"Capital Efficiency" is Just Leverage, Part 2

In this post we dive into a few recent examples of capital efficient models that don't amplify risk, and in some cases actually reduce it.

In my initial blog post on the subject, I discussed how, in most cases, “capital efficiency” is synonymous with “leverage”. In this post we dive into a few recent examples of capital efficient models that don't amplify risk, and in some cases actually reduce it.

That Part 1 detailed key examples where capital efficiency does not inherently increase risk, including the following:

Potential Energy - allowing capital to flow autonomously as supply/demand shifts

Aggregation & Interconnectedness - better pricing across dapps and chains

Zero-risk Use of Idle Capital - i.e. flash loans

Capped pools - maximizing efficiency for lucky depositors

Atomized risk/reward - facilitating markets for individual price components

With recent industry developments, and the success of protocols like GMX, I'd append the following to the list: delta neutrality balancing mechanisms.

Let's take a look at the protocols designs that have begun to shift our understanding of the relationship between "capital efficiency" and "leverage" even further.

GMX has stunned with its consistent growth and long-term performance of the GLP Pool.

The GLP Pool is not without tail risk. If there are net shorts, and the shorts are right, the pool stands to take potentially significant losses. However, this is not symmetrical; when there are net longs, the GLP Pool is hedged due to its composition including more of the underlying asset than long-open interest. This makes the pool an attractive option in a sideways or bull market (or even in a down market if retail is consistently wrong over time).

This hedging of open interest is worth a look through the lens of capital efficiency.

The GLP Pool must maintain more spot assets than open interest on the platform, ensuring that it is always delta neutral with respect to open long positions by traders. And, in order to be capital efficient and allow for fluctuations in demand by asset, the GLP Pool must balance its composition over time.

Each asset in the GLP is assigned a target "token weight", and GMX allows for swaps between the spot assets in the pool. If it contains excess ETH (a higher token weight than targeted), the cost to spot swap for ETH (withdraw ETH from the pool and thus bring the pool closer to target) is reduced. The same goes for GLP minting - if it helps balance the pool, fees are reduced. Conversely, fees to swap increase if the swap will hurt the target composition.

Here we have a brilliant example of spot swaps being facilitated by the same pool of capital backing the peer-to-pool exchange, in a way that increases efficiency by allowing for higher open interest for in-demand exchange pairs.

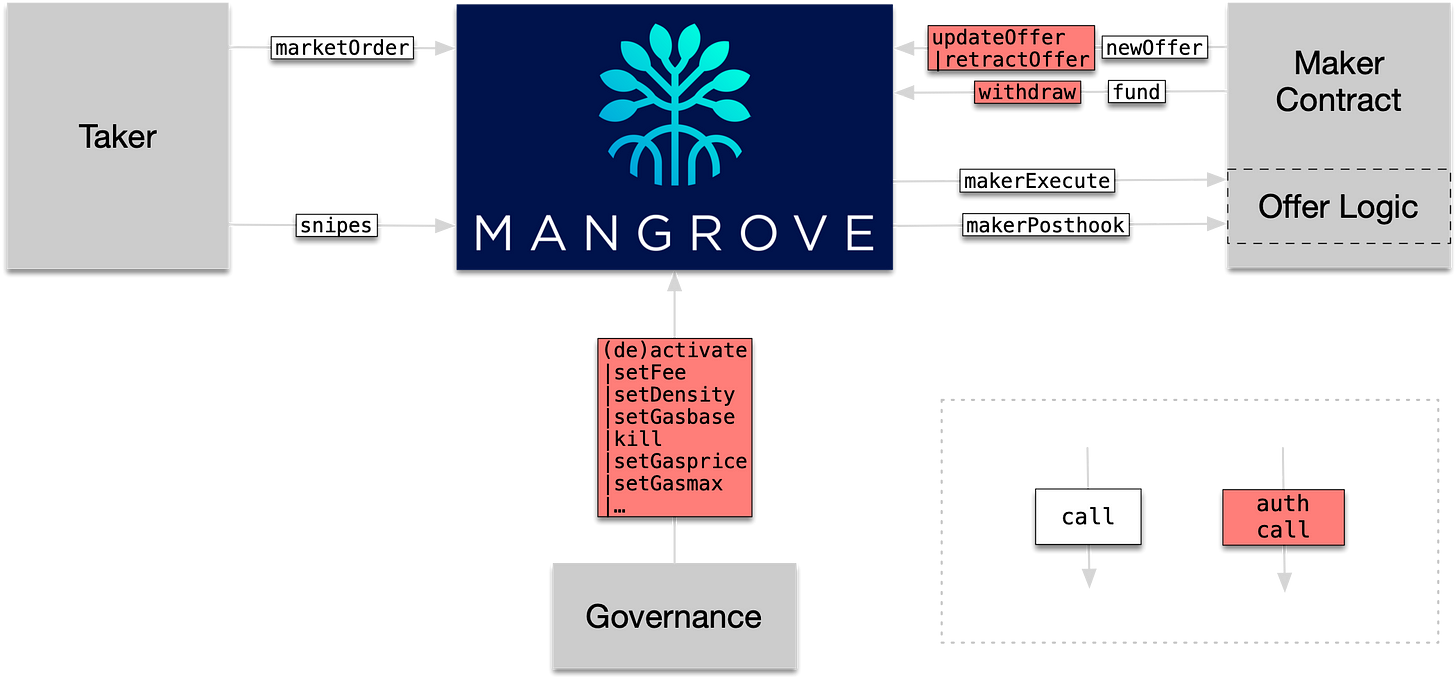

I was excited a few months ago to come across Mangrove. The protocol allows for order books without requiring the provision of liquidity by posting contracts as offers.

This facilitates the provision of liquidity only when an order is matched. For example, I might have value locked in Aave - and, via Mangrove, I may make multiple offers, such as an ETH limit sell order and a WBTC limit buy order. If any of the offers are filled, I can take a flash loan to "pull" liquidity from Aave and provision it as required for whatever offer is filled.

Diagram from the Mangrove docs

The game theory for disincentivizing failed capital provision and allowing keepers to reroute transactions expected to fail is quite interesting and worth a look.

Let's unlock the locked value!

Okay, so Chainlink deserves a big mention here as well, but since it's everywhere we'll just discuss Gelato.

Smart contracts only have access to on-chain data and are oblivious to external events. Oracles change this, pushing off-chain data on-chain, or retrieving on-chain data from one chain and broadcasting it to another. In the most general sense, most oracle networks hope to be an "IFTTT for DeFi", allowing communication, data access, and triggers based on any event.

Allowing any off-chain or on-chain event to act as a trigger for both autonomous and centralized programs will greatly increase capital efficiency across DeFi, allowing money to flow wherever it is most useful and in-demand, without always requiring human intervention.

Gelato's off-chain resolver product (in beta) is a great example, allowing you to make HTTP requests alongside off-chain logic, customizing your trigger events as needed. And, this is all via an intuitive and familiar Uniswap-inspired UI (something I hope Chainlink learns from).

I expect oracle networks will continue focusing on building in more flexibility and customizability to their products, and believe this will unlock capital flows across all DeFi niches as liquidity becomes more automated.

These didn't meet my criteria for not increasing risk, but are worth a mention as they have interesting models and risk/reward dynamics.

Eigenlayer is focused on leveraging staked ETH to secure other protocols. Their plans include a data availability service backed by staked ETH. This relatively low-risk rehypothecation definitely deserves a mention and is worth keeping an eye on.

Rage Trade is aggregating ETH-USD liquidity across chains to facilitate highly liquid perps. I see this as an early success case for better pricing and deeper, concentrated liquidity in a fractured multi-chain environment.

That's it for now, and if you missed Part 1, here's a link.

Disclaimer: Not investment advice. I do not follow the projects mentioned closely, and have made no effort to assess any tokenomics. I hold no tokens or equity in any of the mentioned projects at the time of writing this.

// Jason Garland