BTC Connect Roundup: 4th Edition

Babylon's 70m funding round, LRC-20 live on mainnet, Grayscale lauching $STX Trust, and more

Subscribe to the Telegram channel at: https://t.me/btcconnectx

About the author

Particle Network (https://particle.network) is at the forefront of Web3 innovation with its Modular L1 powering Chain Abstraction. After successfully integrating Wallet Abstraction into 900 dApps, serving 17 million users, Particle Network is unifying the Web3 experience through its Cosmos SDK Layer-1. This empowers Universal Accounts, Universal Liquidity, and a Universal Gas Token across diverse ecosystems, such as BTC, SVM, IBC, and EVM.

Vamient Capital (https://vamient.xyz) is a quant fund specializing on trading on-chain with strategies deployed across multiple chains. As a market maker, Vamient specializes in making for order books, JIT liquidity for AMMs and can work with different hybrids in between, running liquidations and keeper bots for lending and collateralized protocols. Vamient looks to be a strong partner with new ecosystems to leverage on our niche in HFT and will be interested in contributing to lower spread, higher price stability and higher trading volume.

RESEARCHES & CONCEPTS

Atomicals Virtual Machine (AVM) Whitepaper

Atomicals Protocol has introduced the Atomicals Virtual Machine (AVM). AVM is a smart contract system that stores smart contracts in transactions for execution in a sandboxed runtime via the overlay digital asset indexers.

They didn't rely on any new smart contract language but relying on the existing Bitcoin Script language itself, which is already Turing-complete, being a Two Stack Pushdown Automata (2-Stack PDA) and has the benefit of not having any looping instruction, but can achieve the same effect as loops using the technique of loop unrolling.

The Future of Bitcoin # 3: Scaling Bitcoin

Binance Research continues their series about Bitcoin Ecosystem by talking about scaling efforts on top of Bitcoin.

Recent developments in Bitcoin, such as Ordinals, Inscriptions, BRC-20 tokens, and Runes, have intensified discussions on scalability solutions due to rising transaction fees. However, while Ethereum's Layer-2 solutions represent about 10% of its total value, Bitcoin's Layer-2 solutions only account for about 0.13% of its total value.

They also elaborate on key considerations for Bitcoin scalability solutions include trustless two-way bridge issues, alignment with the Bitcoin base layer, fork requirements, and incentive alignment. Additionally, more "Bitcoin-native" projects like Lightning Network and RGB aim to enhance Bitcoin's P2P transaction capabilities and introduce smart contract capabilities.

Other scaling solutions, such as sidechains, zk-rollups using BitVM and EVM Layer 1s, are also being explored. In conclusion, the growing expressivity of Bitcoin and the emergence of DeFi primitives underscore the increasing importance of Bitcoin Layer-2 solutions.

Fast Transactions, Low Fees: Bitcoin's Layer 2 and Sidechains

This piece from Antonio Quentai argues that Bitcoin's security and decentralization features, while excellent for blockchain resiliency, can hinder usability, particularly for micropayments.

The author continues by saying that Layer 2 and Sidechains offer solutions, functioning like a smaller, quicker notebook for everyday transactions that eventually settle on the main Bitcoin blockchain. This allows for faster, cheaper transactions, and opens up new functionalities. However, these solutions add complexity and potential security risks, and bugs. Some also have deceiving marketing buzz that obfuscated their centralised nature.

All in all, these also provide a sandbox for testing and experimenting with new technologies without compromising the Bitcoin Blockchain.

OP_CAT and the Infinite Nothing

OP_CAT, a potential upgrade for Bitcoin's script language, is neither infinitely capable nor dangerous, but a useful opcode - according to this article from Bitcoin Magazine.

OP_CAT enables introspection, checking parts of its spending transaction, and even looking back at parent transactions. However, it can lead to constructions like hashrate escrows and automated market makers (AMMs), which were considered risks of bringing centralizing Miner Extractable Value (MEV) to Bitcoin. To avoid centralizing MEV, ensure that any opportunities for MEV on Bitcoin are either easy to extract or cost more to extract than they're worth.

The author also suggests that OP_CAT should be activated with another way to do transaction introspection, such as OP_TXHASH or OP_TX, to reduce the size and complexity of the scripts needed.

Some reflections on the Bitcoin block size war

Ethereum founder Vitalik offers a comprehensive thought of the Bitcoin block size war, viewed from the perspectives of both small-block proponents and big-block proponents. The blog covers the contrasting views within the Bitcoin community on block size, the technical and governance-related complexities, and the differing interpretations of Bitcoin's intended purpose.

The small-block perspective, represented by Jonathan Bier, argues for a conservative approach to increase block size slightly, maintaining simplicity and affordability for running a node. Small-blockers also emphasize the importance of consensus among users for protocol changes, insisting Bitcoin should remain free from control by central organizations.

The big-block perspective, represented by Roger Ver, argues for a substantial increase in block size to maintain Bitcoin's original vision as a digital cash system with lower transaction fees. Big-blockers criticize the small-blocker's solutions, particularly the Lightning Network, as inadequate and potentially leading to centralization.

The blog also includes the Vitalik's personal views on the block size war, arguing for a balance between increasing transaction fees and the cost of running a node. Vitalik criticizes both sides for their unwillingness to compromise and criticizes the big-blockers for a lack of technical competence and for their shifts in principle regarding block size limits.

NEWS & LAUNCHES

4 New Projects Launching on The People's Launchpad

The People's Launchpad from Particle Network is hosting the Bitlayer Mining Gala Event, offering rewards to active community members who participate in various tasks.

Bitlayer is a Layer-2 solution offering Bitcoin-equivalent security and Turing completeness. The event is a partnership with several DeFi protocols from Bitlayer's ecosystem, and The People’s Alliance. Rewards amounting to $23.24M will be distributed to participants. Four projects featured in the event are Lorenzo, bitCow, Avalon Finance, and Pell, each offering their own unique DeFi/restaking solutions. Participants can increase their Power ranking and token allocation by performing tasks related to each project.

For detailed guide of the steps, read more at: https://blog.particle.network/bitlayer-mining-gala-launchpad/

LRC20 is live on mainnet

Asset tokenization protocol on Lightning LRC20 has officially live on mainnet. A Javascript SDK is also launched along with the default Rust implementation "yuv".

Babylon's 70m Raise Led By Paradigm

Babylon has announced their latest 70m funding round led by Paradigm, with participations from Polychain Capital and the venture arm of crypto exchange Bullish (also CoinDesk's parent company).

This latest round of investment, follows the 18m round announced on last December, will accelerate Babylon’s mission to enable a Bitcoin-secured decentralized economy.

Nubit's Integration with Babylon DevNet

Follow the above funding announcement of Babylon, Nubit has also announced the integration with Babylon on Devnet. This integration enables trustless Bitcoin staking within Nubit to secure the network. Babylon Node manages staking operations and processes critical data. Meanwhile, the IBC Relayer facilitates efficient communication between Nubit and Babylon.

Grayscale launching $STX Trust

Grayscale, the world's largest crypto asset manager, has announced the Grayscale Stacks Trust, providing accredited investors with easy access to $STX. This move allows investors to gain exposure to the leading Bitcoin L2, thereby activating the Bitcoin economy.

The STX Trust reflects growing institutional interest in Stacks, with potential for increased liquidity in the Stacks ecosystem. Additionally, Grayscale's successful efforts in obtaining SEC approval for BTC and ETH ETFs suggest other crypto ETFs are now more attainable.

Joint Pre-Launch Staking Event from Lorenzo for Babylon and Bitlayer's Mining Gala

Lorenzo is launching a joint event with Bitlayer, rewarding users through a point system for participating in the Lorenzo’s Pre-Launch Staking Event for Babylon and Bitlayer Mining Gala.

To participate, users stake BTC in Lorenzo, mint stBTC, and bridge stBTC to Bitlayer to earn further yields. Rewards are divided into three pools based on participation and contribution, with additional referral rewards for inviting new users. The event aims to maximize earning potential with increased points for early contributions.

Bitlayer's STARK Verification

The Bitlayer team has claimed to have successfully implemented Fast Reed-Solomon Interactive Oracle of Proximity (FRI) verification in Bitcoin Script without relying on extra protocol changes like OP_CAT.

They do so by implementing the BitVM2 model - splitting the script into smaller segments and using BitCommitment and Taptree. The FRI prover and verifier are based on Plonky3 FRI, with the main difference being the use of Taptree for polynomial commitment. The Bitcoin Script implementation of FRI verifier verifies the FRI folding and the Fiat-Shamir Transformation, and uses Blake3 hash for the Fiat-Shamir Transformation. A more efficient BitCommitment implementation from BitVM called Winternitz Signature is also used.

This implementation is crucial for implementing STARK proof systems on Bitcoin and scaling Bitcoin through zero-knowledge proof-based rollups. However, challenges remain, such as enforcing the game responder to publish the contents of the Taptree leaves without transaction introspection.

$TAP Launch on CoinList

$TAP - the native token of TAP Protocol - has launched on CoinList from 29th May to 5th June at 3.57$ (75m FDV), with terms for purchasers including 10% unlocks at TGE, followed by a 12-month linear release. TGE is expected on or around June 28, 2024.

TAP Protocol enhances Bitcoin ordinals with advanced capabilities, simplifies token usage, and offers enhanced security by leveraging Bitcoin's existing infrastructure. It also introduces a novel approach to computation, enabling the development of games, metaverse experiences, productivity tools, and social applications directly on the Bitcoin Network.

Introducing UTXO Stack

After the launch of RGB++ protocol on mainnet, Nervos has introduced UTXO Stack - which combines RGB++ Protocol on Layer 1 with a stack to launch UTXO-based BTC Layer 2 appchain. RGB++ assets have the capability to be "leaped" onto the Layer 2s, with the capability to also stake BTC, CKB and other assets to provide security for these Layer 2s.

Chakra TestNet-1 is live

The Chakra Testnet-1 will launch at 5 PM UTC on May 30, 2024, in collaboration with Babylon Bitcoin Staking Testnet-4, enabling users to stake on both platforms simultaneously. Chakra will secure Babylon's PoS services based on the amount of BTC staked by users.

The launch includes two phases: Aqua Dropping and Aqua Merging. In Aqua Dropping, users complete tasks to claim Signet Bitcoin from Chakra. In Aqua Merging, users will stake Signet Bitcoin, with details to be announced. Note that Signet Bitcoin is a simulated currency for testing purposes and carries no monetary value.

Zeus Network's Apollo final testnet is live

APOLLO from Zeus Network has started their final testnet. Users can access the testnet dApp at: https://muses.apollobyzeus.app

APOLLO introduces liquid staking solutions for Bitcoin holders to explore the Solana DeFi ecosystem. It introduces $zBTC, a ZPL-Asset on Solana pegged one-to-one with Bitcoin, allowing users to transfer their $BTC onto the Solana ecosystem seamlessly.

Potential uses of $zBTC include depositing into DeFi protocols to earn yields, providing liquidity, swapping for any SPL token, and collateralizing to create stablecoins. APOLLO opens up new DeFi opportunities like borrowing and lending, maximizing Bitcoin assets' potential on Solana.

Bitflow launching new trading routes

Bitflow is launching new trading routes to enhance its Swaps Aggregator.

It is expanding trading routes with Velar, featuring new pairs including STX to WELSH, ODIN, LEO, and PEPE. Bitflow is also supporting the USDA pool from Arkadiko Protocol, with new routes including DIKO<>USDA, STX<>USDA, and STX<>DIKO.

Liquidium introduces OTC Loan

Liquidium's Custom Offers (OTC Loans) allow lenders to make custom offers on individual ordinals. The process involves creating a loan offer, accepting an offer, and countersigning offers.

OTC Loans offer more customizability compared to regular loans and are ideal for high-value loans of special or rare inscriptions. However, they are recommended for special cases as traditional loans provide a better user experience and quicker loan matching. In Liquidium, the loan repayment and default rules, as well as the points system, remain the same as traditional loans.

NEW PROJECTS SPOTLIGHT

Zulu Network

Zulu Network is a Bitcoin Layer 2 that introduce a dual-layer architecture:

ZuluPrime acts as L2 on Bitcoin with EVM compatibility.

ZuluNexus acts as L3 on Bitcoin expanding its features supporting UTXO & Account type.

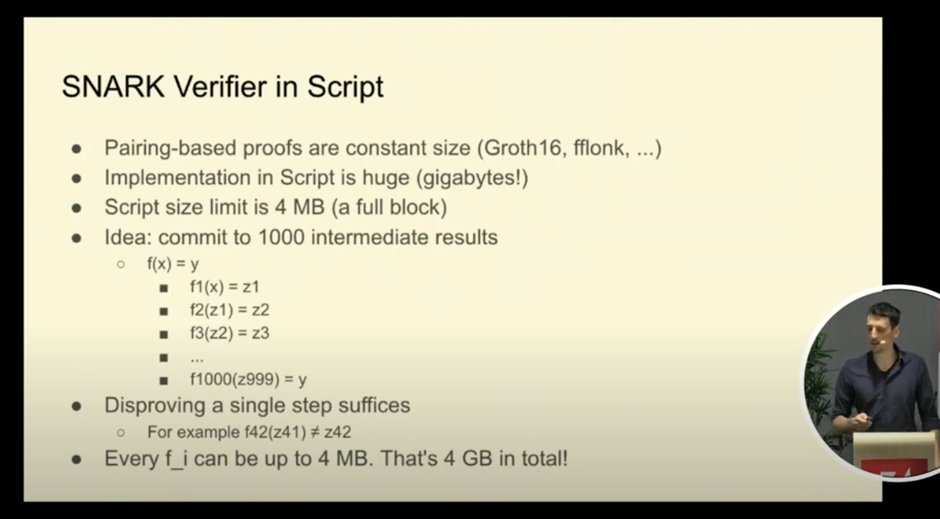

The team has open-sourced the first Zero-Knowledge Proof (ZKP) Verify Code Implementation using Bitcoin Script, involving algorithms such as Groth16/FFlonk. The size of the verifier for Groth16/Fflonk is substantial, but the entire ZKP script only needs to be split into fewer than 2,000 sub-scripts.

This achievement sets the groundwork for a decentralized bridge based on BitVM2, with Zulu's next goal being to launch a trust-minimized Bitcoin bridge using cross-chain technology and BitVM2.

LRC-SWAP

LRC-SWAP, a non-custodial near real-time trading platform for tokens on Bitcoin, is launching its beta version.

The platform initially focuses on the LRC-20 token protocol on L1 Bitcoin, with plans to support more token protocols and move most of the volume onto Lightning. The beta version allows users to create, transfer, and discover LRC-20's, with the swapping feature going live in the coming weeks.

The launch is structured as a game, with the top 3 tokens listed first and their creators winning $1,000 in Bitcoin each. Users can upvote tokens with points, and beta invites are available for those who quote tweet the announcement thread.

Hedgehog

Hedgehog from supertestnet is a two-party payment channel protocol similar to Lightning channels but simpler and offers unique benefits. It uses a Bitcoin script primitive called "revocable connectors" to facilitate off-chain transactions.

Revocable connectors operates on two primitives: revocable scripts and connector outputs. Revocable scripts allow either party to revoke their ability to receive money safely, while connector outputs enable conditional transactions. These two primitives allow the creation of Hedgehog channels, where transactions can occur "off-chain". The process can be repeated indefinitely, with each party having the ability to revoke and create new transactions, or the channel can be closed when either party decides to do so.

With Hedgehog, parties can create payments for each other, send them via any communication method, and go offline. The recipient can accept or reject the state change without the sender's assistance. The protocol also addresses potential issues such as a party's inability to force close the channel after sending money, or the inability to access funds if a party dies before completing a transaction.

Disclaimer: this piece is purely informational and does not reflect endorsement or support of the projects mentioned. Please do your own research.

490

490

is there as a bonus feature. I know more than one team will be releasing a wallet based on it very soon. Exciting times ahead.

is there as a bonus feature. I know more than one team will be releasing a wallet based on it very soon. Exciting times ahead.

Exciting news! Babylon has successfully completed a $70M raise led by Paradigm

Exciting news! Babylon has successfully completed a $70M raise led by Paradigm

…

…

Turing-complete capability with

Turing-complete capability with

Chakra's Testnet-1 is LIVE!

Chakra's Testnet-1 is LIVE!

Phase 1: Signet BTC airdrop

Phase 1: Signet BTC airdrop

Launch dApp:

Launch dApp: