NFTFi Weekly #9

Paraspace V2 plan, introducing Kyoko, luxury-watch-as-collateral-loan on Arcade, and more

ParaSpace released information about V2.

Even amidst the recent controversy involving its CEO, ParaSpace remains steadfast, forging ahead with plans for launching its anticipated V2. Paraspace V1 previously reached approximately $230 million in total value locked (TVL) at its peak. Currently, V1 sits at around $80 million TVL.

With the launch of Paraspace V2, the platform aims to expand support for more NFT collections and additional blockchain networks beyond Ethereum.

X2Y2 added CyberKong as collateral

Since launching its lending feature, X2Y2 has achieved a total borrowing volume of 100M.

Presently, CyberKongz token holders have the added advantage of using their holdings as collateral against borrowing in Ethereum (ETH). The imminent launch of Genkai, a fresh addition to the CyberKongz collection, introduces an array of new trading opportunities for enthusiasts and investors alike.

BENDAO made its first buyback and burn.

In accordance with their BIP #34, BendDAO will allocate 20% of pairing fee revenues derived from $APE staking to purchase and incinerate $BEND tokens. The intensity of this buy pressure is contingent upon both the volume of BAYC and MAYC staked and the prevailing price of $APE. Notably, the inaugural burn successfully eliminated 1.7 million $BEND tokens from the circulating supply.

Here is the transaction ID for the $BEND burn:

https://etherscan.io/tx/0x2d959a05201916bf8328f30025cae1cc923cc7ab06dbecb18984855646dbc0e7.

Furion launched testnet V2

Furion serves as a money market that enables users to fractionalize their NFTs into ERC20 tokens, facilitating lending opportunities. Between July 11th and August 8th, individuals fulfilling all tasks on the Fusion Testnet v2 will earn a distinctive badge. This badge potentially qualifies them for an airdrop upon the launch of the mainnet.

You can find full instructions at: https://medium.com/@project.furion/furion-x-galxe-v2-testnet-campaign-instructions-85be67ea21e6.

X2Y2Fi released batch borrowing feature

X2Y2Fi's Batch Borrow enables borrowers to collateralize multiple NFTs at once, which makes it quick, efficient, and saves gas fees when obtaining multiple collection loans.

Borrowers can select which NFTs to collateralize and each NFT will be matched with the most suitable offer on a peer-to-peer basis. The NFTs are submitted for loans in batches, and up to 10 NFTs can be used in one batch.

Hook Protocol revealed chest rarity

Following up on what we covered in NFTfi Weekly #8, Hook Protocol has since unveiled the rarity scale of their treasures, where higher rarity corresponds to increased value. Furthermore, you now have the ability to track your standing on the Profiteer Leaderboard based on Total Points.

Since launching the Treasure Hunt program, the number of active vBids has grown steadily every week. Users can earn treasure chests on Hook by placing an offer and listing option.

Introducing Kyoko

Kyoko is a peer-to-pool NFT lending market that supports cross-chain asset lending. It has multiple pools with different levels of risk: independent blue-chip collection pools that only support blue-chip collections like BAYC and AZUKI, and a shared pool for newly added collections. The shared pool has the same risk factor, lending ratio, liquidation factors, and other parameters.

Kyoko has raised approximately 6 million dollars last year. Currently their money market has already launched on testnet.

Tribe3 1st trading competition recap

Tribe3 is a perpetual NFT exchange that utilizes the vAMM model. After being open for trading for one month, Tribe3's first trading competition has closed, achieving the following statistics:

Total trading volume of approximately 38M.

Total eligible participants: 289.

Top 3 trading pairs: BAYC, Azuki, Captainz.

For full details on the competition results and prize distribution, please refer to the announcement here: https://mirror.xyz/tribe3.eth/448BHUNBzO8GBQcs0CKbwH8Zqfw2VaZgBXe1ELo0muM.

Pine Protocol now supports Ordinals inscriptions

Since February, all Ordinal marketplaces have achieved ~300M in trading volume and surpassed 20M ordinal inscriptions.

Pine Protocol now supports lending and borrowing for top Ordinal collections such as @BitcoinFrogs, @OrdinalMaxiBiz, and @Bitcoin_Punks_. Users can also lend BTC on Pine to earn yield.

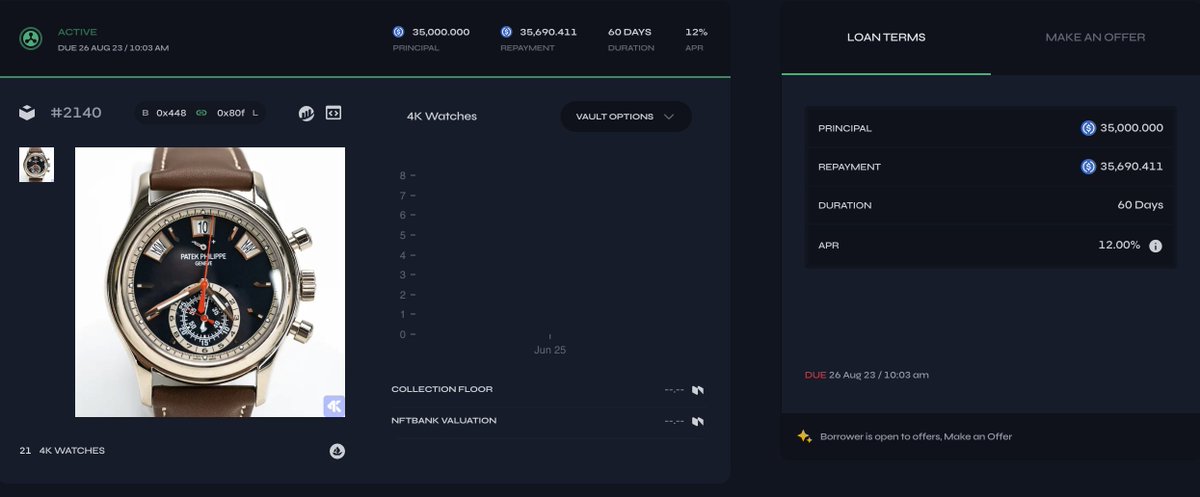

Holder of luxury watches took out a loan on Arcade.

A lender gave a $35,000 loan at 12% APR to a stranger who used a Patek Phillipe watch as collateral.

The borrower sent the watch to 4K Protocol - an escrow company, which then provided an NFT representing ownership of the watch. The borrower listed the NFT on Arcade and accepted loan offer. The NFT was transferred to an escrow wallet until the term was up or the borrower repaid the loan. If the borrower defaulted, the lender could claim the watch. You can find other watch offers here: https://app.arcade.xyz/loans?project=4k-watches

176

176

Furion V2

Furion V2

Chest Rarity Announcement

Chest Rarity Announcement

Top Gainer x 50

Top Gainer x 50 Top ROI x 10

Top ROI x 10 Top Converger x 10

Top Converger x 10 Rekt x 5

Rekt x 5

We are excited to announce PINE now supports

We are excited to announce PINE now supports