LRT Infra Risk Framework

Informing Ebisu's Protocol Parameters Through LRT Collateral Health

A few weeks ago, Ebisu Finance and Tokensight announced their strategic partnership to strengthen the risk understanding and underwriting of liquid restaking tokens (LRTs) as collateral assets in Ebisu’ DeFi marketplace. The collaboration focused on developing a comprehensive framework to conduct infrastructure risk assessments on LRTs based on their portfolio-selected Actively Validated Services (AVS) on EigenLayer.

Ebisu Finance triggers the potential of LRTfi through two main products:

Ebisu Money: A collateralized debt position (CDP) protocol that lets users borrow US dollar or ETH denominated stablecoins against liquid restaking tokens (LRTs).

Ebisu Earn: A suite of restaking yield vaults that automate real yield generation across a basket of LRT DeFi strategies providing diverse exposure to various LRTs and restaking protocols.

As liquid restaking protocols begin composing their AVS portfolio strategies, LRTfi protocols like Ebisu must look beyond traditional DeFi metrics and consider the infrastructure risk introduced by EigenLayer services. Using our mathematical, research-driven frameworks, we have guided Ebisu in evaluating LRT collateral health by focusing on these infrastructure risks. We've recommended on protocol parameters benchmarks, such as deposit caps and minimum collateralization ratios, to prevent liquidations, mitigate risky lending practices, and ensure the secure scaling of its DeFi marketplace.

Assessing the soundness and solvency of these new assets from first principles is essential. Let’s dive in!

AVSs and LRTs are core to the EigenLayer ecosystem. AVSs are services built on EigenLayer that benefit from pooled security, costs reduction, and a simplified initial bootstrapping process. They share a common security base with other AVSs, much like how dApps on Ethereum leverage the main L1's security.

LRTs are similar to liquid staking tokens, allowing users to maintain liquidity while restaking formerly illiquid assets. They enable restaking across multiple protocols at once, creating both new opportunities and new risks. Unlike traditional staking tokens, LRTs factor in infrastructure risk as well, as their yield and security depend on the health and performance of the AVSs on EigenLayer.

Tokensight’s framework for underwriting infrastructure risk for AVSs evaluates each service's risk profile based on various components in their architecture. As detailed below, the framework starts by identifying the vulnerabilities and strengths of each AVS within their particular category, which influences the overall risk profile of the LRTs that support it.

Key Parameters in AVS Risk Calculation:

AVS Business Model: Considers the AVS's business model, such as Pure Wallet, Tokenize the Fee, Dual Staking Utility, or Native AVS Token Payment, and evaluates the balance of the token composition. At this early stage of development, all AVSs are assumed to use a Dual Staking model with a 50/50 ETH to native AVS token balance;

AVS Protocol Security: Evaluates the protocol's security by considering the number of code audits performed, GitHub code coverage percentage, and overall code complexity, which may affect vulnerability to bugs;

AVS Operator Profile: Evaluates the reputation, geographical distribution, and level of entrenchment of EigenLayer operators validating the AVS;

Protocol Execution Mechanics: Examines the reliability and security of the various dependencies, smart contract executions, and cryptographic algorithms used by the AVS at an execution level;

Protocol Consensus Design: Evaluates the type and security of the protocol’s consensus mechanism and node network (if separate from EigenLayer’s), focusing on its ability to maintain network integrity and liveness;

Protocol Risk Mitigation Solutions: Evaluates the protocol's architectural vulnerabilities and the effectiveness of its risk mitigation mechanisms.

Each parameter is assigned a quantitative value within a specific range, and the product of its likelihood and impact scores is also factored into the calculation. Additionally, two overarching AVS parameters—regulatory risk and maturity level—are also considered. An Individual AVS Risk Score (IR) is then calculated, reflecting the risk of the AVS experiencing a fault (malicious or non-malicious) and being slashed.

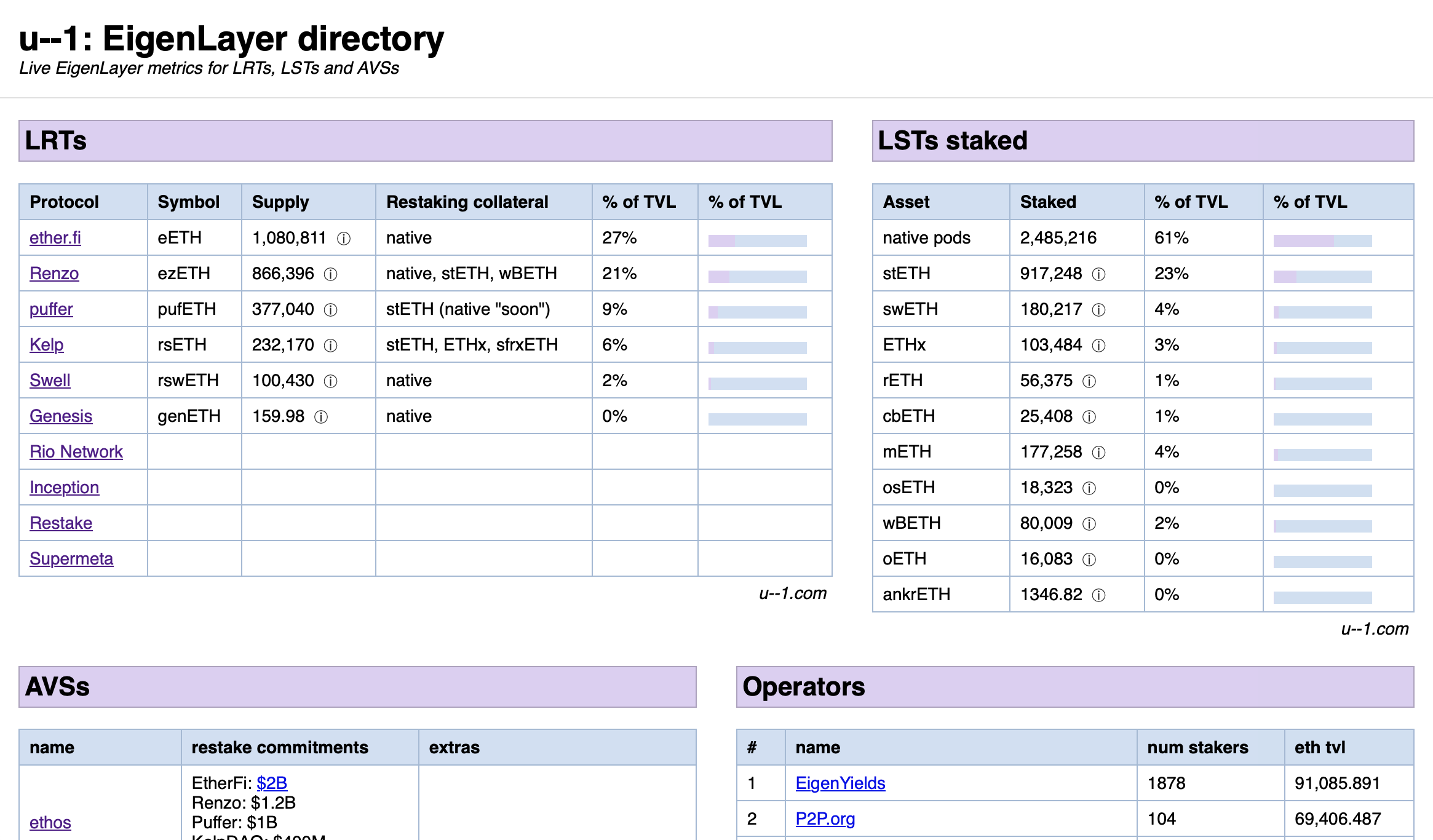

The reader can view a qualitative and simplified version of this framework in the AVS risk matrices on the AVS page of u--1:’s website. Public-facing risk assessments have been integrated, through our partnership with u--1: for EigenDA, Omni, Lagrange State Committees and ZK Coprocessor, and Brevis, with more to be added in the future.

The following analysis is based on u--1:’s real-time AVS registrations for Ether.fi, Renzo, Puffer, and Kelp LRTs:

The LIR score reflects the overall risk of each LRT, based on the combined individual risk scores of its registered AVSs, in isolation. This calculation helps determine each AVS's contribution to the LRT portfolio's total risk.

Where:

IR is the Individual Risk score for each registered AVS;

w represents the proportion of the total amount an LRT's operators have delegated to each AVS, divided by the total amount delegated to all AVSs in its portfolio. For instance, if an LRT has delegated $1B in total to AVSs, with $100M allocated to EigenDA, the weighting (w) for EigenDA would be 10%;

a represents the sequential number of AVSs (n) in a given LRT portfolio, starting with 1;

LIR represents the aggregate risk score for the LRT portfolio (t), factoring in the individual, isolated risks of each AVS in its portfolio, weighted by the LRT's relative delegation to each AVS.

While the LIR score assesses risks based on individual AVSs in isolation, LPR provides a broader perspective by considering the collective risks of the AVSs within a pooled security ecosystem. It captures the aggregate risk of the ecosystem-aware AVS portfolio, accounting for its interdependencies and cumulative risk exposures.

Where:

N quantifies the added risk based on the number of AVS registration an LRT has;

C quantifies the added risk based on the concentration of AVSs in the same category;

A quantifies the added risk based on the aggregate risk score of the AVS portfolio, considering the grouped risk of individual AVSs;

LIR is directly dependent on and proportional to the sum of the independent variables N, C, and A. By summing these variables and multiplying by LIR, we capture their combined impact and how they amplify the original LIR value.

LPR therefore offers a comprehensive view of the interdependent risk exposure within the pooled ecosystem of AVSs selected by the LRT.

At this early stage and when slashing is firstly introduced, LRTs face significant risk exposure if they delegate to an excessive number of AVSs (N), particularly if these AVSs are in the same service category (C) due to increased dependency in case of an exploit, and if the majority of their AVSs have high individual infrastructure risks (A), as computed by IR above.

The calculated LIR and LPR scores reveal varying risk levels across the different LRTs. This stratified approach helps maintain the overall health and stability of the ecosystem by tailoring risk management measures to each LRT's specific profile.

As our research and understanding progress, additional insightful metrics, such as operators' risk profiles based on delegated AVSs, level of operators' entrenchment onto a set of AVSs, and the degree of the probable cascading effects pursuant to infrastructure vulnerabilities and AVS slashing conditions, will be integrated into our calculations to more accurately measure the complex nature of these products, within EigenLayer and other restaking protocols.

Ultimately, it's crucial for Ebisu and LRTfi protocols to set appropriate Deposit Caps (DC) and Minimum Collateralization Ratios (CR) for each LRT, as a collateral asset on their marketplace, based on their underlying, specific risks. These metrics help the protocol mitigate potential liquidations and maintain solvency, especially in adverse conditions or black-swan events:

DC is calculated by adjusting the total allowable amount for LRT deposits (as set by Ebisu) according to each LRT’s Pooled Risk score (LPR), which ensures that each deposit cap aligns with the risk profile of its LRT; preventing undue exposure to high-risk collateral.

CR is determined by relativizing the pooled risk of an individual LRT (LPR) against the aggregate pooled risk of all LRTs. The CR value is set to maintain adequate overcollateralization (with a baseline of 100%), ensuring sufficient collateral is available to cover potential losses and protect the protocol from cascading liquidations and market volatility.

By setting DeFi protocol parameters like deposit caps and collateralization ratios according to the framework above, Ebisu Finance can effectively manage risk and maintain solvency and consumer trust in its DeFi marketplace.

The Ebisu team is also advised to enhance these assessments with additional DeFi metrics for LRTs, such as liquidity, volatility, and supply, to gain a comprehensive view of the health and stability of restaked assets. Upcoming research on slashing conditions and their impacts will also be a key focus.

As liquid restaking on EigenLayer evolves, robust risk assessment frameworks are becoming increasingly vital. The partnership with Ebisu Finance provides a structured approach to managing these new risks, ensuring LRTs are evaluated based on their infrastructure security, aligning with Ebisu’s commitment to building a fully decentralized, censorship-resistant protocol.

Visit the official Ebisu Finance website to dive deeper and stay updated on their latest developments! Also learn more on EigenLayer by checking their website.

Learn more on their ethos and the LRTfi space on the insightful blog posts: Introducing Ebisu & ebUSD and Underwriting LRTs: Balancing High Yields with Security.

Follow us on X!