Maverick Protocol – The Novel AMM for All Weathers

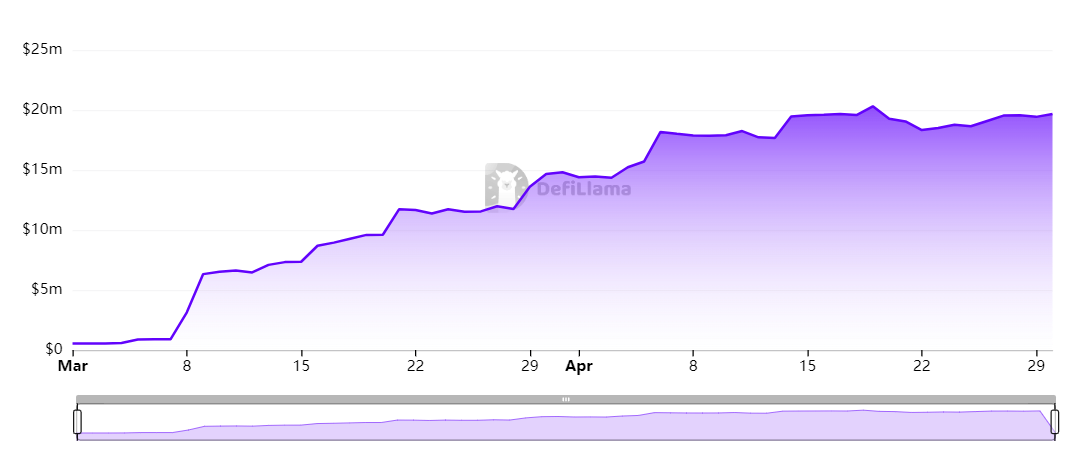

DeFi has been the fastest-growing sector in the crypto area since its inception. The market downturn of 2022 took its toll on many DeFi projects and TVL (total value locked) shrank. Bear market continues this year too but several protocols are working towards accomplishing game-changing breakthroughs in the industry. Maverick Protocol is one such project that is continuously building in the bear market. The unique AMM of Maverick empowers liquidity providers with a set of tools to facilitate their own liquidity strategies. The team consists of creative experts in the blockchain space. The project is supported by Pantera Capital, Jump Crypto, Circle Ventures, Altonomy etc. Maverick, a tokenless protocol, is live on Ethereum mainnet and zkSync Era as of now. Let us have a deep dive into Maverick for a better understanding!

In the traditional AMM model, liquidity is distributed uniformly along the price curve between 0 and ∞. An LP in a traditional AMM can make huge impermanent loss due to asset price volatility and it may exceed the fees collected. AMMs do not have order books. The price of the assets in the pool is the ratio between them in the pool and the ratio continues to change. As the change becomes bigger, liquidity providers become more exposed to impermanent loss. Suppose, you have provided liquidity in the USDC/ETH pool in a 50:50 ratio. If ETH goes up in value, the pool will have to rely on arbitrageurs continually to ensure that the pool price reflects the market price for maintaining the same value of both tokens in the pool. In such a situation, profit from the token, that appreciated in value, is taken away from the liquidity provider. If you decide to withdraw your liquidity at that point, your impermanent loss becomes permanent. Often, we can see that an LP could have earned more just by HODLing rather than LPing.

Uniswap V3 tried to change the game with its concentrated liquidity. It was the first protocol that allowed liquidity to be allocated within a custom price range. In a concentrated liquidity, liquidity providers may concentrate their capital to smaller price intervals than (0, ∞). For example, in DAI/USDC pair, an LP may choose to allocate capital solely to the 0.99 - 1.01 range. In a concentrated liquidity pool, LPs may have many different positions that create individualized price curves to reflect the preferences of each LP. While this is an effective way to decrease impermanent loss but you can earn trading fees only if the market price is within your selected range. The problem with concentrated liquidity is that it needs a more active presence from LP. In a volatile market, you need to reset the price ranges frequently to optimize returns. If the price moves outside the range, the capital efficiency effectively becomes zero. Again, continuous monitoring of such LP position is a big problem and moving the liquidity to a new range costs gas fees.

Maverick AMM solves that problem by natively automating the movement of concentrated liquidity. It maximizes capital efficiency by automating the reconcentration of liquidity as price moves. If you are an LP provider on Maverick, you can select from a variety of liquidity-shifting modes that do the work of monitoring prices and reconcentrating liquidity for them. Let us simplify this. Suppose, you want to provide your liquidity in the USDC-ETH pair and you are very bullish about ETH. You have a directional belief that ETH is going to move up in the long run and that is why you want to collect trading fees while increasing your ETH amount. There is no AMM in the market that can support your directional belief. In Maverick AMM, you can make a bet on the price movement of a particular token.

Liquidity providers on Maverick can choose to follow the price of an asset in a single direction and can effectively bet on the price trajectory of a specific token. This looks a bit like the single-sided liquidity strategy on a concentrated liquidity pool. To understand it better, let us explore the three scenarios when you provide liquidity with a concentrated liquidity pool:

1. Current price is within your target price range

2. Current price < your target price range

3. Current price > your target price range

For the second and third cases, only one of the two tokens is required to provide LP. It allows single-side deposits. Here, your position does not earn fees or be used in trades until the market price moves into your range. Maverick brings innovation here. Let us remember your USDC-ETH pair and your bullishness about ETH. When ETH price moves up, your selected AMM mode of Maverick will automatically reconcentrate liquidity to follow it, in order to capture more fees. If you make a correct bet on price direction, you can use this mode to enjoy re-concentrated liquidity around the price as it moves in your desired direction without experiencing any impermanent loss.

Maverick AMM’s core philosophy is centered around Automated Liquidity Placement (ALP). This is a proprietary feature of Maverick. The goal of ALP is to provide better capital control for LPs and improve capital efficiency. It fills the gap between price belief and the tools available to bet for the price belief in an AMM model. The beauty of Maverick AMM is that you can select a range and specify how that liquidity should move as the price moves. The smart contract of Maverick AMM will natively shift your liquidity (maybe with each swap) so that your LP can remain capital efficient on a continuous basis.

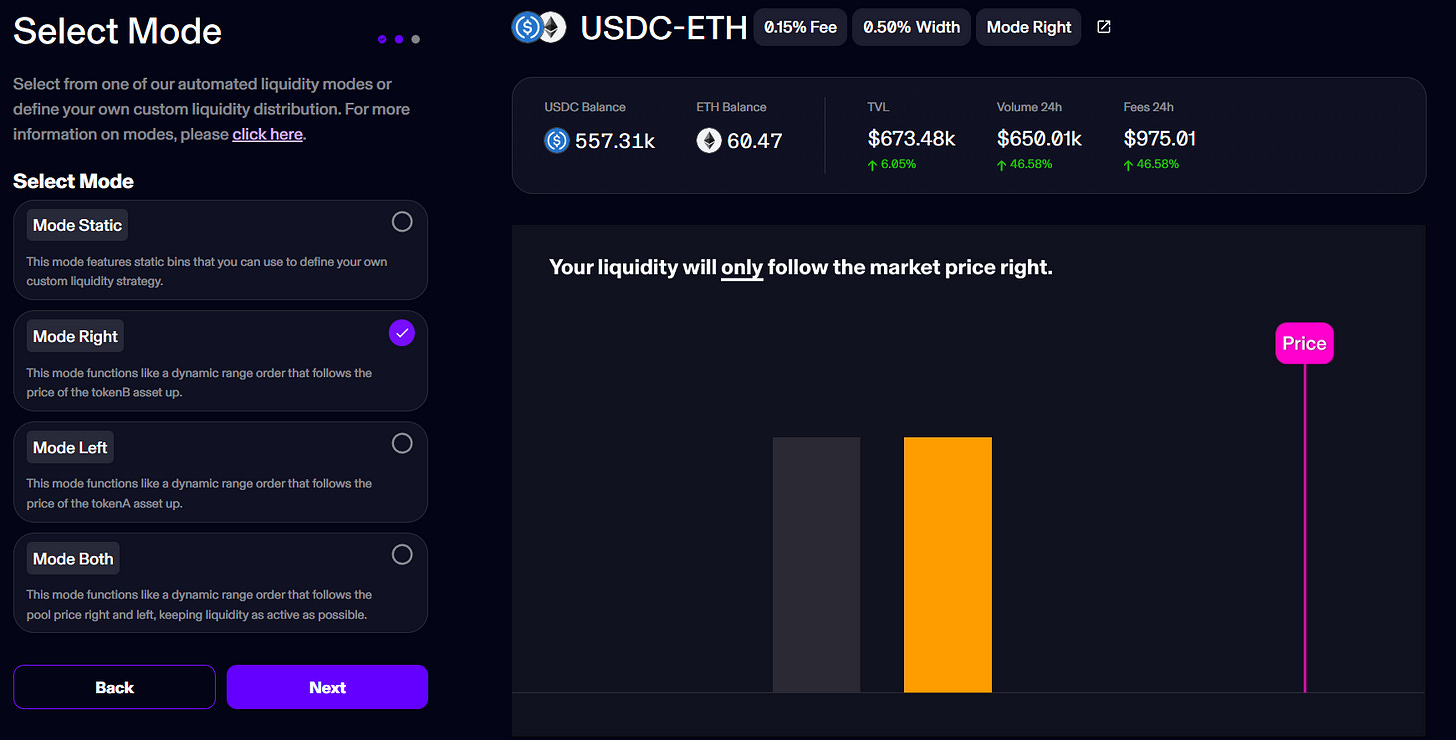

Like any other AMM DEX, LPs supply liquidity to a pool on Maverick so that the traders can trade. LPs earn trading fees from the swaps made by traders. Each pool is defined by three parameters: Pair of assets, Bin width, and Fee rate. LPs can freely choose the pools. Generally, an LP supplies quantities of both tokens but a ‘single-sided liquidity’ provision is also there. When LPs supply liquidity, they need to select how the liquidity will be distributed across a price range. The smallest unit of the price range is called ‘bin’ and LPs can choose to stake liquidity in one or more bins. Maverick is a permissionless AMM and anybody can deploy a pool. The widths of the bins are variable and pool deployers set it when they deploy pools. During pool deployment, fee tier is also selected. There are 4 liquidity modes in Maverick AMM:

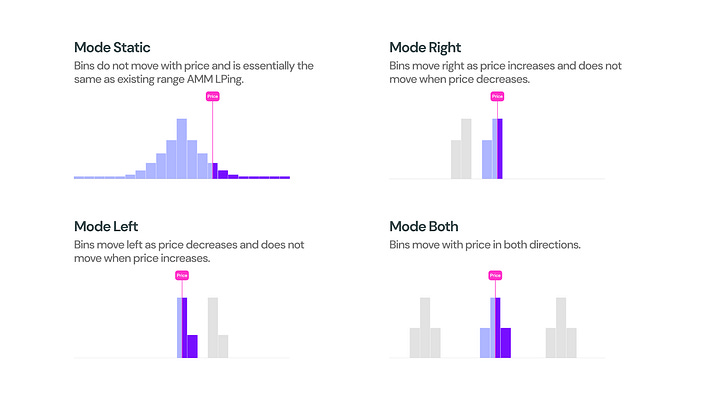

Mode Right: Liquidity moves with price as the price increases but there is no movement when the price decreases. Consider the USDC-ETH pool. If you are bullish about ETH, you will select Mode Right and add liquidity to the left of the current active bin.

Mode Left: Liquidity moves with price as the price decreases but there is no movement when the price increases. Consider the USDC-ETH pool. If you are bearish about ETH, you will select Mode Left and add liquidity to the right of the current active bin.

Mode Both: Liquidity moves with price in both directions. This mode allows you to add liquidity to the current active bin and to either of the bins immediately to the left or right of the active bin. It is designed to generate maximum trading fees by keeping all your provided liquidity concentrated close to the price.

Mode Static: It allows adding liquidity without engaging any of Maverick AMM’s liquidity-shifting mechanisms. It is very much like established Range AMM and less capital efficient.

The flexible market-making of Maverick is an innovation that allows users to select different positions in a single pool. The best thing is that these positions can be parameterized as per the need of the user. Customizability is a popular feature of TradFi and DeFi needs it for better user adoption. Maverick has the potential to take LPing to a new level by bringing a new class of market participants. In maximum AMM models, the fee is held separately from the liquidity in the pool. Maverick excels here too. The fee income is auto-reinvested to the bin where it is collected, which increases capital efficiency even more. So far, so good! But what about decentralization? A protocol like Maverick needs to be truly decentralized in order to be sustainable over the long term. This is why the team wants Maverick to be community-owned down the line. The decentralization roadmap is already in progress, and MAV, the governance token of Maverick, is supposed to be launched soon. Be sure to keep an eye out for Maverick's upcoming surprises!

Follow Maverick on Twitter and Medium. Join their vibrant Discord if you have queries. The audit reports of Maverick are available here. DYOR before investing your money.

This article was first published here.

Follow Me

👉 Twitter @paragism_