This content is brought to you thanks to the support of Emerald. Discover your wallet's potential today with personalized onchain recommendations and let opportunity come to you. Learn more at emeraldfi.xyz

Disclaimer: this content is for educational and entertainment purposes only. It is not intended as financial advice. Your financial situation may very. Do your own research to determine what's right for you

Hey friends 👋

I'm always late to meme coins. And when I'm not late, I almost always pick the wrong ones. And when I do pick the right ones, I never buy enough, or I sell too early, or I sell too late.

Sound familiar?

The Good, The Bad, and the Degen

Crypto is full of stories of people making it rich overnight from random tokens that are willed into existence abruptly, whipping the market into a frenzy, only to be forgotten mere days later. Far fewer stories get written about the majority of people who lose some or all of what they put in during these moments of frenzy.

I've always said that this is fine, as long as it's viewed as a casino. The opportunity that this kind of trading presents in terms of asymmetric upside is appealing, and, like gambling, is not to be wholly discounted as a practice. But, like gambling, no one in their right mind would suggest you make this your entire financial strategy.

The risk averse, from new crypto converts coming from traditional finance (TradFi) to recovering degens, weary from the big losses of the last cycle, will find that the best course of action is to put the bulk of their assets into something low-risk with a stable return. That provides for a good counterweight to the ups and downs of gambling, so that you can sleep easier at night.

Dabbling In DeFi

I've experienced the worst of banks, from predatory lending at high interest rates, to being refused access to credit. I've even been misled by bank employees into investing decisions that made no sense for my needs, but rather benefited the employees themselves through commissions.

DeFi offers a comparably transparent financial system where all the details you need to make an informed decision are visible onchain, updating in real time. To me, this approach is undeniably better, but its clear why the old guard (who often benefit from the opaque nature of traditional finance) has pushed back so hard against it.

Still, one thing I did like from TradFi is the idea that you can "set it and forget it." To know that, within the context of that broken, old system, that I could hand off my portfolio to someone and know that I was getting (pretty close to) the best rate available to me and that, if I left my money in one place for long enough, I could expect a particular return.

This was not always my experience with DeFi.

I've written before about some of my favourite protocols, like PoolTogether, Notional, and Aave. All of these have one thing in common: they're built for stability. They offer transparent and decently predictable returns, and they're not wasting time trying to produce unsustainable yields in the hundreds of percentage points.

But I'd be lying if I said that I never went chasing after hundred percent yields on flavour-of-the-moment tokens, only to see the the APY drop to the single digits in a few days; sometimes even just a few hours. In almost every case, the combination of gas (network fees), and impermanent loss meant that it wasn’t worth my time, let alone my money, to do this.

The smart move, I remind myself, is to build a portfolio grounded in trusted tokens like Ether and stablecoins. But just holding the tokens themselves could lead to a lot of missed opportunity. Putting these assets to work in DeFi is a good idea, but where exactly is the real question...

Enter, Emerald

What if I told you that there is a way to "set it and forget it" in DeFi? A way to be sure you're finding the best long term opportunities. What if I told you that you could compare all the options available to you, from a list of reputable DeFi protocols, see the expected returns and you could choose for yourself what's best?

And what if I told you that you could do all this in a streamlined interface with just a few clicks?

Thanks to Emerald, you can.

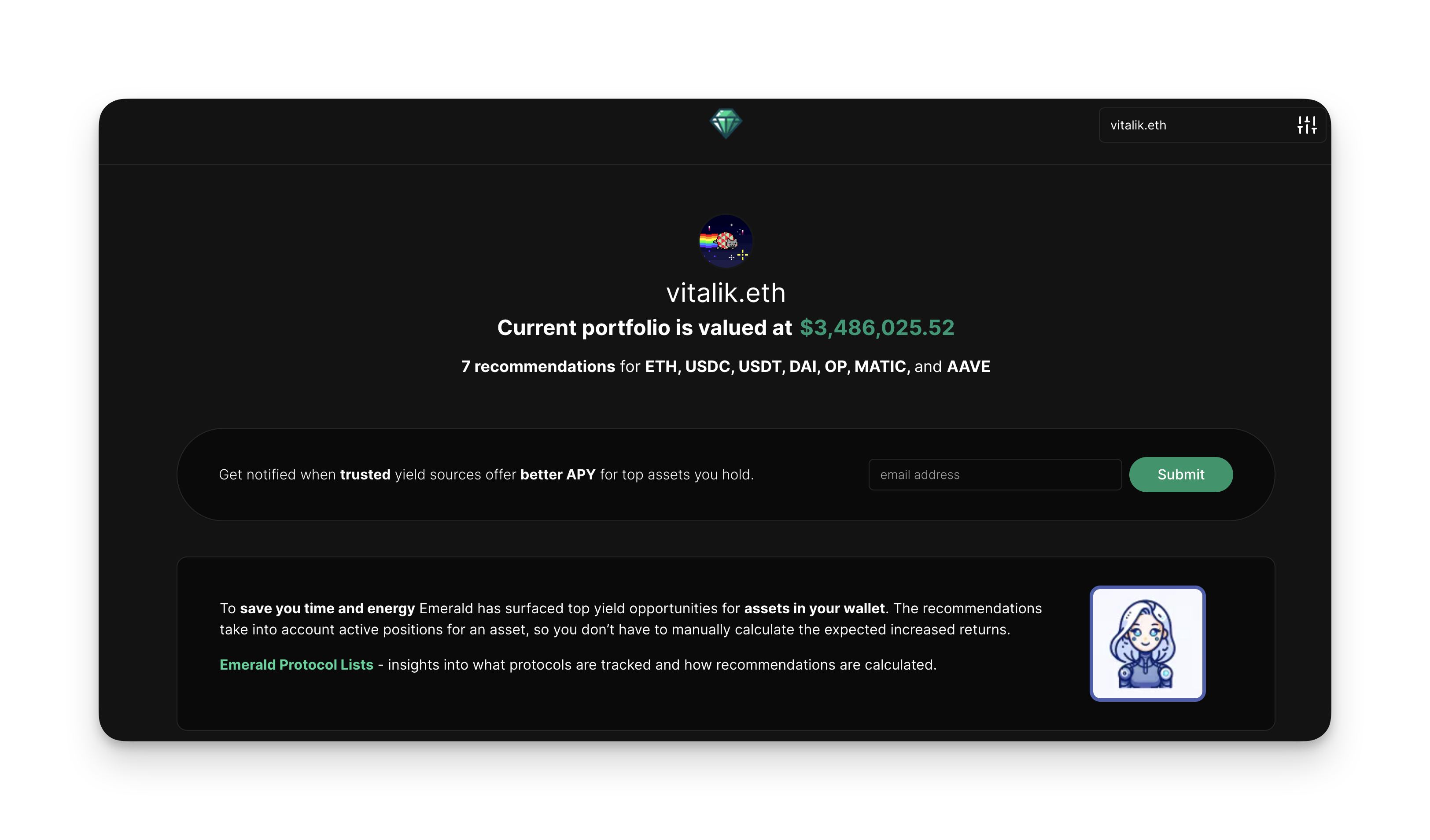

Emerald is like your own personal financial assistant whose only job is to find you the best rates on the highest quality assets, over the longest periods of time. That is to say assets like ETH (including wrapped or staked), USDC and other stablecoins, or governance tokens like OP.

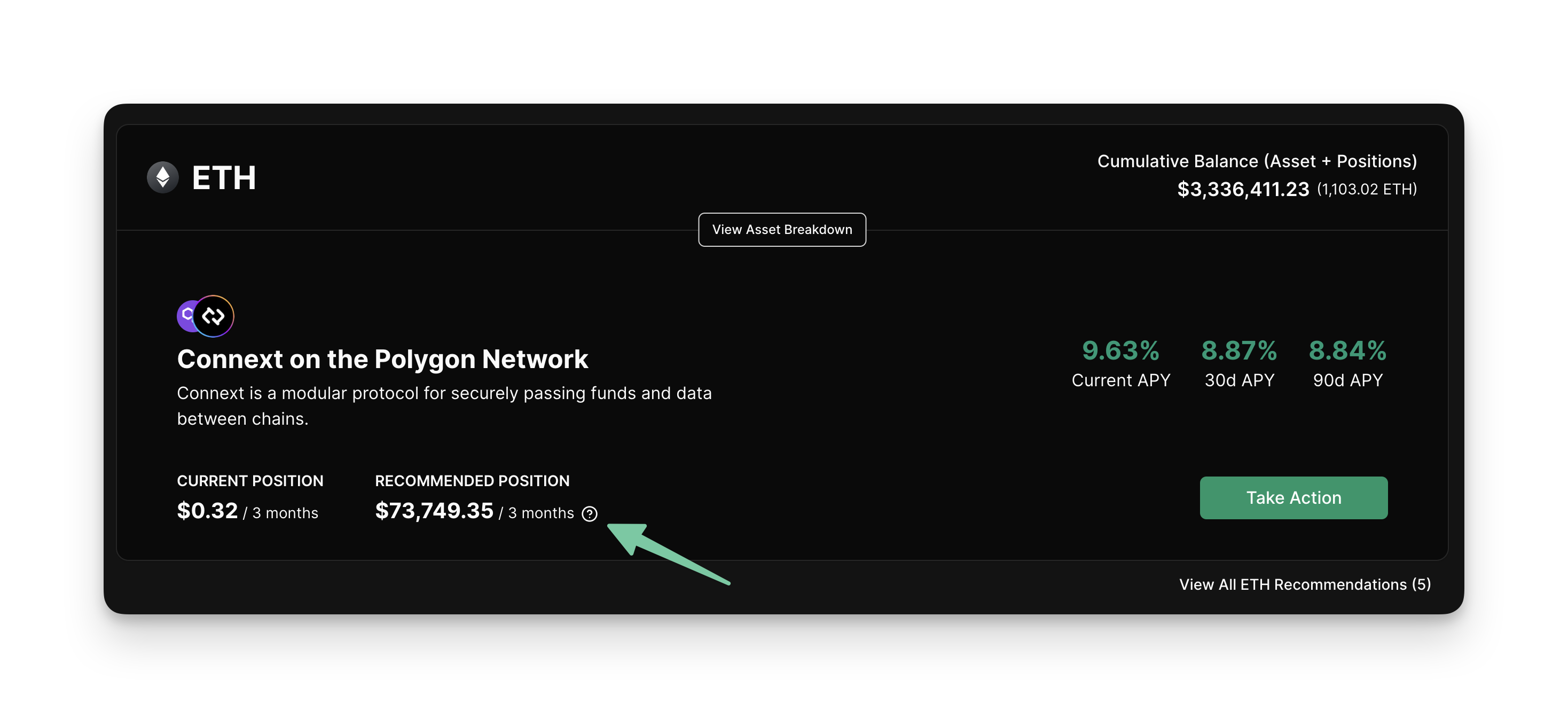

Emerald presents you with a list of recommended positions, and displays what you're earning now (if anything) beside what you could be earning from a given recommendation. Let's look at an example: Vitalik's wallet.

According to Emerald, he's leaving nearly $75k on the table over the next 3 months. How much are you leaving on the table? (Find out here)

For most people, it won't this stark, and even Vitalik probably doesn't want to put all $3M of his ETH into one protocol, but you can see how this could be a fantastic tool, especially for those of us with assets that just sitting in our wallets earning nothing.

You see, so much of crypto culture is focused on pump and dump tokens and DeFi protocols that pay out hundreds of percent yields by rapidly inflating the token supply. But these are short-lived, high risk, opportunities, and for most people, aren't going to yield a return that's worth the time and money you put in.

What we, recovering degens, just need to remember is that if you can manage to consistently get 10% returns over longer periods of time, you'll be beating the market.

So go ahead and play around in the casino if you want to, but do it with a minority of your portfolio. For the rest, let Emerald help you find the best rates, so you can "set it and forget it."

Until next time,

Thumbs Up

Thanks again to Emerald for sponsoring this content. As always, all opinions expressed are my own and I only work with partners that I respect. Still, doing your own research to find what works for you is essential.

Become a monthly supporting patron to unlock special perks on Hypersub ⬇

And for the privacy minded patron, I accept anonymous tips with Zcash to my shielded address:

zs17a2mhl6xeu56cqqeqync9kddyg8gggcy6253l5evjdyw8l8j8f60eg40exr4wk27hnvfgkkgnju