🟣 New Bitcoin All-Time High Unlocked

$100k Coming in 3 Weeks?

GM DOers!

Bitcoin is up 15% in the last week, 54% in the last month, 150% in the last 6 months, and almost 200% in the past year. 🚀

Due to Bitcoin’s incredible rally over the past year, it has hit a new all-time high yesterday, at $69,000.

Immediately after kissing new highs, $BTC dropped to $59,000 (this is normal), only to bounce back quickly to around $65,000.

The immediate bounce made it clear that the demand for Bitcoin is immense and with the halving coming in about 45 days, many are wondering if this could be the top for Bitcoin or if this is just the start of the real bull market.

I think this is just the start of the real bull market. To show you why, I will cover:

Bitcoin’s inflows & the huge demand

Bitcoin’s potential massive supply shock

Can Bitcoin double in the next 3 weeks?

Should you hold $ETH or $BTC right now?

Let’s go! ⏬

Bitcoin’s Inflows & Huge Demand 🌊

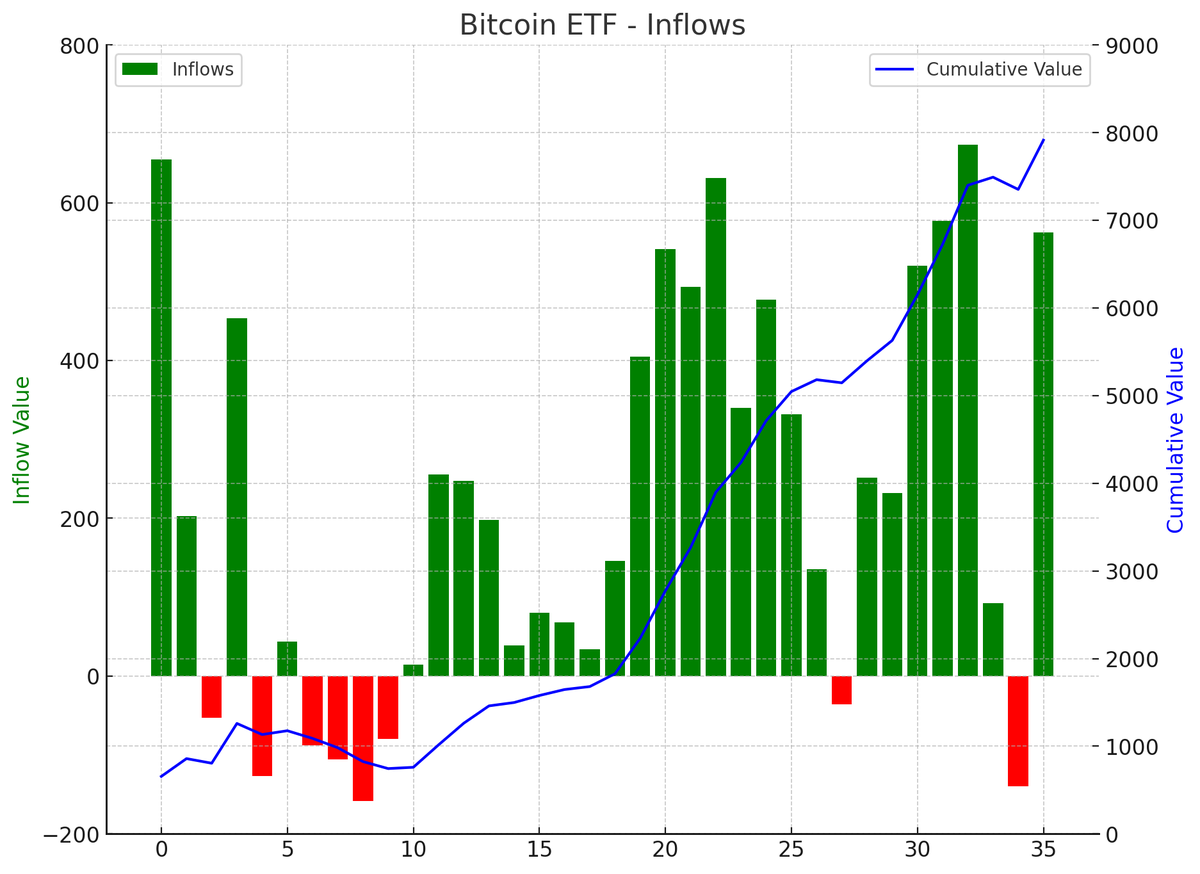

Ever since the ETF approval, the demand coming from TradFi has been overwhelming for Bitcoin.

The total $BTC held in ETFs is now at all time highs, nearing 800,000 $BTC.

Keep in mind though, that most of this Bitcoin is still being held in Grayscale’s $GBTC, the fund out of which investors are exiting for 2 reasons:

Grayscale is charging a 1.5% yearly management fee, which is 5–6 times higher than other ETF issuers.

A lot of investors bought GBTC at a 40% discount, and now it's at 0%, so they are taking profits.

So, if we exclude $GBTC from this discussion, we can see that BlackRock’s $IBIT ETF is leading the way, becoming the preferred Bitcoin ETF (as expected).

By the way… Even with the significant $GBTC outflows, the net flows are still positive. On Monday, ETFs added an extra 8,800 Bitcoin to their holdings.

With over $560 million flowing into ETFs, Monday marked the 5th biggest day in terms of inflows.

Oh, and let’s not forget that the Bitcoin ETF is blowing the Gold ETF out of the water.

Apart from the huge demand for Bitcoin ETFs, we also have BlackRock planning to buy Bitcoin ETFs for its Strategic Income Opportunities Fund ($BSIIX) to diversify and potentially enhance the fund's returns.

Then we also have Stanford allocating 7% of their portfolio to Bitcoin.

As predicted before, TradFi is FOMOing into Bitcoin at all-time highs. Love to see it.

A Massive Bitcoin Supply Shock is Brewing ♨️

So we already established the demand for Bitcoin is through the roof. Let’s see if there’s enough supply to match this demand.

Spoiler alert: There’s not enough Bitcoin for everyone!

Bitcoin on exchanges is at around 2.3 million $BTC, levels not seen since 2017.

This means that only a total of 11% of all the Bitcoin in existence is sitting on exchanges right now.

So demand is high, and nobody is selling.

When it comes to newly issued Bitcoin, there’s only around 800 Bitcoin being mined per day.

In about 45 days, this number will be cut in half.

A massive supply shock is just around the corner for Bitcoin!

Can Bitcoin DOUBLE in 3 Weeks? 🚀

Here’s the deal… When an asset surpasses its all-time high, it enters price discovery – i.e., it reaches a price level for which there is no historical reference, leading the market to explore and establish a new value based on current supply and demand dynamics.

When Bitcoin exceeds and sustains above the $69,000 threshold, it will enter a phase of price discovery.

Historically, during such phases, Bitcoin has typically doubled in value within just three weeks, on average.

Why is this happening over and over again?

It’s simple: People ignore assets when their prices are low and only notice them when they hit record highs.

Slowly, then all at once – you know the drill.

This creates a flywheel where the higher the price, the higher the demand. ♻️

That’s why we’re now seeing ETF demand at an all-time high, led by TradFi investors.

When it comes to retail investors, we have signs that they’re lurking back.

Coinbase keeps crashing

Crypto gurus are growing insanely on YouTube and X

Google searches for “Bitcoin” are up massively

All of this will intensify once Bitcoin enters price discovery and hits new highs every day.

When this happens, your uncles & aunts will come calling, asking you how they can buy crypto. At that point, nobody can predict how high Bitcoin will go and whether or not it’ll double in ~20 days post-ATH like it did in the past. It’ll be complete mania.

Regardless of what happens, 1 thing is for sure! We will have continuous pull-backs. No bull market is a straight line up.

There will be days and weeks when we’ll experience 10%, 20% or even 30% drops! Make sure you’re expecting them.

I have a PRO report coming up soon that’ll teach you how to prepare for that. upgrade to get it in your inbox.

Wrapping Up — $ETH or $BTC? 🤔

Bitcoin is a great asset. I have no doubt it’ll reach and surpass $100,000 during this bull cycle.

But is Bitcoin the best opportunity for investors right now?

I would argue it’s not! Why?

Because historically, whenever Bitcoin surpassed its ATH, it was the start of $ETH outperforming $BTC big time.

Here’s what happened in 2020:

$BTC did a 3x from $20k in just a few months

$ETH did an 8x from $550 in that same time period

Will history repeat? I don’t know.

But from a risk/reward perspective, I personally prefer to hold $ETH instead of $BTC during these times.

I’m interested in your take, though! What’s your biggest bag? Ethereum, Bitcoin or another token? Let me know w/ a reply to this email!!

Thanks for reading. And remember, you're strong, you’re powerful, you’re alpha! ❤️

How'd you feel about our read today?

Are You Fairly New to Crypto & Web3?

Let us help you wrap your head around this industry that’s constantly transforming.

Take our Free 1-hour Web3 Rabbit Hole Course to learn the foundational components you need to start building and investing successfully.

Recommended Tools 🛠

Secure Your Crypto w/ a Hardware Wallet – Get a Ledger Today

Join us on Discord | Follow us on Twitter

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.

9,811

9,811

Stanford University's Blyth Fund has bought

Stanford University's Blyth Fund has bought