Blur Will Give You Free $ETH via its L2 😲

But Is It Worth It?

GM DOers!

Free $ETH? WTF Kyle? Don’t tell me that the title is clickbait.

Happy to let you know, it’s not! But it’s also not as exciting as you may think.

Here’s what’s up. Late on Monday, Blur officially announced the end of its Season 2 airdrop, during which they gave away over $100 million in $BLUR tokens. 🤯

At the same time, they announced Season 3 and a new Ethereum Layer 2 blockchain called Blast.

TL;DR: Blast aims to be the first blockchain ever to provide native yield. And right now, users who send assets to Blast get yield and points towards the Blast airdrop.

But let's be clear: Blast IS NOT an L2 in its current form. So, while we love the concept of a blockchain that offers native yield to users, it also raises some serious concerns because as of now, Blast is only a multi-sig wallet controlled by 5 people.

Despite this, degens be degens, and ~50k people bridged $400+ million to Blast in the past few days. Complete madness.

Let’s dive into it, but first, here’s a brief recap of Blur's Season 2.

LFG. ⏬

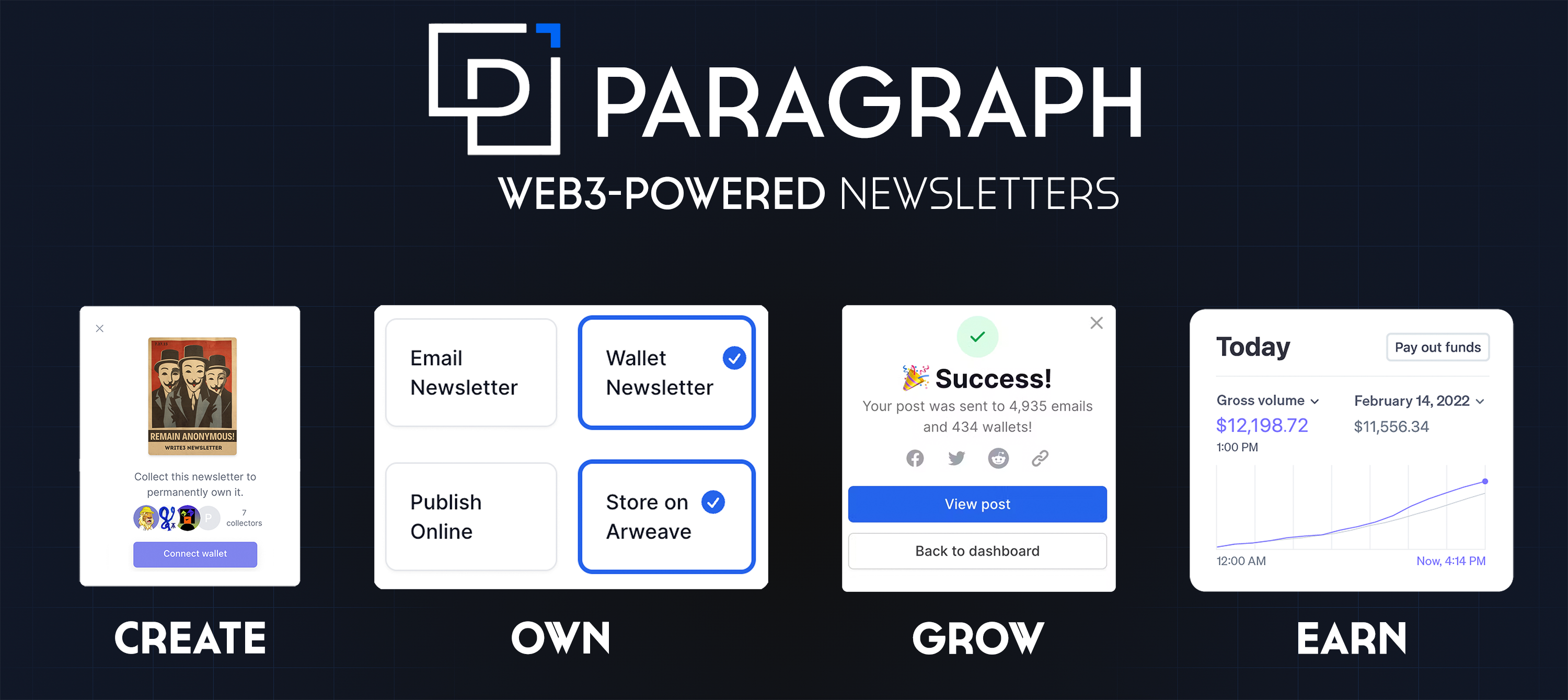

Paragraph powers modern newsletters, enabling readers to own their content and creators to share revenue with fans.

Web3 Academy has already transitioned to Paragraph because it’s the future of newsletters.

If you're a creator, writer, or keen reader, explore Paragraph's early opportunities!

Blur Shared $100M in S2. 🤯 What About S3?

As Blur’s Season 2 wrapped up this Monday, let's rewind and highlight what went down in this bustling chapter of the Blur saga.

A Massive Airdrop: Season 2 saw an extraordinary airdrop of 307.6 million $BLUR, translating to over $100 million in value at the time.

Update: Binance just announced the listing of $BLUR this morning – the token is up 30% today, to $0.62.

At these prices, the airdrop is worth over $190 million. 😳

The response was overwhelming. Over 87% of the airdropped tokens have already been claimed, showcasing the community's active participation.

Interestingly, a mere 10 wallets claimed a colossal 27% of the total airdrop, highlighting the concentration of rewards among a few top players.

Top Players: Among the big winners, Hanwe Chang stood out, bagging 22.8 million $BLUR, then valued at a staggering $7.5 million.

However, not all stories were of triumph; infamous NFT trader MachiBigBrother lost a whopping $18.7 million while farming the airdrop, only to receive a modest $2 million.

He then said this on X.

Pretty funny if you ask me. 😂

The biggest takeaway from S2 is this: The $BLUR token didn’t plummet. Instead, the price doubled since the airdrop, despite there being 307 million new tokens (28%) added into the circulation.

Why didn’t it plummet? Because Blur cleverly incentivizes people to hold tokens into S3. Let’s talk about that. ⏬

Get the Latest in Web3

Binance fined $4B & CZ’s OUT, the SEC sued Kraken & the DOJ threatened DeFi.

WTF is going on right now? Tune into our freshly released Weekly Rollup & get the lowdown.

On your favorite platform.

So What About Blur’s Season 3? 👀

Hot on the heels of Season 2, Blur has launched Season 3, set to run until May 2024.

The goal? Keeping traders engaged and on the hunt for new opportunities.

Here's what's new in S3. (Unless you’re planning to farm this airdrop, you can probably skip past.)

Equalized Point System: Unlike Season 2, no collection will receive double points, ensuring a fairer distribution of rewards.

Loyalty Redefined: Your loyalty score decreases not just for listing on other platforms, but also for engaging with AMMs or fractionalization platforms, possibly targeting specific competitors like Flooring Protocol.

Adjusted Lending Points: Now, lending points per collection are halved compared to bidding points, a shift from the equal distribution in Season 2.

Trait Bid Changes: Only certain collections will receive trait bid points, with a focus on collection bids.

Revamped Listing Focus: Listing gains importance again, influencing loyalty scores and encouraging diverse listings.

However, the biggest change in S3 vs S2 is the new L2 blockchain, Blast, upon which Season 3 has already kicked off.

Blast Layer 2 – Revolutionary Concept or Scam? 😳

Blast wants to give you yield for simply holding your money onchain. Right now, if you deposit your assets on chains like Base, Arbitrum, or Optimism, you can’t make any yield on your assets.

Blast wants to change that, so they’re introducing an interesting approach to yield generation.

Here’s how it works.

Yield on $ETH: By depositing $ETH on Blast, they’ll automatically stake it to generate a 3-5% yield, which is then distributed back to you, allowing your balance to grow over time.

Over 150k $ETH – $135 million – is now being staked on Lido.

Stablecoin Yields: Bridging stablecoins like USDC, USDT, or DAI into Blast places them in T-Bill protocols, such as MakerDAO. The resulting yields are then converted into USDB, Blast’s auto-rebasing stablecoin, and returned to users.

The goal of this mechanism is to help users generate a constant yield that doesn’t require any effort for the user.

A very cool idea – but it comes with concerns.

Blast is currently in beta, functioning on an invite-only basis, with withdrawals locked until the mainnet launch in May 2024.

This creates a significant risk as funds are currently one-way, with no exit until the launch.

There’s no guarantee that this will actually succeed and play out as it’s planned to. It could very well be a rug-pull (although it’s unlikely).

Despite these risks, Blast has attracted considerable attention, with users already bridging over $400 million.

The reason for this massive inflow into Blast is due to airdrop farming. Not only can people farm the new $BLUR Season 3 airdrop, they can also farm a potential future $BLAST airdrop.

At the moment though, we have no details about a Blast airdrop – we’ll keep you posted.

Wrapping Up 🧵

I wouldn’t risk my $ETH.

At the moment, Blast isn’t a Layer 2. It’s a smart contract that:

Accepts funds from users.

Stakes users' funds into protocols like LIDO.

There's no testnet, no transactions, no bridge, no rollup, and no sending of transaction data to Ethereum.

Jarrod Watts did a cool (technical) deep dive into Blast and the conclusion is clear. Right now, Blast is literally a multi-sig wallet controlled by 5 people.

The fate of all current assets that are on Blast are entirely in the hands of the developers, who can pull the rug with a few clicks.

For the record, I don’t actually think this will happen – Paradigm is a big investor in Blast, and that’s usually a good sign.

Regardless, in its current form, Blast goes against the ethos of web3: permissionless and trustless.

Blast is neither.

You can’t withdraw your funds after depositing (until 2024) – not permissionless.

And you need to trust the team that they won’t rug you – not trustless.

So, participating this early on is incredibly risky in my opinion, so be cautious.

With that being said, early participants could be rewarded big time through $BLUR & a potential $BLAST airdrop.

Will it be worth the risk of losing it all? That's the big question. Nobody knows. Time will tell.

But one thing’s for sure. I prefer to get a lower, yet much safer yield by buying & natively staking $ETH & $SOL instead.

Thanks for reading. And remember, you're strong, you’re powerful, you’re alpha! ❤️

How'd you feel about our read today?

Are You Fairly New to Crypto & Web3?

Let us help you wrap your head around this industry that’s constantly transforming.

Take our Free 1-hour Web3 Rabbit Hole Course to learn the foundational components you need to start building and investing successfully.

Join us on Discord | Follow us on Twitter

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.

5

5