THE GOOD OL’ DAYS OF NFTS

One Step Forward by Saule Suleimenova

DECEMBER 23RD, 2021

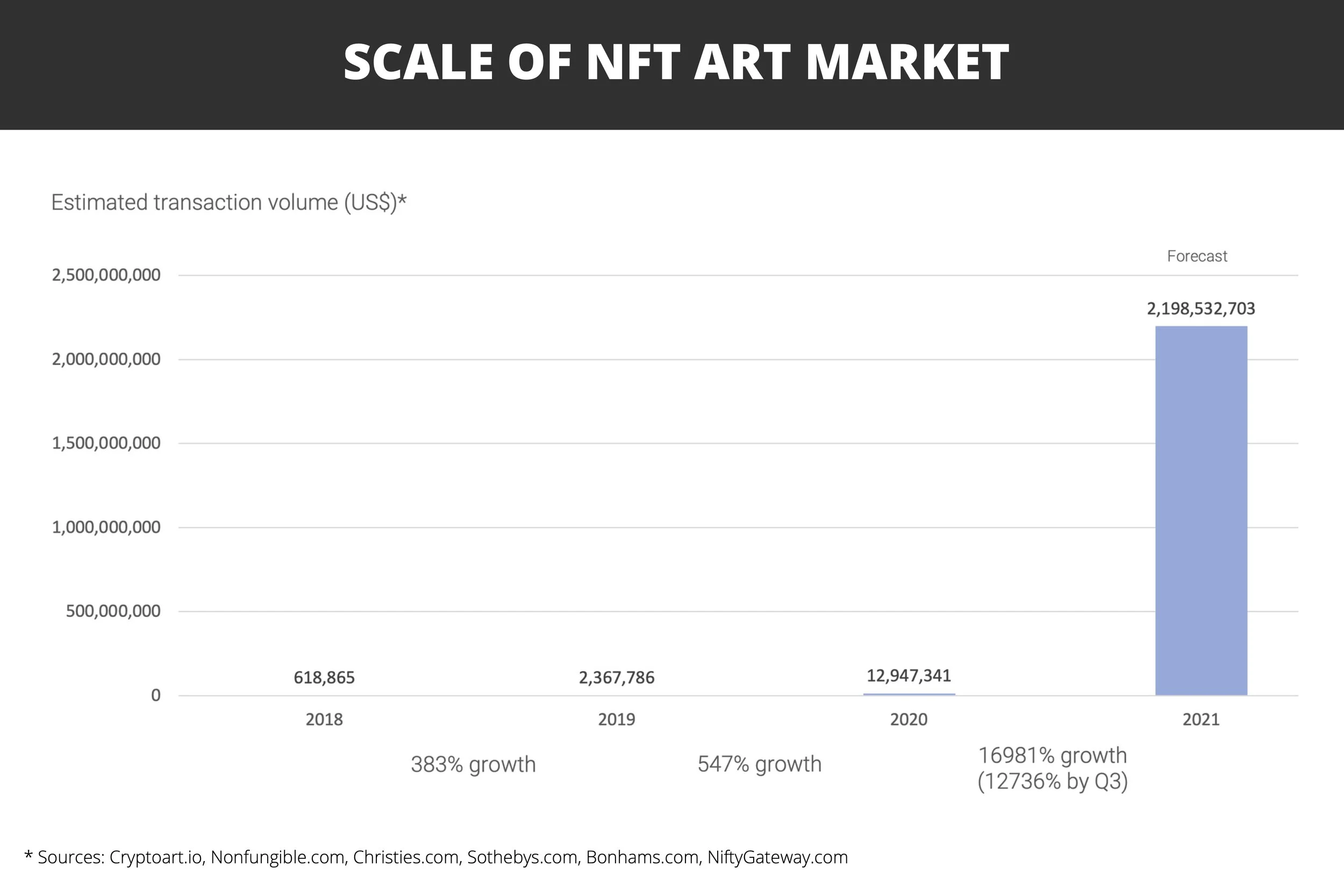

I don’t think anyone reading this will have missed the scale of growth of the NFT market. We have all been blinded with dizzying headlines and jaw-dropping figures ever since the $69m Christie’s sale of Beeple’s Everydays 5000 in March. NFT was even announced as the word of the year (despite it being an acronym). However, whilst interest was strong at the beginning of the year for unique artworks, the second half of this year has been dominated by collectables. Punks, Kitties and Apes have been ruling the roost, with many artists who were enjoying the wave that Beeple brought, feeling a little shaken by the sudden and sharp turn towards the collectable market. That’s not to say the buyers aren’t there.

Research into the NFT art market shows the actual number for percentage growth in 2021 for NFT art is an eye-watering 16,981%. It’s almost too steep of a curve to plot on a graph. However, the penetration of crypto-art into the traditional art market remains low. In 2020, it was only 0.026% with a forecast of 3.71% by the end of this year.

Traditional art is a proven asset class that, when curated well, outperforms others and acts as an inflation hedge because it is not correlated to other asset classes. According to the ArtTactic: Deloitte Art and Finance Report 2019, "86% of wealth managers surveyed recommended investing in art". Yet most of those are still not buying NFTs. But, the gap is closing. Allocation to NFTs in IRL investment portfolios is in its infancy and despite enormous growth, the NFT market is still relatively young, meaning that opportunities for growth are high. When the traditional world fully catches up, those early birds will be the ones happily munching on the worms.

So, when we look back in years from now, we will realise that for NFTs, 2021 was a year of good ol’ days. I am part of MORROW collective and back in May, with my colleagues Jen Stelco and Claire Harris, we launched our inaugural Metaverse exhibition: Genesis. It was an exhibition of 60 artworks from well-established traditional artists, with artwork sourced from our gallery partners. In that show, we had some stunning works. Sara Rahbar, an Iranian-American who is known internationally for her flag series – a reimagining of the American flag, with a questioning of notions of nationhood and identity that has been collected by the British Museum and Le Centre Pompidou (to name a few) - gave us her first ever flag, which we made into an NFT. Halim Al Karim, a brilliant Iraqi artist whose photographic works are based on his quite incredible life story was also in the exhibition as was Philip Mueller, a renowned surrealist artist from Austria. Other high-profile names from around the world included Saule Suleimenova, from Kazakhstan, Edward Woodley, a Sydney-based practitioner and Bernardo Siciliano, an Italian-American based in New York. At the end of November, we partnered with Atrum, a new Saudi-Arabian initiative to launch the work of Lulwah Al Humoud into the Metaverse. Known for her minimalist, abstract, artworks that draw together elements of language, spirituality, and traditional Islamic art, Lulwah’s works are highly sought after by collectors and her Genesis NFT Al Salam – which attracted a bidding war - was just as well received.

Hidden Love by Halim Al Karim

Stolen Land by Sara Rahbar

Perhaps these names are not known to those in the crypto world and perhaps, in the decentralised, democratic world of NFTs, that is a good thing. Everyone should have to prove their worth. However, when the gap does completely dissolve between the two spheres and the traditional heavyweights in the art world make their move, we will be ready and waiting. Damian Hirst has already waded in, as has Urs Fischer, from (arguably) the world’s most prestigious gallery, Pace.

Right now, NFTs offer a way for investors to diversify their portfolios, they also allow collectors to authenticate their collection and have it continually on show to a global audience in a constantly active market. But the most exciting thing when it comes to fine art NFTs as an asset class is that it is still in its early days. And there is still potential for huge returns. So, for anyone looking for the next wave, my prediction is that it is in the one-of-one, fine art market. And mark my words, who knows how many of these NFT good ol’ days we have left.

Part of our mission at UNDRGRND is to work with curators and people who know art and can help guide a new generation of art collectors. One of the ways we do that is by partnering with collectives like MORROW who know traditional art and exist to bring galleries, artists, museums, collectors and investors into the NFT space.