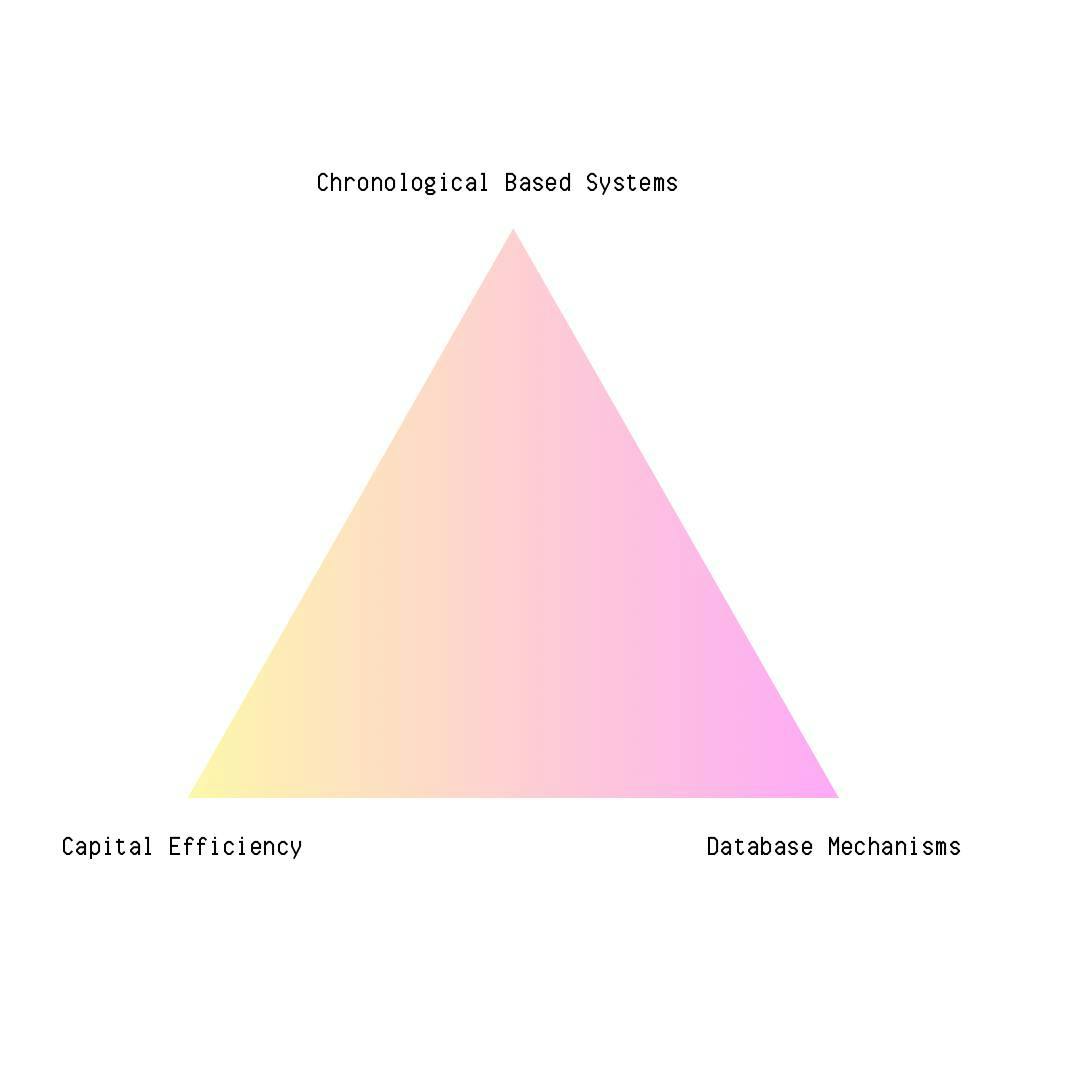

The Defi Trilemma

A Martin Luther 95 thesis but for Defi

Defi (Decentralized Finance) aims to establish a transparent financial system that surpasses the conventional financial sector. However, despite its ambitious objectives, it has not made significant advancements in balancing the design tradeoffs, which I refer to as the "DEFI Trilemma." Taking inspiration from the "Blockchain Trilemma", I believe that the challenges faced by all Defi applications can be categorized into three distinct areas, each with various subsystems falling within their scope. In the following sections, I will delve deeper into these categories. This article aims to demonstrate how diverse underlying design mechanisms impact protocol behavior including but not limited to market participants, user behavior, liquidity, and protocol revenue.

First, We have Chronological based systems which can be broken down into

Execution (TPS)

Settlement (Finality)

Block Ordering (Mev)

Liquidation Delay

Atomic Closeout

The Importance of Execution

Transactions per second (TPS) constitutes a pivotal metric that profoundly influences the end user experience within a protocol. This fundamental aspect intricately governs the ability of market participants to seamlessly execute orders and serves as the determiner of the upperbound threshold of a network before encountering bottleneck-induced spikes in the mempool's entropy. In the context of decentralized finance (DeFi), these bottlenecks pose a significant challenge as they can impede the processing of orders, resulting in heightened slippage fills, liquidations, and an increased susceptibility to information asymmetry, notably in the form of Miner Extractable Value (MEV). Consequently, this aspect of a protocol assumes paramount importance, representing the prominent and conspicuous facet that directly impacts and captures the attention of users.

The complexity of a transaction can also have a significant impact on the TPS of a blockchain network. The more complex a transaction, the longer it takes to verify and process, which can reduce the TPS of the network. Therefore, it is important to consider the complexity of transactions when designing blockchain networks.

However this can lead to many developers to adopt a gas optimization mindset Gas optimization involves finding ways to minimize the computational resources required for executing smart contracts and transactions on the Ethereum blockchain. This optimization typically involves streamlining code, reducing unnecessary calculations, and employing more efficient algorithms. However, it is crucial to recognize that such optimization techniques can inadvertently introduce security vulnerabilities.

When developers focus solely on gas optimization, there is a risk of overlooking critical security measures. Complex and intricate smart contract logic may be simplified or omitted, potentially leaving exploitable loopholes or attack vectors. By prioritizing gas efficiency over security, developers may inadvertently compromise the integrity and robustness of their smart contracts, making them more susceptible to malicious activities such as reentrancy attacks, front-running, or other forms of contract vulnerabilities.

Moreover, gas optimization often involves reducing redundancy and limiting error-checking mechanisms, which can further undermine the security of the system. By minimizing redundant code and error handling, developers may inadvertently overlook potential edge cases or fail to adequately validate inputs, making the system more prone to exploitation or manipulation. One prevailing challenge lies in the tendency of developers to overlook the intricate interdependencies within the Ethereum ecosystem. This oversight often results in the implementation of solutions driven solely by gas optimization, disregarding the broader spectrum of tradeoffs and considerations.

The Importance of Settlement

Settlement, as a metric, holds paramount significance for both end user experience and market liquidity. Unsettled transactions directly impinge upon the available liquidity and introduce vulnerabilities to manipulation, As the usual safety provided by additional confirmations is absent further more the disincentive of slashing is also absent making it a zero cost decision to pursue the potential MEV. Thus exerting consequential implications. The presence of transactions in limbo disrupts vital functions such as liquidation events, deposits and withdrawals, as was seen with Polygon's ZkEVM and DYDX during Ethereum's lapse in finality. Thereby potentially instigating a cascading effect akin to a bank run within a protocol. These bottlenecks not only disrupt the protocol's internal operations but also reverberate across interdependent applications such as bridges, thereby amplifying the magnitude of their impact. Additionally, settlements implicate the resilience of governance processes, which are particularly time sensitive to disturbances.

The accurate determination of settlement timestamps assumes critical importance for auditing and compliance purposes. Even slight deviations in settlement timestamps can give rise to substantial legal ramifications, as the coherence of the paper trail becomes compromised. Consider, for instance, the investigation of illicit practices like wash trading or insider trading, where the precise sequencing of settlements serves as a crucial piece of evidence.

Hence, a comprehensive understanding and meticulous management of settlement dynamics are imperative to uphold optimal end user experiences, fortify market liquidity, and safeguard against disruptive influences ranging from liquidity constraints to systemic attacks. Attentive monitoring and rigorous adherence to coherent settlement processes are vital to foster trust, preserve market integrity, and ensure the robustness of the overall financial ecosystem

The Importance of Block Ordering

The time ordering of transactions on a blockchain is a fundamental property that has a significant impact on the security, efficiency, and fairness of DeFi applications. In particular, the order in which transactions are included in blocks can be exploited by malicious actors to extract profits from unsuspecting users. It is important to note that the users being referred to in the context are small retail investors, typically defined as individuals with holdings of $2,000 or less more of this research can be found here

Credit by Lekos

One of the most well-known examples of this is miner extractable value (MEV). MEV refers to the profits that can be obtained by miners by strategically ordering transactions in blocks. For example, a miner may include a transaction that benefits them personally, such as a transaction that pays them a fee, ahead of other transactions that would have been included in the block otherwise. This can give the miner an unfair advantage over other users, and can also lead to congestion and higher fees on the network.

Another type of attack that can be facilitated by the time ordering of transactions is frontrunning. Frontrunning occurs when a malicious actor observes a transaction that is about to be submitted to the blockchain, and then submits a transaction of their own that takes advantage of the first transaction. For example, a frontrunning attacker might observe a transaction that is about to swap tokens between two addresses, and then submit a transaction of their own to swap the same tokens in the opposite direction. This would allow the attacker to profit from the price difference between the two transactions.

Finally, sandwich attacks are a type of frontrunning attack that specifically targets liquidity providers on DeFi exchanges. In a sandwich attack, the attacker observes a liquidity provider's order to buy or sell an asset, and then submits two transactions that sandwich the liquidity provider's order. The first transaction sells the asset to the liquidity provider at a lower price, and the second transaction buys the asset from the liquidity provider at a higher price. This results in the liquidity provider losing money on the trade, while the attacker profits.

These are just a few examples of how the time ordering of transactions on a blockchain can be exploited by malicious actors. As DeFi applications become more complex, it is likely that we will see even more sophisticated attacks that take advantage of this property. Therefore, it is important for DeFi users to be aware of these risks and to take steps to protect themselves.

In addition to the attacks mentioned above, there are a number of other ways in which the time ordering of transactions can affect DeFi users. For example, the time ordering of transactions can affect the price of assets on DeFi exchanges, as well as the profitability of DeFi yield farming strategies.

The Importance of Liquidation Delay

The liquidation delay directly impacts the timing of user liquidations, thereby exerting a significant influence on the overall market health. Extended liquidation delays impose strain on the system by prolonging the period during which positions may remain uncollateralized. This exposes all users of the application to risk, as the protocol becomes responsible for absorbing potential losses from counterparties who fail to honor their obligations. The absence of timely settlement adversely affects market fairness, as it disregards the importance of honoring both sides of a trade.

Another crucial aspect of liquidation is the potential consequence of excessively short delays, which can lead to unnecessary and premature liquidations. Such circumstances can result in system congestion, particularly in the face of short-term volatility. The excessive sell pressure generated by these untimely liquidations may disrupt the equilibrium of the market, causing unintended consequences and frustrating users.

Furthermore, liquidation delay also impacts the timing of user deposits aimed at restoring the health of their accounts. By allowing users to promptly deposit collateral to rectify their positions, the protocol can mitigate the risk of liquidation. This not only saves on gas fees for individual users but also alleviates network-wide congestion, aligning with Ethereum's resource model. It is worth noting that a single application's liquidation delay has the potential to trigger network-wide gas spikes, making responsible borrowing practices even more critical.

Thus, a meticulous consideration of liquidation delay is essential for maintaining a healthy market environment. Striking a balance between prompt liquidation to protect the system's integrity and providing sufficient time to allow users to rectify their positions is vital for fostering a resilient and efficient ecosystem. By prioritizing responsible borrowing and implementing appropriate liquidation delay protocols, the application can promote market stability, optimize gas utilization, and ensure the well-being of its users and the wider network. However, liquidation delay can also have some negative consequences for DeFi users. For example, if the price of an asset falls sharply, a user's position may be liquidated even if they have added more collateral to their position. This is because the liquidation price is based on the current market price of the asset, and the market price may continue to fall after the user has added more collateral.

In addition, liquidation delay can give malicious actors an opportunity to frontrun liquidations. For example, a malicious actor might observe a user's position that is close to being liquidated, and then submit a transaction to buy the collateral at a price below the liquidation price. This would allow the malicious actor to profit from the liquidation, while the user loses their collateral.

The Importance of Atomic Closeout

Atomic closeout represents a pivotal facet of order coordination aimed at preserving stability, optimizing market efficiency, minimizing gas costs, and mitigating associated risks. By employing atomicity, the simultaneous execution and settlement of interconnected orders are ensured, fostering a synchronized and reliable trading environment.

The concept of atomic closeout encompasses a comprehensive approach to transaction processing, where multiple interdependent orders are executed as an indivisible unit. This holistic execution mechanism bolsters market stability by synchronizing the fulfillment of orders, reducing the potential for fragmented or partial executions that could disrupt market dynamics.

Moreover, atomic closeout enhances market efficiency by streamlining the execution process. By executing interconnected orders atomically, it minimizes the time and computational resources required for order coordination, thereby optimizing liquidity utilization and minimizing trade latency.

From a gas cost perspective, atomic closeout minimizes the number of transactions and associated gas fees. By bundling interconnected orders into a single atomic unit, redundant gas expenditures associated with multiple individual transactions are significantly reduced, resulting in cost savings for market participants.

Importantly, atomic closeout also addresses risk mitigation. By ensuring that interconnected orders are executed simultaneously, it mitigates the potential for price slippage or adverse market movements between the execution of different orders. This reduces the risk of unfavorable price impacts and improves execution quality for traders.

Second, We have Capital Efficiency mechanisms which can be broken down into

Fees (Borrow, Lend, Base Layer, Funding Rates)

Impermanent Loss

Slippage

Auctioned Based VS Fixed Spread

Leverage ( Quantity, Collateral)

Composability ( Fragmentation, L2 Aggregator)

Risk Modeling (Dynamic VS Static Methodology)

Market Structure (Long Tail Vs Short)

Protocol Incentives (Liquidity Mining, Market Participants,Revenue)

The Importance of Fees

Fees have a significant impact on trader profitability within the realm of decentralized finance (DeFi). There are four primary types of fees that one should consider when utilizing or developing a DeFi application, as they hold paramount importance for different types of users (borrowers and lenders) and directly influence liquidity attraction, protocol risk management, overall health, and revenue generation.

Layer 1 fees are the fees charged by the underlying blockchain network for transactions. These fees are typically paid in the native cryptocurrency of the network, such as ETH for Ethereum or BTC for Bitcoin. Layer 1 fees can vary depending on the network congestion. Transaction fees in the context of DeFi lending platforms can have an impact on the type of debt created and the liquidation actions that can be taken. Specifically, Type 1 debt which refers to an undercollateralized position that has become overdue for liquidation and Type 2 debt which refers to an overcollateralized position, where the borrower holds collateral in excess of the required amount. When such a position is closed, the borrower is entitled to regain the excess assets.

In the case of Type 1 debt, where the collateral value falls below the required threshold, liquidation is typically initiated to protect the lender and maintain the overall health of the lending platform. However, the presence of transaction fees can introduce complexities and considerations when executing the liquidation process as during periods of price volatility or network congestion, transaction fees may increase significantly. In such instances, the cost of executing the liquidation transaction can potentially surpass the available collateral, resulting in a loss for the borrower or even the lending platform itself.

In the case of Type 2 debt, when the value of the excess assets is insufficient to cover the transaction fee associated with closing the position. The borrower may lack the incentive to repay and close the position. If the transaction fee exceeds the value of the excess assets, it creates a disincentive for the borrower to proceed with repayment. In this situation, the borrower may choose to delay the repayment or opt to leave the position open, as closing it would result in a net loss due to the high transaction fee.

This can lead to a reduction in liquidity, as borrowers choose to keep their positions open, resulting in a potential increase in interest rates. The increase in interest rates might initially benefit lenders and even attract them due to higher short-term yields due to the reduced availability of capital for lending. However, in the long run, if the reduction in the number of users and the demand for capital lending persists, lenders may experience a decrease in overall yield. The market demand for capital lending relies on a healthy balance between borrowers and lenders, and a significant reduction in borrower participation can have adverse effects on the sustainability and profitability of the lending market.

The funding rate percentage and calculation wield significant influence over user behavior, as without relying on funding rates to control market divergence it would disincentives short and long traders from engaging with the platform, as they would no longer receive compensation for participating in arbitrage positions.

This strategic design mechanism also provides a security safeguard provided by economic incentive as without it in scenarios where the market trends in a manner that aligns with the positions held by traders (which might be heavily skewed, given the disincentive for assuming counter positions), the platform risks exposing traders to substantial losses, thereby impairing the protocol's operability.

The phenomenon of impermanent loss within Automated Market Makers (AMMs) reverberates into nascent DeFi offerings like option vaults, engendering a nexus of intricate challenges arising from their reliance on AMM structures. Impermanent loss denotes the transient devaluation of liquidity provider assets triggered by fluctuations in pooled asset prices within the AMM ecosystem. In the context of option vaults, which frequently deploy AMM-based mechanisms, this phenomenon cascades through the entire system.

Foremost, liquidity providers in option vaults adopt a prudent stance, sidestepping precarious impermanent loss scenarios linked to volatile pairs and leveraged positions. Such scenarios entail a heightened potential for substantial losses due to market volatility and leveraging exposure, prompting liquidity providers to shy away, thereby diminishing liquidity within the option vault.

This reduced liquidity profoundly impacts the accuracy of option pricing. As liquidity wanes, the bid-ask spread expands, and slippage escalates, impeding precise option pricing. Users seeking to engage in option trading may thus grapple with escalated transaction costs and less propitious execution prices stemming from these liquidity-related inefficiencies. Moreover, constrained liquidity impinges on the expeditious and effective execution of trades. With limited liquidity, trade execution becomes progressively arduous, leading to potential delays or complications in closing positions when desired.

The ensuing negative feedback loop perpetuates the liquidity shortage as dwindling liquidity entices more liquidity providers to eschew participation. This amplifies the liquidity predicament and accentuates the aforementioned issues regarding option pricing accuracy and trade execution. Furthermore, this market phenomenon adds a layer of complexity to the process of bootstrapping new market liquidity for assets.

The Importance of Auction Based Vs Fixed Spread

Presently, within the domain of lending platforms, a prevalent practice involves the adoption of two discrete liquidation mechanisms. The first mechanism revolves around a non-atomic English auction process, wherein the liquidation of assets is executed through a step-by-step bidding system. The second mechanism, in contrast, adheres to an atomic fixed spread strategy, wherein liquidation occurs at a predetermined price differential, ensuring swift and immediate resolution. Auction mechanisms in the context of collateral liquidation lack a specified close factor, affording them a more fine-grained and flexible approach to the liquidation process. However, this increased flexibility comes with the inherent risk of exposure to price fluctuations in the collateral during the liquidation process which may increase the profitability of an unprofitable liquidation event, As a tradeoff, Dutch auctions stand out for their inherent resistance to Miner Extractable Value (MEV) concerns. By empowering liquidators to determine the acceptable discount level, Dutch auctions avoid simultaneous liquidation attempts by multiple participants, effectively reducing gas spikes and mitigating MEV-related issues. Moreover, the absence of simultaneous liquidations also minimizes the likelihood of different liquidators targeting the same position at a single moment, thus contributing to a more orderly liquidation process.

As liquidators engage in this competitive environment, they may resort to front-running strategies to gain a strategic advantage. This is evidenced by the observation that many liquidations involve above-average transaction fees, further intensifying the competition among liquidators. In this dynamic landscape, market forces drive free market dynamics, fostering an environment of healthy competition among liquidators seeking to optimize their returns.

Further research is warranted to explore the potential benefits and advantages of Vickrey auction methods over Dutch auctions in the context of liquidation mechanisms. While Dutch auctions have demonstrated inherent resistance to Miner Extractable Value (MEV) due to their ability to allow liquidators to choose acceptable discount levels and prevent simultaneous liquidations, Vickrey auctions present a different set of characteristics and features that may offer unique advantages.

Vickrey auctions, also known as second-price sealed-bid auctions, operate on the principle of the highest bidder winning the auction while paying the price submitted by the second-highest bidder. This design eliminates the need for real-time bidding and reduces the possibility of front-running or gas spikes associated with simultaneous liquidations. By enabling liquidators to submit sealed bids privately, Vickrey auctions introduce an element of strategic behavior, encouraging bidders to evaluate their valuations carefully and submit bids that reflect their true assessment of the asset's value.

In the context of liquidations, Vickrey auctions may offer improved fairness and transparency by ensuring that the liquidator who wins the auction pays a price that aligns more closely with the market value of the collateral. This mechanism could potentially lead to more accurate and equitable liquidation outcomes for borrowers and lenders alike instead of other liquidation methods that favor a particular party.

Fixed Spread Liquidation, a mechanism designed to streamline the liquidation process, offers an efficient alternative to traditional auction-based approaches. Rather than engaging in prolonged bidding over a specific time-frame, this method enables instant liquidation of a loan by purchasing the collateral at a pre-determined discount relative to the current market price. Liquidators are granted the flexibility to locally assess and decide whether to seize a liquidation opportunity based on the known liquidation spread.

By adopting the fixed spread model, the need for lengthy hour-long liquidation auctions is circumvented, eliminating the associated time and transaction fees. Additionally, liquidators can leverage the concept of atomic flash loans, which, although incurring higher transaction costs, effectively mitigate currency exposure risks associated with holding the assets required for liquidation in contrast to auctions. This reduction in currency exposure risk ensures a more secure and profitable liquidation event, minimizing the likelihood of encountering unprofitable outcomes during the process. Fixed-spread liquidation mechanisms, which are currently used in many decentralized finance (DeFi) systems, unfairly favor liquidators over borrowers. This is because these mechanisms allow liquidators to liquidate more collateral than is strictly necessary to repay the borrower's debt. As a result, borrowers may incur unnecessary losses, which can discourage them from borrowing in the future. This can lead to market imbalances, as there is less liquidity available to borrowers.

The Importance Of Leverage

Leverage exerts a profound impact on market sensitivity as well as enticing venturesome traders. Additionally, it has implications for optimizing capital efficiency in financial markets. By embracing leverage, investors amplify the responsiveness of their investments to market fluctuations, enabling them to reap larger gains with relatively modest price movements. However, this heightened sensitivity also exposes them to escalated risks, potentially leading to considerable losses in the event of adverse market shifts. from the borrower's perspective, though overcollateralized lending may lead to reduced liquidity, limiting the availability of assets for general use. Yet, from a security standpoint, it proves to be a formidable defense against Sybil borrowing, bolstering the integrity of the financial system.

The adoption of leverage can also spark network-wide gas wars, especially evident in dutch auctions where transaction values are elevated due to liquidators being entitled to part of the leverage. As a result, the total gas required to execute the auction surges. Moreover, leverage further exacerbates fixed spread liquidation transaction costs for flash loans during a liquidation event, contributing to the aforementioned gas wars. With more loans becoming susceptible to liquidation and incurring greater losses, fixed liquidators enjoy an increased discount entitlement. Notably, the introduction of leverage augments the probability and profitability of liquidation events for both auction and fixed spread mechanisms.

One such solution is a hybrid mechanism in the form of Auto Deleveraging

The Importance Of Composability

In the current epoch of Layer 2 solutions, a proliferation of applications has ensued, each deployed across multiple instances on various chains. This burgeoning ecosystem, while fostering innovation, has inadvertently led to fragmented liquidity across these chains. Consequently, developers find themselves grappling with the burdensome task of maintaining two separate code bases, thereby escalating the workload among teams. Moreover, this expanded surface area presents an elevated number of attack vectors, necessitating meticulous security measures.

For the end-user, this distributed landscape disrupts the once seamless interaction with applications. Engaging with different networks and transferring assets across multiple chains to access and utilize an application can be cumbersome and intricate. This increased complexity raises the barrier of entry for potential users, impeding widespread adoption and leading to a natural attrition of prospective participants.

To address these challenges, Layer 2 aggregators and routing protocols are needed more than ever. As these protocol would aggregate liquidity from different Layer 2 networks and route traffic between them, making it easier for users to find the best prices for assets and to reduce the risk of slippage. It would also improve the performance of applications and reduce the latency of transactions.

The Importance of Risk Modeling

Risk modeling methods play a pivotal role in the comprehensive evaluation of potential protocol risk, user liquidations, and the type and magnitude of leverage employed within decentralized finance (DeFi) systems.

Risk modeling enables a quantitative and qualitative assessment of various risks, including market volatility, liquidity fluctuations, counterparty default, and smart contract vulnerabilities. It provides a framework to gauge the potential impact of adverse events on the system and the magnitude of losses that participants, including users and protocol maintainers, might incur. Furthermore, risk modeling methods help identify the optimal level of leverage that can be safely utilized without exposing the system to excessive risk.

One crucial aspect of risk modeling is its role in understanding user liquidations. By analyzing historical data and market conditions, risk models can project potential liquidation scenarios and estimate the probability of borrowers defaulting on their positions due to rapid asset price declines or insufficient collateralization. This information is vital for DeFi lending platforms as it assists in devising appropriate collateral requirements and liquidation mechanisms to safeguard lenders' interests and maintain the platform's overall health.

Additionally, risk modeling methods help in managing and controlling systemic risks that may arise from high levels of leverage within the DeFi ecosystem. Through stress testing and scenario analysis, risk models can simulate extreme market conditions and assess how the system would perform under such adverse scenarios. This aids in designing robust risk management protocols that mitigate the cascading effects of sudden market downturns and reduce the potential for systemic failures.

Overview of Dynamic Risk Modeling vs. Static:

Static risk modeling

Is a method of assessing risk that assumes that the market conditions that existed when the model was created will remain constant over the time horizon of the analysis. This type of modeling is often used for regulatory compliance purposes, as it can be relatively simple and straightforward to implement. However, static risk models can be less accurate in volatile markets, as they do not take into account the possibility of changes in market conditions.

Dynamic risk modeling

Is a more sophisticated approach to risk assessment that takes into account the possibility of changes in market conditions over time. This type of modeling typically uses mathematical simulations to generate a range of possible outcomes, based on different assumptions about future market conditions. Dynamic risk models can be more accurate than static risk models in volatile markets, but they can also be more complex and time-consuming to implement.

The Importance of Market Structure

The appropriate selection of a market structure is of paramount importance in the realm of decentralized finance, particularly given the prevalence of long-tail crypto assets. Understanding the nuances of market structures becomes crucial, as it directly impacts liquidity provision, market efficiency, and overall participant experience.

In the context of long-tail crypto assets, bootstrapping liquidity is a critical challenge. Automated Market Makers (AMMs) emerge as a more practical and effective solution compared to other market structures, such as Centralized Limit Order Books (CLOBs) as even In a CLOB with a maker-taker model, liquidity providers might be incentivized to provide the long-tail asset, but the matching of orders on the taker side can prove disincentivized.

This discrepancy in incentives can create imbalances in liquidity provision and hinder efficient price discovery. Moreover, the potential exposure to market impact further dissuades liquidity providers from participating actively in CLOBs, particularly for assets with limited trading activity.

The Importance of Protocol Incentives

The concept of protocol incentives introduces various complexities and interactions, often manifested through liquidity mining and airdrops. While these initiatives are well-intentioned and initially serve to address the cold start problem, they can prove counterproductive in the medium and long term for protocol development. Users who are primarily attracted by the allure of liquidity mining rewards, such as high yields, tend to exhibit a transient loyalty, as their engagement with the protocol is primarily driven by the financial benefits. Consequently, this influx of users may result in a temporary inflation of user numbers at the expense of resources that could have been allocated more effectively elsewhere. Moreover, the intensified selling pressure on tokens caused by users cashing out their rewards can exert downward pressure on token prices, further complicating the dynamics of the ecosystem. It is worth noting that these mechanisms, while contributing to decentralization, can come at the expense of protocol revenue. A prominent example is Aave which generated $400 Million in revenue during the year 2022 but after accounting for liquidity incentives it ended up generating $150 Million.

Finally, We have Database Mechanisms

Data Storage

Matching Engine

Lack of Object Support

UX/UI Design

Vanity Metrics

The Importance of Data Storage

The importance of data storage in DeFi dapps is a critical issue as many DeFi dapps host centralized front ends on infrastructure such as Amazon Web Services (AWS). This can lead to downtime for users, as a single point of failure can take down the entire Dapp. Additionally, the open interactive interface of Ethereum smart contracts can be helpful for bypassing inactive front ends, but it also poses a security risk themselves as attackers can exploit this interface to steal funds or cause other damage.

The Importance of Matching Engines

Whether a matching engine is open source or not is paramount, as it shapes the development, adaptability, and security of the DeFi platform, enabling extensive scrutiny for potential vulnerabilities therefore maximizing security as well as enabling more revenue generation in the form of eluding exclusive licensing fees compared to closed source counterpart engines.

The Lack of Object Support

The lack of object support is a core infrastructure problem in DeFi. Objects are a fundamental concept in programming, and they allow us to model complex data structures and relationships. Without object support, DeFi applications are forced to create individual smart contracts for each object, which is inefficient and limits composability.

For example, let's say you want to create an index of assets. With object support, you could create a single smart contract that represents the index. This contract would have a property for each asset in the index, and it would also have functions for adding and removing assets from the index.

However, without object support, you would need to create a separate smart contract for each asset in the index. This would be inefficient because it would require you to deploy and maintain multiple smart contracts. Additionally, it would limit composability because you would not be able to easily reuse the code for the asset smart contracts in other applications.

The Importance of UI/UX Design

Enhanced User Experience: Thoughtful UX design can transform the application into a user-friendly and intuitive platform, simplifying user navigation and task completion. This, in turn, can significantly boost traffic, as more users effortlessly engage with the application.

Tailored Risk Profiles: The color scheme chosen for the application can appeal to different trading personalities with varying risk appetites. It's a subtle yet powerful way to attract specific user segments, enhancing their experience.

Maximizing Potential Profits: A well-crafted UX empowers users to grasp the intricacies of DeFi risks, aiding them in making informed decisions. This heightened understanding can potentially lead to increased profits, as users are less inclined to engage in risky investments.

Engaging Gamification: Gamification can inject excitement into the application, akin to a DeFi adventure. For instance, offering rewards for tasks and deposits can motivate users to actively participate. This strategy has previously proven successful in onboarding new investors, as seen with Robinhood's approach.

Trustworthy Design Elements: Leveraging colors associated with trust and security, such as blue and green, within the UX design can instill confidence in users. This trust extends to the application's security features, further enhancing the user experience.

Clarity Through Language: The use of clear and concise language in DeFi application UX design simplifies risk comprehension and informed decision-making. This approach minimizes the chance of users making ill-advised investments.

Error Resolution Made Easy: By providing clear and concise error messages, users can swiftly identify and address issues, enhancing their overall experience. This proactive approach minimizes the risk of users encountering financial losses.

Accessible Support: Offering multiple support options, including FAQs, tutorials, and live chat, ensures users can obtain assistance when needed. This commitment to support not only improves the user experience but also reduces the likelihood of user errors.

Vanity Metrics

TVL and volume are the most widely used metrics to gauge the success of a DeFi protocol, but they are also relatively easy to spoof. This is because these metrics can be manipulated by creating fake transactions or by depositing and withdrawing funds repeatedly.

For example, a malicious actor could create a fake transaction that shows a large amount of value being locked into a DeFi protocol. This would artificially inflate the protocol's TVL, making it appear more successful than it actually is.

Similarly, an actor could deposit and withdraw funds repeatedly into a DeFi protocol in order to artificially inflate its volume. This would make it appear as if the protocol is more active than it actually is.

The spoofing of TVL and volume is a major problem in DeFi. It makes it difficult to assess the true health and success of a protocol.

Conclusion

In conclusion, the DeFi Trilemma encapsulates a complex interplay of design trade-offs that directly affects the scalability, robustness, and decentralization of DeFi protocols. By examining the intricacies of chronological and capital efficiency mechanisms, as well as database mechanisms, we can gain valuable insights into how diverse underlying design elements impact protocol behavior. In our quest for a more transparent, efficient, and inclusive financial system, understanding these complexities is crucial. It's akin to peeling back the layers of an onion: with each layer we peel away, we uncover a new dimension of challenges and opportunities. The journey towards resolving the DeFi Trilemma is not a straightforward path, but with thoughtful design choices, collaboration, and continuous innovation, we can navigate this intricate landscape.

References

14

14