9 Critical Reads on Bitcoin's Fourth Halving

This halving is very different than those of the past

Collect this post and receive 500 Taylor Tokens.

The Bitcoin Network experienced its fourth halving event last Friday. For those following the event, there are some essential reads post-halving. Here are 9 reads about the halving event that everyone interested in bitcoin should read:

Bitcoin whimpers - Forbes notes that this bitcoin halving event is not like past events.

Bitcoin halving's effect on price - Not a deep dive, but Crypto.com gives a decent graphic image of the impact that each of the four bitcoin halvings have had on BTC price.

What happens next? - You can always count on Investopedia to give you the lowdown on a topic in very concise terms. In this case, they mention three specific ways the bitcoin halving will impact the future.

5 ways this bitcoin halving is different - If you have time for only one read, this is it. CoinTelegraph breaks down why this bitcoin halving is different from all the others, and they've identified five specific ways. With graphs.

What's happening with mining stocks - CNBC often focuses on how BTC affects traditional markets. In this case, they've got something interesting to say about bitcoin mining stocks.

At-home BTC mining could go the way of the dinosaurs - Decrypt expects at-home bitcoin miners to struggle and go extinct turning BTC mining into a strictly institutional business.

BTC transaction fees hit record high - Forbes wants to tell you why. Hint: They're reading the Runes.

Bitcoin mining and artificial intelligence - CoinDesk predicts miners will turn to AI.

President Biden offers to kill the bitcoin mining industry - In other words, he wants to follow in the footsteps of China.

Industry experts pretty much agree that a post-halving bull run is not in the cards for bitcoin this time around. They're also in agreement that two things have impacted things this time around: Bitcoin ETFs, which allow investors to expose themselves to bitcoin without fiddling with the messy business of wallets and cryptographic security, and the advent of layer-2 solutions like Runes, which launched just days prior to the halving.

My take: I concur that these two developments make the bitcoin halving different this time around. What's unclear, however, is whether BTC will see a post-halving surge. Maybe it will, maybe it won't. The fact that it hit an all-time high (ATH) prior to the halving is itself a strong signal that it may not go as high as some anticipate.

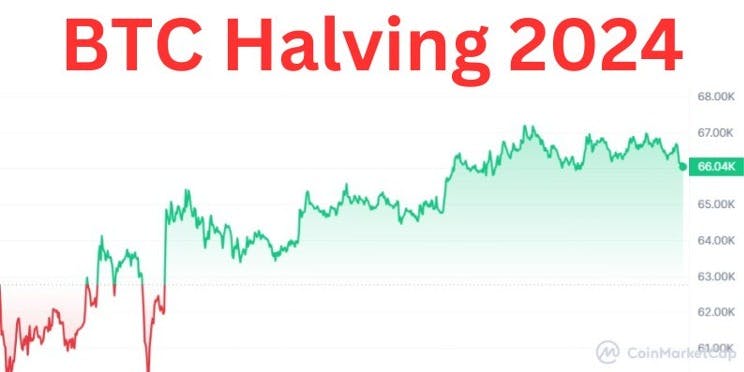

BTC currently sits at just over $66K. It's been fairly stagnant since the halving but has gone up some. On April 17, BTC was at $62.76K. While it has risen as high as $67K since the halving, it still hasn't matched its previous ATH. That doesn't mean it won't. It could be months before we see another surge that takes bitcoin new new ATHs. Much of that depends on how the whales move between now and then. Will they cash out and take profits or will they buy more BTC and drive up the price? Maybe they'll do both.

At any rate, if BTC doesn't move beyond its current ATH and doesn't fall below its current support, it should hover comfortably between $60K and $72K for the rest of the year. That could be a sign of its strengthening. In that case, we may see less volatility in the long-term even if we see a lot of volatility during short-term cycles. I still see bitcoin rising in the long-term and that means it will be good for dollar-cost averaging. Eventually, bitcoin could become a peer-to-peer currency as it was intended to be.

Of course, all of this is speculation. No one truly knows what the future will bring. What we can know for sure is that this bitcoin halving is different than past halvings. That means an uncertain future for the network, but I am still an optimist.

Connect With Me

Feel free to connect with me on the following Web3 social media platforms.

3 Reasons you should collect this post:

This is a historic moment as I hit my highest earnings to date from Web3 social media platforms. You can help me commemorate this moment by collecting this post.

I make a bold prediction at the end of this post. If you collect this post and I'm correct, you'll thank me later.

You want to support me and help me continue doing what I love.

Collect this post and receive 500 Taylor Tokens.