NFTFi Weekly #10

Tensor's first collection, Sharkify acquiring Honey Finance, Fungify releasing Fungify Pool, and more

Tensor has released its first collection.

Tensorian is a collection of 10,000 NFTs created by the Tensor team and Zen0m artist. The minting started on August 9th and will last for one month.

To mint one Tensorian, users need to own 10 Tensorian shards of the same color plus pay a minting fee of 1.69 SOL. There are four types of Tensorian shards, which were distributed based on users' activity on Tensor during Seasons 1 and 2 (NFT Boxes).

Further announcements on the utilities of Tensorian are expected to be announced in the coming weeks.

Reservoir released a new price oracle model

The Reservoir oracle aggregates the bid-ask midpoint (BAM) time-weighted average price (TWAP) of a collection using real-time bid and ask data sourced by Reservoir.

By taking the TWAP of a collection's bid/ask midpoint for any NFT collection, the price becomes less susceptible to manipulation and more accurate compared to using only the latest sale price. The Reservoir oracle was built by Jason Maier and the Hook Protocol team.

With expansions to new chains such as Polygon, Avalanche, and others, Reservoir has become a standard for NFT infrastructure.

Introducing Unlockd

Unlockd is an NFT lending/borrowing protocol that utilizes a peer-to-pool model. To determine the floor price of one collection, Unlockd uses an appraisal model that incorporates third-party tools such as Upshot, NFT BANK, and Nabu, which use an algorithmic pricing model. The model is then combined with Unlockd's dynamic loan-to-value ratio to determine the final amount that can be borrowed.

In addition, Unlockd's liquidation process uses an in-house Dutch auction process and external liquidation pools to limit bad debt for the protocol. To learn more about Unlockd, you can follow this link: https://docs.unlockd.finance

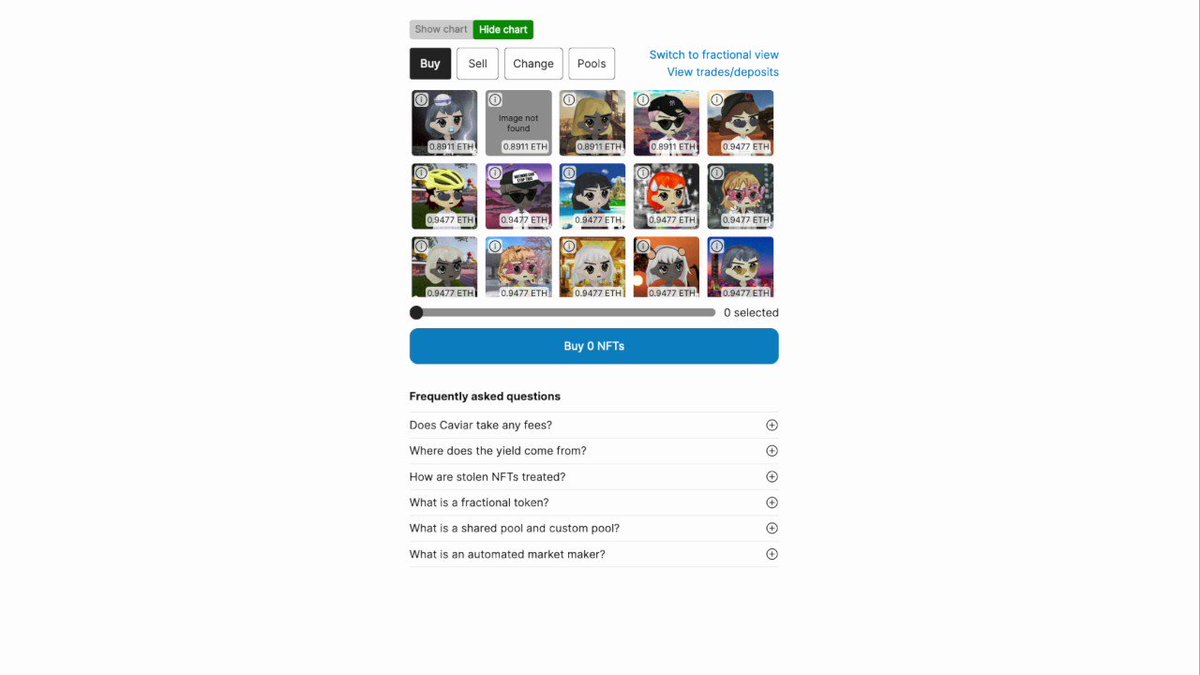

Caviar integrated a chart view into its UI.

Caviar is an automated market maker (AMM) used for trading NFTs. Since its launch in February 2023, Caviar has achieved a total value locked of 1.4M and a total trading volume of around 3M.

Now, users don't need to switch between multiple tabs to see live charts, they can view them directly on the Caviar UI.

Sharkyfi acquired Honey finance

Sharkyfi is an NFT lending and borrowing protocol built on the Solana blockchain. Honey Finance is a peer-to-pool lending and borrowing platform for NFTs that operates on EVM-compatible chains.

Since launching in April, Sharkyfi has facilitated over $2.7 million in total borrowing volume on Solana. To expand its reach, Sharkyfi has acquired Honey Finance. This will allow Sharkyfi to leverage Honey Finance's existing infrastructure and launch lending and borrowing protocols on EVM chains as well.

Nftperp released a teaser for V2.

Since June, negative market sentiment has caused the prices of some blue-chip NFT collections to drop dramatically. NFTperp identified limitations in its V1 vAMM design which resulted in extreme imbalances during periods of high volatility.

To address this, NFTperp made the decision to sunset V1 and pause the protocol in order to protect users. Since pausing operations, the team has successfully returned all user funds without any capital losses. Additionally, unrealized profits for traders will be fully compensated through a distribution of $vNFTP tokens at a discounted price of $0.053.

Moving forward, NFTperp has revealed plans for its V2 design which incorporates a fusion AMM combined with external liquidity provider integrations and decentralized limit order books. This is aimed at creating a more robust and balanced market structure.

LooksRare introduced YOLO

YOLO is a lottery game that utilizing Chainlink VRF to determine to winner. Every four minutes, a new round begins where players can deposit ETH, LOOKS tokens, or eligible NFT collections into a shared prize pool. At the end of the round, Chainlink VRF randomly selects one player as the winner to claim the entire accumulated prize pool.

LooksRare charges a 5% fee on the total deposits of each round. The fee is allocated to LOOK treasury, and 50% of revenue earned from YOLO will be used for buybacks $LOOKS token.

JPEG'd protocol successfully recovered the funds from the Curve exploit.

On July 31st, Curve Finance suffered a major exploit due to a bug in the Vyper Compiler, resulting in the theft of approximately $47 million worth of cryptocurrency. Additionally, the JPEG'd protocol reported a loss of 6106 WETH (~$11.6M) from its pETH-ETH liquidity pool on Curve.

However, white-hat hackers were able to front-run the exploiter and rescue the funds from JPEG'd. The team announced that it awarded a 10% bounty of the recovered assets to the white-hat hackers, and the DAO is choosing the disbursement plan for all addresses impacted by the Curve exploit.

Fungify released Fungify Pool

Fungify has launched the testnet of its NFT index, building upon its initial NFT index release. Fungify has debuted the Fungify Pool - a peer-to-pool NFT lending and borrowing market.

Users can now supply $NFT index tokens to the pool and borrow against their position on the testnet. This also enables shorting of the $NFT index token. This introduces additional trading strategies to leverage their index holdings while generating yield.

Metastreet released a teaser about punk_mstETH.

MetaStreet is a peer-to-pool NFT lending and borrowing market that uses an automated tranched lending model.

Their latest addition Punk_mstETH serves as a liquid staking token built on top of stETH. Holders of Punk_mstETH earn yield from both the underlying staked ETH in stETH and interest paid by borrowers who collateralize loans with CryptoPunk NFTs. This dual income structure is expected to offer yields of 10-14%.

388

388

Introducing - YOLO

Introducing - YOLO

Announcing: punk_mstETH by MetaStreet

Announcing: punk_mstETH by MetaStreet