🟣 Is the Bull Market DONE?

Or Just Getting Started…

GM DOers!

Over the past 7 days, Bitcoin dumped from $72k to $62k…

And Ethereum from $4k to $3.1k…

This heavy correction led to the wider crypto market losing $400 billion in 7 days. 🤯

So is this it? Did the bull market just get canceled? Is it time for endless sleepless nights and to re-apply for that old McDonald’s job?

Not at all – this is a totally normal correction that I think we were due anyway, because frankly, the market got really heated lately, which I’ll explain below.

We’ve also seen Bitcoin crash to <$10k on BitMex and Bitcoin ETFs having a negative flow day for the first time in a while.

So, let’s dive in and recap WTF happened in the markets this week.

A new meta has taken over crypto over the last few days: Memecoin Presales.

In short: Investors transfer funds to random crypto wallets posted on X by various crypto influencers promising huge returns. As a reward, they get token airdrops.

Yesterday, ZachXBT reported that almost 800k $SOL (~$150 million) was raised from 33 presales.

As you can expect, a bunch of these presales were complete scams and ‘investors’ got rugged.

But one funny thing happened.

The ‘dev’ behind the memecoin $SLERF accidentally burned all of the proceeds received in the presale (over $10 million).

So presale investors never got their airdrop, but SLERF went on to reach over $800 million in market cap, and surpassed the trading volume of all Solana-based tokens except for $SOL.

Imagine waking up, seeing that your token did over 100x since the presale, only to check X to see that all your money was burnt by ‘accident’. Horror.

Because of all of this mania, BonkBot, the leading trading bot on Solana, did more trading volume than blockchains like Base and Polygon.

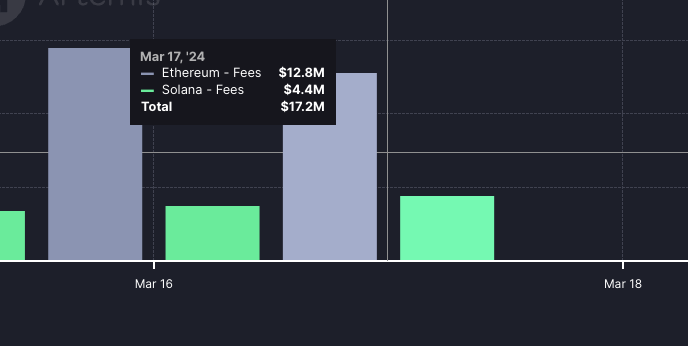

Due to a lot of trading, Solana's revenues increased (because of how much gas users paid), making it closer to Ethereum's revenues—going from being 17 times lower a month ago to just 2.9 times lower at one point this week.

Solana also flipped Ethereum in Google searches.

So it’s clear that Solana was the main beneficiary from this memecoin frenzy. However, when the music stopped, Solana started to take a big hit in price.

Understandable.

Bitcoin's price on BitMEX suddenly dropped to ~$9k from $67k.

This sudden drop freaked out the global market a bit, making Bitcoin's price fall around 7% during that time.

Some think that this sell-off was caused by a user who suddenly sold 850 BTC ($55.49 million) on the open market.

Because of this, BitMEX is digging into what happened and has even put a temporary hold on withdrawals for some accounts.

In other (even less exciting) news, Bitcoin ETFs have had a negative flow day for the first time in a good while.

Of course, the outflows were mainly led by Grayscale ETF holders, who are exiting because of Grayscale’s high fees.

Good news though… Grayscale’s working on lowering their ETF’s fees soon.

If we look beyond the noise, we understand that the bull market is just getting started.

Yesterday, BlackRock announced that they’re building on Ethereum.

BlackRock teamed up with Securitize, experts in turning real world assets (RWAs) like property into digital tokens, to start a new fund, to which they deposited 100 million $USDC.

They haven't said exactly what they'll invest in, but it's likely about making real-world stuff ownable through digital tokens.

This is HUGE!

In other news, Standard Chartered increased its year-end $BTC price forecast by 50% to $150,000.

TradFi diving head-first into crypto. That should make you bullish, not scared, regardless of market corrections.

My two cents. 👇

Think of these market dips as sort of like taking a breather during a marathon. They're totally normal and super necessary for the market to climb even higher – without these little breaks, we'd burn out way quicker than anyone would like.

If you're new here or don't have a plan, these dips can be scary. But in reality, these are the opportunities you get to buy your favorite coins on sale and beef up your portfolio for the rest of the bull market.

Also, this is an opportunity to differentiate the strong assets from vaporware.

Look for the tokens that recover quickly during these dips, i.e. $BTC, $ETH & $SOL – generally, these recoveries show that these investments will outperform this cycle.

Then look at the assets that get completely rekt, i.e. go down 30, 40 or 50% in a matter of days – these are heavily speculative assets held by short term traders and paper hands, which will probably get crushed during market corrections.

Lastly, remember that as we get closer and closer to the peak of this cycle, these roller coaster dips will happen more often.

This is just part of the game, and, in a way, a sign that we're heading in the right direction.

Before I wrap up, I wanted to share the message that I sent to PRO members in Discord yesterday – this should give you a good overview of where I stand right now.

I share these kinds of insights regularly in the PRO Discord channel with the goal of helping PROs invest successfully in crypto.

If you’d like to join us, then go PRO, and you’ll get instructions on how to join the Discord in the welcome email.

Thanks for reading. And remember, you're strong, you’re powerful, you’re alpha! ❤️

Let us help you wrap your head around this industry that’s constantly transforming.

Take our Free 1-hour Web3 Rabbit Hole Course to learn the foundational components you need to start building and investing successfully.

Secure Your Crypto w/ a Hardware Wallet – Get a Ledger Today

Join us on Discord | Follow us on Twitter

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.

6,152

6,152

JUST IN: Standard Chartered raises

JUST IN: Standard Chartered raises