Introduction to Polynomial Trade – The Next Generation Perpetual DEX

Perpetual futures are very popular among crypto traders. The perps contribute a huge trading volume on the exchanges and this volume outstrips the spot market volume. As per this press release of Coinbase, perps accounted for nearly 75% of global crypto trading volume in 2022 and created highly-liquid markets while offering traders additional versatility in their trading strategies. Perpetual futures are derivative trading contracts that have no expiry date. They are like futures contracts but the traders can hold a position open indefinitely without worrying about the contract expiring. Both retail and institutional traders favour perps as they can speculate on the price of an underlying asset indefinitely. While centralized custodians dominate the ballooning perps market, many decentralized protocols have started to allow users to trade perpetual contracts without intermediaries. Users can enjoy more control over their assets here without worrying about the security or trustworthiness of a centralized party. Smart contracts act as financial robots to automatically execute actions according to the terms of a contract here. The decentralized perps market is getting amazing responses from the traders and the latest player is Polynomial Trade.

Polynomial Trade is a new product from Polynomial Protocol. The project started in HackMoney 2021 by ETHGlobal with the objective of automating financial derivative strategies. Polynomial also received an allocation from the OP governance fund and it is dedicated to the ecosystem adoption of low-cost and lightning-fast Ethereum L2 blockchain Optimism. The DeFi Options Vault (DOV) of Polynomial aka ‘Polynomial Earn’ received a great response earlier as it optimized yield by selling options directly to an AMM. ‘Polynomial Swap’ simplified the swapping experience on Optimism, especially the synthetic assets. Now the team wants to storm the decentralized perps market. The newly launched perps marketplace powered by Synthetix Protocol allows leverage trading up to 50x with a fast, smooth UI and lower fees than other derivative exchanges. Let us have a deep dive into Polynomial Trade.

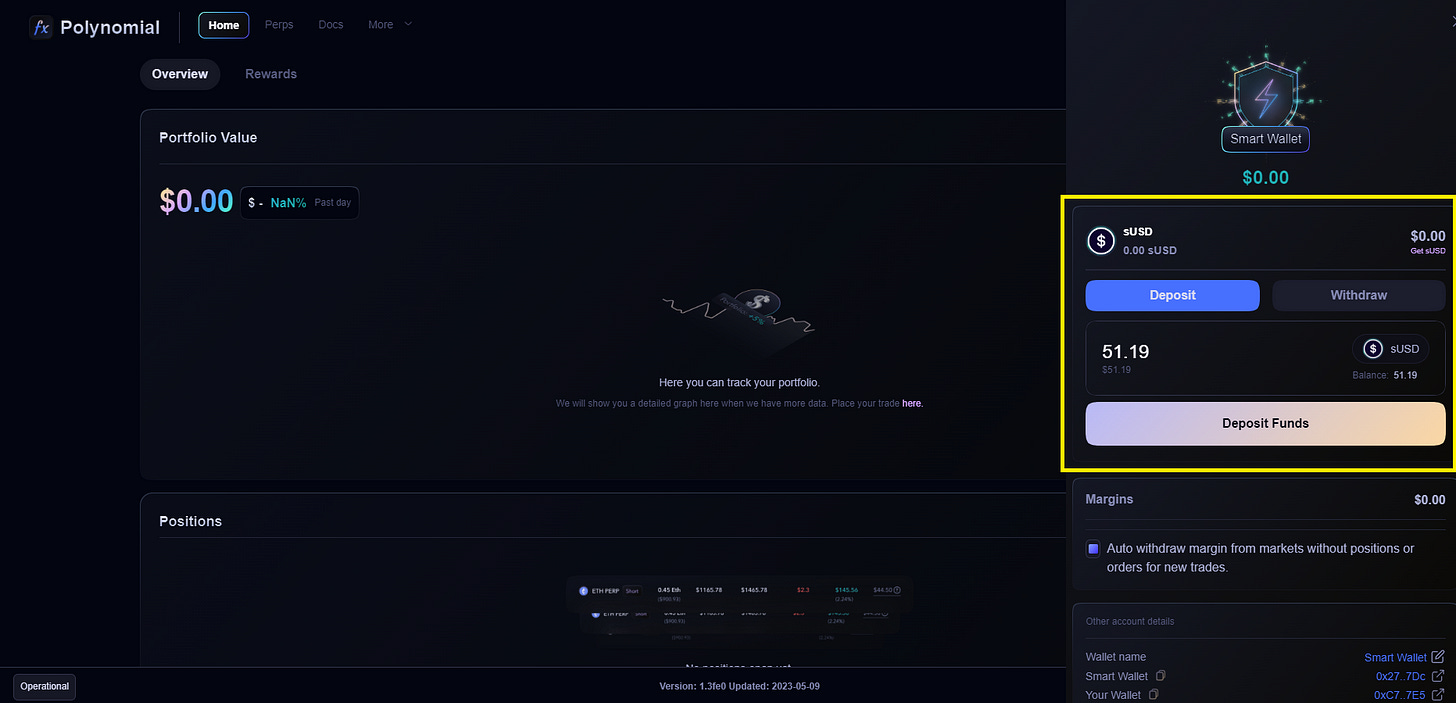

Perpetual Trade UI looks like the UI of any centralized exchange. You need to connect your Metamask or any other Web3 wallet. You must be connected to the Optimism mainnet. Polynomial Trade uses smart contract wallet. So, you need to create a Polynomial Smart Account. The wallet creation consumes nominal gas. After the creation of the wallet, you need to deposit sUSD. If you do not have sUSD, do not worry. You can swap your ETH or other stablecoins to sUSD on Polynomial Swap. You can also use any other AMM DEX to get sUSD. Once you have got sUSD, you can deposit it into the smart wallet. After depositing funds to the smart wallet, you can add margin to the respective markets. The minimum margin to start trading is $50 and there is no maximum margin limit. More margin can be added whenever you want. Are you wondering who is providing liquidity on Perpetual Trade? The exchange obtains deep liquidity from Syntheix and SNX stakers are the counterparty for the trades here. SNX stakers get fees from the platform for providing liquidity.

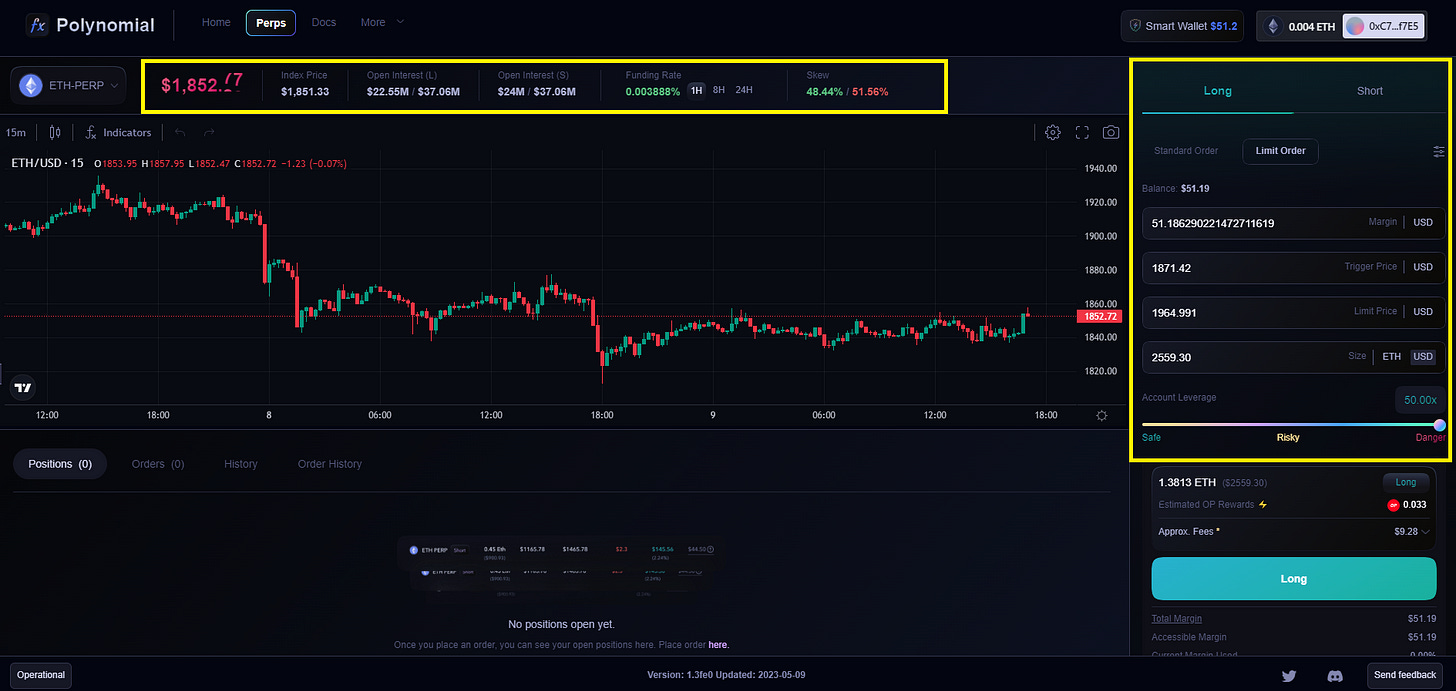

So, you have margin to start trading now. Suppose, you have added margin to ETH-PERP market. You can long or short ETH. You can trade $50 worth ETH with $1 because the exchange lends out the remaining $49. Trading with high leverage may be risky as you can earn 50x gains, but you should note that a 1% price move against you can wipe out your capital. If you are not a pro trader, you should take less leverage to test the water. You can use the slider bar to set leverage. Polynomial offers two types of trades – Standard Orders and Limit Orders. Standard Order is a market order and it is executed at the current market price. A Limit Order is an instruction to buy/sell an asset at or below a specified limit price. Suppose you want to place a limit buy order on Polynomial. You will see two new things on the screen – Trigger Price and Limit Price. You need to select that as per your choice. Suppose, ETH current price is $1900 and you have selected Trigger Price as $1910 and Limit Price as $1930. Your order will get executed when ETH price lies between $1910 and $1930 for some time. There will not be any instant trigger. The order will get executed only when the price on the chain is the same as the price of the execution bot.

Synthetix perp v2 uses Delayed Off-chain Orders and Polynomial processes all the orders through this. Delayed orders are next-price orders but with a time delay. It avoids any issue created due to arbitrary price updates by Chainlink price oracle. Front-running risk also gets eliminated due to this. While you put long or short orders, do not forget to look at the ‘Funding Rate’. It can help you to judge the market situation. Since perpetual futures contracts never settle, exchanges use funding rates to ensure that futures prices and underlying spot prices converge on a regular basis. You can see the average funding rate in the UI. If the futures price is higher than the spot price, the long position traders will pay a funding fee to the short position traders. If the funding rate is positive, it means that many traders are bullish and they are willing to pay the funding rate to short traders. If the funding rate is negative, it means that short position traders are dominant in the market and they are willing to pay the long position traders. If you are going long with high leverage in a market where the funding rate is negative, you may get liquidated even during low volatility as you are continuing to pay for funding. ‘Open Interest’ - long and short both are visible on the trade screen and that should help you to make informed decisions. Also, look at ‘Skew’. It depicts the total no of long and short contracts expressed as a percentage.

Are you a pro trader and want to explore something adventurous? You can deploy your funding rate arbitrage strategy on Polynomial Trade as within the Synthetix ecosystem, the funding rates on Synthetix Perps are currently long-skewed. Funding rate arbitrage is a popular trading strategy in perpetual futures contracts in crypto exchanges. It involves taking advantage of differences in funding rates between exchanges to profit from the interest rate differential. For blue-chip assets like ETH or BTC, DeFi yield farming rates are generally very low and funding rate arbitrage yields can be very high due to the amplification of returns with leverage. Suppose, the funding rate for ETH-PERP on Polynomial Trade is positive and it is negative on another exchange called ‘A’. It opens the door to making profits. You can easily shorth ETH on Polynomial Trade with 3x leverage and long ETH on ‘A’ exchange with 3x leverage. As you go long and short on the same position, you are hedging your risks with perfection. It is suggested not to go for high leverage as this strategy is not immune from liquidation risks. Never try this if you do not have any idea about what you are doing!

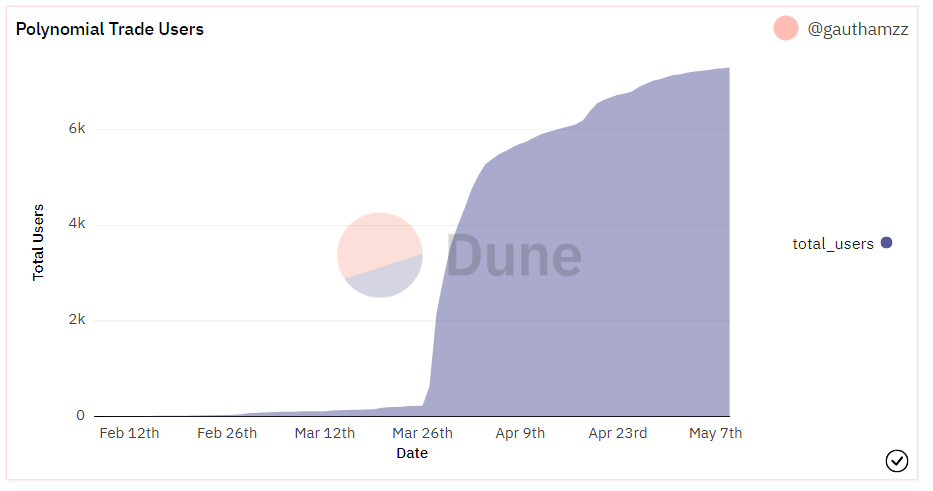

The size of the orders continuously varies in the futures market due to leverage, and the traders look for potential volume to suit their trading strategies. A deep market allows traders to execute large orders efficiently without causing significant price movement. Polynomial Trade looks promising in this area as the deep liquidity from Synthetix provides a lot of scopes to bring high-volume traders. The Chainlink and Pyth oracles provide the up-to-date token price data to smart contracts here and you can be assured not to see ‘scam wicks’ of CEXs. The platforms’ interface also displays a lot of information about the user’s trade and position which makes it very transparent. You can trade BTC, ETH, SOL, AVAX and many more perpetual products efficiently without any KYC or professional investor requirements that are found on CEXs. The trading fees are as low as 5-10 bps which is significantly lower than other perps exchanges. While you trade on Polynomial Trade with multiple assets, you become eligible for OP rewards too. This OP season started on April 19th and it is going to be a 20-week-long event in which 300,000 OP tokens will be distributed weekly to traders. Polynomial has a plan to launch Power Perps later this year. Power Perps are derivatives that provide convexity without expiry and strike prices such as ETH², BTC² etc and the crypto community is eagerly waiting for this. The trade volume can burst anytime on Polynomial Trade. Keep a close watch on this potential DeFi derivative powerhouse.

Follow Polynomial Protocol on Twitter to get regular updates and join their vibrant Discord. DYOR before investing your hard-earned money.

This article was first published here.

Follow Me

👉 Twitter @paragism_