W3A PRO | What Happened Onchain in 2023?

And What's Coming in 2024?

GM PRO DOers!

What a year 2023 has been for the onchain world.

2023 was the year that many began to understand that onchain IS the next online

2023 was the year that showed us that onchain was once again NOT “dead”

2023 was a big year and 2024 looks to be setting up to be even bigger.

To help us understand where things are heading, it’s always wise to take a step back and look at how we got here.

In today’s PRO report we are doing a 2023 year in review: Onchain edition.

We already did a review of the news and events that shaped our industry in 2023, now we move deeper to real onchain analysis across the crypto and web3 ecosystem.

We’re looking at where the value ($$) accrued in 2023, where the users went as well as where the most activity was. From chains to apps, we’re doing a full onchain review of 2023.

This will set us up to understand past and current trends and help us to make big decisions for this current cycle.

So let’s not waste anymore time and get into it…

Where Did Value Accrue Onchain?

Let’s start with the most obvious and yet the most exciting.

More than $890 billion dollars moved onchain throughout 2023, as seen by the increase in the total crypto market cap.

$350 million of that (41%) moved into Bitcoin, driving Bitcoin dominance to 55% of the total crypto market cap.

The market cap comeback of the year goes to Solana, with its market cap doing more than a 12x in 2023 alone! 🤯

Moving on to value locked in smart contracts, L2s accrued the most value here, locking in more than $14 billion combined throughout 2023.

And that doesn’t include the fastest growing L2/chain (...Multi-sig wallet?) of all time, Blast, accruing over $1 billion in assets in under 1 month! 🤯

In terms of other smart contract platforms that gained significant value locked throughout 2023, we have Solana, Cardano, Gnosis and SUI as the biggest winners.

Tron also saw a significant increase in TVL due to its growing role with stablecoins.

Moving on to specific use cases and applications, Real World Assets onchain had a breakout year, moving from <$1 billion to more than $5 billion this year!

Staked $ETH also had a big year due to the Shapella upgrade (the ability to unlock your stake), moving from about $20 billion to more than $64 billion in 2023!

Solana staking has always been extremely high, however, 2023 saw massive inflows to liquid staking (LSDs), led by JITO and its LSD JitoSOL.

Total liquid staking on Solana went from near 0 to $1.8 billion.

In terms of specific tokens, if we look at a combination of chains, applications and of course memecoins, below are our 15 top gainers by price increase (excluding super small cap tokens).

$BONK was the clear winner this year, with Rollbit (a crypto casino) and Injective (another L1) as the runner ups.

We also saw a GPU network in $RNDR at #5, another meme coin in $PEPE at #11, the new Data Availability Layer wars are kicking off with Celestia’s big airdrop coming in at #14 and one of our favorite picks in $IMX leading the way for web3 gaming at #15.

In terms of NFTs, Opepen had a massive year earlier in 2023, followed by Bitcoin Frogs.

Mad Lads over on Solana was the big winner this year and Milady had a big year with the tweet from Elon Musk.

All of the above shows where all the investible and speculative money flowed in 2023, now let’s take a look at who is actually earning revenue across web3.

Who’s Generating Revenue Onchain?

Starting with the chains, we can look at which L1s and L2s are generating the most from fees.

Let’s remember that blockchains sell blockspace and Ethereum is currently the best at doing this, followed closely by Tron, selling a ton of blockspace to over 1 million monthly active stablecoin users.

The big L2s + Filecoin are the only other chains with meaningful numbers in the revenue side of things.

In terms of expenses, Bitcoin has the most, though this is a bit skewed because of the size of market cap Bitcoin has vs. every other chain. These expenses come from the inflation of the token which pays for miners to secure the network.

Ethereum and Tron are the runners up, though as we’ll see in the next chart, unlike Bitcoin, their expenses are paid for by their revenue.

From a profit and loss standpoint, Bitcoin has the most losses of any chain, which is a function of its expensive proof of work security system.

Solana comes in second due to their extremely high inflation (around 7%) and extremely low fees.

On the profit side of things, Ethereum remains #1 here, with Tron and BNB at 2nd and 4th respectively, thanks to their consistent high user base.

We also have 3 L2s at the top as a result of growing adoption and minimal expenses due to Ethereum handling the bulk of their security costs.

Moving away from the chains and looking from an application level, OpenSea managed to generate the most revenue of any application, even during a terrible year for NFTs and an extremely competitive year for NFT marketplaces.

In third place was FriendTech the first real onchain consumer app to gain some meaningful adoption, though that appears to be fading at the end of 2023.

Ethereum Name Service continues to print money as an important service for the onchain world with most of the other top revenue generators in the space coming from blue chip DeFi applications.

I think this chart will look very different at the end of 2024 with so many new applications launching.

Enough about $$, what about the users throughout 2023?

Users

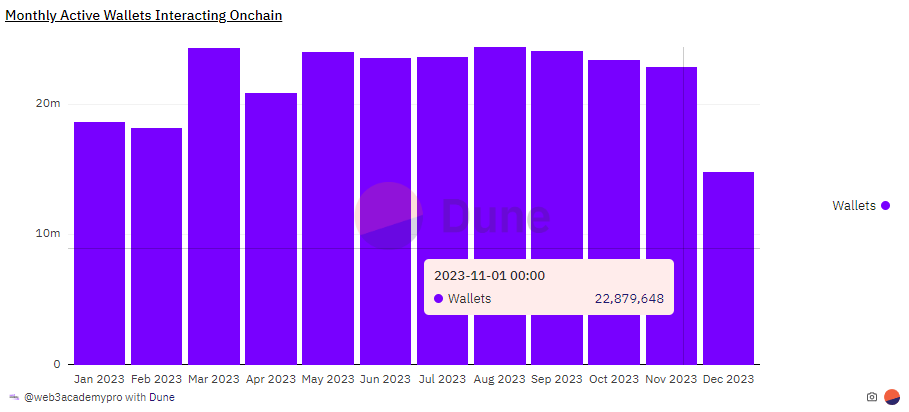

Monthly active users saw some growth from early 2023, pushing above 20 million MAUs for the entire second half of the year, though the growth was minimal overall. I expect this to grow significantly in 2024.

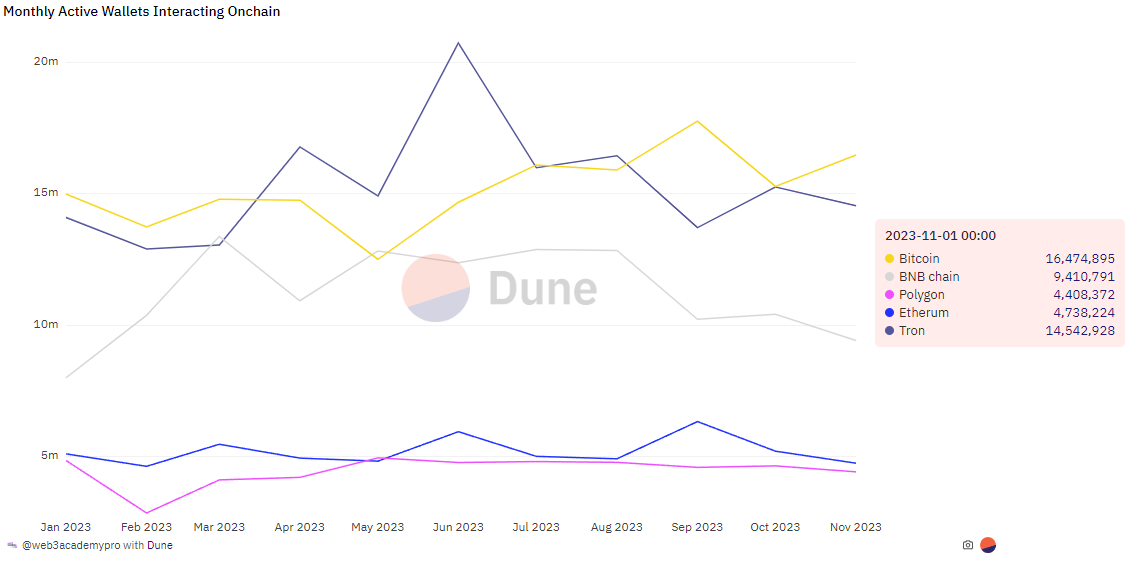

From the big chains, Bitcoin and Tron were the only two that saw user growth, whereas Ethereum and Polygon stayed the same across the year. BNB actually saw a decrease throughout the year as well.

When looking across the smaller chains by user base, most of the growth came from L2s and just in the last 2 months, Solana too.

Zooming in on L2s, we saw some significant growth in weekly active users, starting the year at < 500k and ending at over 2.7 million weekly users across the entire ecosystem.

Also zooming in to Solana who was stagnant all year but has shot up like a rocket ship in the last 2 months due to airdrop farmers spamming the network.

I think Solana continues to see adoption here, just understand that most of this is not “real” users currently, it’s speculators creating wallets to receive incoming airdrops.

In terms of use cases, token transfers and stablecoins are consistently the biggest use case by users.

However, in the last half of 2023 SocialFi exploded onto the scene with the launch of FriendTech and FriendTech competitors.

Additionally, gaming saw a gradual increase over the year in active users.

If we look at the most used apps onchain, DEX’s are the kings here with 14 out of the top 20 apps by users falling in that category.

The only other standout apps were Opensea and FriendTech, as well as WorldCoin app (which is basically just a DEX at this point too).

Onchain Activity

We’ve gone from where liquidity is going, to where most of the users are, to now where the most activity (transactions) is.

From the overall blockchain level, Solana is the king here with more than 7 billion transactions in 2023, followed by Tron at 2.35 billion and then BNB chain and Polygon as a close third and fourth.

It’s hard to tell what Solana transactions were real or not, but regardless, for most of the year it was on a clear downtrend.

In the last few months, activity on Solana has picked up massively, especially in just the last 2 weeks with the migration of so many airdrop farmers.

Solana is doing an incredible number of transactions, numbers that wouldn’t be possible on most other chains currently.

If we look into L2s combined, they have seen consistent growth in transactions over the year.

However, once Ethereum fees rose in Q4, the cost to transact on L2s rose to over $0.10 and we quickly saw a reduction in transactions.

With prices skyrocketing at the end of the year and inscriptions now happening on L2s as well, the transactions are beginning to pick up heavily once again.

When EIP 4844 goes live in Q1 2024 making L2s an order of magnitude (10x) cheaper, this should pick up significantly.

From a use case perspective, peer-to-peer transfers, swaps, DeFi, and stablecoins were consistently at the top for transactions.

The big breakout this year of course was SocialFi apps in the second half of the year, thanks to FriendTech as well as apps like Lens Protocol and Farcaster.

Key Takeaways & Looking Into 2024

Throughout 2023 we have seen small blips of excitement and potential catalysts for onchain activity, however it wasn’t until the last 2 months that things are beginning to seriously pick up.

As usual in this space, price drives narratives and activity. As capital begins to flow back into crypto, so will most users and activity, which will in turn drive more capital.

This is what creates the wild mania cycles of crypto.

I expect this flywheel to go full force in 2024 and bring in all time highs across the ecosystem in most value based metrics (market caps, TVL, etc.).

As a result, it’s likely that users and activity will reach all time highs too, though that may lag price action a bit and flow into 2025.

Regardless, as we analyze onchain right now, we need to understand that many applications are launching tokens and thus opportunists are here to farm those tokens. Activity across many ecosystems are already inflated vs. reality and this will continue much, much higher in the coming months.

I’m not saying this is a bad thing, as it drives more capital into the space and much of that liquidity and some of the users will stick around when the music stops, but we just need to understand that it doesn’t reflect the fundamentals.

We still need apps that provide real value to its users and are scalable. Something we have had very little of in crypto thus far (outside of stablecoins and gambling).

That said, I think technologies like L2s and Solana are at a point (or close to) where they can provide the much needed scalable block space to support these mainstream consumer facing apps, like gaming, payments and more.

We also had billions of venture capital pour into this space throughout 2021-22, which enabled builders to build projects over the last few years, many of which are launching now and over the coming year.

This should spark some really cool new primitives for the world to play with and experience onchain. Much of this innovation will be things that many of us were not thinking of or will play out in ways we could not predict, that’s what makes this space so exciting.

That said, for those who keep a keen eye onchain, you can stay ahead of these trends and better understand where this space is going.

This will help you execute better as a builder and profit more as an investor, exactly our goal here at Web3 Academy PRO.

🍻 Here’s to another year in this wild industry, we’re looking forward to spending it with you and helping you make sense of an onchain world in constant transformation!

Enjoy your time with loved ones and I’ll see you tomorrow as usual. 🫡

Thanks for reading. And remember, you're strong, you’re powerful, you’re alpha! ❤️

How'd you feel about our read today?

ABOUT THE AUTHOR

Kyle Reidhead

Founder of Web3 Academy and Impact3

Find him on Twitter

PRO ACTION STEPS

CLAIM PRO NFT

As a PRO, you’re entitled to a PRO or FOUNDERS Pass (NFT), depending on your subscription.

This Pass will grant you access to our token-gated Discord and to other perks such as early access to various protocols and discounts to IRL and online events.

To grab your Pass, simply click the button below, connect your wallet to your Paragraph account and grab your Pass.

TAKE WEB3 INVESTING MASTERCLASS

Learn the best practices to allocate capital and successfully invest in crypto and web3 with our Web3 Investing Masterclass.

This invaluable resource costs $249. But as a PRO, you get it at a 50% discount.

And as a Founding member, you get it for FREE! 🤯

All you need to do is grab your PRO/Founders Pass (see above ☝) and connect your Pass using the link below. 👇

JOIN OUR DISCORD

As a PRO or FOUNDERS Pass holder, you have exclusive access to our token-gated Discord channels dedicated to PRO members!

Upon claiming your Pass, head to Discord and connect your Pass in the #start-here channel (WEB3 ACADEMY PRO category) to unlock access to PRO-only channels!

Disclaimer: This article is for informational purposes only and not financial advice. Conduct your own research and consult a financial advisor before making investment decisions or taking any action based on the content.