Today's book, "The Bank Investor's Handbook" by Nathan Tobik and Kenneth J. Yellen examines the banking business and core elements when investing in a bank.

Banking is a commodity business and the commodity is liquidity. TradFi denominates these assets, capital, and equities in USD while defi holds any asset that can be carried on blockchain worth value.

The book sheds light on bank management, lending officers, and other people involved in the business which I found analogs to cryptos VCs, community, and developers when evaluating a project.

It lays out the importance of due diligence by investigating the bank loan and deposit holdings, quarterly and annual reports, and other financial statements just like a true crypto investor studies the code of a project open sources, reviewing community engagement and other online data matrices.

Overall the book is highly succinct and to the point on the key points of investing in banks. It doesn't get boggled down in the intricacies and is written in an approachable style. I am starting to consider that DEXs are the new bank hubs for they both need liquidity to live.

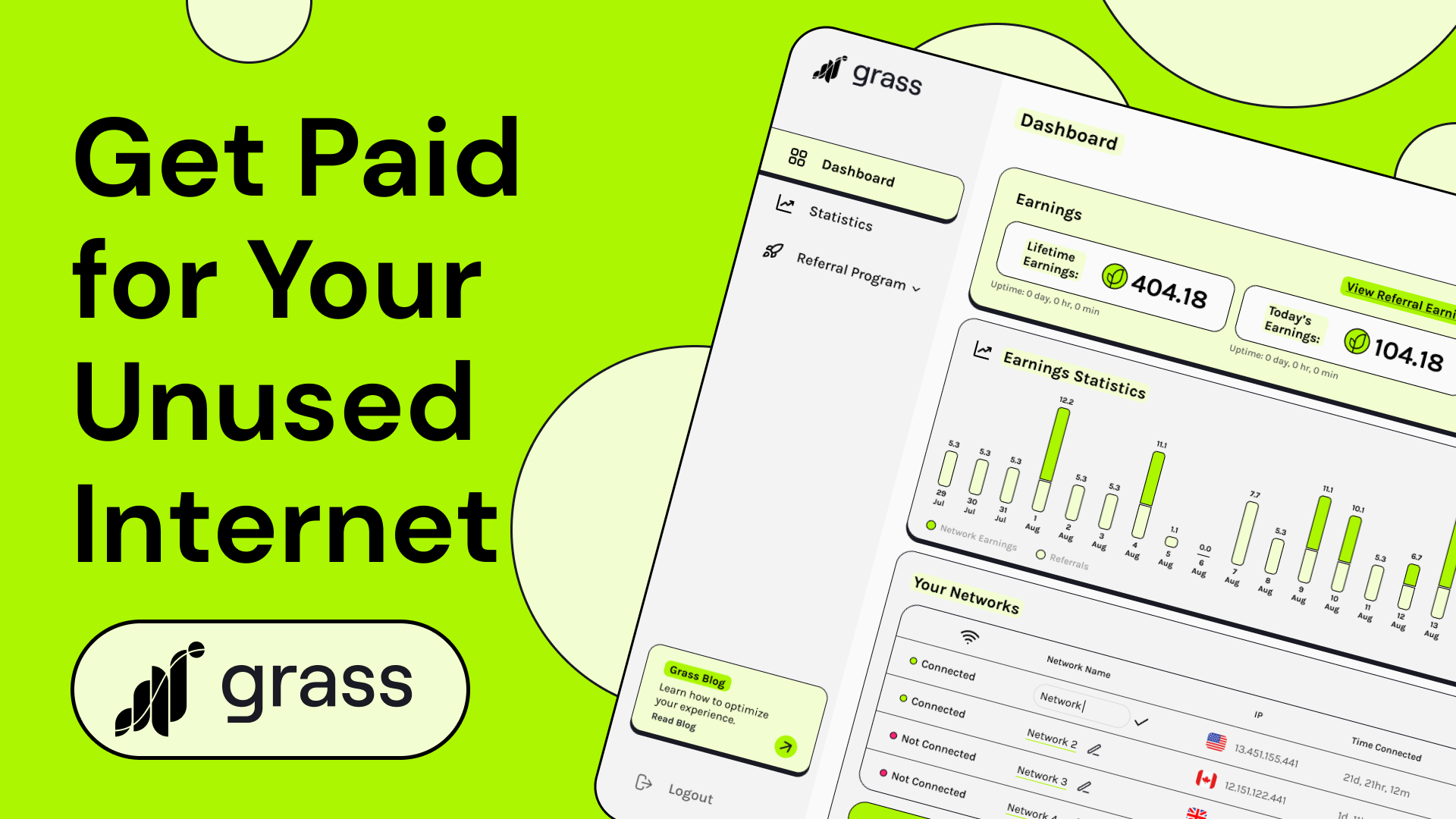

I leave everyone with links to referral codes of projects I aped into to earn points, spices, and other degen bait. This is not financial advice, and let's get rich together!

https://fusion.gobob.xyz/?refCode=4jdbxh

Gyroscope: 9ZCHZR

Lisa STX: ETR78