BlackRock CEO Is Bitcoin's Chief Marketing Officer

BTC Labeled Digital Gold On National TV.

GM DOers! 😎

Can you hear that? It's the sound of our Bitcoin rocket revving for the moon! 🚀

Larry Fink, the CEO of BlackRock, the financial titan managing a cool $10 Trillion, went on Fox News (2.5 Million viewers in prime time) and labeled Bitcoin as digital gold. 🎉

This is a massive U-turn from his stance 6 years ago when he said Bitcoin was an index for money laundering. 💱

What triggered this 180-degree turn? Is he a newfound fan or does he have an ace up his sleeve? 👀

Let us tell you about it.

👉 Lens Protocol: The Future of Social Media

Decentralized social media finally allows creators to own their content, data and followers. That’s why we choose to build part of our media platform on Lens Protocol.

BlackRock and Bitcoin: An Intriguing Relationship 👫

If you've been hiding under a black rock (pun absolutely intended 😄), here's some quick context.

On June 15th, BlackRock put forth a proposal for a Bitcoin ETF. For a deeper dive into BlackRock and ETFs, refer to our previous newsletter here.

Then, on June 30th, the SEC flagged the proposal as inadequate, leading to a flurry of angst among investors, particularly those in crypto.

The hiccup? It lacked the name Coinbase as the SSA counterpart, aka the entity from which the ETF manager would purchase Bitcoin. A tiny detail that was quickly rectified.

What caught our eye, however, was the approval of a leveraged Bitcoin ETF by the SEC between these dates. 🤦

It launched on June 27th and it got a lot of traction from the get-go.

These leveraged ETFs don't represent actual Bitcoin. It’s just a piece of paper that is much riskier than buying and holding actual Bitcoin.

So, why would the SEC greenlight a leveraged ETF before a spot ETF, when its intention is to protect inventors?

It's one of the world's mysteries, I guess. 😅

So, what has caused Larry Fink's shift from viewing Bitcoin as a money laundering index to now endorsing it as digital gold? 🧐

The answer is simple - he wants traditional finance (tradfi) investors to embrace Bitcoin and add it to their portfolios through the future BlackRock spot Bitcoin ETF (yes, I’m optimistic it'll get approved!).

I will tell you about when we’ll most likely see a spot Bitcoin ETF but first, I wanted to talk about why Larry Fink hyping Bitcoin up is such a big deal for our industry. 🚀

Catch Up On Web3 News 🗞️

🎧 Listen to today’s Weekly Rollup podcast where we break down the NFT Market Collapse, the launch of Instagram’s Twitter competitor Threads, news coming out of Pudgy Penguins, Moonbirds, and more.

Check it out on your favorite podcast platform!

Larry Fink Legitimizes Bitcoin ✅

Remember when Paul Tudor Jones (net worth of $5.8 Billion and widely considered one of the best traders in history) publicly announced his Bitcoin ownership in 2020?

The ripple effects were HUGE! It legitimized Bitcoin for many tradfi investors, making it safer for them to bet their clients' funds on it, without getting fired.

Soon after, Microstrategy plunged into Bitcoin with a $500 Million purchase, sparking a bull run. 🐂💰

The influence of these whales was instrumental in driving funds towards Bitcoin and was the inflection point for the start of the bull market in the summer of 2020.

And now, with the biggest whale of them all, Larry Fink, vouching for Bitcoin and creating a new financial vehicle for it, we might be on the verge of another massive influx. 😏

Of course, we need the Bitcoin spot ETF approval before that happens at a big scale. However, this should serve as a beacon for tradfi investors to re-enter the space, even if it's not necessarily through a spot Bitcoin ETF.

But how long do we have to wait until a spot Bitcoin ETF? Keep scrolling to find out 👇

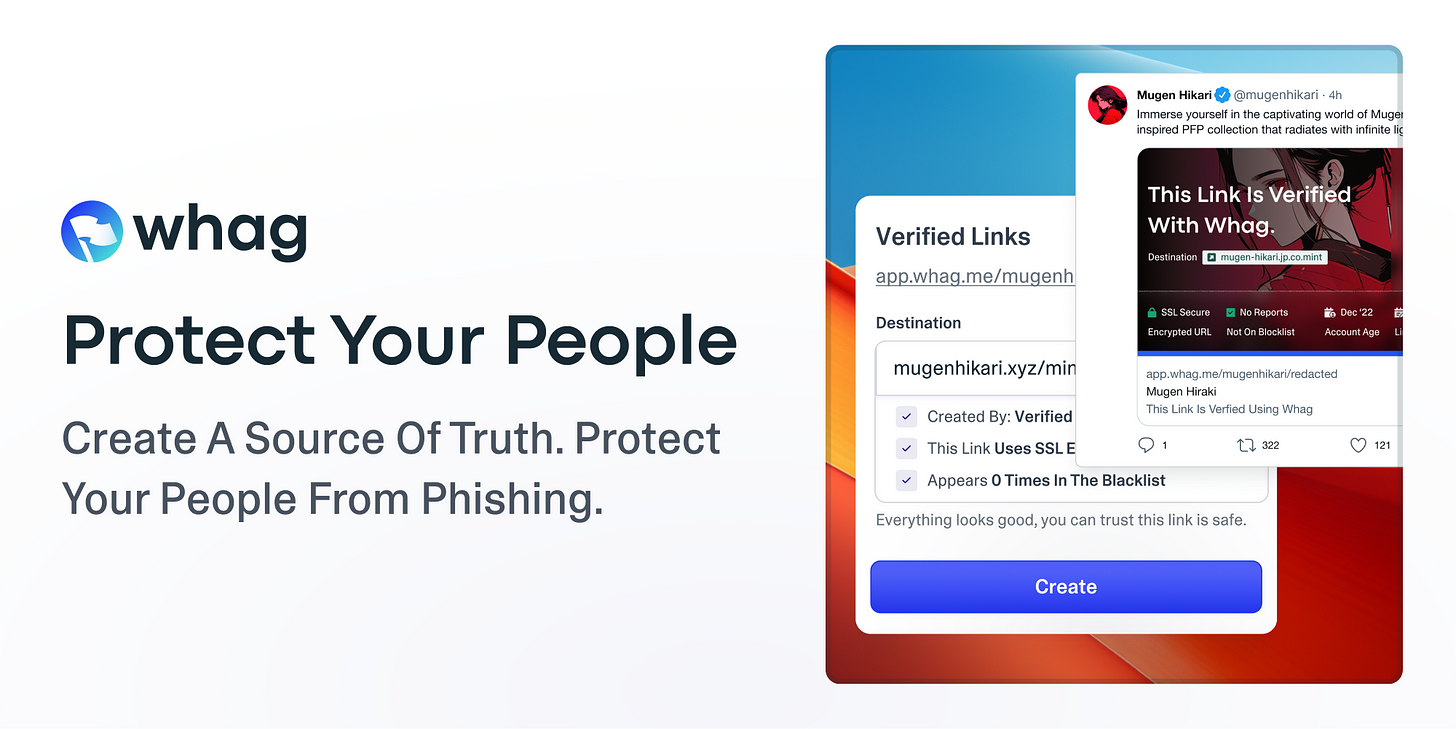

🤝 Thanks to our trusted partner, Whag.

Web3 users lose billions of dollars every year due to phishing attacks. Luckily, Whag uses verifiable links so you can rest easy, knowing that every link you click on is safe.

Just click below to see for yourself. The first 1000 users that sign up and use the code “free1000” get free access FOR LIFE.

Countdown To A Spot Bitcoin ETF ⏰

As we previously highlighted in our newsletter here, an ETF approval works in phases. The SEC has a total of 240 days to approve, deny, or delay the decision, following a certain timeline.

According to this timeline, Ark Invest's ETF filing is set for a decision by December 2023.

This gives us a ray of hope for a Bitcoin ETF this year! However, we're leaning more towards BlackRock or Fidelity’s ETF getting the nod due to their stronger influence. 💪

By mid-March (at the latest), the SEC will have to make a decision on 7 ETF filings. Denying all of them seems unlikely. We're betting on at least 1 or 2 getting the green light by March 2024.

On top of the ETF likely getting approved, we have the Bitcoin halving coming in April 2024, adding even more to the anticipation.

Now… What should YOU do to capitalize on the opportunity? Below, we’re sharing what we think is the way to go from here from an investor’s point of view.

The following section is exclusive to our PROs. 💜

PRO Advice For Investors 💰

Given the current dynamics, buying Bitcoin seems like a great bet. Once the ETF gets approved, we expect a surge of investments flowing into Bitcoin - setting the stage for the next bull run. 🚀

But, is Bitcoin the only option? No! Enter ETH. Bitcoin has outperformed ETH in recent months, as you can see below:

ETH/BTC denotes the price of Ethereum in Bitcoin. For instance, if Ethereum is trading at $2,000 and Bitcoin is trading at $40,000, the ETH/BTC crypto trading pair will trade at 0.05.

The chart above will go up if Ethereum outperforms Bitcoin.

But as you can see, in the last 6 months, Bitcoin has outperformed ETH by 16%, which is normal in a bear market.

But, historically, Ethereum has outperformed Bitcoin over time, as shown here:

Therefore, buying BTC over ETH here is almost like buying the top between the two.

Once the Bitcoin ETF gets approved, ETH is next in line. And at some point, ETH will get a spot ETF too.

With that said, we know from the last cycles that ETH usually lags behind Bitcoin.

That’s because of how the money typically flows in crypto. First, FIAT flows into Bitcoin, then into Ethereum, and then into lower cap (and riskier) crypto assets.

We wrote about this extensively in our PRO report last week.

We’re at the stage where Bitcoin is performing and ETH is lagging behind. Therefore, this is a perfect opportunity to scoop some $ETH. When its time comes, it will rip like crazy. 🚀

With that said, don't be swayed by the Bitcoin-only hype and overlook ETH. It's a promising buy right now. However, you’d ideally be able to accumulate both. But if you had to choose between the two, I’d recommend choosing $ETH right now.

That’s all for today, frens! I hope that today’s piece helped you understand what’s going on with this Bitcoin ETF & with why Larry Fink is out there marketing Bitcoin.

Keep accumulating, keep DOing & stay away from hype cycles over the weekend! 💪

Thanks for reading. And remember, you're strong, you’re powerful, you’re alpha! ❤️

See you soon. ✌️

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.

1

1

First leveraged

First leveraged