crypto applications deflated the economic bloat over a fast ~12 month period.

Much of the promise in these cryptonetworks of 2017 failed to launch due to overoptimistic entrepreneurs selling an idea they did not fully understand and failed to execute.

After capital fled the space in mid to late 2018, the tide went out, and all these developers, entrepreneurs, designers, cryptographers, crypto anarchists, remote-first workers, etc. stayed around and appreciated the extent to which the ecosystem needed to evolve (there were no users). The opportunities to make an impact were abundant, and still are.

During that bear market, core Decentralized Finance (DeFi) infrastructure was created. Uniswap, AAVE, Compound, Maker DAO and many others created new ways to utilize internet money without an intermediary via smart contracts. These tools offered decentralized trading, decentralized lending, options trading, and stable coin protocols that ultimately drove the spark and foundational momentum for the two year cycle in 2020.

Cycle 2: 2020-2022

DeFi Summer: Spring 2020 – May 2021

The maturity of DeFi infrastructure led to Yield Farming. These technologies catalyzed the second cycle I experienced (2020-2022). The tech stack for DeFi opened up many new avenues for Debt Creation, Decentralized Exchange, and Gamified Token Distribution.

From my memory, things kicked off gradually in January due to Compound, Synthetics, and later Yearn.Finance introducing a new type of token distribution method called the “Fair Launch”. Traction continued to develop into the notorious “DeFi Summer” with unprecedented (+1000% annualized return) yield opportunities in different liquidity pools for various DeFi protocols. That said, these returns were constantly fluctuating and required a significant amount of active management.

Note: “Fair Launch” is no longer a term used today.

The reason people described this token distribution as a “Fair Launch” is because *anyone in the world* could theoretically participate. The limiting factor in this experiment was 1. Internet access, and 2. Investable capital. The process for distributing this “Fair Launch” yield happened in this way:

A DeFi protocol launches

This is typically a smart contract based system that allows for trading or debt to form. The important thing is that the system needs liquidity to run, and anyone with internet access and money can add liquidity!

The protocol creates a “Liquidity Farm” where protocol tokens are distributed to liquidity providers.

The “Liquidity Farm” essentially allocates a certain amount of protocol tokens to liquidity providers (LPs) on some consistent basis. As more LPs join a farm, the APY (annualized % yield) decreases.

At some point the market matures, triple digit yield is reduced to double or single digit yield, and liquidity moves to a new protocol offering higher opportunities.

This pattern still happens today. In the market at the moment there’s a furry of “points” systems ongoing that indicate a user’s personal contributions to a specific network (just search “Points Crypto” and you’ll see what I mean).

Ultimately, the “Fair Launch” more handsomely rewarded those with large amounts of capital, putting the name into question. Today we use Yield Farming.

NFT Mania: July 2021 – April 2022

I’m going to skip over the social token developments of late 2020 and NFT mania of 2021. The opportunities there are inherently social, marketing, and reputation based. Value relies less on technical innovation than financial products in the space. Ultimately the paradigms driving crypto in this cycle at the moment are protocol/DeFi driven.

The Bust: 2022 – 2024

Fast forward to May 2022. Terra Luna, a top 10 protocol imploded.

Terra, a key player in Yield Farming, collapsed. You can read my take here… TL;DR the protocol was offering aggressively subsidized ~20% yield opportunities to people who participated in their network. The system was vulnerable to manipulation due to a dependency on a weak token economy. The yield offered did not come from real revenues, rather Do Kwon etc. minted tokens arbitrarily to incentivize the network usage.

This collapse led to many more downfalls in the following months. Most notably FTX and Sam Bankman-Fried’s house of cards. These also related back to BlockFi and Celcius, where many people in the mainstream population felt safe, and lost significant sums of money due to obscure fund management and a lack of awareness of systemic risks.

Crypto suffered a significant setback due to these failures of protocol and financial design. At the same time, these crises occurring force the space to mature.

Note: these explosions occurred with a common thread, both Terra and FTX core teams leveraged their own token economies ($LUNA and $FTT) in a manual (non-programatic) way to bolster synthetic, unsustainable growth.

Ideally the industry leaders learn, and we will see fewer FTX, Terra Luna explosions.

Cycle 3: 2024 – ????

Not to jump on a bandwagon, but I’m confident we’re witnessing an early stage bull market. We have yet to see previous All Time Highs in ETH or BTC, but the stock market literally hit an All Time High today, Friday, Feb. 24. Crypto and stocks aren’t directly correlated, but they do indicate similar macro economic trends with capital flow.

OK, so the technical paradigms driving this crypto bull market:

Real Yield — indicates yield opportunities generated by revenues and usage, not by arbitrarily inflating a token economy.

Liquid Restaking Tokens — gives users the ability to generate yield on ETH and also use that position as collateral in DeFi protocols to earn additional revenues or leverage into debt.

Airdrops — crypto protocols reward early users for participating in their network. Uniswap really changed the game with this strategy in 2020, and there are MANY opportunities out there today that could offer significant income for early participants.

Will explain each of these in more detail soon. The opportunities are literally endless at the moment. Ultimately, in a bull market like this, I’ve found the most lucrative strategy is to pay attention and participate.

If you want to keep up to date in more real time, join this telegram group! Will talk more strategies, opportunities and risks with my people there.

Thanks for reading Square 1! Subscribe for free to receive new posts and support my work.